Justin Sullivan/Getty Images News

This story was originally published on June 21 for subscribers of Reading The Markets, an SA Marketplace service. The story was updated on the morning of June 23, where italicized.

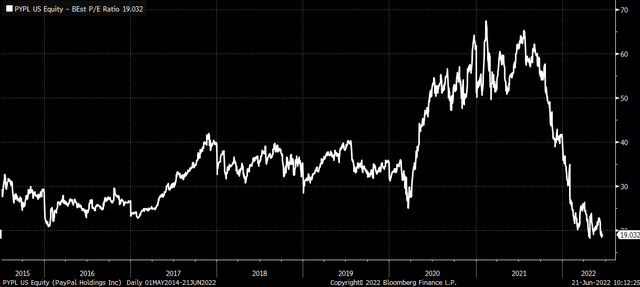

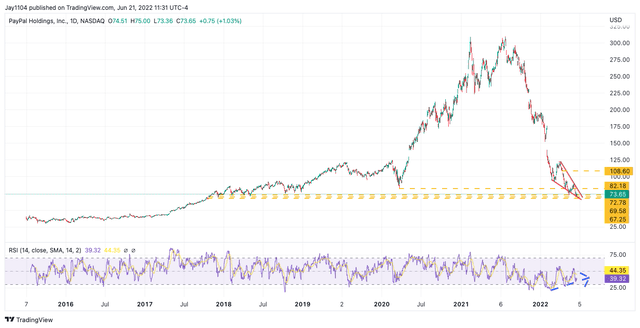

PayPal Holdings, Inc. (NASDAQ:PYPL) has struggled in 2022 and is trying to hold support between $70 and $75. The stock appears to be content with settling around 19 times earnings estimates because that has been the lower end of the trading range and the lowest the P/E ratio has traded for since coming public again.

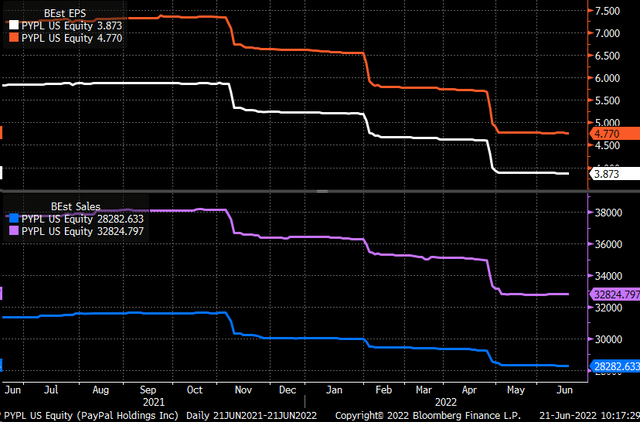

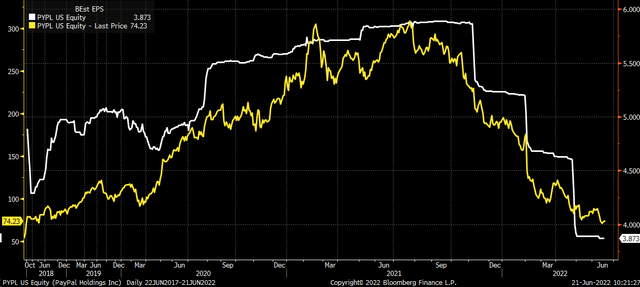

The sharp decline in the stock price and the PE ratio is because sales and earnings estimates for the company have plunged. The declining estimates and suffering stock price is not just a PayPal issue. Many of PayPal’s e-commerce and payment peers have also suffered sharp declines. Block, Inc. (SQ) is another example of a stock in the payment space that has suffered greatly.

What makes things very tricky is that earnings and sales estimates for PayPal haven’t shown a true bottom. Ideally, one would like to see earnings and sales estimates begin to turn higher. The problem is that a stock’s price typically will be the leading indicator of the direction of analysts’ earnings revisions.

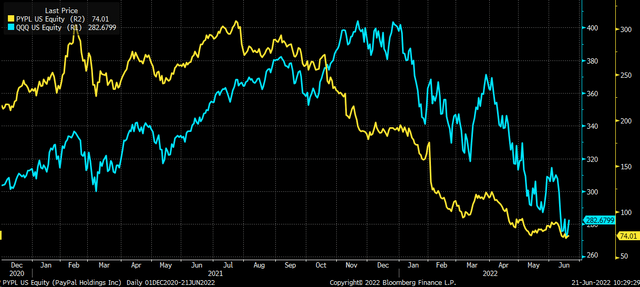

Another sign of a potential bottoming process for the stock price is that PayPal peaked well before the Invesco QQQ ETF (QQQ) peaked and was a leading indicator for the overall market’s direction. It is worth noting that even as the QQQ has made meaningful lower lows, PayPal has not; it has managed to hold around the $75 level during the last two QQQ sell-offs.

Betting Shares Rise

The stock’s price action appears to have caught someone’s attention because the open interest levels for August 19 $80 calls rose by roughly 10,600 contracts on June 21. The data shows the calls were traded on the ASK and bought for $4.70 per contract. The trader would need the stock to trade above $84.70 by the middle of August to break even if the trader holds the calls until the expiration date. It is a large wager with nearly $5 million in premiums paid.

The options bet also has an expiration date after the company is likely to report quarterly results at the end of July. So perhaps there is a bet there the results will be better than expected.

Additionally, on June 23, the open interest for the July 29 $85 calls rose by 6,155 contracts. The data shows that the majority of those calls were bought on the ASK for around $2.67 per contract. It would imply that the trader needs the stock to be trading above $87.67 for the trader to earn a profit if holding the calls until the expiration date.

Technical Momentum Shift

The area around $70 to $75 on the technical chart carries much importance for PayPal. That has been a support zone for the stock from mid-2018 until early 2019. So clearly, if that support region breaks, it would be a very bearish development.

However, there appear to be some signs of momentum-shifting. The RSI has started to make higher lows and an uptrend. Additionally, the RSI is rising as the stock price is flatlining, creating a bullish divergence and suggesting that higher prices for PayPal may be coming.

Additionally, there appears to be a falling wedge pattern that has formed, which is a bullish reversal pattern. The stock would need to climb above $82 for the trend line to break. But if it can rise above that level of resistance, then it could lead to a move to around $108. Several gaps need to be filled between $76 and $84, and a gap around $108. Those gaps may act as a magnet for the stock price to rise towards.

Big Risks

The risk with PayPal remains high because interest rates will likely climb higher as the Fed tightens monetary policy. That could put significant pressure on the P/E multiple for the market, hurting PayPal’s valuation. Additionally, as noted earlier, the region between $70 and $75 for this stock is significant; if it breaks, there is a long way down, perhaps into the low to mid-60s.

The stock has certainly been beaten up, and the valuation is at the very low end of the historical range, while momentum in the trend of the technical chart appears to be signaling a bullish turn. Perhaps things can start to get better from here for PayPal; it has undoubtedly been a painful decline.

Be the first to comment