Michael Vi/iStock Editorial via Getty Images

This article was originally published on February 9 for the SA Marketplace service subscribers, Reading the Markets. The story has been updated as of February 13 where italicized.

PayPal (NASDAQ:PYPL) has plunged over several months after topping out at over $300. The shares are now trading for around $120 at the time of writing, a massive decline in a little bit over six months. Finally, the stock is starting to look attractive from both short- and long-term perspectives.

While it is entirely possible this stock could also be dead money for the next couple of months until investors get a chance to see next quarter’s results, there was a rather sizeable bullish option bet placed, along with a technical chart that is starting to have the characteristics of a bottoming process being put into place.

PayPal – As Cheap As It Gets?

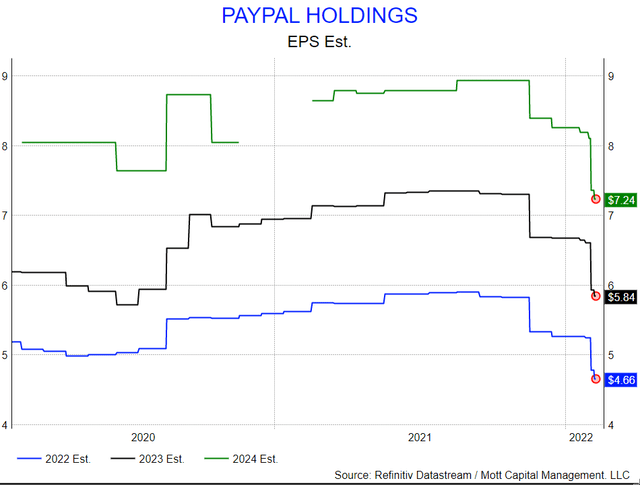

First off, the company reported results that missed the mark, and investors punished it. Additionally, analysts have slashed earnings estimates for the company and now see earnings growing by 1.3% in 2022 to $4.66. However, growth is expected to return in 2023 and 2024, rising by 25.3% and 24%, respectively, to $5.84 and $7.24.

Datastream/ Mott Capital

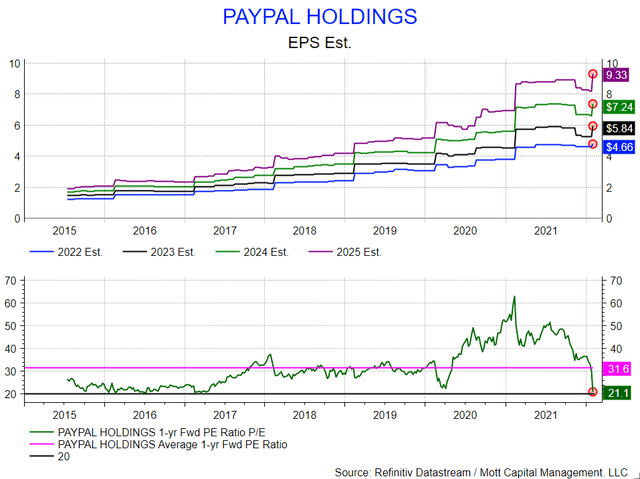

It leaves the stock trading for 20.6 times 2023 earnings estimates, which is well below its average since 2015 of 31.6. If we remove the bloated PE ratio due to the COVID bubble and focus on the stock’s PE ratio between 2015 and 2019, the average PE ratio drops to 27.1, even the very low end of PE range since 2015 is 20. This stock is as cheap as it may get.

But that doesn’t mean that the stock can’t fall. From a valuation perspective, the significant risk to PayPal is whether there is further downside momentum to earnings estimates, and trying to gauge that is not easy. Falling earnings estimates can push the stock price lower, even though the PE remains around 20.

Datastream/ Mott Capital

Getting Paid

Given the big decline, someone is willing to bet that the stock bounces back, at least over the short term, even if it means getting paid to do so. On February 9, the open interest for the March 18 $125 calls rose by 30,158 contracts while rising by 28,591 for the March 18 $125 puts. The data shows the calls were bought on the ASK for around $4.61 per contract. Meanwhile, the puts were sold on the BID for around $9.90 per contract. In all, the trader was paid $5.30 per contract to create the bullish spread position. It is a bet the stock is trading over $125 by the middle of March.

On February 11, the open interest for the May 20 $150 calls rose by roughly 5,300 contracts. The data shows that approximately 3,000 calls were bought on the ASK for $3.14. Additionally, the open interest for the April 14 $110 puts increased by around 5,000 contracts. The data shows 3,000 puts were sold on the BID for about $3.65 per contract.

Together the two trades create a calendar spread. The trader is betting the price of PayPal stays above $110 by the middle of April and then rises to $150 by the middle of May. The trader is getting paid to create this bullish trade, which comes to $0.51.

PYPL Stock – Technical Trends

The technical chart suggests that a move higher is possible, with a giant gap created following the company’s quarterly results, around $175. Gaps tend to get filled over time, and if this gap is filled, the stock will rise from its current price to $175.

Additionally, there is some decent support for PayPal, around $120 per share. The big trouble starts if the stock breaks that support. If support at $120 fails, the shares can fall back to $92.

Upon further review of the chart, there is a minor level of support at $107, which may help keep the stock from falling to $92. However, the stock is weak, and the current drop below $120 raises questions about how much further this stock can fall before it stabilizes. If $107 does fail, there is a very good chance the stock visits $92 before any rebound attempt is seen.

TradingView

Indeed, PayPal has fallen enough recently and over the last few months to think that a bounce is in store. It could turn out a be a big bounce, too, if it plays out correctly. However, that is not to say it doesn’t come with downside risk because there is plenty of that as well.

Be the first to comment