bennymarty

Investment Thesis

PayPal (NASDAQ:PYPL) has been a really poor performer in 2022. You know that, I know that, everyone knows that.

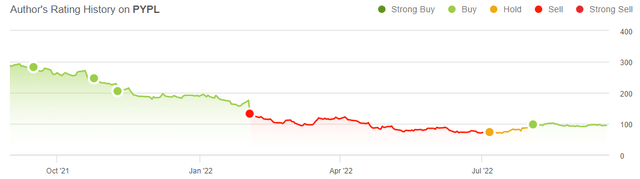

What’s more, given that a lot of people misunderstood my previous recommendations, I want to make it clear. I went bearish the name at the start of 2022. I then went neutral and moved to bullish on the name in August. And as it turned out, I was too soon in calling the bottom for this household name.

But I believe that stocks don’t stay on sale forever. I believe that there’s enough potential in the company for this stock to be a positive performer over the next twelve months.

That being said, I recognize that there are still issues that need to be ironed out. But on balance, I’m compelled towards its valuation of 20x its non-GAAP 2023 EPS.

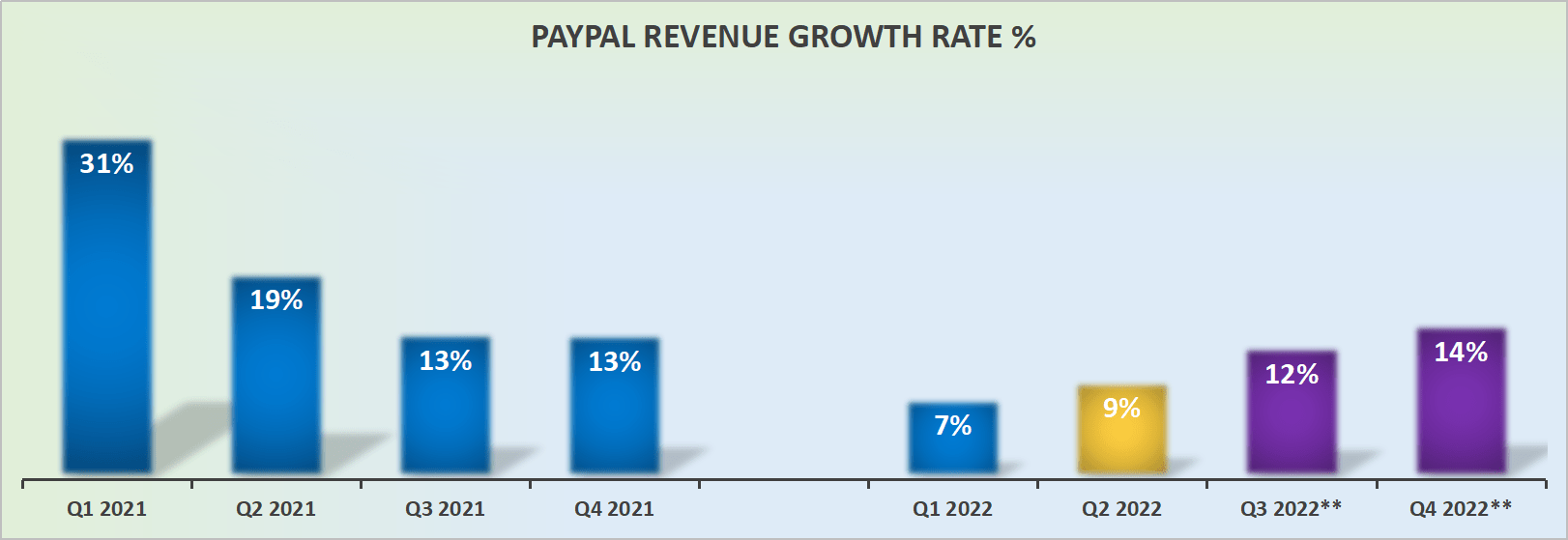

Can PayPal’s Normalized CAGR stay at 15%?

Author’s work

PayPal believes that it can get its revenue growth rates to accelerate. The figure that PayPal believes is appropriate as it exits Q4 2022 is close to 15% CAGR.

What’s more, given that the early part of 2023 provides PayPal with an easier comparison, we can assuredly believe that unless something goes dramatically wrong, PayPal could indeed be a 15% CAGR business.

Yes, I recognize that is a far cry from the 30% CAGR we all got accustomed to during the pandemic. But very few investors now in the stock probably consider that as a realistic CAGR for PayPal. At least not in the near term.

Indeed, I suspect that most investors would not even consider PayPal a 20% CAGR business. Something that we were being guided to at PayPal’s Investor Day (February 2021).

What’s Next for PayPal?

There’s good news and bad news. The great news is that PayPal didn’t stay sucking its thumb for too long until it recognized that Buy Now Pay Later was a serious value-add for PayPal. It managed to follow Affirm (AFRM) and got to scale at a very quick rate.

The bad news is that BNPL’s growth driver for PayPal is now going to face considerable headwinds. The reason for this is that there’s now a plethora of competition now. Think Block (SQ) and Visa (V), but others too.

So even though there’s clearly a lot of appetite for BNPL products, the fact remains that competitors are now having to elbow each other out of the way to entice consumers onto their platform.

That said, recall that PayPal has approximately 430 million active accounts on its platform. Hence, PayPal’s ability to cross-sell into its own user base will be manifold easier than that of its peers, which will have to go through significant hurdles to acquire more users. Those hurdles are not only going to be resource-heavy but a very time-consuming endeavor too.

Meanwhile, even if there is a rose-glassed argument that BNPL could in time be a highly profitable endeavor, I don’t believe that’s a realistic outcome any longer.

On yet the other hand, let’s remember, PayPal oozes free cash flow. Something that I’ll soon discuss. Undoubtedly I’m bullish that PayPal will be able to continue to self-fund its BNPL ventures. While the likes of Affirm are going to struggle.

What’s more, there’s every reason to believe that as we enter a period of slower economic growth, the number of non-performing loans will increase.

And the last thing that fintech companies likely want, is to be sacrificing profit margins to grow their user base, while at the same time increasing proportions of their user base start to let their loans turn sour. And here again, I believe that PayPal is ahead of the curve, as it already has nearly 450 million active accounts on its platform.

The other headwind that impacted PayPal throughout 2022 has been eBay’s (EBAY) exit from the PayPal platform. And now, looking ahead, this impact will no longer be a headwind as PayPal gets into Q4 2022.

So, with that in mind, let’s discuss PayPal’s free cash flow profile.

The Bull Case Is to Be Found Here: Oozing Free Cash Flow

We know that PayPal is going to make around $5 billion of free cash flow. But I’ll be upfront with readers that I have no idea of whether or not stock-based compensation is presently recognized as a real cost by the market!

For so long investors have failed to negatively appraise companies with excessive SBC, that an open and constructive discussion over SBC has now appeared to have once again gone behind the curtain.

Is SBC a ”real cost”? It’s easy to say yes. But I know of plenty of companies that for more than 6 years haven’t yet been negatively by their excessive SBC as a proportion of free cash flow.

So while the free cash flow figure is clearly substantial, it will be significantly lower if SBC is perceived by the market as a real cost.

PYPL Stock Valuation — 19x This Year’s EPS

Here’s what we know, PayPal is guiding for $3.95 of non-GAAP EPS at the high end (SBC added back, of course). This puts PYPL at 24x its 2022 EPS.

But what about next year? Could PayPal succeed in growing its EPS by 25%? If yes, then PYPL could reach around $4.90 next year. That would put the stock priced around 19x next year’s EPS.

Now, what if PayPal’s prospects next year are not so strong? What if PayPal only grows its non-GAAP EPS at 20% CAGR? That would put the stock priced at 20x EPS.

My point here is that I believe that PayPal has enough in its tank to continue at least over the next couple of years growing its EPS figures at around 20% CAGR, meaning that an investor in the stock today is not paying an egregious multiple.

The Bottom Line

PayPal’s stock has fallen from grace, with its multiple substantially compressing. Nevertheless, it’s still growing its FCF at a rapid rate and growing intrinsic value.

PayPal hit some headwinds, as it was too eager to extrapolate its Covid period, with targets that now turn out to have been unrealistic.

But given these much lower investor expectations, I believe that paying 20x its 2023 EPS is an attractive multiple.

Be the first to comment