NirutiStock

Owning it: I have been following the shares of Las Vegas Sands (NYSE:LVS) for five years, for any number of reasons that most investors share with me. It is the global leader of the gaming industry, having been built from the Las Vegas legacy of the original Sands, home of the famous Rat Pack of Frank Sinatra, and decades later, its extension to the Sands of Atlantic City.

From these failing properties, visionary entrepreneur Sheldon G. Adelson (d.2021) rebuilt a powerhouse market leader. The Venetian and Palazzo in Vegas defied the slide rule geniuses, who, just after the debut in 1999, said he’d never make a dime there. In fact, some analysts predicted a quick trip to Chapter 11. There were some hairy early moments, for certain, but Adelson proved his point about reinvention of the casino hotel. The property and its subsequent twin, The Palazzo went on to generate immense profits.

He followed that up in 2007 with a multi-property empire in Macau that rose to control over 22% of the world’s biggest gaming market with multiple properties. Pre-pandemic LVS clocked $12b in revenue, making it the biggest casino operator on the globe. Adelson maintained he was far from finished, promising more IR properties to come in Asia and the US.

I had known the two top Sands executives from AC who Adelson had recruited for his Vegas project. I also knew many key executives there down the years. I understood how the inner gears meshed around the dramatic vision of Adelson. Before the 2020 pandemic, it was clear to me that LVS was a stock that had not begun to fight, even though it was trading as high as $80. I saw catalyst after catalyst ahead as the company went from success to success.

Then in 2021, LVS sold its entire Vegas asset base for $6.2b, with most of the proceeds presumably earmarked for its next big step: A third Asian IR and possibly a bid for the possible open bidding for a metro New York based mega-project. Also hinted at by management was a move into online sports and iGaming, again utilizing the immense cash hoard LVS had accumulated from pre-pandemic earnings and the Vegas asset sales.

Early that year, Adelson died, taking with him the singular vision that had created LVS literally from the shambles of dated, marginal properties with little more than legacy names.

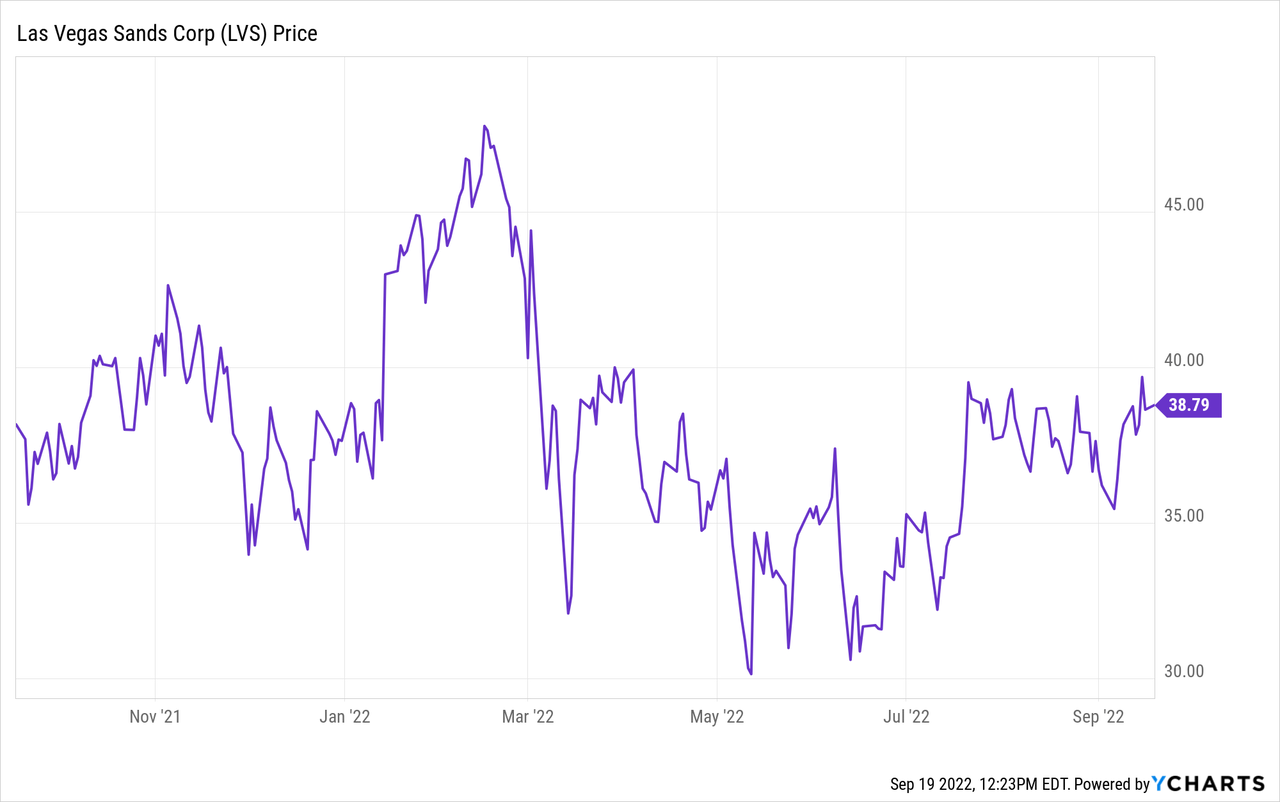

Above: LVS stock price, Crabs in the bucket, sideways but not up – yet.

Adelson’s widow, Dr. Miriam Adelson, now firmly in control of the trust holding LVS majority shares, echoed her husband’s commitment to a vision that included the development of new markets.

His successors, led by successor CEO Robert Goldstein quickly assured investors in earnings calls that it was on the trail of new vistas, having conversations with governments and other interested parties reaching for the Adelson goal. While I hardly expected any announcement overnight about such expansion, my best appraisal at that moment was that sooner, rather than later, LVS would be deep into the process of making big decisions.

What I saw was a deal to build and develop a third Asian property, specifically I had reason to believe it could be Thailand coming to the fore by the latest spring 2022. (It could still happen). I also believed the possibility that LVS, using its huge cash pile, would buy a significant chunk of the equity of an online gaming operator. This was despite founder Adelson’s militant opposition to online gaming during his lifetime. And lastly, I believed, LVS would be among the most qualified bidders for a New York City IR if and when the city politicos began taking bids.

Based on this, my logic was this:

LVS, like its Macau peers, faced chaotic uncertainties in Macau resulting from China’s continuing zero covid tolerance policy. Nobody can reasonably now forecast just how long Beijing will keep that policy in place. But a move in Thailand, the Philippines, Vietnam, or South Korea would not be as chancy given the recovery arc already in process there. So I concluded that an announcement of a big move in Asia would be bullish for the stock. No such move has come yet. Singapore was slowly edging back to normalcy and LVS MBS revenue flows reflected that bullish sign. It has since advanced even further and that is what is currently making a contribution in compensating for some of the cash burn LVS still faces in Macau. My assumption was that the crowding, cash bleeding online sports betting sector notwithstanding, that LVS would recognize that in one way or another, they had to be in the business by applying their cost control, high margin skill sets to the management of such an enterprise.

On that basis, plus my knowledge of management and its bench, its disciplined approach to asset allocation, I continued to believe that there were enough catalysts outside of any possible positive news flow from Macau that could move the stock ahead.

I was wrong in judging the duration of one crucial fact that did not materialize:

The uncertainties of China zero toleration policies not only affected gambler visitation to Macau, but the mother’s lode of Asian mass tourism outbound from China pre-pandemic would. With those obstacles looming, would it be prudent for LVS management to do a deal anywhere in Asia? How could you possibly value an existing property, no less the return on a given sunk cost to develop, when the single most crucial market in all of Asian gaming was essentially shut down?

You could numbers crunch, by using what you already know as a yardstick. For example, LVS’ Macau properties are valued even now at 7X cash flow. You could also work from a replacement value paradigm of an existing property for sale. You could do a low, average and high return scenario projection against educated guesses about an end of the zero policy say from 2023, 4 to 5.

It was on the premise, I believed, that LVS would have no problem with a longer-term Macau cash burn while they did all the novel contemplation that afforded comfort to their deliberations. And if China reopened their gates, it was beyond question in my mind, as a gaming veteran myself, that the floodtide of humanity that would invade Macau would be massive. No matter the bruised state of the China economy at the moment, a reopened Macau would quickly recover.

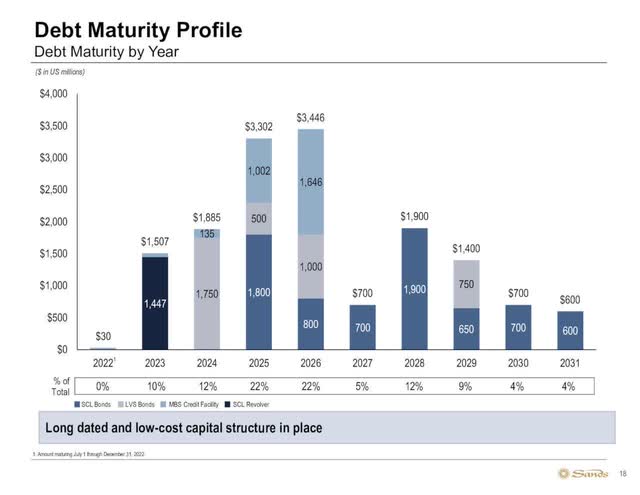

Above: LVS debt profile ahead tells it is in good shape unless there is a black swan swimming to crap all over the entire sector again.

But no word came from LVS indicating anything more than that the company was “talking”. I watched the stock’s valuation ebb away. It became clear to me that Mr. Market was not buying a “wait it out, it’s worth it” scenario. And LVS shares moved around like crabs in a bucket, not able to crawl up and out, but only sideways.

I was wrong in assessing what I believed to be an Adelson’s like decision process, which was an astute combination of marshalling facts and making a gut-level decision against a perceived inner obsession to move. My belief was that Goldstein and his associates had so long imbibed the mantras of Adelson and that there would be support from the widow, that an announcement that would move the shares could come at any time in the second half of last year. It was not to be. What we fundamentally have now is crickets.

It is too glib to merely suggest that the absence of Adelson was the ant at the picnic. Clearly, in such times, there is a logical case to be made to proceed with great caution. That valuations, indeed, would be dangerous guesswork in a market where the single biggest percentage of revenue (70%) from locked down mainland China. Yet, on reflection, we pose the ultimate question: Were Adelson alive and well, would the company have already moved and been well on the road to a shinier future than we can now see?

The complexities faced by a successor management to a visionary leader with the group that controls the foundation in the persona of Dr. Adelson are tough to assess. There could be hard dissent, there could be harmony, there could be other roads that seem less potholed. LVS, for example, could make a run at a merger with Wynn Resorts, Ltd. (WYNN) or a leader in the US regional space like Boyd Gaming (BYD).

So the question now is this: At writing, LVS is $38.97 a share, up in the last 90 days 25.3% as some investors see the improving numbers out of Singapore and the market cap of $29.5b reflecting a huge undervaluation of LVS assets that can’t go on ad infinitum for those with the risk tolerance. LVS has a strong balance sheet with $6.4B in cash, and an analyst consensus PT of $46.77.

Google

Above: So far it’s following its peers unrecognized as a big buy.

According to Alpha spread analysis, its DCF base case value is $49.25, indicating the stock is undervalued by 21%. Part of the calculation of course is projected assumptions about future China revenue flows, which is the core issue of the stock – that is the 600lb gorilla in the room without question. Having gone through my own review several times now, I am moving my LVS guidance from buy, to hold, on the theory that the stock may be undervalued, but unless we see greater clarity on China in the quarters ahead, we can no longer make the case to accumulate. Yet, at its current value, investors are still getting an asset base way undervalued in a new normalcy to come. When and if clarity does come, how and when LVS will respond will be aggressive and fast without question.

We believe there is a margin of safety in ~$38 a share.

Be the first to comment