SelectStock/E+ via Getty Images

Investment Thesis

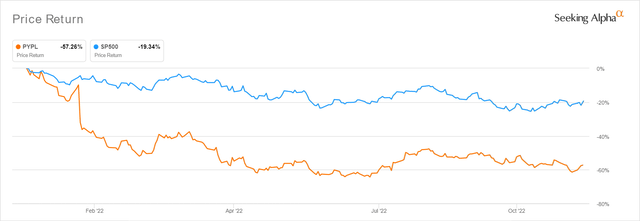

PYPL YTD Stock Price

Seeking Alpha

PayPal Holdings (NASDAQ:PYPL) is inherently undervalued now, given the drastic destruction the stock had suffered thus far. The stock is now trading nearer to its lower-end 5Y EV/Revenue and P/E valuations, while suffering a -73.89% correction in stock prices from peak levels of $301.38 in July 2021.

PYPL may also record sustained growth moving forward, given its growing partnership with Amazon (AMZN) and Apple (AAPL). The latter could potentially be a decent booster, due to the expanded point-of-sale capability in its merchant segment. Furthermore, with the addition of PYPL and Venmo branded credit and debit cards to Apple wallets by H1’23, we expect increased total payment volume as well, further contributing to the company’s top and bottom lines moving forward.

The reason is simple. Though iPhones may only constitute 25% of the smartphone global market share, most iOS users actually command higher spending power due to the higher average annual household income of $200K, compared to Android users at $100K. This fact directly contributed to the higher in-app spending by iOS users at $83.79B in 2021, against Android’s $49.21B at the same time. Therefore, we may see PYPL record improved numbers against the consensus FY2023 revenue of $30.47B and net income of $5.4B. As a result, triggering a slow and steady recovery despite the impending recession in 2023.

PYPL Continues To Impress With Cost Management & FCF Generation

S&P Capital IQ

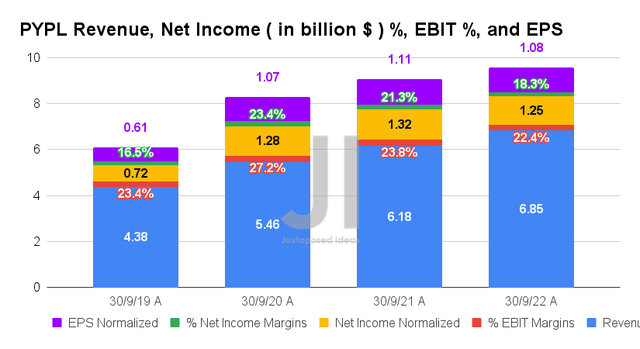

In its recent FQ3’22 earnings call, PYPL reported revenues of $6.85B and EBIT margins of 22.4%, indicating remarkable YoY growth of 10.84% though a moderation of -1.4 percentage points, respectively. The latter is attributed to the rising inflationary pressures on its gross margins by -2.4 percentage points YoY.

However, PYPL’s profitability remains decent, with net incomes of $1.25B and net income margins of 18.3%, despite the tougher YoY comparison. The management’s aggressive cost-cutting strategies are already paying off, with $0.9B in cost moderation expected for FY2022 and $1.3B for FY2023. Thereby, triggering the sustained growth in its EPS to $1.08 for the latest quarter and $1.19 for FQ4’22, against FQ2’22 levels of $0.93 and FQ3’21 levels of $1.11.

S&P Capital IQ

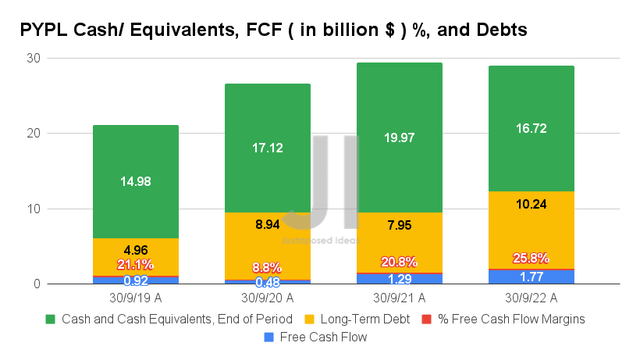

PYPL also reported an excellent Free Cash Flow (FCF) generation of $1.77B and FCF margins of 25.8% in FQ3’22, indicating an increase of 36.43%/ 6.8 percentage points QoQ and 37.5%/ 5 percentage points YoY, respectively.

Though PYPL’s long-term debts of $10.24B may seem elevated at the moment, we are not overly concerned, since only $418M will be due by 2023 and $1.25B by 2024, with the rest tremendously well staggered through 2062. It could also well afford the $274M in annual interest expenses, given its excellent profit margins. Combined with the growing cash and equivalents of $16.72B on its balance sheet for the latest quarter, the company remained well-prepared to meet the recession head-on through 2023.

S&P Capital IQ

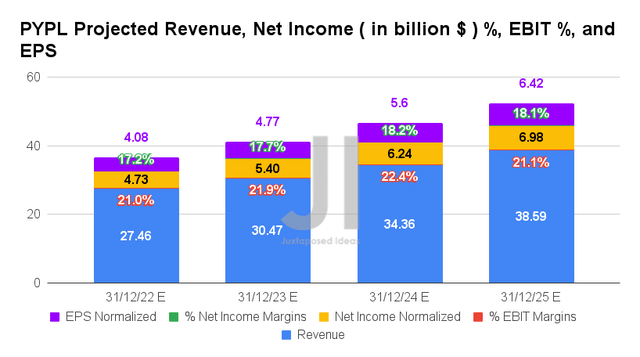

Over the next four years, PYPL is expected to report a notable deceleration in revenue and net income growth at a CAGR of 11% and 6.3%, respectively, against pre-pandemic levels of 17.9%/26.4% and hyper-pandemic levels of 19.5%/21.7%. It is evident that Mr. Market is unconvinced about its top and bottom-line growth ahead, given the drastic downgrades by -19.77% and -30.89% since our first coverage in April 2022.

However, we believe that there are zero concerns about PYPL’s forward profitability, given the impressive sustained growth in its EPS, from $1.15 in FY2016, $3.1 in FY2019, $4.6 in FY2021, and finally to $6.42 by FY2025, at a normalized CAGR of 17.9%.

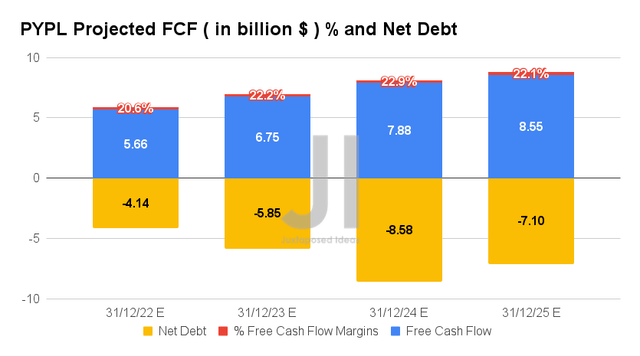

S&P Capital IQ

Furthermore, the expansion in PYPL’s FCF margins remains excellent, from 21.7% in FY2019, 21.4% in FY2021, and finally to 22.1% by FY2025. Combined with the projected improvement in its net debt situation by FY2025, we reckon that the recent battering was overly done, with the stock plummeting by -57.26% YTD against the S&P 500 Index’s decline of -19.34% at the same time. Its growth is only normalizing as a mature fin-tech company, not entirely gone.

In the meantime, we encourage you to read our previous article on PYPL, which would help you better understand its position and market opportunities.

- PayPal: Mr. Market Is Over Whipping The Cash Cow

- PayPal Vs Amazon’s Buy With Prime: Which Will Emerge As The Winner?

So, Is PYPL Stock A Buy, Sell, or Hold?

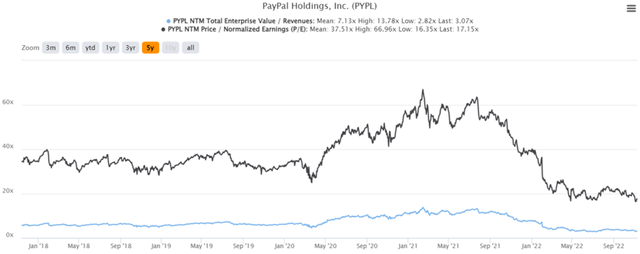

PYPL 5Y EV/Revenue and P/E Valuations

S&P Capital IQ

PYPL is currently trading at an EV/NTM Revenue of 3.07x and NTM P/E of 17.15x, lower than its 5Y mean of 7.13x and 37.51x, respectively. The stock is also trading at $78.68, down -65.93% from its 52 weeks high of $230.97, though at a premium of 16.42% from its 52 weeks low of $67.58. Nonetheless, consensus estimates remain bullish about PYPL’s prospects, given their price target of $112.93 and a 39.20% upside from current prices.

Though analysts were right in terms of PYPL’s deceleration in the top and bottom-line growth over the next few years, we remain convinced about its massive relevance ahead. The company continues to grow its Total Payment Volume impressively at 14% FXN YoY to $337B and expand its e-commerce checkout volumes by 4% YoY, against Bank of America’s benchmark of 2% YoY. Its existing consumer base remained sticky as well, with a 2.87% QoQ and 13% YoY growth in payment transactions per active account to 50.1x over the last twelve months (LTM), while reporting an exemplary 15% YoY increase in total transaction volumes to 5.6B for the FQ3’22 quarter.

PYPL’s BNPL segment remained robust as well, reporting a total volume of nearly $5B in FQ3’22, indicating an excellent 157% YoY growth, while growing its consumer base by 13.63% QoQ and 263.15% YoY to 25M customers by the latest quarter. These results are inherently stellar in comparison to its BNPL peer, Affirm (AFRM), which had to reduce its FY2023 guidance in its recent earnings call due to higher interest rates on its funding costs. Thereby, proving PYPL’s excellent standing as a legacy fintech company during the worsening macroeconomics.

PYPL also continued to return much value to its long-term shareholders, through $5.06B of share repurchases over the LTM. Thereby, massively negating the dilutive effects of its $1.28B of Stock-Based Compensation, which has also notably declined by -10.48% sequentially. It is no wonder then, that the stock has found a relatively sustainable support level at these prices. Since the October CPI results are rather upbeat, we expect this bottom to hold, especially since 80.6% of analysts expect the Feds to pivot by the upcoming December meeting, significantly encouraged by the Bank of Canada’s recent 50 basis points hike.

Therefore, we rate PYPL stock as a Buy now. In the meantime, bottom-fishing investors may possibly wait a little longer for the $70s, at the risk of missing these rock bottom levels. Do not miss the boat.

Be the first to comment