Justin Sullivan

In February 2022, I published my last article about PayPal Holdings, Inc. (NASDAQ:PYPL) and called it a “Buying Opportunity In The Making” when the stock was trading around $110. I expected that the stock might drop lower and identified several support levels for the stock – the lowest around $70. I wrote:

However, if PayPal should be trading for $70 or $80 in the months to come, we have a real bargain at our hands.

Now PayPal has reached that level (I purchased shares myself slightly below $80 a few weeks ago), but it seems like the overall stock market pressure continues and we must question if PayPal has found a bottom yet. Not only is Seeking Alpha warning me that PayPal is at a high risk of performing badly, but it is also a realistic possibility that the bear market has begun and will last for a long time (my mid-term target for the next few years is the S&P 500 (SPY) at 1,550). It might be difficult for PayPal to perform well in such an environment.

Hence, let’s look at PayPal again if we are really looking at a great buying opportunity around $70 or if this is not the time to buy stocks at all. We start by looking at the quarterly results.

Quarterly Results

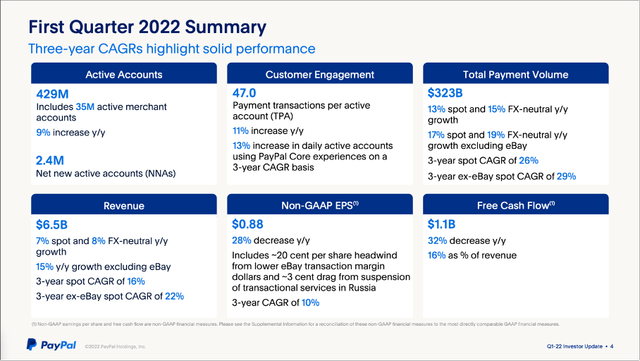

In the first quarter of fiscal 2022, PayPal reported mixed results, but maybe not as bad as the market was expecting. Net revenue could still increase from $6,033 million in the same quarter last year to $6,483 million this quarter – 7.5% year-over-year growth. While the top line could still increase, operating income declined from $1,042 million in the same quarter last year to $711 million this quarter – resulting in 31.8% YoY decline. And diluted earnings per share declined even 53.3% YoY from $0.92 in Q1/21 to $0.43 in Q1/22. When looking at non-GAAP diluted earnings per share, PayPal had to report a decline of only 27.9% YoY and free cash flow declined from $1,537 million in Q1/21 to $1,051 million in Q1/22 – 31.6% YoY decline.

Aside from the income statement, we can also look at some additional metrics. While PayPal could add only 2.4 million net new active accounts in the first quarter of fiscal 2022, total payment volume increased 15% YoY to $323.0 billion. Total payment transactions increased 18% year-over-year to 5.2 billion and payment transactions per active account on a trailing twelve-month basis also increased 11% YoY to 47.0.

The biggest part of PayPal’s revenue is still stemming from transaction revenues (responsible for 93% of total revenue), but PayPal is also generating revenue from other value-added services – similar to Visa (V) and Mastercard (MA). These value-added services derive from revenue earned through partnerships referral fees, subscription fees, gateway fees, and other services provided to merchants and customers. In the first quarter, revenue from value added services was $485 million.

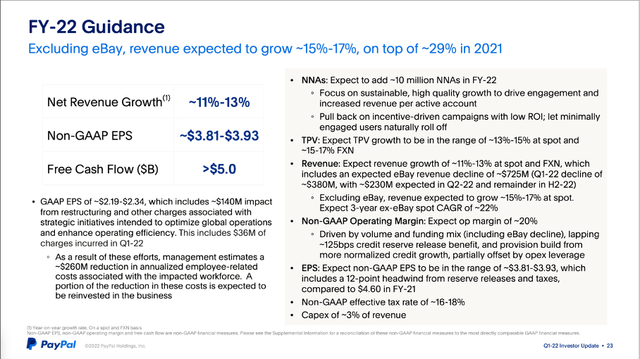

When looking at the full-year fiscal 2022 guidance, PayPal is expecting net revenue to grow between 11% and 13%, which is still a high growth rate. Free cash flow is also expected to be at least $5 billion and therefore in a similar range as last year. However, non-GAAP diluted earnings per share are expected to be in a range of $3.81 to $3.93 and therefore lower than in fiscal 2021 (it was $4.60). GAAP EPS is expected to be only in a range between $2.19 and $2.34 and therefore clearly below the EPS of fiscal 2021, which was $3.52.

Recession and Interest Rates

In almost every one of my previous articles I devoted one section to the potential upcoming recession. And I usually look at the company and its performance during previous recessions as this might give us some hints about the performance in a future recession. In case of PayPal, we only have the data for one recession although the business witnessed several recessions. But during the Great Financial Crisis, the company was part of eBay (EBAY), and we don’t have publicly available data for that time.

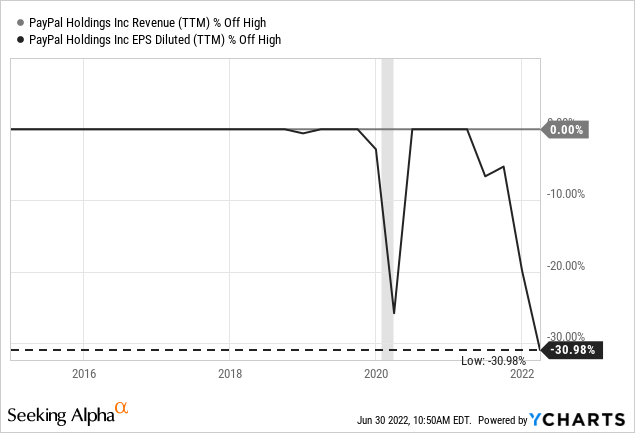

Instead, we can look at PayPal’s performance during the COVID-19 recession two years ago. When looking at revenue, we don’t see the recession at all. When looking at earnings per share, we can see EPS declining about 25% during the COVID-19 crisis (but as we all know, that decline was offset quickly, and PayPal reported much higher earnings per share in the following quarter).

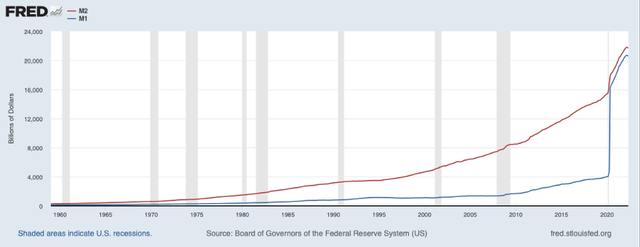

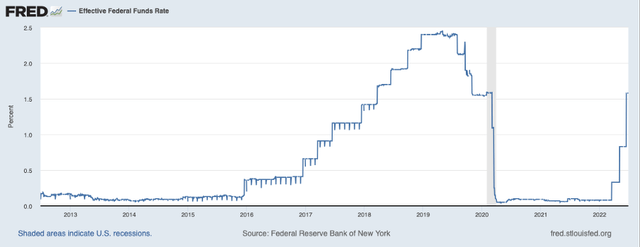

However, the last recession is not a good example as it was rather untypical. Due to the lockdowns, people had to buy online, and PayPal profited from that. Additionally, the inflationary environment and the extreme liquidity provided by the FED and U.S. government distorted the picture and the next recession will most likely be very different. These actions are also visible in the following chart, and for a short period of time so much liquidity was provided that even the savings rate was extremely high.

In the next coming recession, we must assume that consumers will spend less as the disposable income will decline. Several factors are contributing here: unemployment during recessions, declining asset prices leading to lower liquidity, banks are not willing to lend high amounts of money (and borrowing is more expensive with higher interest rates).

And PayPal will be directly affected by people spending less as the total payment volume might grow not as fast as before or even decline for several quarters in a row. Transaction fees will be lower if people make fewer transactions or spend smaller amounts per transaction.

Long-term Trends

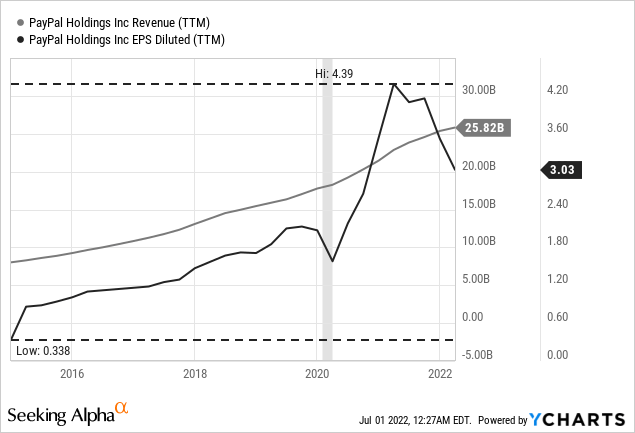

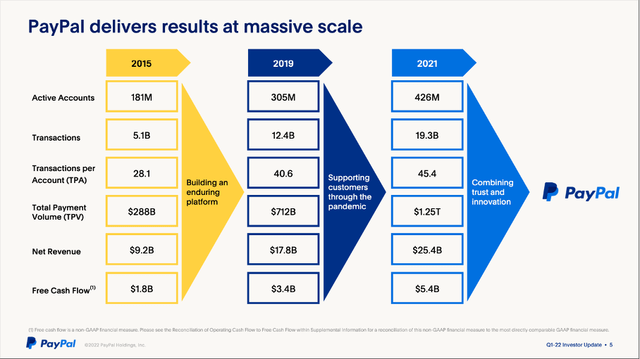

PayPal will be affected by a recession, and it will be affected by higher interest rates. However, these are rather short-to-mid-term developments. The long-term trends making PayPal a good (or even great) investment are still intact. And when ignoring the last one or two quarters, PayPal could deliver high growth rates for almost every metric.

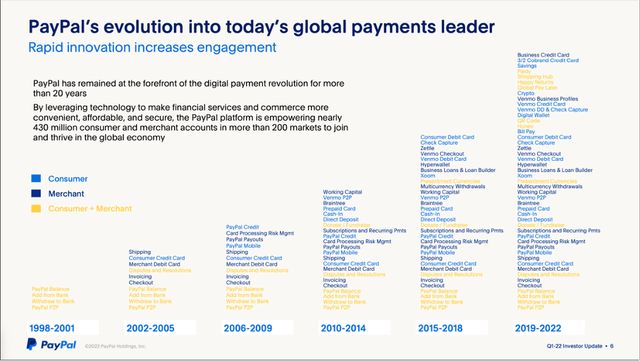

PayPal can continue to grow with a high pace. Although user growth slowed down in the recent past, PayPal has only 429 million active accounts and the possibility to grow further. Transactions per account can also continue to increase and this will result in total payment volume to increase. And by adding new and additional services, PayPal can generate additional revenue – aside from transaction fees. The following chart shows how PayPal evolved into the payment giant it is today.

PayPal can also grow by signing contracts with new merchants. One example is the plan to integrate Venmo with Amazon (AMZN), and the plans are progressing and should come to an end at some point in 2022. Considering the huge customer base and the payment volume Amazon is generating, PayPal (or Venmo) should profit – even if Amazon has pricing power and the conditions for PayPal won’t be as great as with smaller retailer. And according to the last earnings call, Venmo is a great success. Not only does Venmo have more than 85 million accounts in the United States, but it could also grow revenue approximately 60% in the first quarter of fiscal 2022.

Another example is “Buy now, pay later” (“BNPL”), which also seems to be a success according to the earnings call:

We continue to be pleased with our Buy Now, Pay Later franchise, which is seeing persistent market share gains. We did $3.6 billion in volume in Q1, up 256%, with over 18 million consumer accounts choosing this funding option since launch. And we are seeing increased merchant penetration and upstream presentment, which will allow us to continue to deliver strong results.

All in all, the trend towards paying cashless will most likely continue and PayPal as one of the major players in this market will profit from that trend. According to different studies, a CAGRs in the teens is to be expected (see here for example). And even if these estimates are way too optimistic and the underlying market will grow only in the single digits, PayPal still seems to be undervalued.

Intrinsic Value Calculation

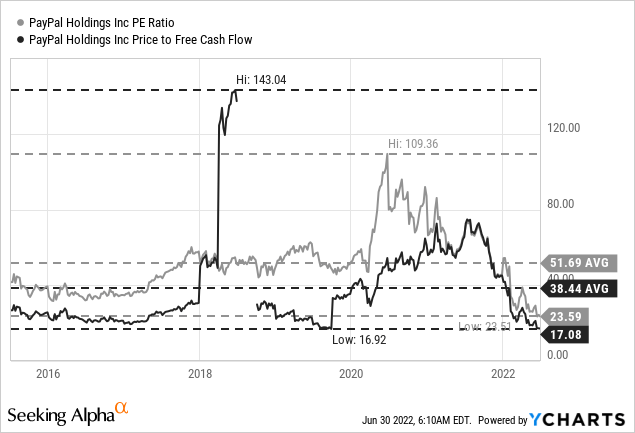

When looking at the simple valuation metrics, PayPal seems to be the cheapest it has ever been since its IPO in 2015. Right now, PayPal is trading for a P/E ratio of 23, which is clearly below the average P/E ratio of 51.69 and the lowest P/E ratio PayPal has been trading for. When looking at the price-free-cash-flow ratio, PayPal is trading for 17 times free cash flow, which is also below the average P/FCF ratio of 38.44 and close to the lowest P/FCF ratio PayPal was trading for in 2019.

Aside from looking at simple valuation metrics, we can also use a discount cash flow calculation to determine an intrinsic value for PayPal. In my last article, I calculated an intrinsic value around $180 for PayPal and considered the stock already undervalued at that point (it was trading around $110 back then). I assumed that growth would slow down from 15% over the next ten years to 6% growth till perpetuity (which is realistic for a wide moat company).

We can provide an updated intrinsic value calculation in this article and be a little more cautious with our assumptions. Free cash flow in the last four quarters was $4,946 million, which I often take as basis in my calculation. As mentioned above, management is expecting free cash flow in fiscal 2022 to be above $5 billion hence I will take $5 billion as basis in our calculation. For PayPal to be fairly valued right now, the company must grow free cash flow 4% annually from now till perpetuity (this would lead to an intrinsic value of $71.10 for PayPal).

And I know many investors and analysts seem to be extremely pessimistic about PayPal right now, but 4% growth seems to be ridiculously low. And analysts are still expecting earnings per share to grow with a CAGR of 18.57% in the next ten years. While I don’t think these growth rates are realistic, I would still assume that growth slowing down from 15% to 6% in ten years from now followed by 6% growth till perpetuity is realistic. However, I would assume stagnating free cash flow for fiscal 2023 (recession seems to be likely and PayPal probably won’t manage to grow). Taking 1,172 million outstanding shares and 10% discount rate leads to an intrinsic value of $135.40 – and PayPal is still extremely undervalued.

I am aware, that PayPal can’t grow its bottom line right now, but over the long run I will assume that PayPal can not only increase revenue (as it still does with a high pace) but can also improve margins. And in theory it could also use the free cash flow it is generating to buy back shares (if the cash can’t be used in any other way) and we might get rather high growth rates for PayPal again.

Sentiment vs. Fundamentals

When looking at PayPal it seems obvious that the stock is a bargain and screaming buy at this point. Although growth slowed down and the next recession will have a negative effect on PayPal, I can’t imagine PayPal growing only in the low-to-mid single digits in the years to come and if the company can achieve higher growth rates, the stock is undervalued.

While I don’t assume PayPal will continue to grow revenue 20% or more annually (as it was the consensus a few quarters ago), I consider growth rates in the double digits for the bottom line more than realistic. When looking at revenue and earnings per share in the last few years, we can argue that in 2020 and 2021 PayPal just broke out of the long-term growth trend and accelerated growth rates for a few quarters during the pandemic. And now the company is returning to this trendline (like a reversion to the mean). But the long-term growth trends are still intact – growth rates will only slow down over time (a typical pattern).

Conclusion

In my opinion, lower stock prices for PayPal are not justified from a fundamental point of view – even if growth rates will slow down drastically as the United States will be hit by a severe recession. And the stock is a buy in my opinion. Nevertheless, you might need a strong stomach as the stock can go much lower (it could easily get cut in half again) and the next two or three years might be a difficult time. But over the long run (a decade or longer) I don’t think you will regret buying PayPal at current prices.

Be the first to comment