ipopba

Investment idea

Automatic Bank Services ltd. (OTCPK:ABANF) has a dominant position in the Israeli market. As explained in our first report, we like the equity story but would not buy at the current market prices as we believe it’s almost fairly valued. We think we need a margin of safety before considering an investment in ABANF.

Latest Earnings Review Q1 22

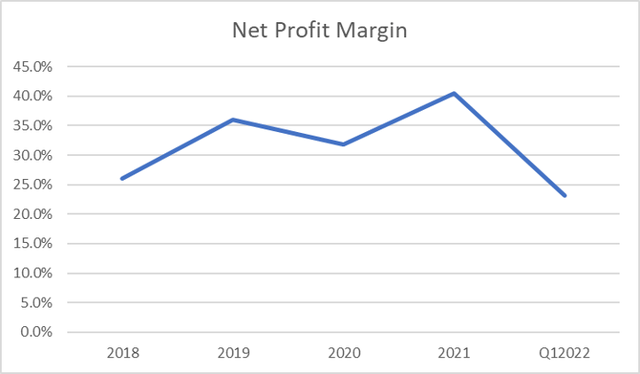

Regarding Q1 22 financials, it is worthwhile noting that, although ABANF has generated almost 25% of last financial year’s revenues, it has only generated 14.6% of the previous year’s Net Income. This is due to the increase in operational costs following the separation from Masav and the losses from marketable securities.

Net Profit Margin Chart (Moat Investing)

Source: Moat Investing

The Valuation Angle

As highlighted in our first report, comps-based valuation is not suitable for this stock as Visa (V) and Mastercard (MA) are providing many other services, too, not in the scope of ABANF.

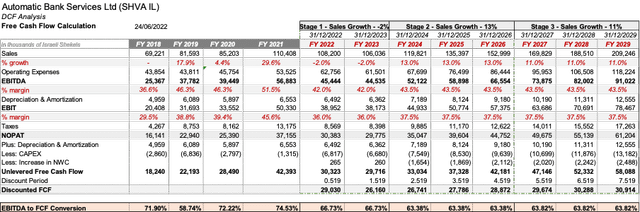

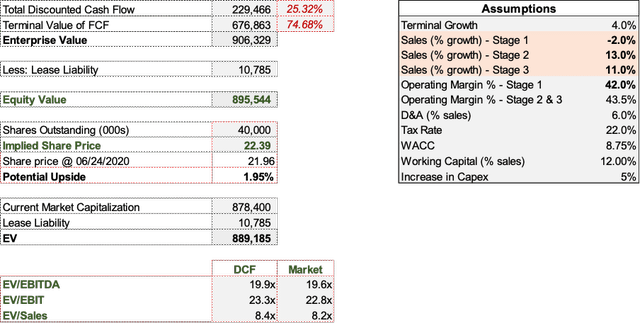

Since the new restrictive agreement expires in 2029, we have approached our valuation by employing eight years, three-stage DCF model with -2% growth in the first two years, accounting for the possible recession effects, and 13% & 10% growth for the following three-year stages each.

Risk related to Masav, which we identified in September 2021, has matured, and the company has identified the need to increase working capital requirements and capital expenditure. We thus assume WC requirements to increase by 12% of the YoY change in revenue and CAPEX to exceed by 5% the depreciation expense.

We are also factoring in the possibility of decreasing margins because the Strum Law forces ABANF to increase compensation level and employee count due to the continued separation with Masav. Considering the possible recession scenario, we have used a 42% margin in the next two years and a 43.5% margin after that.

Given BOI’s expected increase in interest rates because of the highest inflation expectations since 2008, we have assumed a WACC of 8.75% and terminal growth of 4%. Based on these assumptions, our equity valuation is in the region of 895.5m shekels which is 22.39isl per share. Our valuation is very close to the current market prices giving almost no upside potential.

Source: Moat Investing

Source: Moat Investing

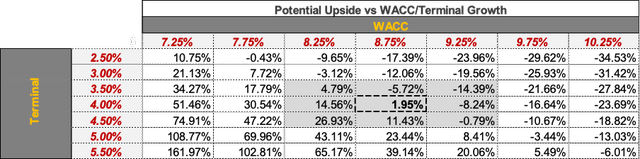

Sensitivity analysis

We have also performed a sensitivity analysis based on the primary value drivers determining the company’s potential upside.

It is worth noting that around 74% of the equity value is based on the terminal value. Thus, our valuation is extremely sensitive to changes in WACC and Terminal Growth following a potential increase in interest rates. So, it is helpful to see the valuation under different WACC and terminal growth scenarios. The following table shows a sensitivity analysis of the potential upside and downside concerning our intrinsic equity value.

Sensitivity Analysis (Moat Investing)

Source: Moat Investing

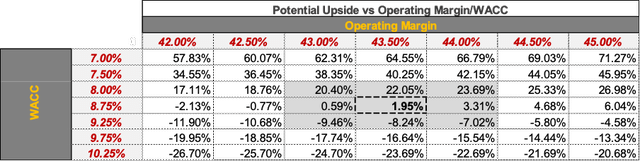

We expect operational costs to be affected due to recessionary factors, Strum law, and separation with Masav. The table below shows the sensitivity analysis, which is quite helpful in understanding this impact.

Sensitivity Analysis (Moat Investing)

Source: Moat Investing

Conclusions

Our Intrinsic valuation based on the above valuation model and assumptions tells us that the stock is fairly valued at 22.39 against the current market price of 21.96, giving a potential upside of just 1.95%.

We will look to go in once it gives us the desired (between 20% and 30%) margin of safety against our fair value estimates.

Be the first to comment