iLexx/iStock via Getty Images

Investment Thesis

PayPal Holdings (NASDAQ:PYPL) remains a stellar pick in the fintech industry, given its strong global presence and established brand value. Its financial performance has been stellar as well, with robust net income and FCF profitability, compared to its peers such as Block (SQ). However, given Mr. Market’s fear about the potential recession and his odd determination to correct PYPL’s rich valuations during the COVID-19 pandemic, it is evident that the stock has been over-corrected, dipping to 2017 levels.

Unfortunately, given the historical stock price trend, we don’t think the pain is ending anytime soon, thereby cutting any hopes for a potential recovery – barring a ( really ) positive catalyst. Therefore, we advise caution to any investors looking to add more positions during this perceived dip, since we could be seeing another retracement in the intermediate term.

PYPL Has Proved Itself As A Robust Cash Cow

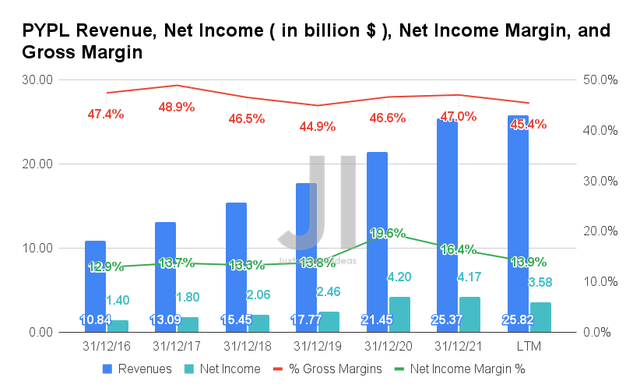

It is evident that PYPL has prevailed during the height of the COVID-19 pandemic, given its continued growth in revenues in the past two years. By the LTM, the company reported revenues of $25.82B and gross margins of 45.4%, highlighting its stellar execution thus far. Despite the timely normalization of its net income margins, PYPL continues to report robust net incomes at $3.58B and margins of 13.9% in the LTM.

PYPL Total Payment Volume, Active Accounts, and Customer Engagement

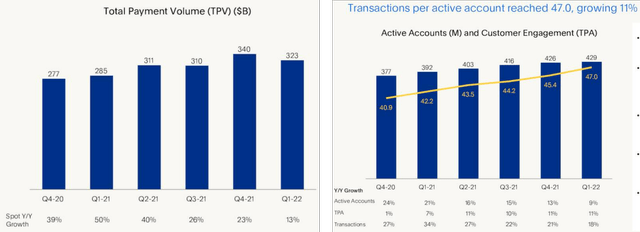

Despite the market’s valid concerns about its slowing account growth, it is also evident that PYPL has been reporting an excellent increase in customer engagement thus far. By FQ1’22, the company reported 47 transactions per active customer, with 11% YoY growth then, compared to 7% in FQ1’21. In addition, PYPL proves its market leadership given the 24% YoY growth in the volume of its payment transactions in FQ1’22, excluding eBay.

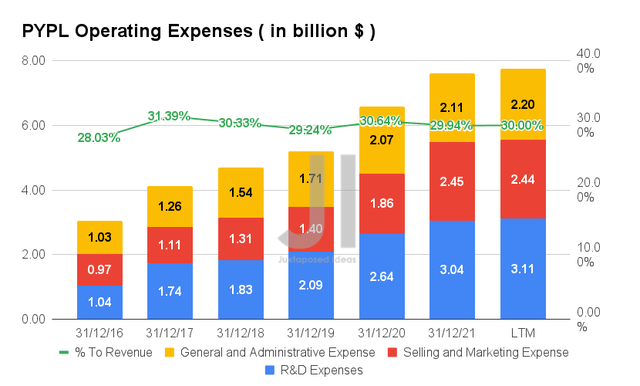

As evident from the chart above, PYPL has also grown its capabilities prudently in the past few years, with total operating expenses of $7.75B in the LTM, representing a stable ratio of 30% of its growing revenues then. Given its historical operating efficiencies, we expect stellar execution ahead despite the rising inflation and potential recession.

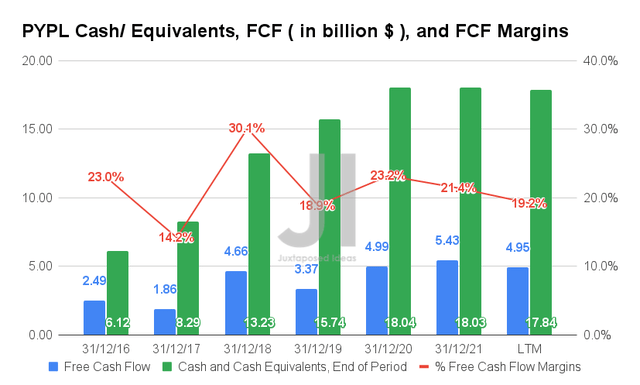

Therefore, given its growing revenues and consistent profitability, PYPL has been reporting robust Free Cash Flow (FCF) generation, with an FCF of $4.95B and an FCF margin of 19.2% in the LTM. These have directly contributed to its growing war chest of cash and equivalent at $17.84B in the LTM.

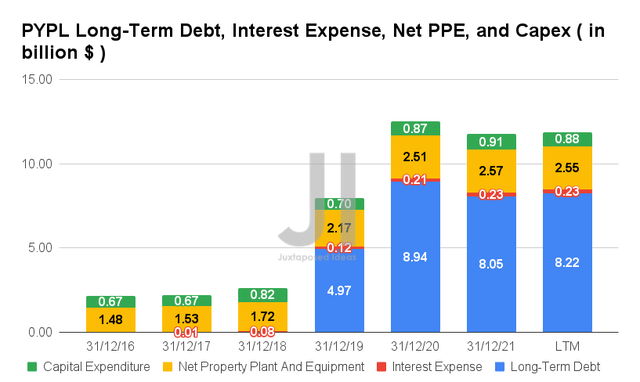

In the meantime, PYPL continued to strengthen its balance sheet with the aid of additional long-term debts during the height of the pandemic. By the LTM, the company reported long-term debts of $8.22B and interest expenses of $0.23B, representing a notable increase of 65.3% and 91.6% from FQ3’19 levels, respectively. In addition, PYPL grew its net PPE investments to $2.55B and capital expenditures to $0.88B by the LTM, representing increases of 17.5% and 25.7% from FY2019 levels, respectively. Nonetheless, we are not overly concerned since the company continues to report robust net income/FCF profitability and exercise prudence in its capital deployment thus far.

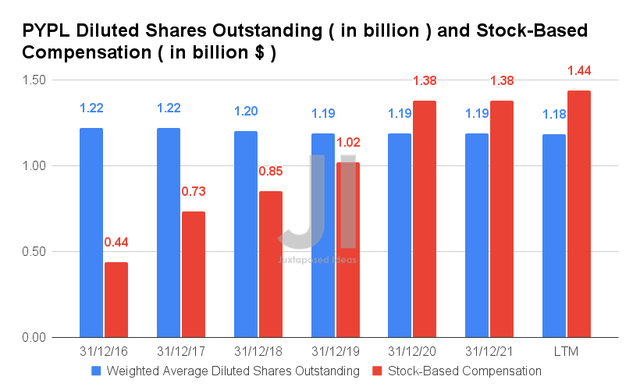

In addition, PYPL continues to return additional value to its existing shareholders through share buy-back programs with an impressive $3.4B spent in FY2021 and $1.5B in FQ1’22. Therefore, we are not concerned at all about the company’s elevated stock-based compensation of $1.44B in the LTM, since its diluted shares outstanding have remained relatively stable thus far.

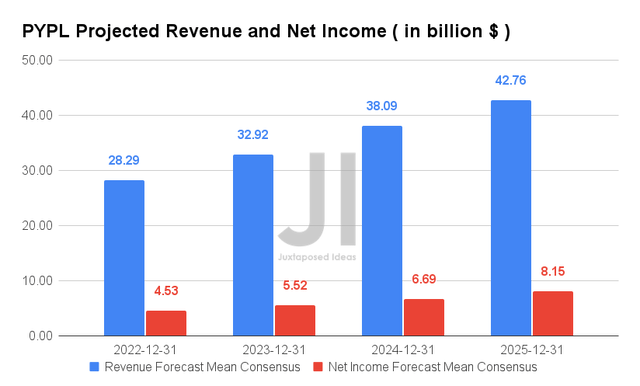

Over the next four years, PYPL is expected to report revenue and net income growth at an impressive CAGR of 13.94% and 18.31%, respectively. It is evident that the company is expected to expand its profitability further, with net income margins of 16.4% in FY2021 to 19% in FY2025, a massive improvement from 13.8% in FY2019. Nonetheless, it is apparent that PYPL’s growth has been downgraded by -11.1% since our analysis, given the management’s moderation of FY2022 guidance in FQ1’22, thereby contributing to its -19.3% stock price decline in the week after its latest earnings call.

For FY2022, consensus also estimates that PYPL will report revenues of $28.29B and net incomes of $4.53B, representing excellent increases of 11.5% and 8.8% YoY, respectively. However, this is also a downgrade from the previous revenue estimates of $29.3B and net incomes of $5.4B.

In the short-term, analysts will be closely watching PYPL’s FQ2’22 performance on 02 August 2022, with consensus revenue estimates of $6.8B and EPS of $0.87, representing a YoY improvement of 9.05% though a decline of 24.05%, respectively. Given how the company has mostly exceeded consensus estimates for the past eight consecutive quarters ( barring the baked-in pessimism for its FY2022 revenue ), we expect another decent earnings call ahead, assuming minimal impact from the potential recession in Q2.

In the meantime, we encourage you to read our previous article on PYPL, which would help you better understand its position and market opportunities.

- PayPal Vs Amazon’s Buy With Prime: Which Will Emerge As The Winner?

So, Is PYPL Stock A Buy, Sell, Or Hold?

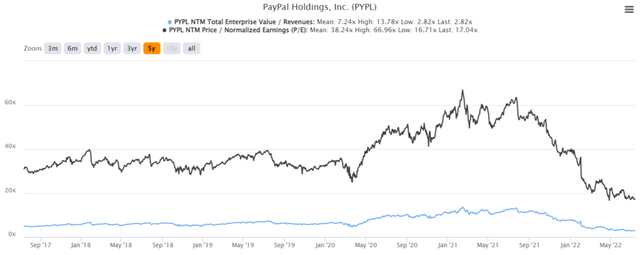

PYPL 5Y EV/Revenue and P/E Valuations

PYPL is currently trading at an EV/NTM Revenue of 2.82x and NTM P/E of 17.04x, lower than its 5Y mean of 7.24x and 38.24x, respectively. The stock is also trading at $69.55, down 19.1% from our previous analysis in April 2022, given the market’s continuous worry about the saturation of its growth potential and slower performance ahead.

PYPL 5Y Stock Price

Therefore, despite its historical financial performance and continued relevance in the e-commerce and fintech industry, we are definitely looking at an apparent disconnect in its fundamentals and stock price performance, since the stock had declined all the way to 2017 levels.

Given the bearish market sentiment, volatile economic outlook, and potential recession, we have to, unfortunately, encourage caution and re-rate to a hold rating, despite our previous buy recommendation. In addition, we prefer to glean more information on its Q2 performance from the upcoming earnings call, since the bottom is unlikely here yet.

Therefore, we rate PYPL stock as a Hold for now.

Be the first to comment