JasonDoiy

PayPal (NASDAQ:PYPL) is one of the largest Fintech companies in the world. The Global fintech as a service market is forecasted to be worth $681.6 billion by 2028 and growth at a rapid 16.9% compounded annual growth rate. PayPal is poised to continue to benefit from this growth trend and its Venmo App has increased its commerce volumes by a rapid 150% in Q3,22.

Management is executing a series of cost-saving initiatives in an outstanding manner and is on track to save $900 million in the year. The company also bought back a staggering 10 million shares, returning $939 million to stockholders in the process. In 2022, the company has executed $3.2 billion worth of share repurchases which is simply astonishing.

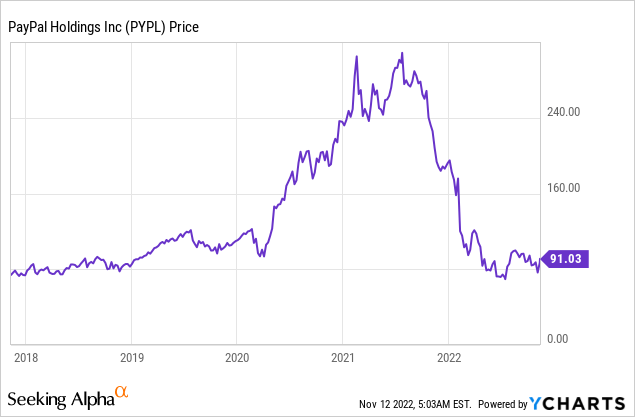

Despite this great progress, PayPal’s stock price has been butchered by 70% from its all-time highs in August 2021, which has mainly been driven by the rising interest rate environment. Thus in this post, I’m going to break down the company’s financials in granular detail before revealing its valuation, let’s dive in.

Third Quarter Results

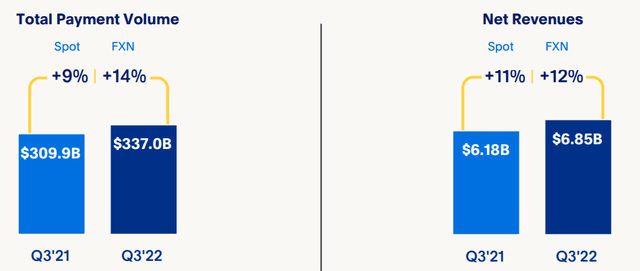

PayPal generated strong financial results for the third quarter of 2022. Revenue was $6.85 billion which was up 11% yoy (12% FX neutral) and beat analyst expectations by $29.98 million. This revenue was the result of solid Total Payment Volume (TPV) of $337.0 billion, which increased by 9% year over year or 14% on an FX Neutral basis.

PayPal’s P2P App Venmo continues to drive strong growth across the business portfolio. The platform has close to 90 million active accounts. The total Payment Volume for Venmo increased by 6% year over year, while its commerce volumes increased by a blistering 150% in the third quarter of 2022. The Venmo app is part of a new wave of “millennial” banking applications which are disrupting traditional financial institutions. The tagline for the app is “Simple, Social Payments” and a popular use case is splitting a bill between friends at dinner which can often be an awkward situation. You can also send “gifts” to friends and even add emojis to actually make payments more fun and less mechanical.

Other companies have similar rapidly growing financial applications such as Cash App by Square (now Block), SoFi App, Revolut (Europe), and more. Revolut is an interesting case study, the U.K based company was founded in 2015 and reached 300,000 users within the first year of launch. Just a few years on Revolut has over 15 million monthly active users, which is still approximately one-quarter of Venmo’s 57 million monthly active users but Revolut is now expanding to the U.S. Venmo had a first mover advantage against other applications as it was founded in 2009, Braintree acquired Venmo in 2012 for a measly $26.2 million and the platform was then subsequently acquired by PayPal. Venmo also looks to have more monthly active users than Cash App by Block, which has ~44 million active users [MAU]. Therefore it is safe to say Venmo is the leader in the Fintech App market, in the U.S at least anyway. In Latin America, Warren Buffett-backed NuBank is the largest fintech app in the region.

All these financial applications have generated astounding growth and this was further accelerated by the stimulus checks of the pandemic era. I believe that despite the competition, there is a large enough market opportunity available. For example, a social media platform such as TikTok has 1 billion monthly active users, so the 57 million MAU of Venmo is small in comparison, and given most people will need to make payments at some point, the growth potential is huge.

PayPal is also continually innovating the Venmo application. The company recently started to onboard charities, which is expected to boost engagement through a “feel good” mechanism of charitable giving, which is especially popular with Millennials. This should be especially powerful as we enter the holiday season. Venmo also scored an incredible partnership with e-commerce giant Amazon, which will offer Venmo as a payment option by Black Friday on November 25th.

The platform is also rolling out Apple’s tap-to-pay function with PayPal and Venmo. This will enable PayPal Merchants to use their iPhone as a Point of sale Terminal to easily accept payments from customers. This is also great for freelancers, those selling items on Facebook Marketplace, and those doing “Garry Vee” style Garage sales.

PayPal has jumped in bed with Apple, which is quite surprising but also makes sense to give Apple ownership of the IOS App store and operating system. PayPal will offer an Apple Pay option at its unbranded check flows. In addition, PayPal and Venmo will be able to be added to an Apple Wallet by the first half of 2023. This is a game-changer and should further boost adoption by the platform.

In October 2022, PayPal launched its reward program which will unify its legacy reward program and Honey (acquired for $4 billion in 2020). Honey is a browser extension that saves customers time by finding them discount coupons at checkout of an e-commerce store. I believe the concept of the application is great, however, in practice, I have not seen any benefit to the extension in my personal experience. I do believe PayPal overpaid for the platform ($4 billion is a lot for a browser extension), but I believe the company wanted its 17 million monthly active users. PayPal’s overarching Rewards program is being developed and the company has a roadmap of product iterations.

Profitability and Expenses

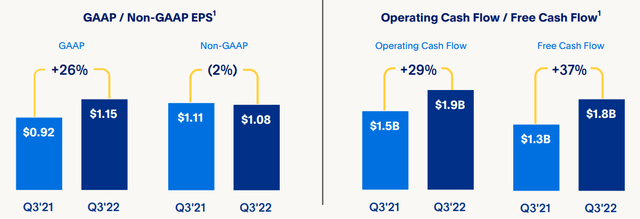

PayPal generated $1.15 in Earnings Per Share in the second quarter of 2022, which beat analyst estimates by $0.53. Non-GAAP EPS was $1.08, which surpassed the midpoint of the company’s guidance.

Management has made it a strategic priority to reduce the cost structure of PayPal and remain on track to save over $900 million across its operating and transaction expenses in 2022. In 2023, the company plans to do even better and save up to $1.3 billion through improved efficiencies. This in turn is forecasted to drive at least a 100 basis points improvement in the operating margin.

Free Cash Flow was $1.8 billion in the third quarter of 2022, which has increased by 37% year over year and is a record (not including acquisitions).

Management has shocked analysts by raising its guidance, despite the macroeconomic environment (more on that in the Risks section). Q4 earnings per share are expected to grow between 6% and 8%. The company also has a solid balance sheet with a staggering $16.1 billion in cash, cash equivalents and short-term investments. In addition, the company has total debt of $10.7 billion.

Advanced Valuation

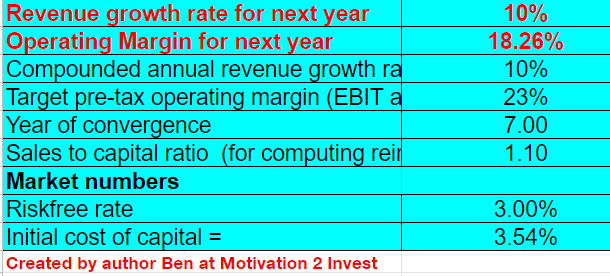

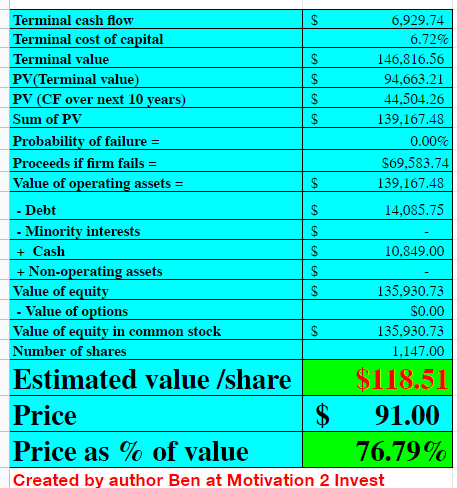

In order to value PayPal, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 10% revenue growth for next year and 10% per year over the next 2 to 5 years. This is fairly conservative given the new partnership Amazon, new rewards program and increasing Venmo adoption.

PayPal stock valuation 1 (created by author ben at Motivation 2 Invest)

I have forecasted the company to expand its operating margin to 23% over the next 7 years, which is the average of the software industry. I believe this is achievable given the aforementioned cost saving initiatives management plans to execute. It should be noted that this includes an adjustment for R&D expenses which I capitalized and this has boosted the operating margin.

PayPal (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $118 per share, the stock is trading at ~$91 per share at the time of writing and thus is ~23% undervalued.

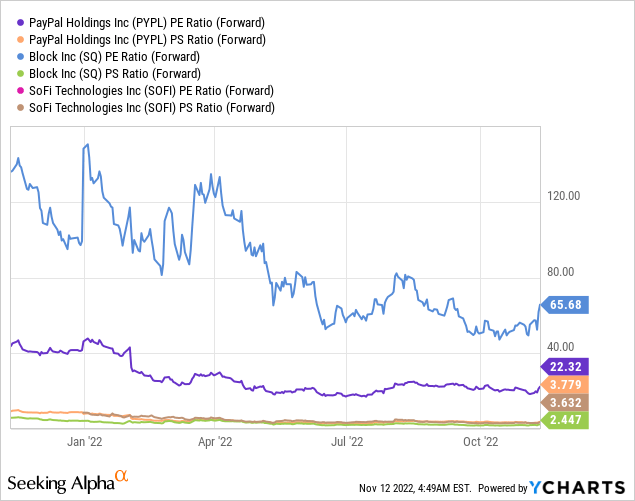

As an extra datapoint, PayPal trades at a forward Price to earnings ratio = 22, which is 43% cheaper than its 5-year average. The majority of its Fintech competitors are unprofitable and thus hard to compare on a PE ratio basis. However, PayPal has a Price to Sales ratio = 3.779 which is aligned with the industry, but remember earnings are what matters, especially in the current environment.

Risks

Recession/Lower Payment volume

The high inflation and rising interest rate environment have caused many analysts to forecast a recession. Higher input costs for consumers generally results in lower spending and thus lower payment volume for payment providers.

Final Thoughts

PayPal is a legacy fintech company that is still feeling the benefit from its historic acquisition of Venmo. Management is executing strong, cutting costs, and scoring partnerships. Given these factors the total addressable market is large and the stock is undervalued, PayPal looks to be a long-term winner assuming it can continually innovate.

Be the first to comment