SrdjanPav

Thesis highlight

I recommend going long on Paymentus Holdings (NYSE:PAY) ($11.37 as of this writing). It offers a product that rides on the secular tailwinds of digital payments and has a strong go-to-market strategy to support its strategy to capture share in a large TAM. As PAY continues to carry out its growth strategy and release products that people want, its value proposition will improve. I expect it to make $1.3 billion in revenue in FY26, which, based on a 2.2x forward revenue multiple, would give it an equity value of $23.94 per share, which is 110% more than it is worth now.

Company overview

PAY’s streamlined, adaptable, and secure omni-channel payment infrastructure allows customers to pay bills using any method they prefer. Because PAY’s biller platform is built on a single code base and uses a Software-as-a-Service infrastructure, all of its billers receive the same updates and enhancements as soon as they become available. Its mission-critical solutions give billers a payment operating system that makes it easier to collect money and gives customers more control over their finances. This is done through a central point of integration with PAY’s core financial and operating systems.

PAY serves billers of all sizes in non-discretionary industries such as utilities, banking, insurance, government, telecommunications, and healthcare. This cutting-edge platform assists financial institutions in a variety of ways, including bill payment, account-to-account transfers, and person-to-person transfers. As of FY21, the majority of PAY’s customers are in the US (97.9% of revenue).

Investments merits

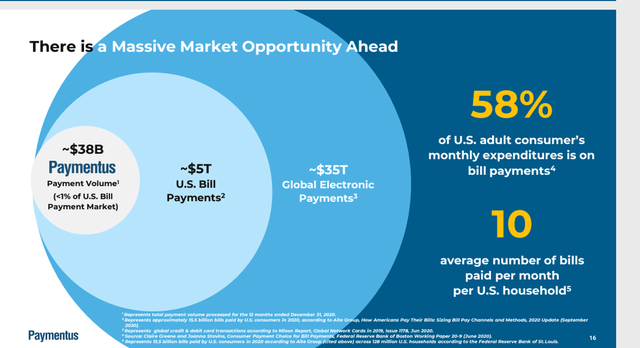

TAM is significantly underpenetrated

Traditional financial institutions have been slow to adopt electronic bill payment methods. While a bank’s bill payment solution handled 38% of all online bill payments made by US consumers in 2010, that figure has steadily declined since then. Financial institutions have consistently underinvested in their bill payment platforms, resulting in a negative customer experience and a decline in digital payment adoption. I’m sure most readers have had similar experiences. Traditional bill payment methods come with a slew of complications. Instead of having a variety of payment options, most bank customers are limited to making payments through automated clearing house (ACH) transactions and manually adding billers.

Traditional bill payment methods are fraught with complications. Most bank customers are limited to making payments through ACH transactions and manually adding billers rather than having a variety of payment options. So, consumers still pay most of their bills with old methods like paper checks, and billers still use manual processes that are time-consuming, expensive, and prone to mistakes to match transactions with their existing operational systems.

In 2020, PAY generated 57% of TPV from utilities, 23% from financial institutions, and 16% from insurance, accounting for nearly 60% of all bill payments in the United States. While PAY has an 18% share of billers in the utilities vertical, I believe it has a lower share of total bill payments because it has historically focused on small and mid-sized billers. Looking at the broader picture, PAY’s total payment volume as of 2Q22 annualized is ~330m, which is less than 1% of the US bill payment market. I think PAY is in a good position to get a piece of a large, mostly untapped market as consumers demand more flexible payment options and billers realize how modern platforms can save them time and money.

PAY Powering the Next Generation of Electronic Bill Payment presentation

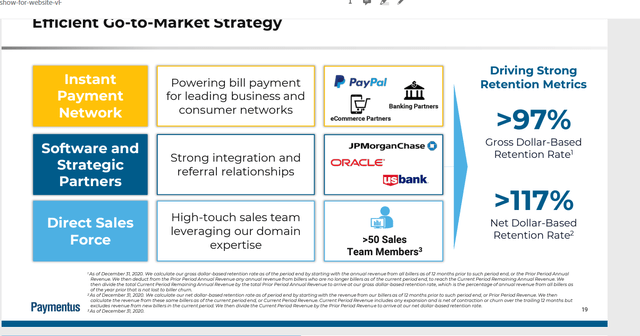

Strong GTM strategy

PAY’s go-to-market (GTM) strategy is robust and varied, involving direct sales, software and strategic partnerships, resellers, and the Instant Payment Network (IPN). Different parts of the TAM are focused on by various sales channels.

While direct sales make up a significant portion of PAY’s revenue, the company also makes significant contributions to its bottom line by way of software and strategic partners and resellers who deliver the company’s solutions to billers and financial institutions. Software companies like Oracle integrate PAY’s platform into their own software to power the bill payment features of those products. New billers are often referred to PAY by strategic partners like JPMorgan Chase and US Bank.

PAY’s IPN strategy is a key part of its GTM plan because it makes it easy for the PAY platform to be used quickly by forming partnerships with top business networks like:

- Banking Partners: PAY’s cutting-edge bill payment infrastructure modernization can help financial institutions of all sizes by making it easy for their digital banking customers to use our solution’s quick, secure, and omni-channel payment capabilities.

- eCommerce Partner: Through PAY’s network of billers, millions of users of a popular global e-commerce retailer’s mobile app and AI-assisted voice service may access and pay bills from any biller in the PAY ecosystem.

- PayPal (PYPL): With PAY, PYPL customers in the United States can make bill payments straight from the PayPal mobile app.

- Other Partners: PAY’s IPN assists other partners in a variety of ways, including allowing clients to pay bills at more than 70,000 retail locations. Customers of Walmart, for example, can use PAY to make in-store or online purchases as well as bill payments using the same account.

Ultimately, the IPN approach makes it easier for customers to pay their bills, increases IPN partners’ involvement, and boosts billers’ collection rates while saving them time and money. As a result of being able to process transactions for billers who aren’t directly connected to the PAY platform, I believe that IPN adoption will speed up PAY’s transaction growth, in addition to boosting client acquisition and expanding the platform’s reach through key partners.

PAY Powering the Next Generation of Electronic Bill Payment presentation

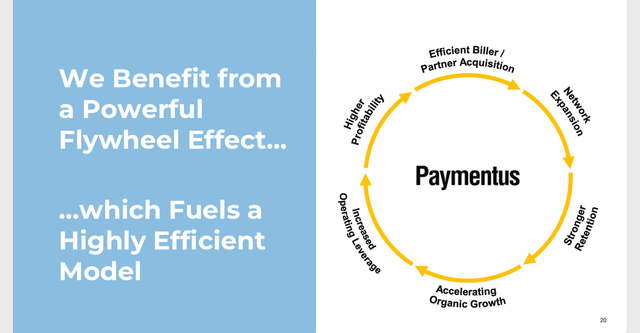

Strong scale and network effort

As more transactions occur on the PAY platform, the company benefits from organically expanding its network. As the volume of transactions processed through PAY’s platform grows, so will the amount of data available for analysis. This data can be used by PAY to develop much-requested features and functionality for seamless, cross-channel consumer engagement and bill payment. The value of PAY’s network will be improved by the addition of these new tools, which will encourage more billers and partners to join the network. This will increase the number of transactions and types of unique data collected.

A growing number of billers are joining the PAY network as evidence of the service’s value. As a result of the network effect, I believe PAY will be able to attract more billers, partners, and customers.

PAY Powering the Next Generation of Electronic Bill Payment presentation

Valuation

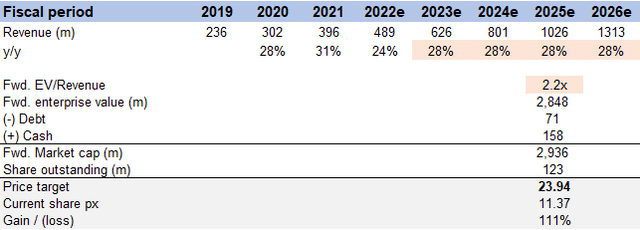

Price target

My model suggests a price target of ~$24 or ~110% upside from today’s share price of $11.37. This is on the basis of high-20s revenue growth from FY22 to FY26 and a forward EV/revenue multiple of 2.2x.

Image created by author using data from PAY’s filings and own estimates

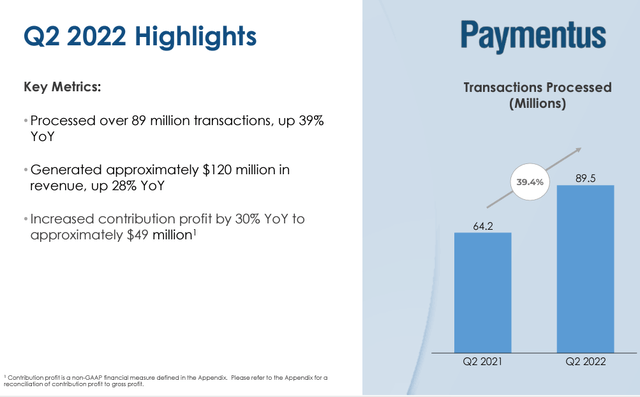

For FY22e, I used the mid-point of management guidance during 2Q22, which was $489 million. Moving forward from FY22e to FY26e, given the sheer size of TAM, I believe PAY can continue to grow at pre-covid levels. If we look at the latest quarter results, PAY is still growing transactions at 39.4%. This is a strong indicator, in my opinion, that PAY can still have the momentum to continue to grow strongly.

As for valuation, given PAY is still not generating significant profits. The right way to view its valuation is by EV/Revenue. While I assumed no re-rate to PAY current valuation (which is currently trading at near its all-time-low, 2.2x), any re-rating upwards would be added on to the upside.

Risks

Fragmented market with a lot of competition

The market is very diverse, aggressive, and dynamic. Companies looking to expand their offerings beyond what PAY provides may choose to either develop their own products in-house or acquire those already on the market. In addition, PAY is competitive in many ways, including price. Unit economics may decline gradually if the competitive environment worsens.

GTM strategy is reliant on third-party relationships

PAY is dependent on third-party programs that integrate its full-featured electronic bill-paying solution. PAY also works with strategic partners like JPMorgan Chase to bring on board new billers. The IPN is also a network that enables partners to incorporate its comprehensive electronic bill payment service into their own ecosystems through a central integration point. PAY’s operating results could take a hit if the company struggles to establish, grow, and maintain these partnerships.

Increase fraudulent activities will hurt margins

When it comes to verifying the legitimacy of its billers and keeping an eye out for any suspicious activity, PAY is on the hook. Swindlers can target both PAY and its Billers in an attempt to steal money. PAY’s profit margins are vulnerable to financial fraud committed by or against PAY’s billers.

Conclusion

To conclude, I believe PAY is worth ~110% more than its value today ($11.37 as of writing). While there is a slight growth deceleration in FY22e (based on management guidance), I believe PAY can continue to grow at historical levels once the macro environment settles for the better, given that the TAM is so significantly huge. The main thing that will drive PAY is the shift in people’s preferences toward more convenient ways to pay bills.

Be the first to comment