grinvalds/iStock via Getty Images

Published on the Value Lab 24/3/22

Paycom Software (NYSE:PAYC) provides a suite of products as one comprehensive solution to improve the flow of HR operations both for the company’s admin and for employees. The performance of the product in terms of retention is high, and that signals pricing power with ROI left on the table for customers. Moreover, they are dipping their toes into larger clients. The sales force productivity is impressive, and the growth is strong, but we think expectations are pretty high here. This is not our kind of bet, since the horizon for performance spans a long distance for the current valuation to be justified.

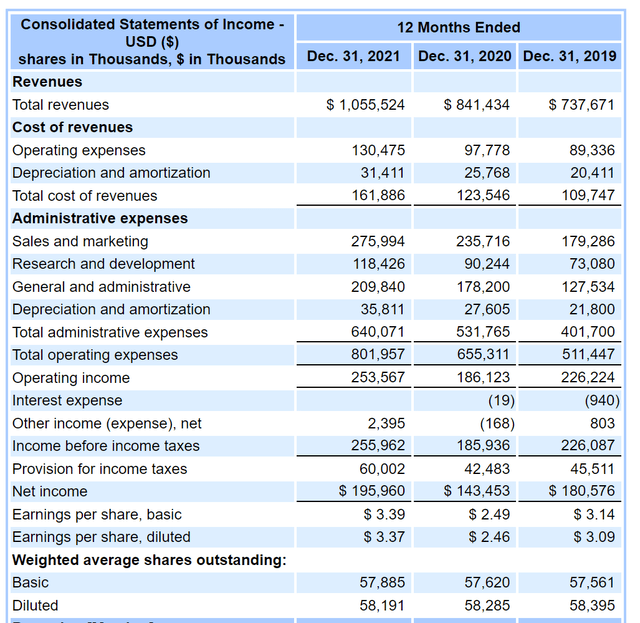

Thinking about the FY 2021

The FY 2021 represents a year where the fruits of a lot of 2020 investment has finally been borne. The company opened up 5 new sales offices in different mid-market geographies and added another 10 sales teams to the sales force, and they are generating strong business growth. The revenues grew another 18% for the FY YoY, and the dip in earnings seen between 2019-2020 has fully recovered ahead of 2019 levels, where sales growth on that stuttered increase in the cost base for 2020 is yielding results.

Income Statement of Paycom (SEC.gov)

Gross margins have improved and are staying ahead of thresholds, and the company is generating great ROICs and margins.

On the product side, the company has excellent retention rates of 94%. This was lower previously, still at high levels around 91%, but the rates have improved as the company added to its suite of products. One of the innovations that seems to have gained traction is Beti, which reduces error and increases transparency by having employees enter their payroll data instead of HR. All new adds are paying for Beti in their suite, and the installed base is uptaking the Beti addition at high rates as well.

The great resignation does not seem to be having a major impact on results. Changes in the size of employee bases of customers don’t seem to be factoring in much into the growth, where the average size of customers in terms of employees continues to grow and good lead conversion and growth are offsetting any negative effects. In terms of pandemic effects, we might be seeing a tailwind as the mid-market needs to comply with regulations and manage hybrid arrangements using suites of services much like Paycom’s.

Investment Considerations

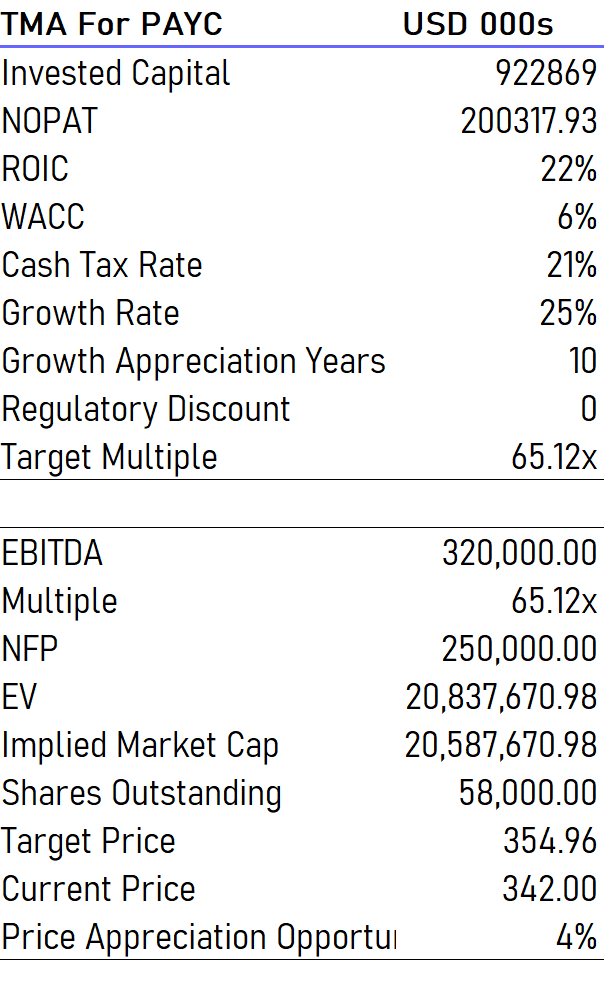

While the company profile seems strong, how does this all play into valuation? To justify the current multiple, the growth appreciation period for Paycom has to be rather long at growth rates ahead of the currently achieved rates. We use a target multiple analysis, which is the fair multiple for a company based on a DCF calculation, in order to see what inputs can justify the current multiple to assess if they’re reasonable.

Our TMA of Paycom (VTS)

The ROICs are high, and so are the growth rates especially in Q4, which dead peak at around 25% ahead of the full year. Using the 25% growth rate, which is given in the outlook as well, we’d need 10 years of growth before the business goes terminal at that 25% to justify the current valuation. That would require a 10x growth in sales to go from a market share of 5% to about 25% assuming the industry grows at a 7% rate annually. It sounds like a lot, but how unreasonable is it?

It’s not out of the question. First of all, a retention rate of 94% means that there could be some value being left on the table. These companies earn on a per-employee basis, and Paycom could probably increase the prices per employee and maintain very high retention rates and value creation from sales force activities. Pricing increases in addition to the market share that they are winning be being ahead of older competitors like Automatic Data Processing (ADP) could lead to substantial growth for a while, especially when the underlying industry is growing. Moreover, there is still a lot of TAM to be claimed. 5% is only the beginning, and their average per customer revenues are still very much in the mid-market at around $70k. It could be more than this once their clients become larger.

The issue is that there are competitors on the market. Bamboo comes to mind, which I’ve used in the past at a VC job, and they seem to offer much of the same value that Paycom does. Also, incumbents could just copy Paycom if they start to worry that their products are going to be a threat to larger customers that they work with. We don’t think there is a strong technological moat here.

With all this in mind, betting on 10 years of phenomenal growth seems optimistic. It could work out, but we’re not bought into the idea that the management can pull off such and amazing growth rate for so long, and outmaneuver all known and unknown competitive threats. This is not our kind of play, so we pass.

Be the first to comment