Alex Wong

It seems like ages since the US government set aside funding to repair crumbling infrastructure. For years, the US House of Representatives, Senate, and administration kicked the infrastructure rebuilding plan down the road, but it finally found some bipartisan support in 2021.

Repairing and updating roads, bridges, tunnels, airports, schools, and government buildings mean substantial contracts for companies that supply the building blocks, equipment, and contractors for the projects.

The Global X U.S. Infrastructure Development ETF product (BATS:PAVE) holds shares in US-listed companies that provide exposure to domestic infrastructure development.

PAVE is a diversified play on infrastructure

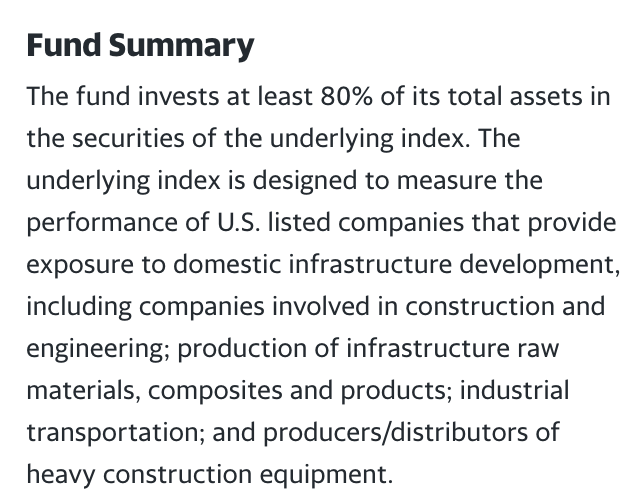

The fund summary for the PAVE ETF product states:

Fund Summary for the PAVE ETF product (Yahoo Finance)

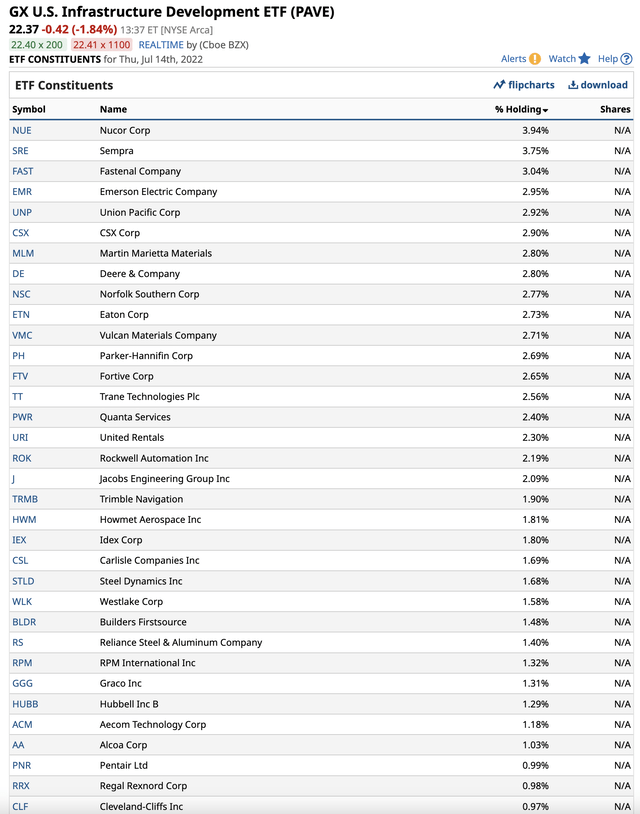

PAVE’s most recent top holdings include:

Top Holdings of the PAVE ETF Product (Barchart)

At $22.37 per share on July 14, PAVE had approximately $3.516 billion in assets under management. The ETF trades an average of over 1.195 million shares daily, making it a highly liquid product. PAVE charges a 0.47% management fee. The latest blended dividend yield is 18 cents per share or 0.80%.

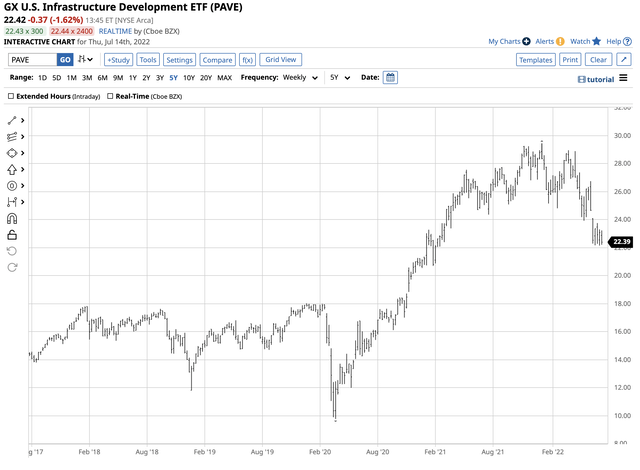

The ETF reached a bottom in March 2020 and a record high in early 2022

In March 2020, during the height of pandemic-related selling and before the US government approved the bipartisan infrastructure rebuilding package, PAVE fell to a low of $9.77 per share.

Long-term chart of the PAVE ETF product (Barchart)

As the chart shows, PAVE rose to a record high of $29.45 per share in early January 2022 when the S&P 500 index, the most diversified and representative stock market index, reached its peak. At the high, the PEAK ETF more than tripled from the March 2020 low.

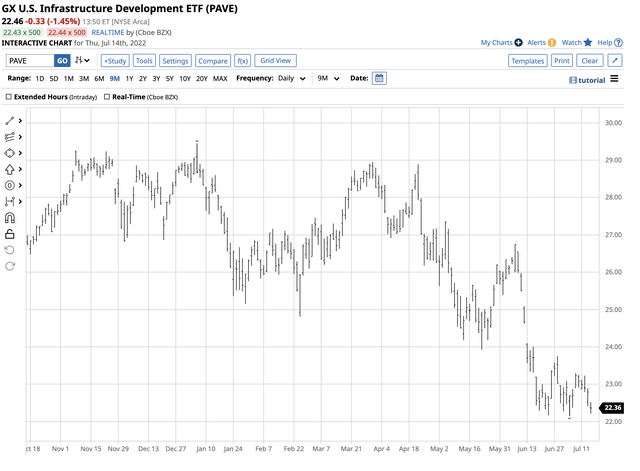

PAVE corrected with the stock market

Since the January 2022 high, PAVE corrected to the downside with the rest of the stock market.

Short-term chart of the PAVE ETF product (Barchart)

The chart highlights the decline to a low of $22.14 on July 5, a 24.8% correction from the early 2022 high. Over the same period, the S&P 500 index fell from 4,818.62 in early January to a low of 3,636.94 on June 17, or 24.5%. PAVE has virtually mirrored the price action in the stock market in 2022.

The three reasons to consider PAVE on the dip

Rising interest rates have weighed on the stock market in 2022. Meanwhile, the war in Ukraine, rising inflation which reached the highest level since November 1981 at 9.1% according to the latest June consumer price index, and overall uncertainty about the domestic and global economic and political landscapes have caused selling to dominate the stock market over the past months.

PAVE is an ETF product that holds the leading US listed companies in construction and engineering, raw material production, heavy equipment manufacturers, industrial transportation, and other companies with significant exposure to infrastructure development. Three reasons make PAVE’s decline a compelling opportunity for investors looking for bargains that could recover over the coming months and years:

- In late 2021, Congress passed the Bipartisan Infrastructure Deal (Infrastructure Investment and Jobs Act). The act was initially a $715 infrastructure package that was boosted to $1.2 trillion in spending. The amended bill passed through the Senate by a 69-30 margin. The House of Representatives passed the legislation by 228-206, and the president signed it into law. The massive spending will provide contracts for the leading US infrastructure companies over the coming years.

- The current economic downturn will not impact funds already earmarked for the infrastructure package to repair the crumbling US roads, bridges, tunnels, airports, government and school buildings, and other infrastructure issues that require updating and a massive construction effort over the coming years.

- Addressing climate change, one of the lynchpins of the current administration’s platform, requires significant infrastructure changes. With over two years left in the current administration, the project will begin with substantial contracts for US infrastructure-related companies. Those contracts will enhance earnings for the companies in PAVE’s portfolio.

PAVE is the most diversified US infrastructure ETF product.

Rebuilding US infrastructure is not an option

US infrastructure rebuilding and updating had been a political hot potato for decades, with partisan issues blocking the legislation. Infrastructure proposals fell through the proverbial cracks as bipartisan support remains elusive. In 2021, Democrats and Republicans finally came together on the long overdue $1 trillion-plus package. US roads, bridges, tunnels, airports, and other infrastructure were never an option but a safety requirement. As time went on, the situation worsened, but in late 2021, the government found the required funds, and projects are now getting underway.

Over the past few months, the stock market has been ugly as rising interest rates and a strong dollar are weighing on corporate profits. Inflation has caused the costs of all goods and services to skyrocket, and the $1.2 trillion infrastructure package may fall short of the initial expense forecasts. However, infrastructure companies will experience an increase in government contracts, revenue, and profits over the coming years. Since rebuilding infrastructure is necessary, PAVE should eventually outperform the overall stock market as the funds flow and the construction begins.

Be the first to comment