Aja Koska/E+ via Getty Images

Dental and animal health product distributor Patterson Companies (NASDAQ:PDCO) fell short of Street expectations in its most recent quarter amid weakness across dental consumables and equipment, outweighing resilience in the animal health business. The revenue miss and a hotter-than-expected opex led to a weaker operating margin result as well, sending the stock lower post-quarter.

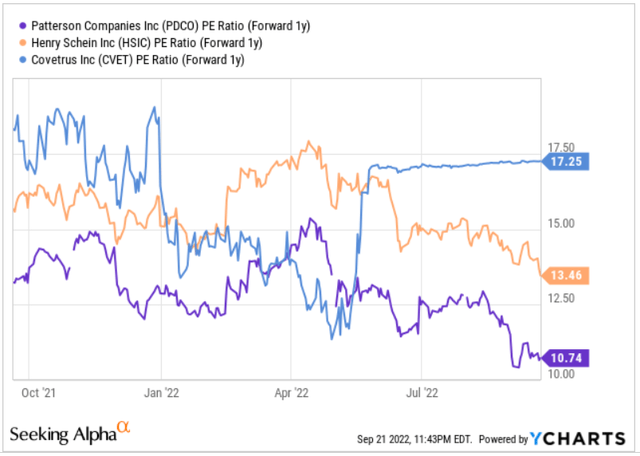

While the pessimism is warranted, I would look past the Q1 2023 weakness given the attractive exposure to secular growth trends, as well as the track record of beats-and-raises PDCO management has built over the years. To be clear, there remain risks – the current guidance implies a steeper EPS ramp in the back half of the year, and the macro environment is as challenging as ever. Still, management’s confidence in its ability to hit the reaffirmed FY23 guidance numbers, as well as its strong execution track record, are key positives. Relative to the unchanged EPS estimates, PDCO stock trades at a discounted ~11x fwd P/E (vs. peers) and offers an attractive ~4% dividend yield to patient investors.

Puts and Takes from the Underwhelming Headline Numbers

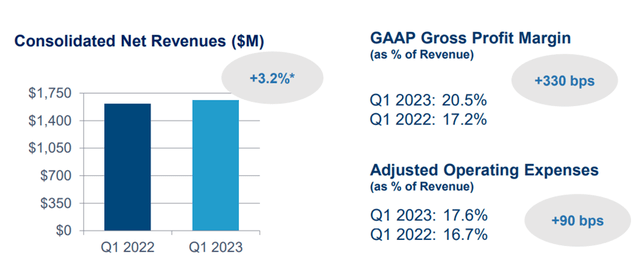

PDCO kicked off the first quarter of its 2023 fiscal year with disappointing numbers across the board – non-GAAP EPS at $0.32 fell ~25% YoY, while sales of $1.5bn were down ~6% YoY on a reported basis. Some context is needed, though, given the YoY comparison is skewed by an extra selling week (~7% negative impact on revenue growth). On a normalized basis (i.e., accounting for the extra week), revenue would have been up a resilient ~3% YoY despite additional headwinds from a stronger dollar.

PDCO’s gross margin at 20.5% (+330bps YoY) was the only bright spot this quarter, benefiting from product mix shifts within PDCO’s key segments (i.e., dental and animal health) and recent freight surcharge actions. The combination of lower revenue and higher operating expenses (mainly from the dental business) weighed on the rest of the P&L, though, as operating margins were down YoY. To a lesser degree, margins were also impacted by expense timing, as PDCO’s national sales conferences for the dental and animal health businesses occurred earlier than expected in the first quarter of this year. The $0.02-0.03/share impact for this period should reverse throughout the year, though, providing a small earnings tailwind to earnings in the coming quarters.

Dental Equipment Lags; Resilient Animal Health Leads

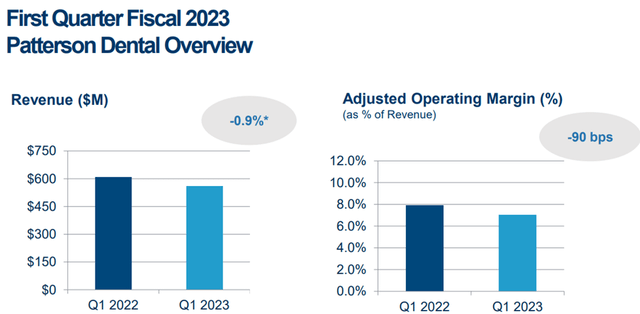

Dental equipment sales were the key laggard this time around, in stark contrast to last quarter’s impressive double-digit % gains, as industry-wide headwinds in COVID/PPE products weighed. There were silver linings, though – while total dental consumables sales fell 2.7%, sales would have grown 1.9% (a ~100bps Q/Q deceleration) adjusted for infection prevention products. Core equipment results were also up in the solid double-digits % YoY amid normalizing supply chain progress, but the declines in digital equipment and computer-aided design/manufacturing are concerning coming off the prior quarter’s strength.

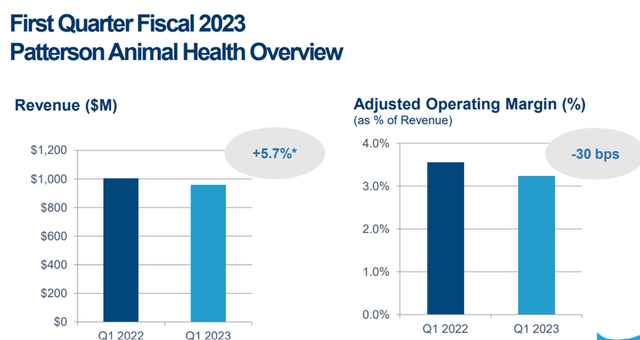

Animal health results were fairly resilient, led by strong livestock growth of ~8%. While this was below the double-digit % growth last quarter, the segment still outpaced the broader market and, more surprisingly, the mid-single-digit % companion animal growth. Given the companion animal sub-segment has historically shown stronger growth potential, the current performance could signal a slowdown in the pet market and/or PDCO-specific outperformance on the production animal side of things. Bears will point to the modestly lower vet traffic trend as a reason for caution, but management commentary supported the sustainability of the Q1 resilience, as vet clinics remain at capacity and per-visit spending is also on the rise.

Guidance Surprisingly Intact Despite the Q1 Miss

Somewhat surprisingly, PDCO maintained its full-year expectations despite the first quarter setback. Management’s rationale is twofold – for one, the company has seen share gains in its animal health and dental equipment businesses, and perhaps more importantly, management sees equipment demand staying robust through the rest of the fiscal year. I suspect the latter point could be valid given the healthy basic equipment backlog, helping to offset any deceleration in companion animal spending in the coming quarters.

The margin outlook will also improve from here, with PDCO calling for opex to improve as the year progresses (in line with seasonal trends). Management also expects the price deflation seen in dental infection control products (i.e., gloves) to normalize by Q4 2022. All this culminates in an implied Q4 ramp-up, as assuming Q3 is flattish (in line with management commentary), the onus will be on a Q4 EPS outperformance to make the FY23 guidance. The underlying guidance assumptions already embed expectations for a tougher macro backdrop, though, so I see limited additional risk to the near-term trajectory.

Looking Past the Latest Earnings Disappointment

PDCO’s dental weakness and below-par margins led to a sell-down post-result, but the reaffirmed guidance and upbeat equipment commentary offer hope for a bounce off Q1 2023 levels. The Q1 miss also leads to a higher bar to clear for Q2-Q4, though, so investors ultimately need to decide if they are comfortable enough with the relative resilience of the dental and animal health markets as well as management’s (led by CEO Mark Walchirk) ability to execute to plan. At a relatively inexpensive ~11x fwd P/E, PDCO is one of the cheaper names in the space – peers Henry Schein (HSIC) and Covetrus (CVET) trade at ~13x and ~17x, respectively. Coupled with PDCO’s peer-leading ~4% dividend yield, I still like the risk/reward at these levels.

Be the first to comment