Olemedia

Patriot Battery Metals, or PMET (OTCQB:PMETF), is an early-stage hard rock Lithium (“Li”) explorer in the James Bay region of Quebec, Canada. It has a fully-diluted (~131M shares) Enterprise Value [EV] {market cap + debt – cash} of ~$633M [as of September 19th at $5.15/share, with no debt] {see new corp. presentation}.

corp. presentation

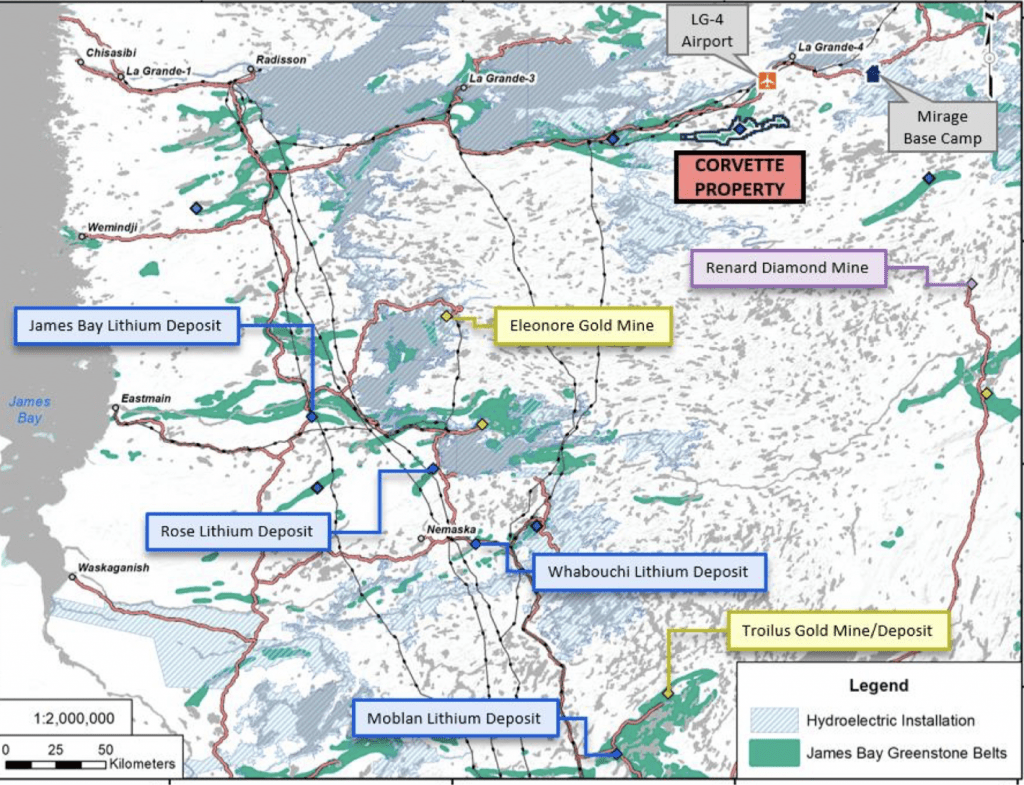

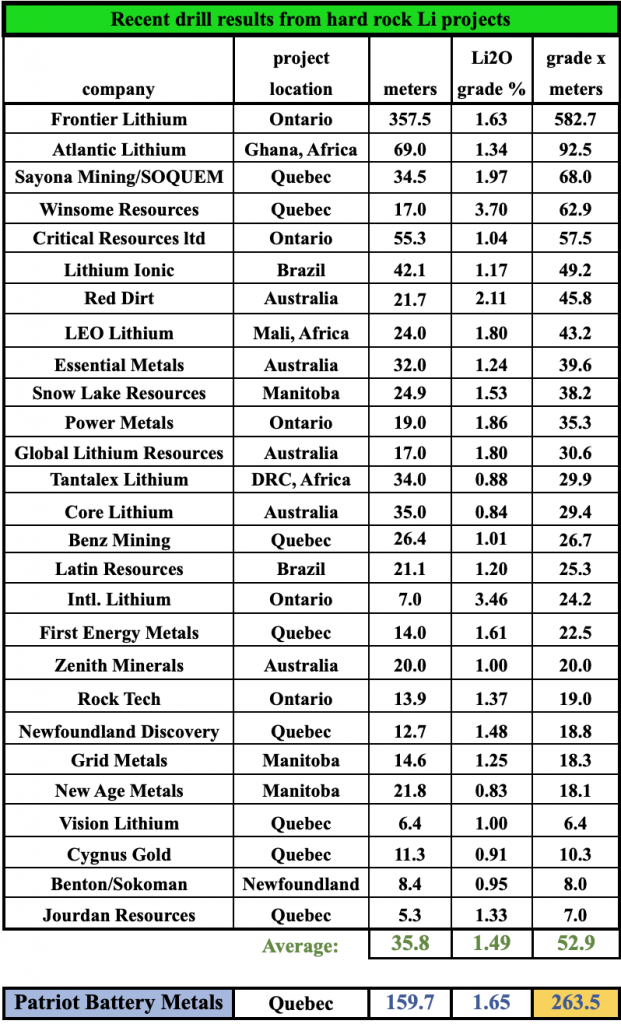

I’m tracking ~75 Canadian & Australian-listed companies that have Li properties in Canada. In terms of drill results, PMET stands head and shoulders above its peers. {see drill results below}

Despite being one of the best performing Li stocks on the planet, for the reasons that follow, PMET’s fundamental valuation still appears attractive to me. However, some investors fear a correction is inevitable as PMET shares are up +773% (March 21st to September 19th) in the past six months.

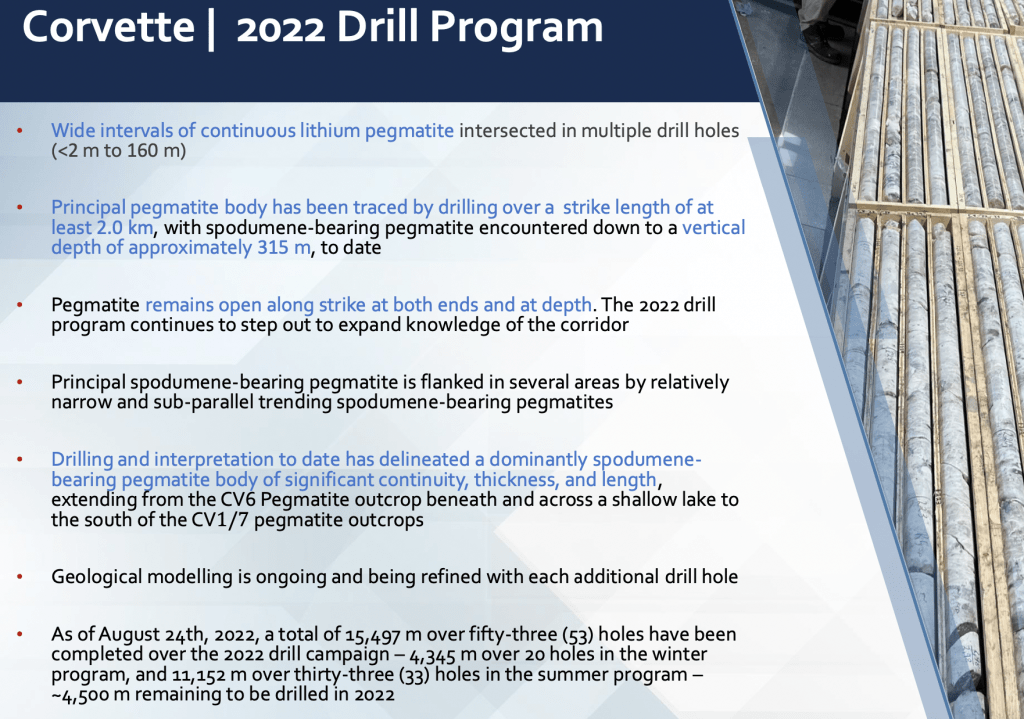

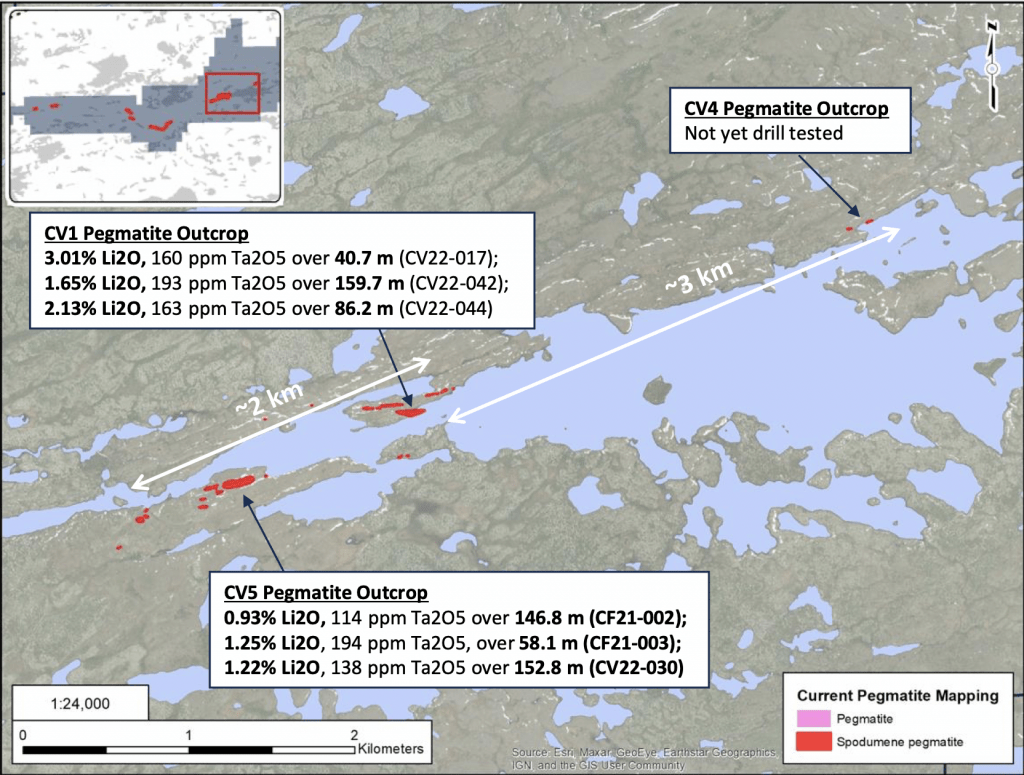

While I don’t know where PMET’s share price is headed, the trajectory of drill results on PMET’s 21,400 hectare Corvette property points decisively to a monster project. In looking at drill results from other hard rock Li projects, PMET stands out on BOTH interval widths AND Li oxide (Li20) grades.

A few weeks ago, PMET announced its best drill intercept ever; 159.7 meters at 1.65% Li20. Multiplying width x grade {159.7 x 1.65} yields a value, [263.5], that can be compared to peers. PMET’s recent drill result is 5x better than the peer average.

company press releases

Astute readers are no doubt wondering if PMET’s tremendous drill results are already reflected in the $633M valuation… That, of course, is the $64,000 question.

As a thought experiment/valuation exercise I take world-class hard rock Li producer Pilbara (OTCPK:PILBF) and apply three broad haircuts to its $9.6 billion valuation. First I cut the valuation in half ($4.8 billion) to account for the equity dilution and time value of money for PMET to reach production.

Next I cut the valuation in half again (to $2.4 billion) to account for the early stage of PMET’s project, still facing considerable permitting, environmental, First Nation, resource building, etc. risks.

Finally, I cut the $2.4 billion valuation in half one last time (to $1.2 billion) to account for Li market risks that could drive Li prices much lower. If Electric Vehicle demand does not soar as high as everyone expects, Li prices could fall. Or, if Li-ion batteries transition to designs that require less Li, that could soften demand.

Another risk over the longer term is battery recycling. New technologies are in the works that could efficiently recycle end-of-life Li-ion batteries. If recycling could be done on a large scale, that would reduce the need for new supplies.

Here are eight reasons to consider buying PMET even after its massive share price gains, and even given the risks outlined above and below.

8: Dual-listing in Canada & Australia. Australian investors seem to love Li juniors. As is the case in Canada, there are some very experienced, well-respected brokerage houses and natural resource-heavy investment groups down under.

Some of the most exciting Li plays on the planet are domiciled in Australia; Pilbara Minerals, Sayona Mining (OTCQB: SYAXF), Liontown Resources (OTCPK: LINRF), Core Lithium (OTCPK: CXOXF), Piedmont Lithium (NASDAQ: PLL) — and soon — Patriot Battery Metals.

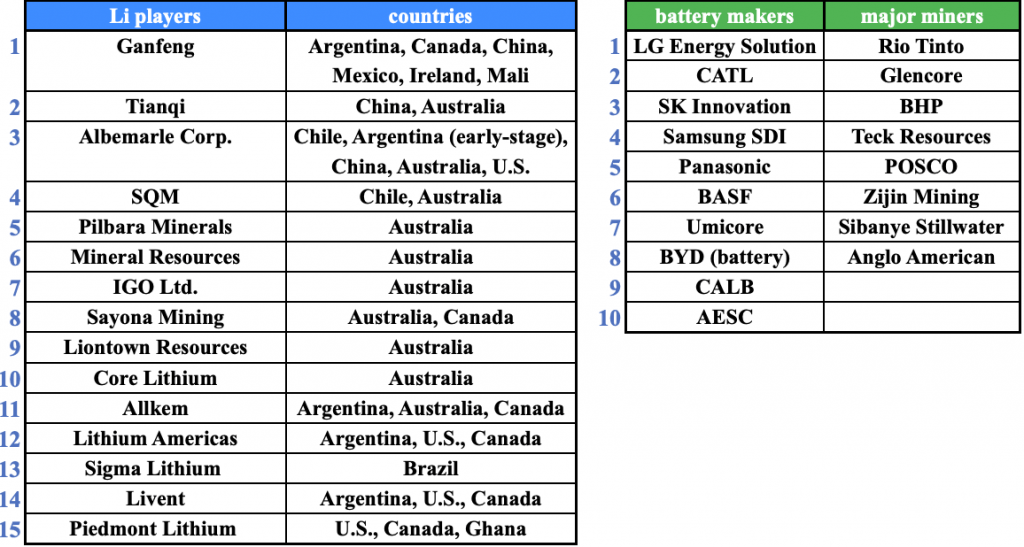

7. World-class scale — if Corvette grows into a multi-hundred-million tonne colossus, it would probably be big enough to move the needle for companies like Glencore (OTCPK: GLCNF), BHP (NYSE: BHP) & Teck Resources (NYSE: TECK). Glencore has a strong foothold in other battery metals, producing cobalt, nickel & copper. It’s reportedly looking at Li for its commodities trading business.

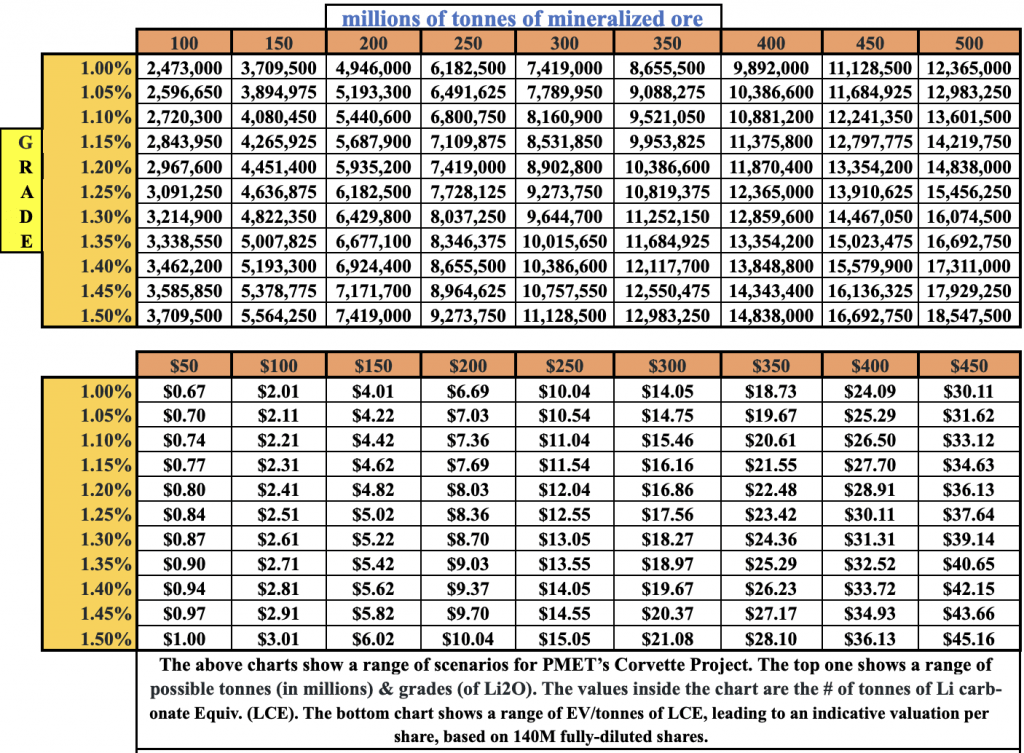

In this chart one can see that if there are 300 million tonnes booked at Corvette (say in 2-3 years) at a grade of 1.20% Li2O, that would be 8.9 million tonnes of Lithium Carbonate Equiv. (“LCE”).

Epstein Research

By comparison, Pilbara clocks in at ~8.7 million tonnes. 8.9M tonnes valued at $250/tonne would equate to an indicative level of $12.04 per share, assuming 140M fully-diluted shares.

For comparison purposes, Frontier Lithium is at PEA stage with 41.8 million tonnes at 1.54% Li2O.That equates to 1.59 million tonnes LCE. Frontier trades at $338/tonne LCE. At 300 million projected tonnes, PMET would be trading at ~$72/tonne.

Atlantic Lithium plans to dual-list in London and Australia in the next two weeks. It has a PEA-stage project in Ghana with 30.1 million tonnes @ 1.26% Li2O or 939.4k tonnes LCE. It trades at $416/tonne.

Both Frontier and Atlantic are well more advanced (at PEA-stage) than PMET, but are years away from production. Discounting both by half equates to an average risk-adjusted valuation of $189/tonne vs. PMET at ~$72/tonne.

6: Very strong interest from strategics & acquirers {see chart below}. NOTE: Ganfeng Lithium (OTCPK: GNENY), Allkem Limited (OTCPK:OROCF), Livent (NYSE: LTHM), Piedmont, Sayona & Lithium Americas (NYSE: LAC) already have investments in Quebec. Not that we think management wants or needs a partner anytime soon, at least not at today’s valuation, in our opinion.

Exploration capital is readily available. In fact on September 15th, PMET announced the issuance of 1.51M shares at a huge premium to market. Assuming deep-in-the-money stock options & warrants are exercised, pro forma for the announced capital raise, the Company has ~$42M in cash.

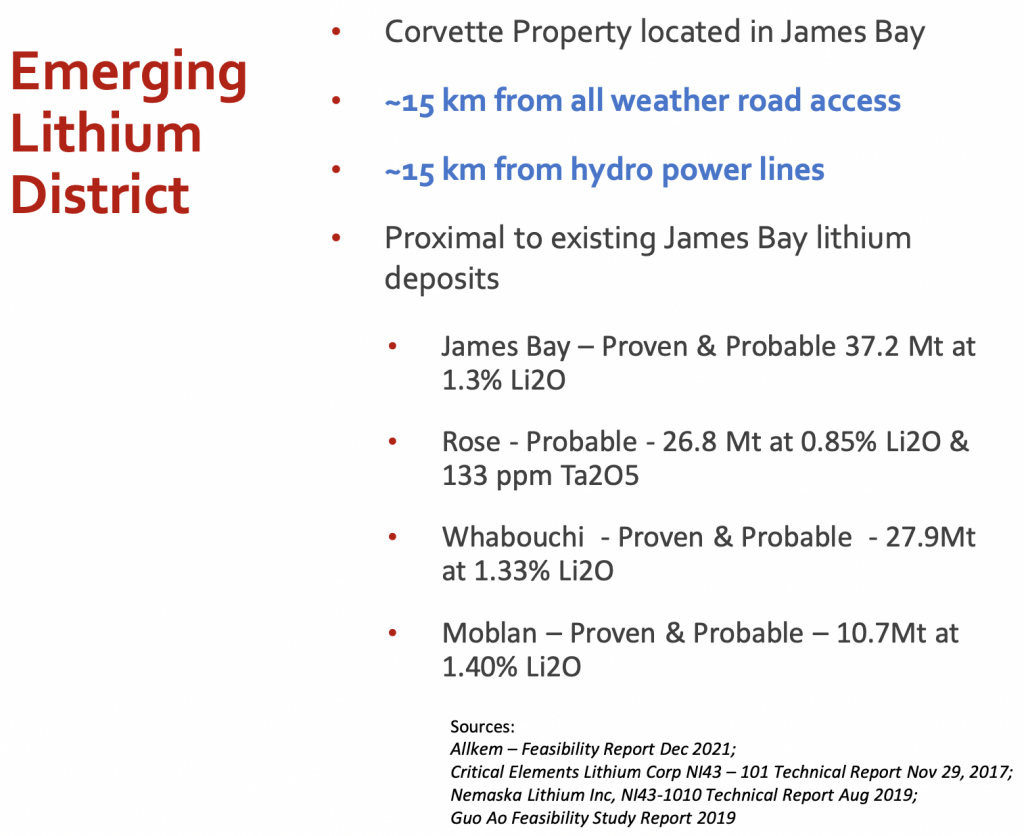

5: PMET’s project is in the world-class mining jurisdiction of Quebec, Canada, a province with one of the greenest power footprints in the world. Roughly 94% of electricity generation comes from hydropower.

It’s ranked #6 of 84 global mining jurisdictions in the latest Fraser Institute Annual Survey of Mining Companies. The Province is famous for local institutions, investment Funds & gov’t agencies helping to finance projects via loans, equity, cash grants & tax breaks.

Importantly, Quebec is becoming a globally significant, EV/battery manufacturing hub. Tesla (TSLA) is increasingly expected to announce plans to enter Quebec.

company websites

For clear geopolitical reasons, “the West” can no longer rely so heavily on China for critical components of the EV supply chain. Quebec offers logistically simple, low-cost, secure & rapid rail or truck delivery into most U.S. & Canadian cities.

Key Li assets in Quebec — PMET’s Corvette, Nemaska’s Whabouchi, Allkem’s James Bay, Critical Element’s (OTCQX: CRECF) Rose, Sayona Quebec’s (75%) / Piedmont’s (25%) North American Lithium and Sayona’s Authier projects are very likely to become mines.

4: Potential to fast-track & de-risk the Company via production of a 6% Li20 spodumene concentrate. With Li demand so incredibly strong, PMET plans to fast-track Corvette into production in as little as 3 or 4 years.

Producing Li2O spodumene concentrate instead of upgrading material all the way to Li hydroxide is a lower-risk way to pull forward production by years & save $100’s of millions in cap-ex. Upfront payments from future off-take agreements could help fund construction. Why fast-track this asset? Li is arguably the hottest investible commodity in the world in our opinion.

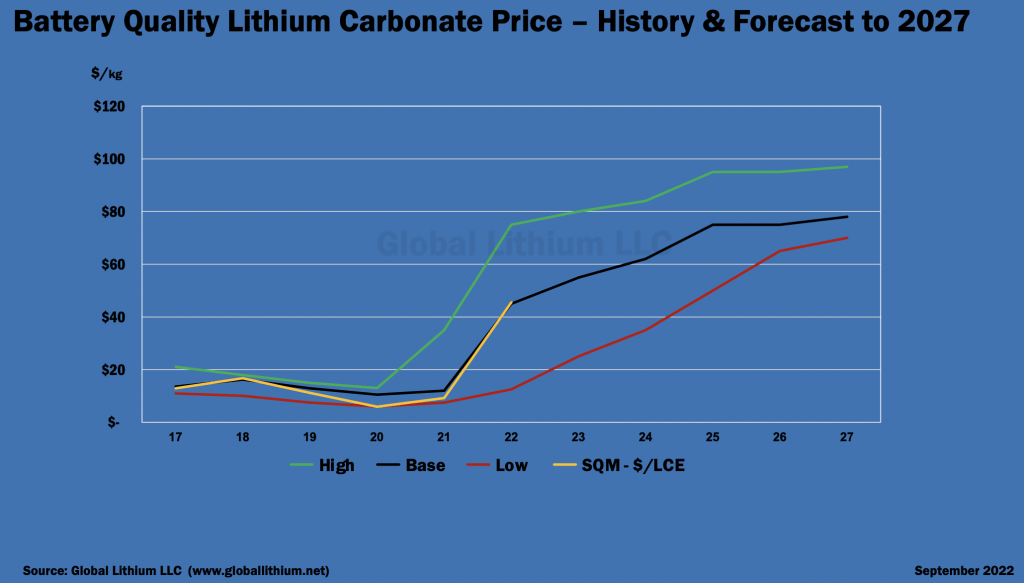

The following forecast & this linked commentary from industry-leading consultant Joe Lowry of Global Lithium LLC is amazing. His base case scenario is for Li prices to be higher than today’s all-time high…. in 2027! What other commodity has this kind of outlook?

Li expert Joe Lowry’s website

3: Some of the best drill results, anywhere in the world, a Li2O grade of 4.12% (over 9 meters) and 6.74%!! (over 1.15 m). In my view even better results could be on the horizon as the Company has drilled fewer than 80 holes. Dozens of assays are pending. To frame what high-grade Li2O looks like in a raging bull market, let’s compare it to a blockbuster drill intercept.

1.65% Li2O = 4.08% LCE. Li giant SQM recently received $54k/tonne. 4.08% of $54k = ~$2,200 rock, which equates to ~41 g/t gold (at $1,675/oz. spot price of gold).

2: Very substantial exploration upside; I believe one can’t rule out 300 million tonnes of mineralization at Corvette as the team has only meaningfully drilled one of six prospective spodumene pegmatite clusters. Red Cloud’s David Talbot is estimating ~170M tonnes (on just the CV5-1 spodumene pegmatite corridor). To be fair, other clusters have shorter strike lengths and may prove less prolific.

Since the deposit is open in both directions at CV5-1 it’s reasonable to imagine strike length there might extend hundred[s] of meters east & west. As it stands, the strike already is known to extend 2,100 meters. And, management believes the deposit[s] could reach well beyond 225 meters in depth.

A quote from Ken Bridsden in Aug. 31st press release is telling,

… Remaining open to the east, west, and to depth, in addition to the numerous other lithium pegmatite targets on the Property, the Corvette Project remains highly prospective beyond what we have found to date. Corvette is one of the world’s great lithium raw materials discoveries…

Notice he said “one of the world’s” (not just one of Canada’s) great discoveries, which I contend directly ties Corvette to western Australia giant mines Greenbushes (360M tonnes @ 1.50%) & Pilbara’s Pilgangoora (309M tonnes @ 1.14%).

corp. presentation

1: Strong management team, board & advisers. Most Li juniors have 1 or 2 impressive execs., PMET has five. CEO/Pres./Dir. Blair Way, B.Sc., MBA has > 30 years’ experience in Australasia, Canada, the U.S. & Europe, working on gold, copper, nickel, zinc, magnesium, graphite, cobalt & Li projects.

Mr. Way has worked for large & small companies including BHP & Oceana Gold. For five years Mr. Way was CEO of a graphite junior where he gained critical insights into the Li-ion battery space.

Blair holds a Bachelor of Science (Geology) from Acadia University in Nova Scotia, a MBA from the Univ. of Queensland, Australia, and is a Fellow of the Australasian Institute of Mining & Metallurgy.

Ken Bridsden, B.Eng. [mining] MAusIMM MAICD is the former CEO of Pilbara. He joined as non-exec. Chairman last month. Pilbara is perhaps the best success story in the Li sector this decade, up ~2,990% from its March 2020 COVID-19 low, to an EV of ~$9.6 billion.

Bridsden was CEO [from early 2016 to Aug. 2022], a period spanning everything from exploration to efficient and growing commercial operations.

corp. presentation

VP of Exploration Darren L. Smith, M.Sc., P.Geo has > 16 years’ experience specializing in high-level project management including program design & implementation, technical reporting, land management, community engagement & corp. disclosure. He has provided technical oversight for PEA, PFS & BFS/DFS-level projects & complex metallurgical programs.

Darren is well-versed in carbonate complexes & associated metals. In 2009 Darren & his team discovered one of the world’s largest REE deposits (Ashram) and has been instrumental in its development.

Newly appointed Brett Grosvenor (lead member of steering group reporting to the board) has > 25 years of experience in the development & delivery of minerals processing, energy & infrastructure projects in Australia, Asia, Europe, and N. + S. America.

Brett was heavily involved in notable Li projects including Greenbushes [Tianqi/IGO Ltd. (OTCPK:IIDDY)/Albemarle (NYSE: ALB)], Pilgangoora [Pilbara] & James Bay [Allkem]. As a Director at Primero Group in Australia, he was instrumental in its strategic positioning as one of the world’s premier Li mineral processing & engineering groups.

CFO Dusan Berka, M.Sc., P. Eng. has 50 years’ experience in N. America & Europe with expertise in corporate governance, financing, marketing & administration, corporate communication, public relations & contract negotiations.

corp. presentation

He has served in senior roles of companies traded on the TSX, TSX-V, CSE & NASDAQ. Mr. Berka is a graduate engineer with a M.Sc. (Dipl. Ing.) degree from Slovak Tech. Univ., Bratislava, Slovakia (1968) and a member of the Engineers & Geoscientists of B.C. since 1977.

Patriot Battery Metals is not without risk; management believes it could be in production in 3-4 years. Yet, that timeline could stretch well beyond 4 years due to environmental challenges, First Nation or other local community opposition, or permitting delays. Political opinion could turn against mining projects.

PMET shares could underperform the market due to very substantial over-performance in past months & years. My understanding & bullishness on PMET’s Corvette project comes directly from management’s assessments. If management is mistaken in its assessment of the Project’s prospects, then today’s $633M valuation could be headed lower.

However, the benefits articulated above outweigh these routine mining project risks. From a trading perspective, trading volume in the U.S. at ~74,500 shares per day is low. It can be difficult to buy a stock that has wildly outperformed peers, but readers are encouraged to take these factors into consideration.

For longer-term investors PMET offers a compelling way to play ongoing Li market strength that I believe will last for at least the remainder of this decade.

Disclosures: Peter Epstein of Epstein Research [ER] has no prior or existing relationship with any company or person mentioned above. Mr. Epstein owns shares in Patriot Battery Metals.

Be the first to comment