Michael Vi/iStock Editorial via Getty Images

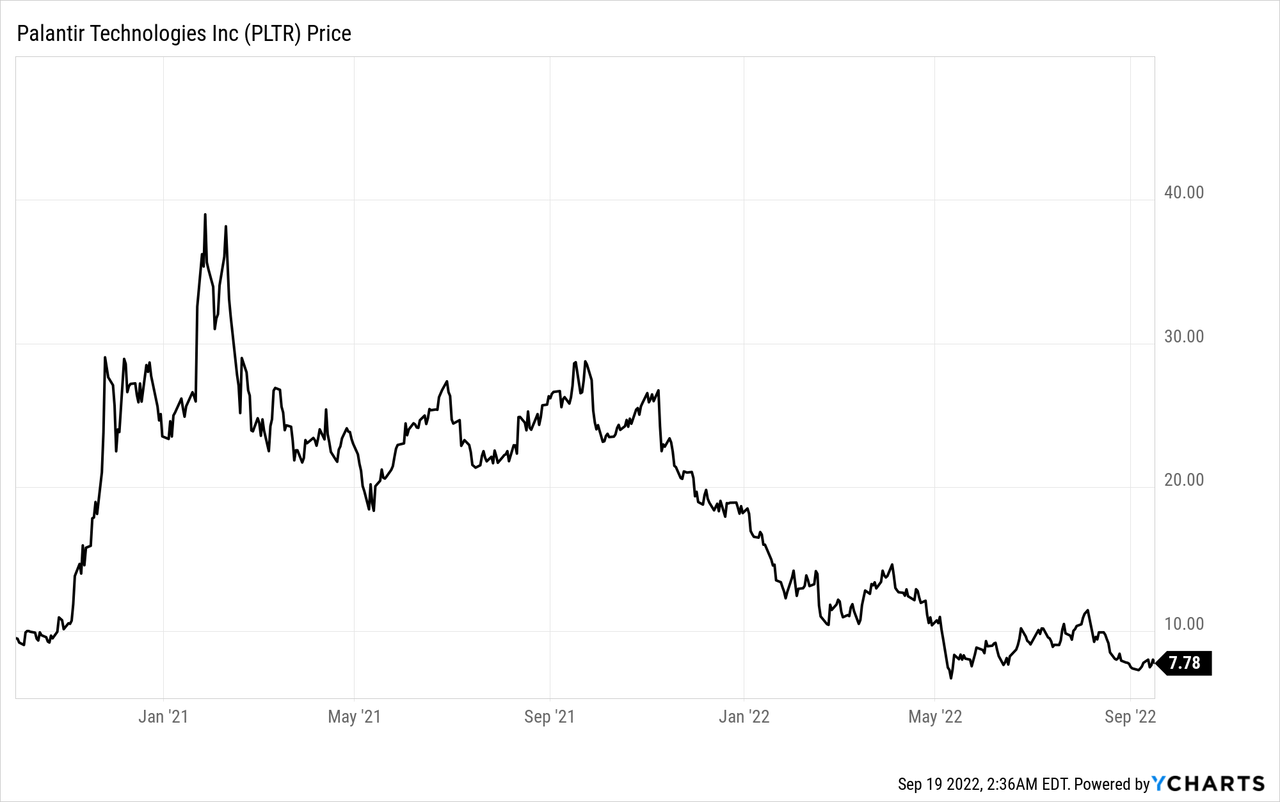

Palantir Technologies Inc. (NYSE:PLTR) was once a stock market darling and it is down 78% from its highs. I have steered away from the hype in the early days due to the unappealing valuations that continued to climb as hysteria reached the markets. However, with the stock now down almost 80%, I think that a closer look at this fallen angel is warranted to see if it will soon be a rising star.

Investment thesis

I think that the current drawdown in Palantir’s stock price presents a rather attractive entry into the company, especially for those bullish on the company’s prospects, as valuations have come down significantly. My investment case for Palantir is as follows:

- The focus on commercial business brings about a huge market opportunity of about $40 billion as Palantir targets large customers in the Global 6,000.

- Palantir is positioning itself for its next stage of growth as it increases its sales force. With a significant number of salespeople ramping up in the next year, I think we will see an upside to growth in the next year.

- In addition, the company has the ability to expand on its current customer’s use cases as it works with customers to bring about new vertical-specific applications.

- The company’s government business will benefit from the tailwinds of rising geopolitical tensions as governments around the world increase spending on defense to target rising global threats.

Overview

Palantir is a platform focused on application development for organizations to develop data-intensive and rather complex applications that are designed to solve their own individual and unique business challenges. I think what differentiates Palantir, based on my conversations with the company, is that Palantir has a more comprehensive offering than its competitors, ranging from data preparation and data aggregation to industry-specific modelling.

Another differentiation about Palantir commonly highlighted is its use of forward deployed engineers and data scientists to help customers solve their most challenging problems. Lastly, one other differentiation I will highlight about Palantir is the company’s ability to comply with the rather complex security as well as regulatory requirements across hybrid computing architectures.

Palantir has had significant success with its government customers like those in law enforcement, intelligence, and the military, and is recently seeing an acceleration in its commercial business. Palantir targets large enterprises as well as government organizations. Over time, I expect that these large enterprises and government organizations will increase spend with Palantir as they discover and utilize more new use cases.

For its largest customers, they typically use a wide variety of solutions from the platform for a range of workflows like data management, integration and orchestration, in addition to supply chain management, analytics and artificial intelligence, amongst others. Customers also have the option of creating a custom solution for their own needs if the scenario arises where the use case is rather specific to the requirements of the organization.

Palantir’s platform has 3 products. First, Gotham is Palantir’s platform that is primarily for the government, like defense agencies and the intelligence community to plan and execute responses to threats identified by Gotham. Second, Foundry is Palantir’s commercial solution for enterprises. Lastly, Palantir’s Apollo is used by customers who need continuous deployment in all types of computing environments.

Opportunity in commercial business

Palantir’s success with enterprise customers continues to accelerate. The company’s Foundry platform targets enterprises with more than $500 million in revenues annually. This, in my view, translates to approximately the opportunity set to be within the global 6,000 companies.

I think that for its enterprise customers, Palantir will continue to target and land large deals relative to competitors, and I expect these deals to expand to more opportunities for Palantir as Palantir’s Foundry becomes their main operating system. With Palantir’s current top 20 customers having an average revenue of $44 million in 2021, although these comprise of both its government customers as well as commercial ones, I estimate a rough ARPU of $20 million for its largest 1,000 customers, $10 million for its next 1,000 largest customers, and $4 million and $1 million ARPU respectively for the next two 2,000 companies, this translates to an opportunity of $40 billion for Foundry from these commercial customers.

As Palantir continues to roll out Foundry to new large customers, there is also an opportunity for the company to target smaller companies as well. The important thing right now is for Palantir to show strong momentum in its acquisition of commercial customers and demonstrate an excellent track record in its ability to execute its land and expand strategy. If successful, this can lead to higher ARPUs than what I currently expect.

Sales force to be next driver for commercial sales

While it is worthwhile to note that Palantir was able to reach $1 billion in revenues in its first 15 years of operations without any material contribution from dedicated sales people, the management now realizes that the company is now in a different stage and will be dedicating more resources to sales and marketing. For the first 15 years, management was of the view that a great software would sell itself and most of the investments were spent on research and development. However, today, the company needs to invest more aggressively into its sales people to grow its commercial business.

In the end of 2021, Palantir had 80 sales people, compared to 12 at the end of 2020. By the end of 2022, the company plans to hire 200 more sales people, suggesting that the company is ramping up on its commercial sales force as it sees the need to invest heavily into its sales and marketing efforts to drive growth. These sales staff take time to ramp up and by the end of 2022, we should see some of the productivity benefits of more fully ramped sales staff as more of these new additions ramp up and contribute more meaningfully to the company’s growth. With the material addition of sales staff in 2022, I think we could also see a further upside to estimates for 2023 when these new additions become increasingly productive and generate more substantial revenue per sales staff.

With the U.S. commercial customer count increasing by 63 accounts from 2020 to 2021 and with 25 full ramped sales staff in 2021, this would suggest that each sales staff brought in about 2 deals in 2021, with an average size of about $500,000.

In addition, in 2021, Palantir invested almost $326 million to acquire minority stakes in 14 publicly traded companies and 2 private companies. As a result of these investments, these companies in which Palantir invested in then signed contracts with Palantir to purchase its products and services from its Foundry platform. For the first quarter of 2022, Palantir disclosed that $39 million of revenues came from these investments made earlier and that the total value of commercial contracts from these companies were $755 million.

While management has explained that these investments are required to build strategic relationships with these potential customers, I think of it as an investment strategy to acquire these companies as customers rather than the traditional sales and marketing spend strategy. If these contracts materialize and Palantir would have spend $326 million in investments to obtain $958 million in revenues, meaning that with each dollar of revenue that is generated from this strategy, 35 cents needs to be invested. This strategy could theoretically lower the customer acquisition cost of the revenues materialize.

However, I take the view that this is not a very sustainable long-term strategy that Palantir can take, as these companies have performed rather poorly in the current volatile market environment. I would rather Palantir focus on building great software products to attract customers rather than employ an investment strategy to acquire new customers.

Creating vertical-specific applications

I think that Palantir’s collaboration with Airbus (OTCPK:EADSF) is a good example of what the future holds for its commercial business. As Airbus expanded on its use case from using Foundry as the operating system to build its A350 aircraft, the two companies continued their partnership to create a new software platform called Skywise.

This platform is capable of integrating and connecting all data from Airbus, its suppliers and customers, providing an immense value add to the Airbus ecosystem by leveraging on Foundry to bring about a more connected, smart and seamless experience for all parties. I think that this example with Airbus shows the huge potential that Palantir’s Foundry platform has in revolutionizing the many other sectors, like financial services and healthcare, to bring able digital transformation.

Geopolitical instability as a tailwind

The global geopolitical tensions are rising and causing uncertainty as the world grapples with new challenges. First, the ongoing Russia-Ukraine war has made national security take the center stage in Europe as it manages the increasing aggression from Russia. Second, the geopolitical tensions between the United States and China looks set to worsen as ties between the two global powers deteriorate and reach new lows. As such, these tensions increase the need for the West to boost spending in the defense ecosystem to address the rising likelihood of conflict in the region. As Palantir’s government business is linked to spending in defense, I think that this environment is a positive tailwind for Palantir and could see more upside in the next year or two.

Valuation

As Palantir has a positive free cashflow profile with margins around 25%, I think that this is a decent basis for valuing the company. Based on a 1 year forward free cash flow (“FCF”) forecast for Palantir and assuming a 28x 2023F EV/FCF, the 1-year target price for Palantir is $12.10, implying an upside potential of 55% from current levels.

This assumed 28x 2023F EV/FCF multiple is a premium to its defense peer group but a relative discount to its SaaS peer group. This discount is warranted, as the Palantir business is currently lacking visibility in terms of growth. But, at the same time, the premium is justified given the faster growth profile and software business model of Palantir.

Risks

Competitive pressures

Palantir operates and competes in a huge market, targeting governments and enterprises spend on digital transformation. There are many other smaller companies as well as big technology companies like Amazon (AMZN), Microsoft (MSFT), Google (GOOG, GOOG) that can potentially build platforms that over time become rather competitive with that of Palantir’s offerings. As such, the competition could intensify if any of these companies manages to catch up to Palantir, and this could bring downside risks to the company’s goal of at least 30% annual revenue growth until 2025.

Slower than expected commercial growth

As Palantir is investing heavily into the commercial business, if there are signs that the growth in the commercial business is slowing, this could bring a substantial risk and concern that the company is unable to gain momentum in its Foundry platform. This will be detrimental to Palantir as the commercial business forms a huge part of its growth story in the future.

Investment strategy risks

As highlighted above, Palantir spent $326 million last year to invest in companies that eventually went into contracts to purchase Palantir’s products and services. However, this strategy has its risks as Palantir is investing in companies whose values have decreased substantially post its investment. As such, the market may view this strategy as an inefficient way to use capital and to acquire customers in the long run.

Conclusion

Palantir’s descent from stock market darling to fallen angel presents an excellent opportunity for investors who were once interested in the company but deterred by the extreme valuations. The company remains committed to growing its commercial business, which is expected to bring a huge market opportunity to Palantir as it targets large customers in need of digital transformation. In addition, the recent ramp up of Palantir’s sales force and new additions to the team will bring increased growth in the business along with better sales productivity 1 year from now as these new additions become productive.

Palantir is one of the few to be able to benefit from rising global geopolitical tensions as the West increases spend on defense in response to growing threats. The 1-year target price for Palantir is $12.10, implying an upside potential of 55% from current levels.

Be the first to comment