Olemedia/E+ via Getty Images

Summary

A year ago, Vertex Pharmaceuticals (NASDAQ:VRTX) shares sold off after setbacks in the pipeline brought into question whether the company could expand beyond their extraordinary CF franchise. Since then, data readouts in multiple programs have occurred which has significantly de-risked the pipeline. Longer term, Vertex has multiple paths to significant, sustainable growth. This article is an overview of some of the pipeline assets which may offer growth and a detailed analysis of VX-548 in pain. VX-548 has the potential to have monopoly-like status, command premium pricing, and generate billions in revenue.

The Pipeline and the Growth Trajectory for Vertex

Proof of concept data for Exa-cel in sickle cell disease and transfusion-dependent thalassemia has put Vertex on track to submit an MAA to the EU in Q422. Discussions with FDA are ongoing. This is likely to be the next approved product slated to begin generating sales in as early as 2023.

VX-147 in APOL1-mediated kidney disease is in pivotal development. There are approximately 100k patients who may benefit from treatment. If the interim analysis of eGFR slope and proteinuria reduction from baseline at 48 weeks is positive, accelerated approval is possible. A data readout from the interim analysis is on track for 2023. VX-147 may be the next leg of growth where sales may begin in late 2024.

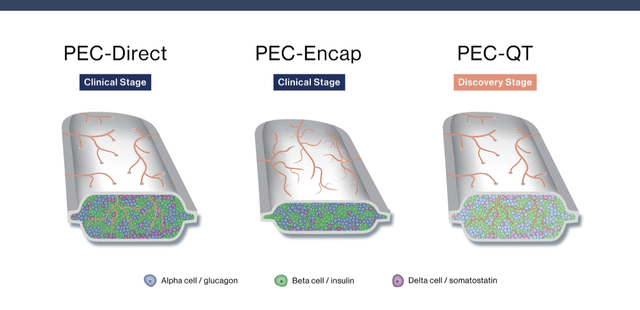

The early-stage type 1 diabetes program produced promising data. VX-880 is a stem cell-derived islet replacement therapy. It holds the potential to provide a functional cure for diabetes. Two patients were treated at half the target dose and showed excellent results. The first patient achieved insulin independence which was sustained and the second patient had significant reductions in exogenous insulin requirements. An additional patient received the full target dose and data should be available soon.

These patients were on immunosuppressive drugs, and there are significant technical challenges to enable treatment without immunosuppressants. The company also seeks to treat T1 diabetes in patients who are not taking immunosuppressants. Vertex is on the path to file an IND for its islet cells and device program in 2H22.

Recently, Vertex bought ViaCyte, a private company that was a competitor also attempting to develop a functional cure for type 1 diabetes for $320 m. In my view, this was a very low price for significant technologies and expertise that will help to overcome the challenges of developing a functional cure. This acquisition allows Vertex to add scientists who have focused on this endeavor for years as well as manufacturing expertise for cell-based therapies.

ViaCyte has developed devices designed to protect the cells from the immune system. Lastly, in partnership with CRISPR Therapeutics (CRSP), ViaCyte developed gene edited cells (VCTX210) which are designed to evade the immune system, and if effective, would eliminate the need for immunosuppressive therapy. Essentially, this acquisition gave Vertex additional tools allowing them to find the best approach for patients.

Acute Pain and Opioids

Opioid abuse and addiction are a public health crisis. The CDC reported there were 69,000 deaths in 2020 from opioid overdoses. Despite a growing understanding of the dangers and addictive potential of opioids, prescribing and overdosing are continuing. The epidemic shows no signs of abating given the CDC’s latest estimate rose to 75,000 Americans dying from opioid overdoses. According to the CDC, more than 2 million Americans are misusing or addicted to opioids.

One explanation for why this continues is that there are no effective alternative medicines. Most prescriptions for moderate to severe acute pain are currently written for generic opioids. Many attempts to develop non-opioid pain medicines, including Vertex’s own efforts (VX-150, VX-128 and VX-961), have failed to show an optimal profile. Thus, opioids continue to be a first-line treatment for moderate to severe acute pain.

While opioids are an antiquated and imperfect solution, they are highly effective. Side effects including sedation, dizziness, nausea, vomiting and constipation are common. Complications of chronic opioid use include hearing loss, tolerance (more of the opioid is needed over time to produce the same level of pain relief), and addiction. Unfortunately, even short-term use has been shown to have the potential for causing addiction. There is a very real unmet need for alternative medicines to treat pain.

VX-548 has a Novel Mechanism of Action

VX-548 was developed based on learnings from families in Pakistan with an inability to experience pain. Due to a genetic abnormality, members of these families walk on hot coals, stab themselves with knives and jump from heights and experience no pain. This genetic mutation prevents pain signals from being sent from the peripheral nervous system to the brain. Vertex and other developers have attempted to develop medicines that mimic the pain blocking that results from this genetic abnormality.

VX-548 is a selective NaV1.8 inhibitor whose mechanism of action is blocking peripheral neurons from transmitting pain signals to the brain. Opioids differ in that they work directly on receptors in the brain. Crucially, since VX-548 works in the peripheral nervous system and on a receptor which is not expressed in the brain, it does not have the addictive potential of opioids.

The non-addictive potential is a significant benefit, and premium pricing is likely justified if VX-548 is successfully developed. The current market for acute pain medicine is $4B annually, and that figure is based on generic pricing. Given the pricing of a branded product would likely be at least double, the commercial opportunity is extremely large. Clinical studies are designed to achieve a broad label for a moderate to severe acute pain indication while positioning VX-548 for patients who fail to achieve relief with OTC medicines but before opioids are prescribed.

Phase 2 Data Showed Efficacy

VX-548 was tested in patients with acute pain following bunionectomy (surgery to remove a bunion on the foot) and in patients who had abdominoplasty surgery (tummy tuck). These studies allow Vertex to prove efficacy, but the FDA label will likely be broader based on precedent.

The Sum of the Pain Intensity Difference over the first 48 hours of treatment (SPID48) was the endpoint used to evaluate efficacy in the phase 2 studies. A higher number on this scale indicates a greater reduction in pain intensity. The phase 2 trials which enrolled 274 and 303 patients respectively, who underwent bunionectomy or abdominoplasty, met the primary endpoints.

In both trials, high dose VX-548 was more effective than acetaminophen and hydrocodone, which is sold as Vicodin. (Vicodin is a combination of Tylenol and an opioid.) One facet of the data which was concerning was that, in the bunionectomy study, there was not a clear dose response and mid dose VX-548 performed worse than the low dose, placebo and the opioid reference arm. The drug was well-tolerated, and the majority of adverse events were mild or moderate with no SAEs reported that were related to treatment.

Bunionectomy (Bunion Surgery)

|

Placebo n=59 |

High dose VX-548 n=60 |

Mid-dose VX-548 n=62 |

Low dose VX-548 n=33 |

Hydrocodone Acetaminophen n=60 |

|

|

Mean SPID 48 |

101 |

137.8 |

86.9 |

112.9 |

115.6 |

|

Difference |

36.8 |

-14.1 |

11.9 |

14.7 |

Abdominoplasty (Tummy Tuck Surgery)

|

Placebo n=77 |

High dose VX-548 n=76 |

Mid dose VX-548 n=74 |

Hydrocodone Acetaminophen |

|

|

Mean SPID 48 |

72.7 |

110.5 |

95.1 |

85.2 |

|

Difference |

37.8 |

22.4 |

12.5 |

VX-548 in acute pain is advancing to pivotal development with studies enrolling in 4Q22. The phase 3 program is essentially an identical trial design to phase 2 – Two randomized, double-blind, placebo-controlled studies evaluating the efficacy and safety of VX-548 for moderate to severe acute pain following bunionectomy or abdominoplasty surgery. While not yet enrolling, both studies will also include a hydrocodone bitartrate/acetaminophen treatment arm to assess how VX-548 compares to standard of care opioids.

An additional single-arm study is planned which will evaluate the safety and effectiveness of VX-548 for up to 14 days in other types of moderate to severe acute pain. These studies are designed to support a broad moderate-to-severe acute pain label. FDA guidance suggests labelling may include statements regarding reducing opioid dosage and duration of use.

In Science, John Wood a neurobiologist who has studied pain pathways such as Nav1.8 at University College London commented on the results:

“This is a major advance in the effort to supersede opioids,” “These results are terrific, and the side effect profile is very good.”

Longer term, Vertex plans to test VX-548 in additional indications including chronic neuropathic pain. Vertex reported they will be conducting a proof of concept phase 2 study which is randomized, double-blind and controlled to assess dose and evaluate the efficacy and safety of VX-548 diabetic peripheral neuropathy.

The Competitive Landscape

In April, ACADIA’s (ACAD) ACP-044 failed to meet the endpoint in a phase 2 trial in acute pain which enrolled 239 patients in a randomized, double-blind, placebo-controlled trial of pain following bunionectomy.

Biogen (BIIB) is conducting a study of its non-opioid, vixotrigine, (BIIB074) in a rare condition, trigeminal neuralgia. They also conducted a phase 2 study in chronic neuropathic pain. Data was mixed with the higher dose not meeting the primary endpoint but the lower dose meeting the endpoint. There are currently no active clinical trials underway in this indication. Vixotrigine appears well-tolerated and is believed to be non-addictive.

Finances

Vertex guided to $8.6 billion to $8.8 billion in sales from the CF franchise for 2022. The company reported $9.3 billion, an increase of approximately $1.7 billion compared to December 31, 2021, which was largely due to product revenue rising 22%. The cash position allows Vertex to continue to engage in business development to build the pipeline.

Conclusions

Exa-cel in sickle cell disease and transfusion-dependent thalassemia, VX-147 in APOL1-mediated kidney disease and VX-548 in acute pain are three late-stage programs that could result in a high level of earnings growth in the next five years. VX-548 is potentially a multi-billion dollar product. If the profile is confirmed, it may have monopoly-like status, command premium pricing, and generate billions in revenue as Doctors may embrace a new alternative.

There is still clinical risk and regulatory risk in all three programs, but even if only one succeeds, Vertex has a path to growth and should command a higher share price. In addition, Vertex’s investigational stage CF program (VX-121/tezacaftor/VX-561), which seeks to replace one of their current assets, would result in higher margins due to reduced royalties (low-double digits reducing to low-single digits) if successful. Additionally, the company has over $9B of cash on hand for acquisitions that can fuel innovation and growth. In summary, Vertex is extremely well positioned and has multiple paths to achieve growth going forward.

Back in 2021, I noted that “Morgan Stanley’s Matthew Harrison valued the CF franchise at $240-$250 per share and Citibank assigned $260-$270 per share to the CF portion of Vertex’s business. These figures highlight that even if the analysts’ valuations of the CF franchise are significantly too generous, there is very little value assigned to Vertex’s pipeline. In summary, any positive news on the pipeline could result in Vertex stock recovering as investors gain new confidence in the company’s future growth prospects.”

Clearly, the market has begun to see the possibilities, and the stock has moved up even in a challenging market. If a $240-$270 DCF estimate for the CF franchise holds true today, which it should given the impressive sales, there is still minimal value assigned to the pipeline given the CF franchise value and the $9B of cash on hand.

Note: If you found this article helpful, please click the follow button to be alerted to new articles.

Be the first to comment