Feverpitched

Investment thesis

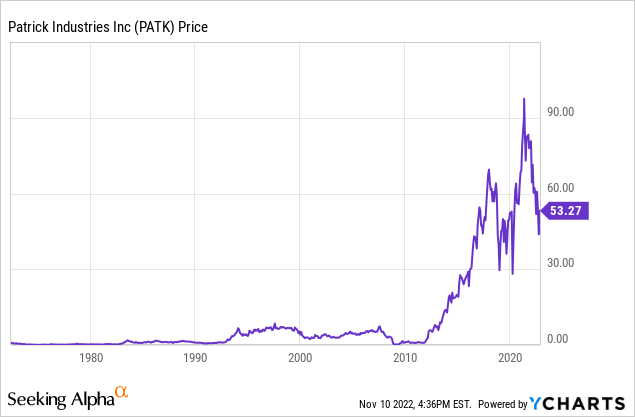

Patrick Industries (NASDAQ:PATK) has shown a tremendous capacity to expand its operations over the past decade, with a big boost taking place in recent quarters thanks to increased demand as a result of the reopening of the economy after the coronavirus pandemic crisis in 2020. The stabilization of demand projected for the end of 2022 and the whole of 2023 has caused a significant drop in the price of the company’s shares, and to this must be added the risk of carrying greater debt used to expand through acquisitions and the current amplified risks of a potential recession as a result of interest rate hikes to cool down the economy and thus combat inflationary pressures.

Even so, the company has shown an enormous capacity to generate strong cash from operations over the years and cash from operations of 2019 was already enough to comfortably cover the current dividend and interest expenses, and that’s without taking into account that the acquisitions carried out in 2020 and 2021 will contribute cash flows to the balance sheet in the future. For that reason, I believe that the company will be able to reduce its debt levels in the coming quarters, which will allow it to free up resources that can be distributed among shareholders in the future.

A brief overview of the company

Patrick Industries is a provider of component solutions for the recreational vehicle, marine, manufactured housing, and various industrial markets, including single and multi-family housing, hospitality, institutional and commercial markets. The company was founded in 1959 and its market cap currently stands at $1.09 billion, employing around 11,000 workers in the United States.

Patrick Industries (Patrickind.com)

The company operates 174 manufacturing plants and 64 warehouse and distribution facilities located in 23 states from the United States, with a small presence in China and Canada. Insiders own 5.81% of shares outstanding with a market value of $70.38 million, which means that their interests are aligned with those of the shareholders.

Currently, shares are trading at $53.27, which represents a 43.89% decline from all-time highs of $94.94 on May 7, 2021. Although sales and margins have increased in the past year, demand is stabilizing after the coronavirus pandemic surge in 2020 and 2022 and recessionary risks, as well as rising interest rates, could have a very significant impact on the company’s operations, especially in the recreational vehicle segment as it can be considered a very discretionary expense for the majority of the population while customers need access to financing to acquire recreational vehicles. These two risks must be added to the increase in debt on the balance sheet as a result of the rapid pace of acquisitions that the company has recently carried out.

An aggressive M&A strategy is driving sales growth

The company has managed to steadily expand operations over the years thanks to the continuous acquisitions it has carried out through its aggressive M&A strategy. During 2021 and 2022, its pace of acquisitions has remained at a very fast pace.

In March 2021, the company acquired Sea-Dog Corporation, a distributor of marine and powersports hardware and accessories, and Sea-Lect Plastics, a provider of plastic injection molding, design, product development, and expert tooling for companies and government entities. Both companies generated around $20 million in revenue in 2020. Later, in April 2021, the company acquired Hyperform, a manufacturer of high-quality, non-slip foam flooring under the SeaDek brand, for the marine OEM market and aftermarket. It also operates in the pool and spa, powersports, and utility markets under the highly complementary brands of SwimDek and EndeavorDek. Hyperform generates around $25 million in annual revenues.

In May 2021, the company acquired Alpha Systems, a manufacturer and distributor of component products and accessories for the recreational vehicle, manufactured housing, commercial building, and marine markets generating over $150 million in annual revenues. Alpha’s products include adhesives and sealants, roofing membranes for recreational vehicles, roto/blow and injection molded products, butyl tape, shutters, and various other parts and accessories. Later, in August 2021, it acquired Coyote Mfg, a leading designer, fabricator, and manufacturer of steel and aluminum products, including boat trailers, towers, T-tops, leaning posts, and other custom components, mainly for the marine OEM market. During the same month, it acquired Tumacs Covers, a leading manufacturer of custom-designed boat covers, canvas frames, and bimini tops for marine OEMs and dealers.

In November 2021, the company acquired Wet Sounds, a designer, fabricator, engineer, and distributor of innovative audio systems and accessories, including amplifiers, tower speakers, soundbars, and subwoofers to OEMs, customers, dealers, and retailers. Wet Sounds products are used in the marine industry and in the home audio and powersports markets and aftermarkets. During the same month, it also acquired Williamsburg Marine and Williamsburg Furniture, a manufacturer of seating for marine and motorized recreational vehicles generating around $41 million in annual revenues.

The pace of acquisitions has not stopped in 2022 and, in March, the company acquired Rockford Corporation and the Rockford Fosgate brand, a global designer and distributor of premier, high-performance audio systems and components, mainly for the powersports, marine, and automotive markets and aftermarkets. Later, in May 2022, the company acquired Diamondback Towers, a manufacturer of premium wakeboard/ski towers and accessories for marine OEMs.

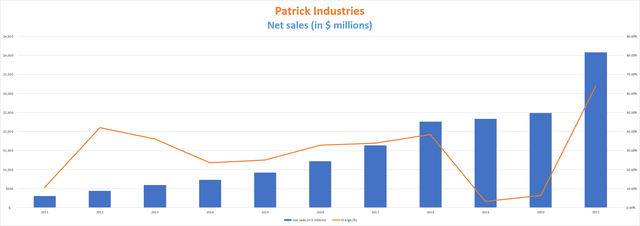

Net sales experienced explosive growth

Thanks to the aggressive M&A strategy, the company’s net sales have grown at an astounding rate during the past few years. More recently, and despite the coronavirus pandemic crisis, the company achieved a 6.40% increase in revenue in 2020 and reported an astounding increase of 64.00% in 2021. This increase was also boosted by post-pandemic consumer demand and is expected to stabilize in 2023.

Patrick Industries net sales (10-K filings)

Net sales grew by 57.81% during the first quarter of 2022, 44.68% during the second quarter, and 4.90% during the third quarter as demand for recreational vehicles is stabilizing after a post-pandemic spike in 2021. In this sense, the current trailing twelve months’ net sales of $5.08 billion are already 24.50% higher than net sales of 4.08 billion in 2021, although the year is expected to close with net sales of $4.89 billion and stabilize at $4.24 billion in 2023. The marine segment is poised to partially offset the decline in recreational vehicles as net sales in the segment increased by 56.69% during the third quarter of 2022, boosted by recent acquisitions in companies with a strong presence in the industry, and represented 24.38% of the company’s total net sales for the quarter as net sales of the Recreational Vehicles segment declined by 17.32% year over year.

Using 2021 as a reference, 59% of net sales were provided by operations in the recreational vehicle industry, whereas 16% was provided in the marine industry, 14% in manufactured housing, and 11% in industrial markets. Still, the marine segment is expected to keep providing over 25% of the company’s sales in 2023 and beyond as the company has heavily invested cash to acquire companies operating in the industry while recreational vehicles’ demand is poised to stabilize at lower levels than current ones.

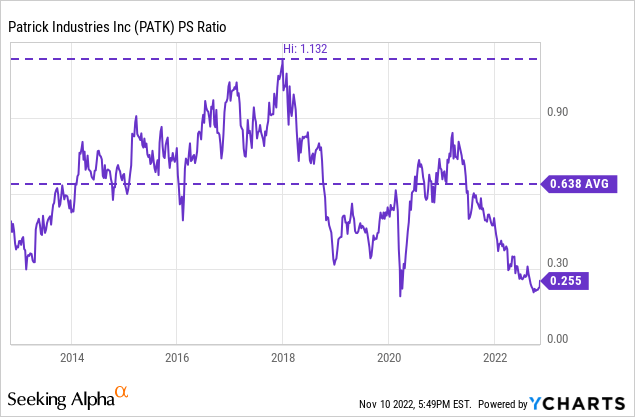

The recent decline in the share price despite the sharp increase in net sales caused a precipitous drop in the price-to-sales ratio, which is at the lowest level of the past decade at 0.255, only equaled during the worst days of the coronavirus pandemic crisis in early 2020.

This means that, at the current share price, the company generates net sales of $3.92 for each dollar held in shares annually. This ratio is 60.03% lower than the average of the past decade and 77.47% lower than the highest spike of 1.132 reached in late 2017, and this shows that this could be a huge opportunity to acquire shares at a more than reasonable price even though net sales are projected to decline by 16.54% when stabilizing in 2023. Furthermore, the company has managed to achieve very healthy (and increasing) profit margins year after year, which means that future sales will be converted into cash with relative ease.

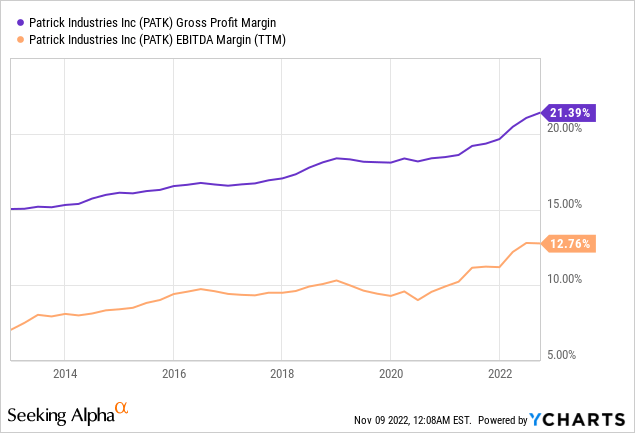

Healthy margins enable continuous cash generation

As we can see in the chart below, the company has managed to maintain very healthy profit margins over the years. And not only that, but they have increased at a fairly steady rate. In this sense, trailing twelve months’ gross profit margins currently stand at 21.39% while EBITDA margins stand at 12.76%. Profit margins are increasing as a result of easing supply chain pressures and the stabilization of freight rates, as well as increased volumes due to the post-pandemic demand surge, the acquisitions that took place during 2021, and increased operating efficiencies.

Still, profit margins are already showing the effects of declining demand in the Recreational Vehicles segment as the company reported gross profit margins of 21.26% and EBITDA margins of 11.33% during the third quarter of 2022, both lower than the current trailing twelve months. This was in fact to be expected as the demand surge after the coronavirus pandemic crisis had to stabilize sooner or later, and margins should continue to decline in 2023 as demand continues to stabilize while inflationary pressures are felt in consumer spending habits. Furthermore, a potential recession as a result of the cooling of the economy through interest rate hikes could result in a drop in volumes, which would lead to significantly lower margins than the current ones.

Still, the company has historically generated wide margins that would comfortably cover the current interest expenses and dividend payout while investors have punished the company with a 43.89% drop in the share price as a reaction to the aforementioned risks. This opens a window of opportunity for investors interested in the long term as the current dividend is widely covered, which gives ample room for future raises as soon as the company reduces its debt pile.

Acquisitions will soon slow down as interest expenses need to be reduced

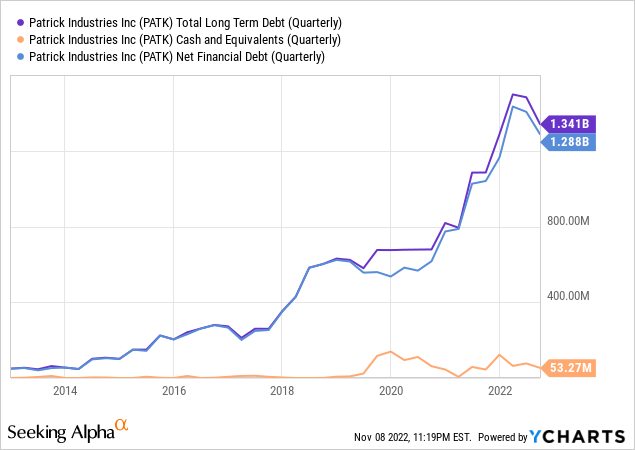

Total long-term debt reached $1.51 billion during the first quarter of 2022 after an aggressive M&A strategy and closed at $1.36 billion in the third quarter. This represents a 10.42% decline in just two quarters which was possible thanks to the increase in sales and margins in recent quarters as a result of the post-pandemic demand surge. However, the pace of debt reduction should slow down in the coming quarters as demand in the Recreational Vehicles segment stabilizes.

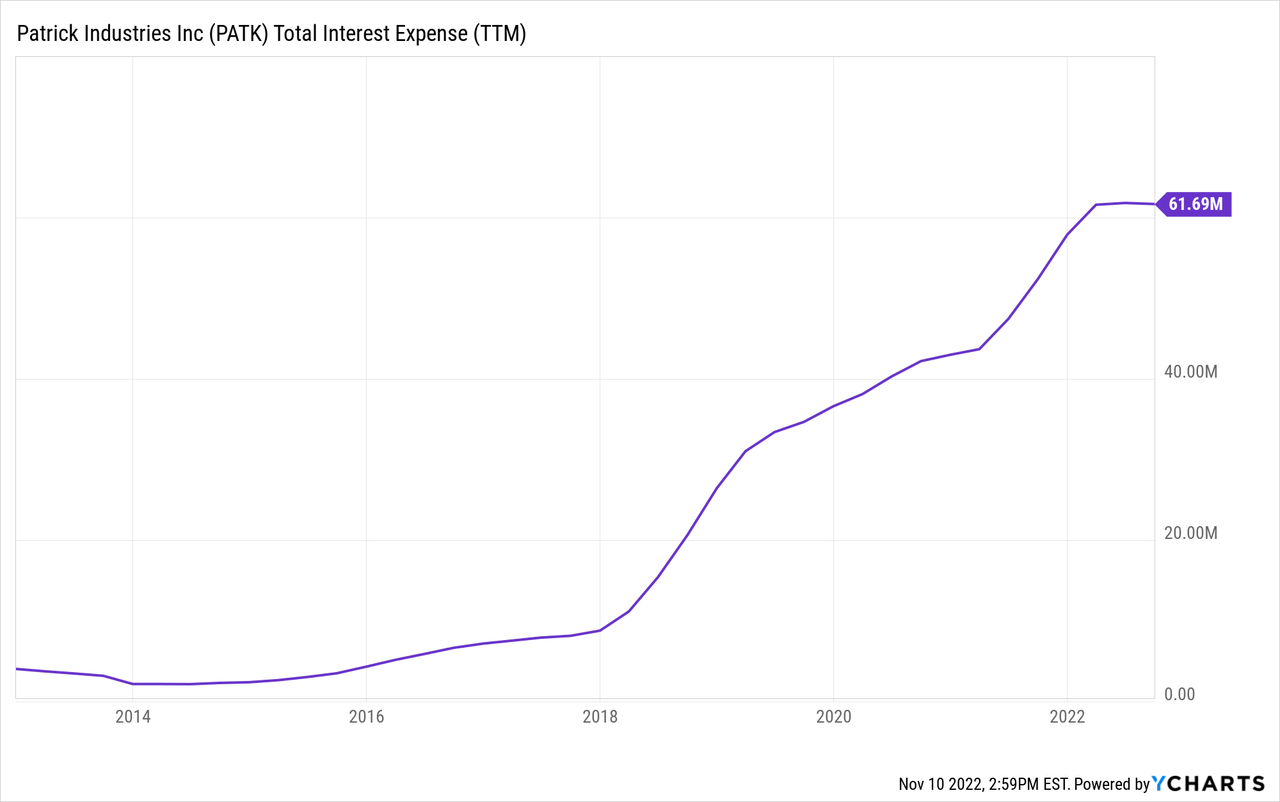

Debt is becoming closer to reaching unsustainable levels in the long term after the recent increase, and therefore, a considerable part of the debt will have to be paid down before continuing with the current pace of acquisitions. This is not only a consequence of the risks involved in carrying such a high level of debt but also a consequence of the interest expenses on the debt that this entails. In this sense, interest expenses currently stand at around $62 million per year, and this will limit future growth as a relatively big portion of the cash generated through operations will have to be used in covering interest expenses.

The current trailing twelve months’ cash from operations stands at $334.5 million, which is more than enough to cover current interest expenses of ~$62 million plus the current dividend payout of ~$30.5 million per year. Still, it will be difficult even to maintain the cash from operations of $252.13 million generated in 2021 despite the acquisitions made in the 2021-2022 period as the company won’t enjoy the post-pandemic demand tailwind during the second half of 2022 and the whole of 2023. Nevertheless, interest expenses should start to decline soon as the company starts to pay down the long-term debt as it did in the past two quarters, so it is only a matter of time before the company makes room for further dividend raises.

The dividend is sustainable but interest expenses will limit its growth in the medium term

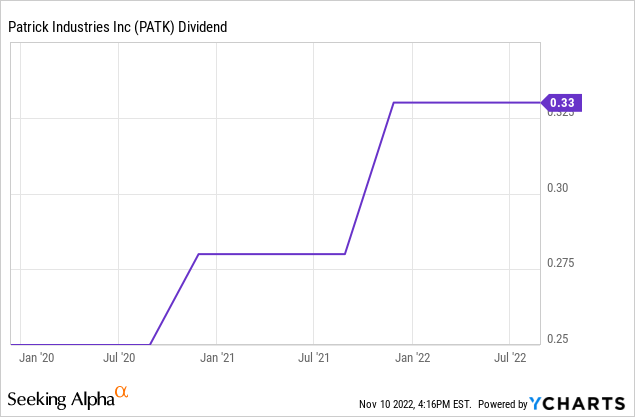

In December 2019, the company paid its first quarterly dividend of $0.25 per share after a period of high expansion and increased it to $0.33 today, which gives a meaning to the investment beyond achieving capital gains.

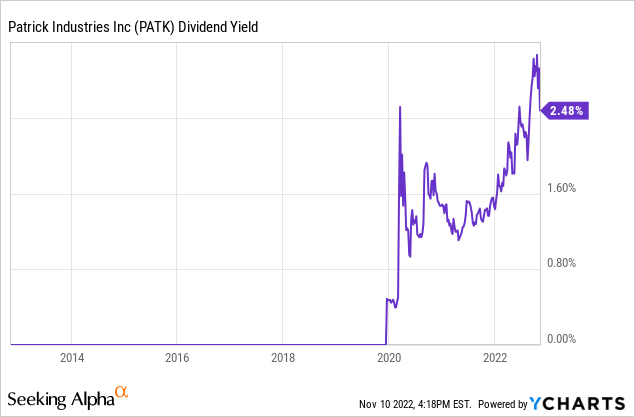

Taking into account the current share price, this gives us a dividend yield of 2.48%. Due to the recent introduction of a dividend, we don’t have enough historical data to make a comparison, so we need to take into account the current cash payout ratio in order to determine the upside potential of the dividend and thus decide whether the current dividend yield is worth the risks given its potential.

To calculate the cash payout ratio, I have calculated what percentage of the cash from operations has been allocated each year to the payment of interest expenses and, more recently, also the dividends. In this way, we can determine the company’s ability to cover them with cash generated through actual operations and thus assess the dividend’s upside potential.

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Cash from operations (in millions) | $22.43 | $46.32 | $66.86 | $97.15 | $99.90 | $200.01 | $192.41 | $160.15 | $252.13 |

| Interest expenses (in millions) | $2.17 | $2.39 | $4.32 | $7.19 | $8.79 | $26.44 | $36.62 | $43.00 | $57.89 |

| Dividends paid (in millions) | $0 | $0 | $0 | $0 | $0 | $0 | $5.80 | $23.63 | $27.02 |

| Cash payout ratio | 9.68% | 5.17% | 6.46% | 7.40% | 8.80% | 13.22% | 22.04% | 41.60% | 32.49% |

As we can see in the table above, interest expenses have been increasing over the years, which has produced an increase in the cash payout ratio to 13.22% in 2018. With the introduction of the dividend in 2019 and further increases in interest on the debt, the cash payout ratio increased to 22.04% in 2019 and reached 41.60% in 2020 before stabilizing at 32.49% in 2021, despite increasing dividends paid and interest expenses, thanks to post-pandemic demand surges.

Current interest expenses of ~$62 million are twice as high as the current dividend payout, so the company could increase its current dividend by 200% if said interest expenses did not exist. This is an important fact because it helps us see where the company has room to increase the dividend in the future. Furthermore, the company could pay said dividend with only half of the cash from operations of 2019, so the margin to increase the dividend is enormous.

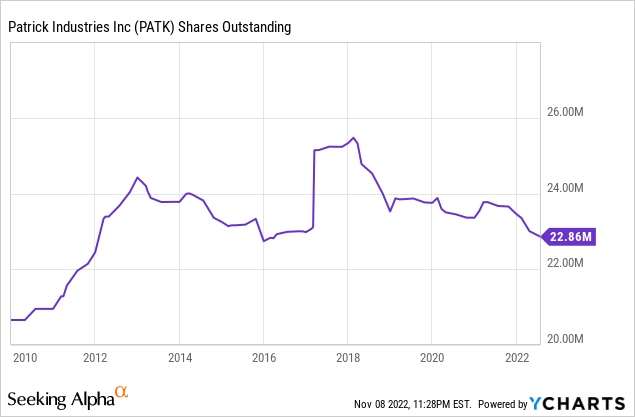

Furthermore, the company has been recently buying back its own shares. In this sense, the company announced an additional authorization of $100 million for share repurchases for a period of two years in February 2022. In 2021, the company spent $48.9 million to repurchase a total of 612,325 shares.

This means that each share represents a bigger part of the company over time, which increases the dividend per share by dividing dividends paid among fewer shares.

Risks worth mentioning

- Rising interest rates and a potential recession as a consequence of a slowing economy would have a significant impact as customers of these products might see them more as a discretionary expense in tough times while they also often need access to finance to buy them.

- Two customers in the recreational vehicles market accounted for 42% of net sales in 2021, so if one of the two customers significantly reduces the demand for the company’s products, this would have a direct impact on net sales as well as margins.

- Debt has increased significantly in recent years as a result of the rapid pace of acquisitions. These acquisitions have enabled exemplary growth in sales and profit margins, but have also added risks for investors as the company now has to meet interest payments on the debt each year. Such interest expenses will limit future growth and dividend raises, but also open up the current opportunity for shareholders interested in a relatively low yield on cost for the long term as the share price declined significantly from all-time highs.

Conclusion

The current share price decline of 43.89% represents a huge opportunity for dividend growth investors interested in holding shares of Patrick Industries with a low dividend yield on cost. The cash from operations widely covers current interest expenses and dividends paid and there is still a lot of room to expand the dividend payout as the company can use excess cash to pay down its debt pile.

2021 was an extraordinary year for the company’s operations thanks to the tailwind of the post-pandemic demand surge, and although in the short- and medium-term sales have yet to stabilize at a lower level than the current one, the company was already generating enough cash from operations in 2019 for covering current at a cash payout ratio of ~50%. Since then, the company has expanded thanks to an aggressive policy of acquisitions, and as soon as the interest expenses decrease as part of the debt is paid, the cash payout ratio will begin to decrease enough to continue increasing the dividend.

Be the first to comment