Beautiful Sioux Falls, South Dakota Waterfront

DenisTangneyJr/E+ via Getty Images

Investment View: Accumulating <$50

I have accumulated shares of Pathward Financial, Inc. (NASDAQ:CASH) shares over the past fourteen months. In September-October 2022, as Pathward’s share price fell into the $30s, I accelerated share purchases. My average cost/share is in the mid-$40s ($33.16-$57.88)

CASH is currently the second largest holding in my Long-Term, Buy-and-Hold Bank Portfolio behind JPMorgan Chase & Co. (JPM) and just ahead of Cullen/Frost Bankers, Inc. (CFR).

My current approach to CASH as an investor, subject to change:

- <$40 Buy

- $40-$50 Accumulate on weakness

- $50-$60 Hold

- >$60 Take some profits if $60+ next twelve months

Key Statistics At A Glance

- November 9 closing price: $41.70

- One month price: +31%

- YTD price: -26%

- One year price: -31%

- YTD price range: $31.16-$65.96

- Analyst price target $48.50. (2 analysts, 1 Outperform & 1 Hold)

- Share count Oct. 13, 2022: 28.93 million

- Market Cap: $1.22 billion.

- P/E: 8.5x (10-year avg. 13.6x)

- Forward P/E: 7.9x Based on low-end Co. 2023 guidance

- Price to Book: 1.98x (10-year average 1.56x)

- Price to Tangible Book Value: 4.1x (10-year average 2.3x)

- Loan/Deposit Ratio: 56%

- Return on Equity TTM 20.4% (10-year avg. 12.2%, SD 3.4%)

- Return on Equity since YE 2017: 14.0%, SD 3.5%.

- ROA Sept. 30 Quarter-end: 2.20%

- Dividend yield: 0.45%

- Beta (5-year): .88

Meta Trademark: $60 Million Payment

Investors might find this of interest.

Pathward changed its name from Meta Financial earlier this year when Mark Zuckerberg of Meta Platforms, Inc. (META) paid $60 million for the bank’s “Meta” trademark and brand. After paying taxes and rebranding expenses, I estimate that $38-40 million dropped to Pathward’s bottom line for the fiscal year ending Sept. 2022.

The Facebook payment together with cash on the balance sheet were used to pay off a $75 million subordinated debt facility that cost the bank $5+ million a year in pre-tax interest expense. At the time of that paydown, the bank’s stock price was in the mid-$50s.

Business Model

Based in Sioux Falls, South Dakota, Pathward is not a traditional bank. It is not dependent on local geography for lending and deposit gathering. It does not operate a traditional branch network.

Pathward Financial is the holding company. Its principal asset is a wholly owned full-service banking subsidiary. Two non-bank subsidiaries are currently immaterial to Pathward’s finances.

Pathward is a niche bank. It specializes in lending and transactional activities that require operational excellence, flawless execution, and superior risk management/ controls. Done well, which is evidenced over time by low credit losses, Pathward should deliver free cash flow exceeding the bank’s cost of capital.

Pathward operates three business segments:

- Consumer/Tax Refunds

- Commercial Finance

- Corporate Services/Other

The Consumer segment’s primary business is tax refund advance lending arranged by tax preparers across the country. H&R Block is Pathward’s largest tax preparer partner. The tax refund business is not without risk as Pathward has no recourse against the consumer whose repayment depends on a confirmed IRS tax refund. In theory, there should be no losses in the tax business, but in practice, losses can be material.

The principal risk is that the borrower is subject to court orders that can be filed between the time a prepaid debt card is approved and funded by Pathward and when the funds on the card are exhausted. A common way Pathward loses money on prepaid cards is when a borrower’s account is garnished. For example, this can occur when a borrower fails to meet child support obligations. Another way Pathward can lose money is when a tax preparer commits fraud such as filing phony tax records.

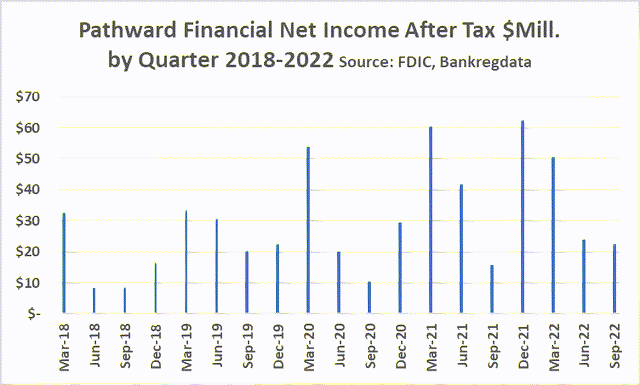

Pathward’s tax refund business is tied to the tax season. This means the bank does not produce steady quarter-over-quarter income growth analysts expect from banks. As the next chart shows, earnings are lumpy, and are best evaluated over trailing and rolling twelve months.

NIAT (Ycharts)

Commercial Finance activities center on traditional Factoring, Asset Based Lending, Leasing, and Warehouse lending. It also does insurance premium financing. Pathward has one of the highest yielding loan portfolios of any bank in the country because its type of lending is expensive to administer and can face considerable fraud/operational risk. Most banks avoid this kind of lending given the administration requirements. Rigorous internal controls and independent audit processes are essential to successful Factoring, ABL, and Warehouse lending.

Corporate Services/Payments focus on building and distributing banking services to third parties. Pathward provides banking services to non-banks as well as federal and state governments. Pathward calls this business “Banking as a Service” (“BaaS”). Pathward provides the operating engine to enable non-banks (such as FinTech firms) to engage in banking activities. Non-banks value BaaS as Pathward enables the non-banks to provide certain bank services without holding a bank charter or being subjected to regulatory supervision (by the FDIC, OCC, or Federal Reserve). An example of how the bank’s BAAS works is the recent announcement by Ramsey Solutions that Pathward will be the bank for its new Gazelle card.

Pathward is one of the nation’s top three issuers of prepaid cards. The IRS uses debit card to get cash to some US citizens (e.g., tax refunds through tax preparers as well as government transfer payment programs such as the US Treasury’s Economic Impact Payment stimulus program). Pathward’s deposits spike during tax season.

Business Model: Not Easy To Analyze

As already noted, Pathward is not a traditional bank. It is also complex given the bank’s seasonality and unusual balance sheet constraints (to be discussed).

Pathward is also difficult to compare to other banks, especially community banks of comparable size. For these reasons, some large bank-focused investment funds choose to not invest in the bank.

Its business model is unique as it drives income from activities that few banks offer. No bank to my knowledge combines Pathward’s unique deposit-gathering business with its principal lending activities.

As measured by P/E, P/B, P/TBV, Pathmark is relatively cheap compared to banks of comparable size. I believe the valuation haircut is justified based on the bank’s unique and complex business model.

While a lower than peer valuation makes sense, when bank stock prices swooned this past September, Pathward’s share price and valuation got arguably too low as share prices fell into the low-mid $30s.

Three Catalysts For Share Purchases

Three events stood out in July-September triggering my decision to buy aggressively in September-October.

- Management announced earnings guidance during its 3Q earnings call on July 27. Here is what CEO Pharr said at that time: “Given the dynamic economic environment, we believe it will be helpful to provide guidance for the current and next fiscal year. We expect fiscal year 2023 GAAP earnings per share to be in the range of $5.25 to $5.75.” Few banks offer earnings guidance, so I interpreted the decision by Pathward as evidence of the bank’s confidence moving into the new fiscal year. At $5.25 2023 EPS and a $35 share price, Pathward sold for less than 7x Forward P/E.

- The second event that caught my attention was CEO Pharr’s and CFO Herrick’s open market purchase of shares between June 14 and August 2 (prices: $33.16-$40). Pharr had three buys (7,500 shares): Herrick one buy (3,000 shares). Herrick’s buys are especially interesting given the announcement made in October that the 60-year-old CFO plans to retire next year; usually retirees are selling, not buying. Regular readers of my bank work know that I place a lot of emphasis on insider buying behavior. I like this buy.

- The third event was the rapid and dramatic increase in Fed Fund rates during 3Q. This event triggered my decision to do a deep-dive analysis in September of banks best positioned to benefit from the jump. I posted a short analysis of this theme for Seeking Alpha on September 7. Pathward is the ultimate “Have” bank, having industry low cost of funds and a relatively low loan-deposit ratio. Pathward shares are up 27% since that date; the S&P 500 is down 5.6%. Here’s a quirk with Pathward’s loan-deposit ratio: The bank’s GAAP reporting under-report deposits. This is because the bank’s unique business model requires the bank to “park” excess deposits off balance sheet. During the October earnings call, management noted that $1.3 billion in cash is currently placed in interest-bearing accounts at other banks.

Business Model Oddities

$10 Billion Asset Cap

Pathward caps its asset size at less than $10 billion because of a peculiar US banking law known as the Durbin Amendment which requires banks to lose a significant portion of debit card income once a bank’s assets exceed $10 billion. Originally designed as a Congressional mechanism to block big banks from earning debit card income, Durbin is today a major obstacle to growth for small cap banks.

In Pathward’s case, Durbin acts as a competitive advantage since a primary source of income is debit card fee income. As long as the bank’s assets remain below $10 billion, Pathward earns the maximum revenue available from a debit card transaction. Durbin also prevents larger banks from getting into Pathmark’s BAAS business model.

If Pathward were to have greater than $10 billion in assets at the end of any given quarter, I estimate that the bank’s debit card revenue (from prepaid Visa cards) would shrink more than 50%, possibly as much as 75%. Such a decline in debit card income would have a material impact on EPS. See page 28 of the CASH recent 10-K for more details about this risk.

From a day-to-day bank governance perspective, CASH’s effective asset cap is closer to the bank’s current size, $7 billion. This is because deposits can swing significantly, especially during tax season. Consequently, as a precaution against exceeding the $10 billion cap, Pathward has outlets for transferring excess deposits. Not long ago when all banks had excess deposits, Pathward did not receive interest on parked deposits. Today, when deposits are again valuable, Pathward likely is earning close to Fed Funds rate.

Regulatory Capital Effective Cap

In conjunction with the board’s determination to cap asset size, the bank has also effectively capped its required regulatory capital ratios at current levels as well. As a result, the bank’s retained earnings each quarter are available for distribution to shareholders in contrast to being plowed back into the business to grow the balance sheet.

Bank’s Risk Profile

The bank’s Risk Profile is High because Pathward engages in transactions requiring superior operational risk management and controls. To mitigate risk, CASH has taken the following actions in recent years:

- Maintains relatively low loan/asset ratio (52% most current quarter).

- Brought in a national bank risk industry leader in 2019 who was appointed CEO in 2021.

- Exited Community Banking, thereby narrowing the bank’s focus to three main business segments.

- Attracts and retains “sticky” zero-cost deposits.

- Maintains capital ratios in excess of regulatory minimums.

- Operates three businesses that have uncorrelated risk to each other.

- Within each business, concentration risk is minimal, with the exception of the tax refund business that is tied closely with H&R Block. (During the bank’s July earnings call, management reported the decision to eliminate relationships with two tax preparers.)

- Specific to lending risk, the bank’s principal lending activity (Commercial Finance) is pure old-fashion banking that provides a lender with two sources of repayment: Cash Flow or Collateral liquidation. (It may also require personal guarantees of business owners.) Make no mistake, ABL/Factoring is a difficult business because it requires expensive infrastructure to Mitigate/Monitor/Report risk exposure. It should be noted that asset-based lending forty years ago was something virtually all banks engaged in, today, such lending is the bailiwick of just a few banks. Among the nation’s largest banks, the unquestioned leader in ABL is PNC Financial Services Group, Inc. (PNC).

My Case For Accumulating Shares

Factor 1: Management

I have known the bank’s CEO, Brett Pharr for 25 years. I worked with him at Bank of America from the mid-90s to 2011 when I retired. I saw Pharr first-hand perform in highly complex roles that required superior risk, financial, control, and influencing skills. I considered him to be one of Bank of America’s top executives in the oversight of change management as well as internal audit. During my time working with him, he acted with integrity and balanced risk and return for long-term shareholder benefit.

Factor 2: Funding Costs/Inflation Hedge

Pathward got on my radar not only because of the bank’s CEO appointment in 2019, but also because the bank started to show up favorably on a number of my quarterly reports highlighting top performing banks in the metrics I value most.

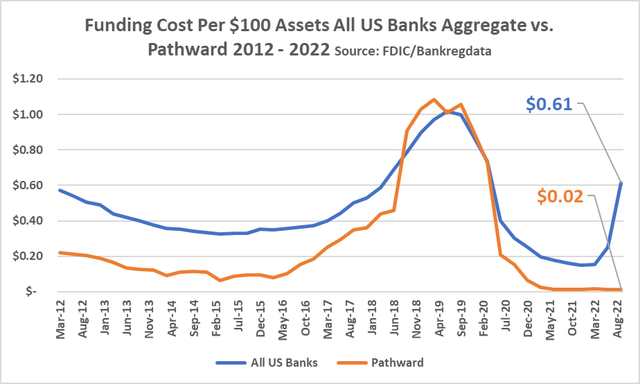

Among those metrics is Cost of Funds. The chart below highlights Pathward’s quarterly COF compared to the industry over the past forty quarters. The steep decline in funding costs in 2018 was associated with the board’s decision to move from traditional community banking to the unique niche model. I give Pathward’s board a lot of credit for approving a business model so unique, and now, so well-positioned to benefit from rising rates.

Funding (FDIC, BRD)

I strongly recommend investors examine the bank’s “Market Risk/Interest Rate Risk” section of the 10-K that should come out later this month for details about interest rate sensitivity. Pathward should continue to be well-positioned to benefit from rising rates.

3. Share Repurchases

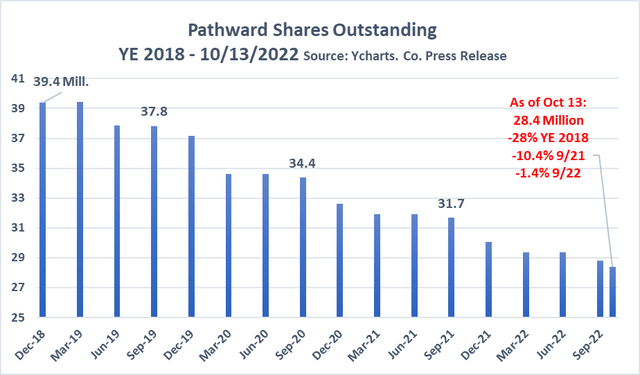

Since assets and regulatory capital are effectively capped, Pathward’s board is using free cash flow to repurchase shares.

The chart below shows share count trend since year-end 2018. Note that there are 28% fewer shares as of October 13 compared to YE 2018.

Share Count (Ycharts)

Regarding the current status of buybacks, the most recent earnings announcement noted:

“The Company resumed share repurchases on July 1, 2022, and during the fiscal 2022 fourth quarter repurchased 573,200 shares of common stock at an average share price of $37.05. An additional 396,100 shares of common stock at an average price of $35.16 were repurchased in October 2022 through October 13, 2022. As of October 13, 2022, there are 3,898,877 shares available for repurchase under the common stock share repurchase program announced during the fourth quarter of fiscal year 2021.”

The share repurchases in the first 13 days of October represented, by my calculations, 18% of the total shares traded during that time. That’s a big number. And the higher that percentage goes, the more difficult (and expensive) it will be for the board to shrink share count.

My ballpark guess is that Pathward will buy back 3 million shares over the next twelve months. Of course, that number could be more or less depending on the price of the shares, but as long as the shares sell under $50, it seems the bank should and will be an aggressive buyer as it was from July 1 to Oct. 13.

I expect the board to announce the plan to acquire another large block of shares during the fourth quarter of fiscal year 2023.

4. Lending: Floating Rate C&I Loans

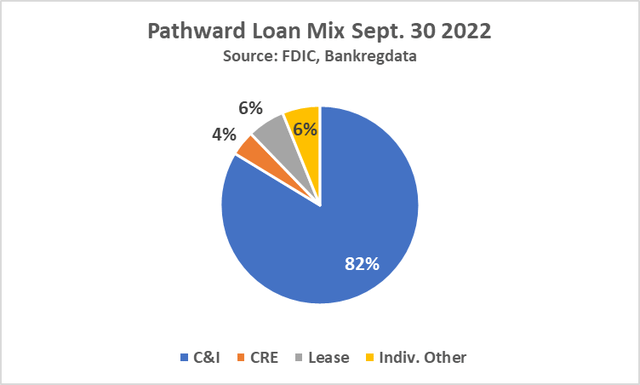

This chart shows the loan mix as of Sept. 30. Readers of my Investing in Banks book know my affinity for Commercial & Industrial (C&I) lending when done well. C&I lending, in contrast to most other forms of bank lending, is less a commodity than other types of bank lending. Relatively few banks have a material and meaningful C&I lending business. This type of lending requires scale, brand, local market knowledge, and especially technical skills and expertise.

Loan Mix (FDIC, BRD)

Pathward’s asset-based C&I lending is high-yielding (FDIC Call Report shows 7.67% for quarter-ending Sept.). The high yield is a function of risk and cost of risk management/controls. ABL is labor and data intensive.

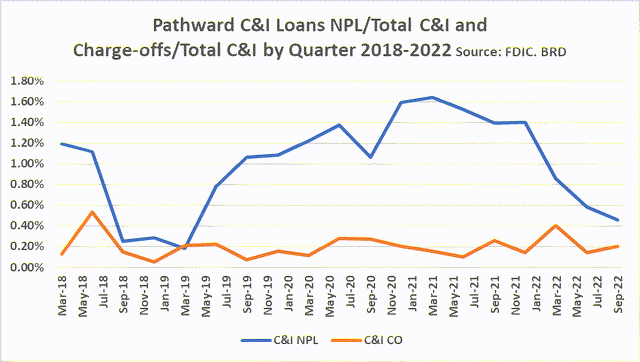

The bankers reading this analysis will be impressed by the next chart. It shows Non-Performing C&I loans as % of Total C&I as well as Charge-offs as % of Total C&I loans by quarter since 2018.

Important note C&I charge-offs are not net; net charge-offs will be lower than numbers shown in the chart.

The key to low charge-offs in asset-based lending/factoring is operational excellence. The primary sources of ABL charge-offs are borrower fraud and the breakdown of the bank’s financial controls. The best ABL lenders have superior processes and talent to monitor and report relevant data regarding the status of the credit facility.

Credit losses (FDIC, BRD)

Given a benign economy, credit losses for banks across the U.S. over the past 12 years have been extremely low. Pathward has not been tested by a severe recession since 2008.

Risks And Watch Items

- Economy: While rising rates widen Net Interest Margin, at some point, rates can rise so high as to make it difficult for borrowers to make sales and repay loans. Mitigating the risk of default is Pathward ABL lending model, but should interest rates go up too high, borrowing will slow and possibly decline.

- Rising Rates, AOCI, Tangible Book Value: To the credit of one of the analysts who covers Pathward, he asked during the recent call whether the bank is concerned about shrinking Tangible Book (result of an accounting standard known as “AOCI”, that requires banks to mark-to-market securities holdings every quarter. Here is the CFO’s response to the question:

“Regulatory capital, both leverage and risk weights is really our driver that we look at. We keep an eye on the tangible capital, we have ongoing discussions with our regulators. AOCI and the calculations for tangible capital are, to me antiquated, they don’t value the whole balance sheet. You think of the value of our deposit base today and other things that sit on both sides of the balance sheet.”

This is a solid answer, although I am a bit traditional in my bank analysis and I will keep an eye on AOCI adjustments and the impact on TBV. I like the CFO’s insights about regulatory capital and off-balance-sheet cash. Both are accurate and germane to the question.

3. Analyst Coverage: Here is something weird: The number of analysts covering Pathward fell from four to two during the pass quarter. I asked CEO Pharr about this during our recent lunch. He said two of the firms covering the bank experienced analyst turnover, and as a result, suspended coverage. He expects at least one to resume soon. Current Consensus Price Target for the two analysts is $48.50 ($43 and $54) with one Outperform and one Hold.

4. Operational Risk Management: In asset-based lending and tax refund lending, the core competence needed is superior operational risk management. And the key to superior operational risk is talent. The Risk Management Association (comprised of 2,000 US banks) currently identifies “Talent” gaps as the number one risk facing the industry. Given the pending retirement of the CFO, I will be keeping an eye on other personnel changes at Pathward.

Caveat

The foregoing is my opinion. I share my Pathward investment for the purpose of getting feedback and questions that challenge my ideas and assumptions.

Every investor needs to do his/her own due diligence before investing as well as determine their risk profile. I am risk-averse, preferring to invest in the nation’s best banks which historically earn returns exceeding cost of capital.

Be the first to comment