Hannelore Foerster/Getty Images Entertainment

Introduction

As a dividend growth investor, I constantly seek new income-producing opportunities. Sometimes I add funds to current dividend growth opportunities, and on other occasions, I consider starting a new position. New positions allow to diversify further and gain access to new industries and capitalize on additional opportunities.

In these volatile times, investors may see many shares trading from their all-time highs. One of the more volatile sectors is the consumer discretionary sector. Discretionary products tend to be more sensitive to inflation, as consumers are more likely to postpone purchasing them as they focus on everyday products. In this article, I will analyze Whirlpool (NYSE:WHR).

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Whirlpool Corporation manufactures and markets home appliances and related products. It operates through four segments: North America, EMEA (Europe, the Middle East, and Africa), Latin America, and Asia. The company’s principal products include refrigerators, freezers, laundry appliances, cooking, and other small domestic appliances.

It markets its products under Whirlpool, Maytag, KitchenAid, JennAir, Amana, and more.

Fundamentals

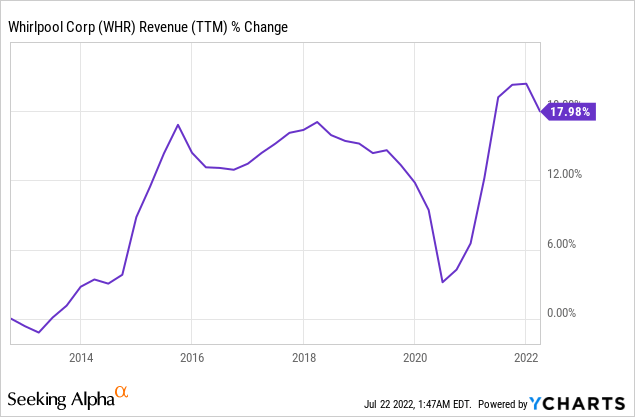

The company’s sales have increased by less than 20% over the last decade. That translates into a CAGR (compound annual growth rate) of less than 2%. Whirlpool is struggling to grow despite several home appliance market acquisitions. In the future, analysts’ consensus, as seen on Seeking Alpha, expect Whirlpool to keep growing sales at an annual rate of ~1% in the medium term.

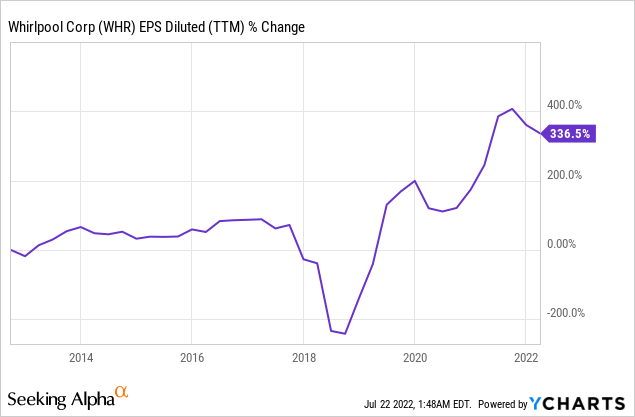

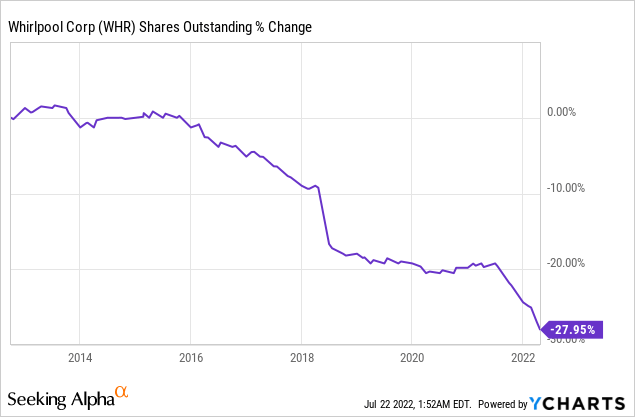

The EPS (earnings per share) grew at a much faster pace compared to the sales. The company more than tripled its EPS despite limited top-line growth. The reasons for the EPS growth are aggressive buybacks, sales growth, and cost-cutting as the company became more efficient and improved its margins significantly. In the future, analysts’ consensus, as seen on Seeking Alpha, expect Whirlpool to keep growing EPS at an annual rate of ~2% in the medium term.

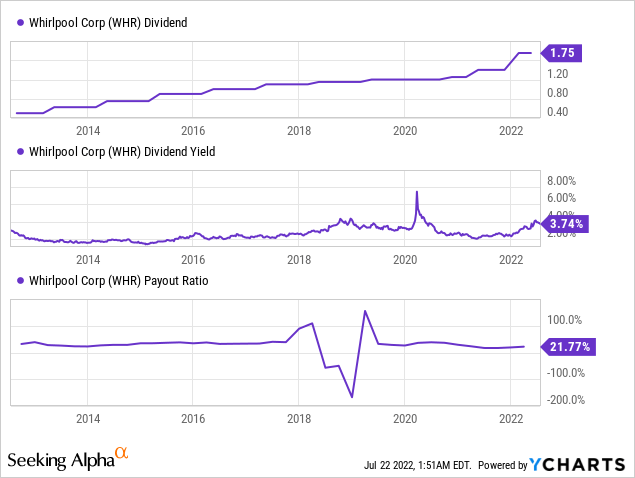

The company has paid a consistent dividend for more than 30 years. It has consistently increased annually in the last 11 years, with the latest 25% increase in February. The dividend is enticing at a yield that approaches 4%. Moreover, the payout ratio is roughly 20% making the dividend relatively safe, and a dividend cut despite the struggling growth is unlikely.

In addition to buybacks, the company is also aggressively buying back its shares. Buybacks are most effective when a company is growing as they supplement EPS growth by reducing the share count. Over the last decade, the number of shares outstanding has declined by 28%. The company intends to keep buying back its shares and take advantage of its low valuation to make the buybacks more effective.

Valuation

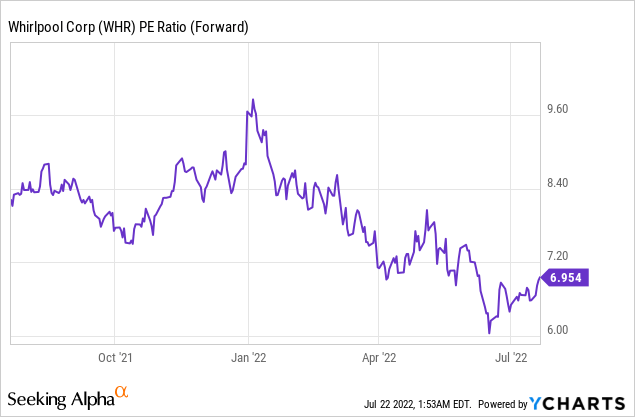

The P/E (price to earnings) ratio is below 7. A single-digit P/E ratio, considering the company’s forecasted earnings in 2022, is exceptionally cheap. It is also almost the most affordable valuation in the last twelve months. Investors are concerned with the medium and short-term growth, and the valuation reflects it.

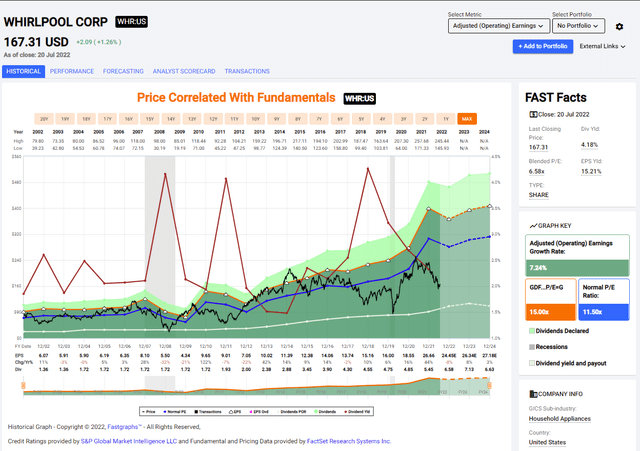

The graph below from Fastgraphs.com also shows how attractively valued the company is. Over the past twenty years, the company has been trading for 11.5 times earnings on average. However, it was a relatively bumpy ride for investors as a consumer discretionary company. At the same time, the average growth rate was 7.34%. The forecasted growth rate is lower, but the valuation is also significantly lower. Investors with long-term vision can enjoy future multiples expansion as inflation declines.

FAST Graphs

To conclude, Whirlpool is a company with significant short-term growth challenges. Investors in the company can capitalize on the high dividend and aggressive buybacks that the company offers. While they wait for the company to return to growth, they will capitalize on the extremely low valuation as they collect their dividends.

Opportunities

Whirlpool has a significant advantage and growth opportunity in its scale. The company is diversified globally and sells in every continent. It allows it to grow in some markets while others lag. Latin America, for example, has shown sing-digits sales growth in the last quarter while other geographies declined. It means that the company can capitalize on opportunities across continents.

Moreover, Whirlpool also has a diversified portfolio of products and a diversified client base. The company sells to individuals, small businesses, and large commercial businesses needing special equipment. The company can sell a toaster to a student and a specialized air conditioning unit to offices. While it means the company is not focused, it can capitalize on more business opportunities.

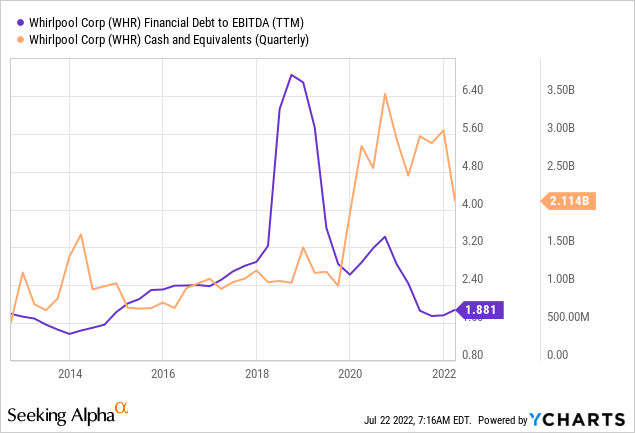

Whirlpool also proved that it has some pricing power. While the pricing power is limited due to the competition, the company did raise prices to combat inflation. Moreover, it has a flexible balance sheet. The company has more than $2B in cash and equivalent, equal to more than 20% of the market cap. It also has a low debt level. These two metrics mean that the company can compete on prices in the long term and that it can also take advantage of the depressed prices for M&A activities.

Risks

Competition is a significant risk for Whirlpool. The home appliance market is highly competitive, and Whirlpool is competing with other giants from around the globe. The company is facing well-known brands like Samsung and Siemens. The competition is making it harder to increase the market share and the pricing. It is a long-term risk as the primary competitors also have similar scales and strengths.

Inflation is another risk, and it is a much harsher risk due to the competition. The company is dealing with increasing costs. The labor cost is rising, and so is the cost of the materials needed to produce the products. The company must raise prices or sacrifice profitability to maintain its market share. It is a challenging dilemma in a competitive environment.

Stagnation and short-term execution are also short-term risks. The company cannot grow due to the first two risks, and stagnation in businesses may continue even after the business environment improves. The company will have to be very efficient and ready to react as the environment stabilizes, initiate future growth prospects, and capitalize on opportunities.

Conclusions

To conclude, Whirlpool is a solid company dealing with a highly challenging business environment. The company is dealing with competition and inflationary pressures that make it hard to grow sales and EPS. It causes some stagnation in the company’s growth profile, while the fundamentals remain strong, and the company pays dividends and repurchases its shares.

The company has the assets it needs to keep growing. It has a strong balance sheet with low debt for future investments and acquisitions. It has a diversified portfolio, and its global reach will allow it to expand in different markets and product lines. I believe the company is attractive enough for income and long-term dividend growth investors at the current valuation.

Be the first to comment