Alex Wong/Getty Images News

Fannie Mae (OTCQB:FNMA) and Freddie Mac (OTCQB:FMCC) are retaining earnings since 2019 on their path out of conservatorship. At $47.4B in total equity value, Fannie Mae has a greater net worth than at any point in its history. Why is Fannie Mae still in conservatorship? The change in presidential administrations required a change in capital rule and that explains the last ~1 year in delay for administrative led housing finance reform.

Now, Sandra Thompson has finished the Biden administration’s version of the capital rule and she has done so before her nomination has even gotten out of committee. This catches the Biden administration up with where the Trump administration left off on administrative housing finance reform.

The Trump administration finished their final capital rule two months before the administration ended because they were unable to fire Watt and because the Covid crisis complicated things. Since then, the Supreme Court ruled that the president can fire an FHFA director making the position a political appointee position. Trump’s Calabria was immediately fired and Sandra Thompson took his seat and has been pushing hard on admin reform ever since.

This administration has more than 2 months left in comparison to the Trump administration when it finished its final capital rule. Treasury presently gets $0 from its GSEs equity position at present but industry stakeholders are in agreement that the government’s equity position valued around $100B should be used to further affordable housing. This capital rule was finalized the same day that FHFA’s comment period for the GSE’s Capital planning rule expires. We are now entering new territory, a finalized capital rule with years left in an administration.

Investment Thesis

Primarily the story that no one is seeing here is administrative reform continues to march forward. Team Biden just finished their capital rule. They will soon finish the Capital Planning rule. Combined these two rules set the stage for raising new money, which is impossible with the existing balance sheets at Fannie and Freddie so I would argue it pre-supposes a balance sheet restructuring. Left on the table for shareholders are some solid legal claims for breach of contract, constitutional structure and possibly takings if appealed to SCOTUS.

The government has enough senior preferred stock and warrants to dilute common into oblivion but for their ability to raise capital and possible legal standing which I understand is minimal but non-zero. The preferred contract claims, however, still have a path to recovering more than par in breach of contract and at least par in constitutional claims mandated restructuring. This administration has been making progress towards restructuring and with this capital rule finalized, I suspect that the ball is now in Treasury’s court to review options to monetize its equity position should it choose to lock in its view of reform and spend money in a way of its choosing. Only upside and zero downside for Treasury on this one, whereas if it waits and does nothing it runs the risk of having to pay tens of billions to shareholders for the claims that have now survived the legal system’s overall answer of how to interpret the law. As such, I do not think that owning common shares is the play here since they don’t really have any material security, whereas I think preferred get at least par in a restructuring.

Biden Admin’s Final Capital Rule

On February 25, FHFA announced their final rule for the Enterprise Regulatory Capital Framework, which is about what we were expecting based on the proposed capital rule by Sandra Thompson:

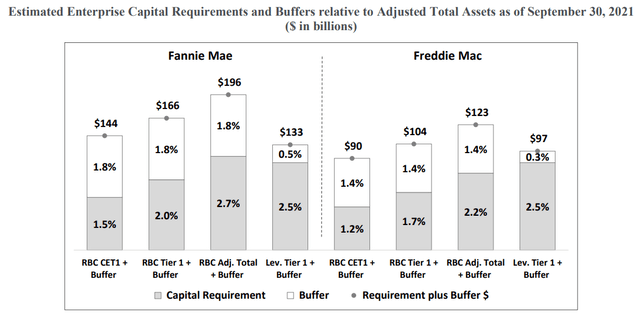

Estimated Enterprise Capital Requirements and Buffers relative to Adjusted Total Assets as of September 30, 2021 ($ in billions) (FHFA Website)

The rule surprisingly acknowledges shareholder complaints with regards to FHFA and Treasury’s dealings during conservatorship:

In addition, commenters offered views on housing finance reform and on matters relating to the Enterprises’ conservatorships, including issues related to the Enterprises’ consent to conservatorships in 2008, subsequent actions by FHFA or the U.S. Department of the Treasury (Treasury), the magnitude of funds remitted to Treasury by the Enterprises relative to cumulative draws, Treasury’s financial interests in the Enterprises, and the PSPAs. FHFA acknowledges the importance of these topics and will thoroughly consider the public’s feedback on these issues when relevant rulemakings and policy decisions are under consideration.

That’s more consideration than I’ve seen in the past for shareholder interests coming from FHFA, where prior director Mel Watt mentioned that he didn’t lay awake at night worrying about shareholders.

United States Court of Appeals for the Federal Circuit Ruling

Originally there were two main schools of thought when shareholder plaintiffs brought legal arguments against HERA 2008. The first was that FHFA and Treasury could not do whatever they wanted to in conservatorship and could only take actions that conserve and preserve assets (APA case). The second was that if FHFA and Treasury can do whatever they want, that the net worth sweep would be a takings case. The Supreme Court ruled in June of 2021 that it’s not an APA case and Treasury and FHFA can do whatever they want. Now we have the Appeals court for the takings case saying that it’s not a takings case either.

So we live in a world where Fannie and Freddie can be put into conservatorship and the government can take everything and it’s not a takings case. This appeals court ruling may get appealed to the Supreme Court. Still pending are the DC District breach of implied covenant of good faith claims and the constitutional claims bolstered by Trump’s memo to Senator Rand Paul.

Brookings – The Path Forward For Housing Finance

Brookings Institute put together an event where key industry stakeholders all got together and agreed that Fannie and Freddie should be released from conservatorship and the government’s equity stake should be used for housing purposes. The group seemed to agree that this should be done as soon as is possible. Mike Calhoun pointed out that Sandra Thompson has been taking steps consistent with his plan.

There was some disagreement on how the ~$100B of Treasury proceeds from the plan should be spent. Some said home ownership, some said to help pay rent, and some said the money should go to existing affordable housing trust funds instead of a new housing vehicle like the plan seems to suggest.

If you see Calhoun get a position at Treasury, we have a Yahtzee.

Summary and Conclusion

Administrative reform continues to progress forward and now the Biden administration has caught up to where the Trump administration left off, with a final capital rule. Now, FHFA, Treasury, Fannie and Freddie can all sort out how to get Fannie and Freddie compliant with that capital rule. FHFA has already put out a pending finalization Capital Planning rule:

The capital plans will allow the Enterprises to identify the amount of capital they need to raise to close the gap with the ERCF, and to consider the timing of when to raise capital, and what types of capital to raise.

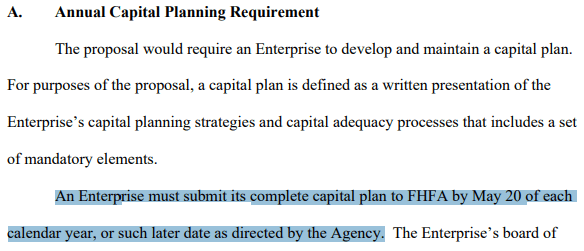

And Fannie and Freddie must submit their plan by May 20th of this year:

Annual Capital Planning Rule Requirement (FHFA Website)

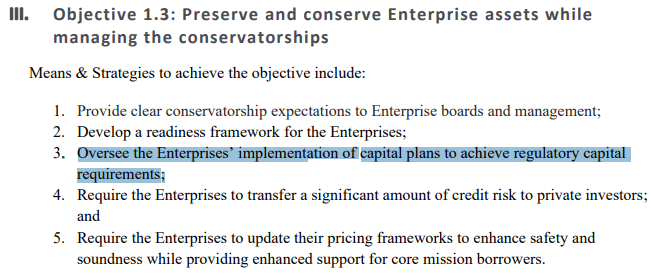

And if you recall, FHFA recently released a Strategic Plan where one of the strategic objectives is to “oversee the Enterprises’ IMPLEMENTATION of capital plans to achieve regulatory capital requirements:

Objective 1.3: Preserve and conserve Enterprise assets while managing the conservatorships (FHFA website)

What’s next? With the comment period expiring today, and no legitimate comments or pushback submitted for the FHFA to review, expect this rule to get fast tracked to final approval in the near term as the May 20 deadline is only 3 months away.

The implementation of these plans gets junior preferred shareholders par value in a restructuring that facilitates the raising of new equity capital. In other words, stocks like OTCQB:FNMAS would be worth $25 and can be bought for under $3 now because, even though everything I just said makes sense, the people who manage money simply do not believe it is going to happen. Nevertheless, the capital rule under Biden is final and now it is time for the most exciting part of this whole saga.

Be the first to comment