Duncan_Andison

Partners Group (OTCPK:PGPHF) is one of the more known private investment GPs in Europe. Aspects of their portfolio are pretty attractive. In PE, their investment philosophy leading up to the dry-up we are currently seeing in private markets likely lends itself to some resilience, and these assets are likely quite unimpaired. However, private debt is a concern, even just looking at the yield curve. In general, we think the current multiple is still too excited. While equity might not be too major of a problem, the massive scale of 2021 investments are going to underperform meaningfully. Yes, there is a lot of dry-powder that will come in at more favourable valuations, but likely not at extraordinary returns. Moreover, opportunities could remain limited for a while longer and reduce the rate that capital can come into the market. Alarms shouldn’t go off over the Partners Group valuation, but there should be some concerns.

Partners Group Key Stats

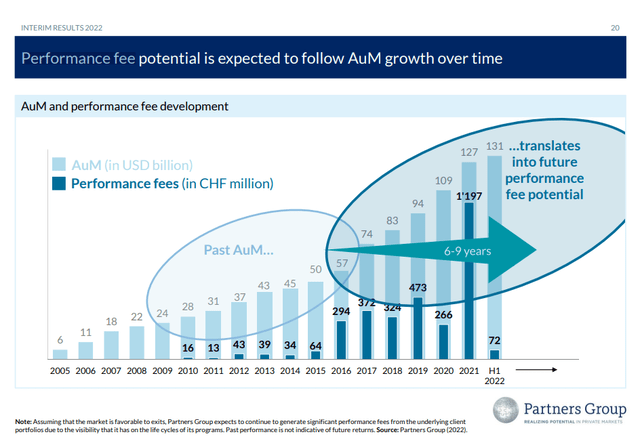

Ultimately they are an allocator. While AUM increases are a solid basis for further revenue growth, carry is where the bread is buttered.

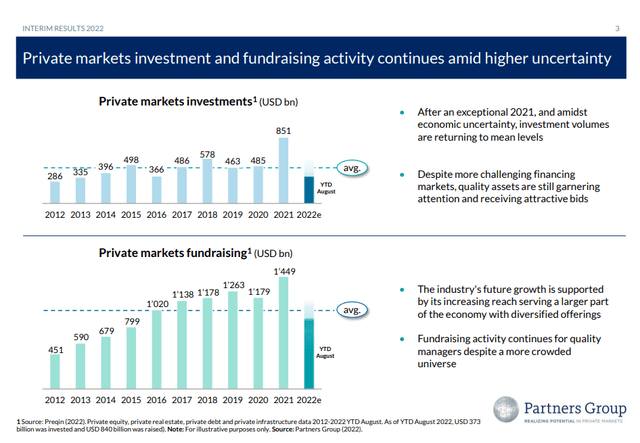

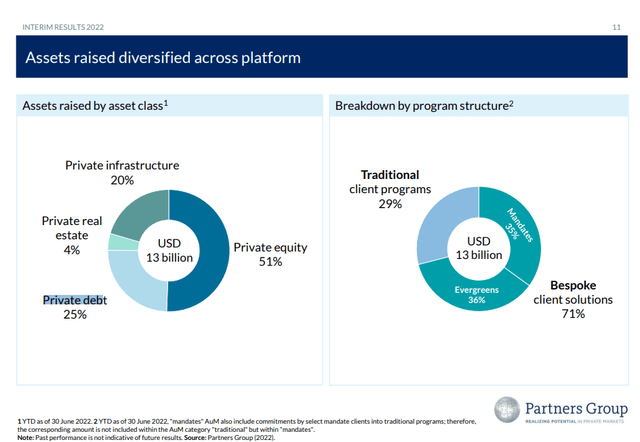

The problem is that last year was a major year for PE outlay, and private debt gained share from the end of the 2021 year.

Last year accounted for twice the typical rate of investment. With the average holding period in a PE portfolio being about 5 years, it cycled quite a bit of dry-powder stores into markets at a pretty inopportune time. The PE investments are focused on a lot of higher tech industrial players. Overall, those investments are likely to see some pressure, especially in Europe, which is reeling from energy inflation especially in the industrial space. Unless the exposures are EV related, there is some concern about those investment cycles, and in general the wallet share of European corporates has already fallen a fair bit, especially relative to the US. While fundamental impacts are a little mixed, what is sure is that contracted multiples limit the carried interest that PG can expect on those PE holdings.

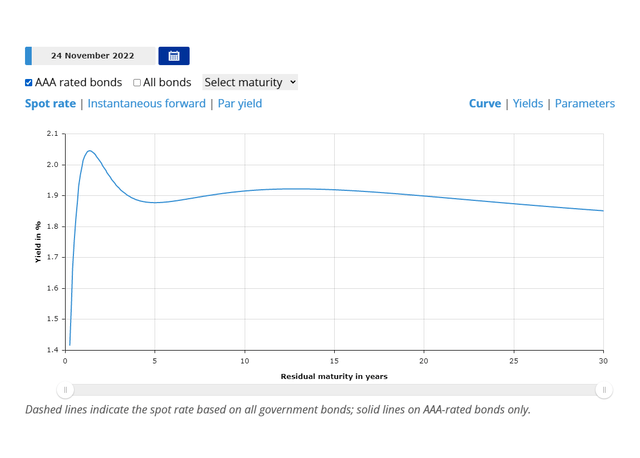

In private debt, things are even more concerning. While a smaller part of the portfolio, private debt went a lot into non-cyclicals and supposed defensives. While defensives remain resilient, comparatively they have underperformed their reputation. Cyclicals have performed better than average in this down cycle due to strength in the oil sector and continued supply chain bottlenecks that have often levitated prices in their commodified markets. Many defensives have seen erosion on the labor and other input cost front, even though pricing power has been flexed. Regardless of the fundamentals, because default isn’t really what we’re concerned about even though there may be cause, the yield curve dooms a lot of private debt investments. Every time there’s been a rate hike, these curves have just shifted upwards. We expect less of that in Europe because their inflation is actually less solvable, but that only means there is even less to be excited about for US-based investors on FX effects.

These very real technical factors have actually shut down completely parts of the credit markets. LevFin has been famously dead for months. Almost zero primary issuances have happened there, and this has been because of major volatility on the private, secondary markets. While PG probably hasn’t invested in leveraged enterprises as much, there is still more leverage in private debt, and more duration effects because of both the longer durations but also the higher YTMs to start with. If there is unworkable volatility in LevFin secondary markets, we think that it would be quite bad as well in private debt broadly. If properly marked-to-market, which is hard to do in private markets, there is likely some meaningful impairment there just on the yield curve effects, which by the way model higher rates for years to come. It’s the same dynamic in the US, except with even higher rates there.

Bottom Line

The multiples are pretty high for Partners Group. There is a PE of 24.6x, and this could only really come from an expectation of a rapid turnaround to upfront some carry soon. We don’t think it’s happening. Since we follow the capital markets space, we hear from managements that basically investments from last year, much like public markets, are at the same levels as this year. That is no performance at all. Debt is probably worse off due not only to market illiquidity but more permanent, structural effects to do with rates. While peaking CPI figures may solve some liquidity issues, they don’t solve cost of capital issues which are coming from structural losses in productive capacity which will take some years to solve. That will erode a lot of value in poorly priced private debt, and it will do as much harm in higher WACCs for equities too. We are not expecting a reversion to the mean for another year for partners group, and even if they have bought at the bottom, the outperformance will be limited, because returns in PE come substantially from the frothiness of the markets in which you can realise multiple expansion. Not an attractive stock.

Be the first to comment