200mm/iStock via Getty Images

Introduction

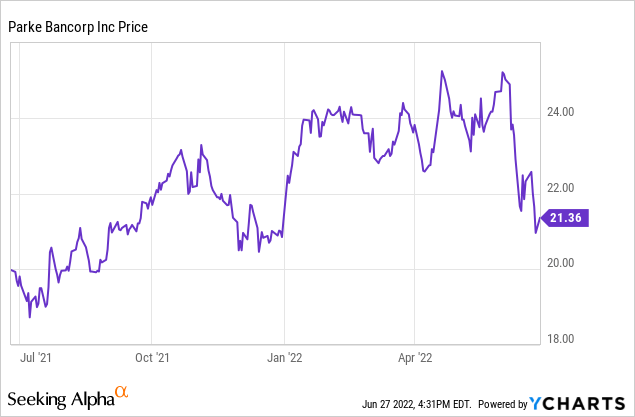

As it has been over a year since I last discussed Parke Bancorp (NASDAQ:PKBK) in this April 2021 article, an update is overdue as the share price is trading just 10% higher. In 2021, I liked the bank for its relatively low earnings multiple and its acceptable premium to its tangible book value. The book value of other smaller banks has been under severe pressure lately due to the decrease in the value of the investment securities due to the increasing interest rates which increases the amount of unrealized losses and reduces the unrealized gains. As Parke Bancorp believes in holding cash rather than owning securities, this small New Jersey based bank is not hit to the same extent, making it slightly more attractive than its peers.

The robust performance in the first quarter looks interesting

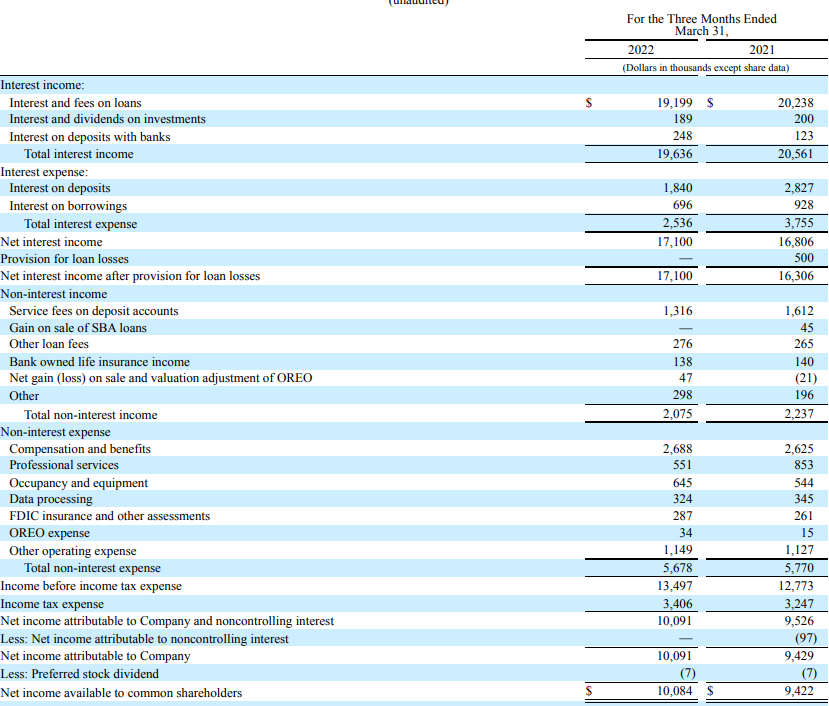

In the first quarter of this year, Parke Bancorp was able to record a very small increase in its net interest income despite reporting a lower interest income. Fortunately, the interest expenses decreased at a slightly faster pace than the interest income and that’s why Parke reported a net interest income of $17.1M, up almost 2% from the $16.8M reported in Q1 2021.

Parke Bancorp Investor Relations

I like Parke as a bank as its business model is pretty simple. The net interest income is the main driver of the financial performance and you can clearly see that when you look at the net non-interest performance. The non-interest income was just $2.1M while the non-interest expenses came in at $5.7M (these mainly consisted of staff expenses) for a pre-tax and pre-loan loss provision income of $13.5M. That’s slightly higher than the $13.2M in Q1 2021 but the bottom line shows a 6% net income increase because Parke didn’t have to record any provisions, unlike the $0.5M it recorded in Q1 of last year.

The Q1 EPS came in at $0.85 and this seems to be a ‘reliable’ net income result as the income statement does not contain non-recurring items.

Parke is currently paying a quarterly dividend of $0.16 for a dividend yield of approximately 3%. This means the dividend yield is only moderate but keep in mind the payout ratio was less than 20% based on the bank’s Q1 results.

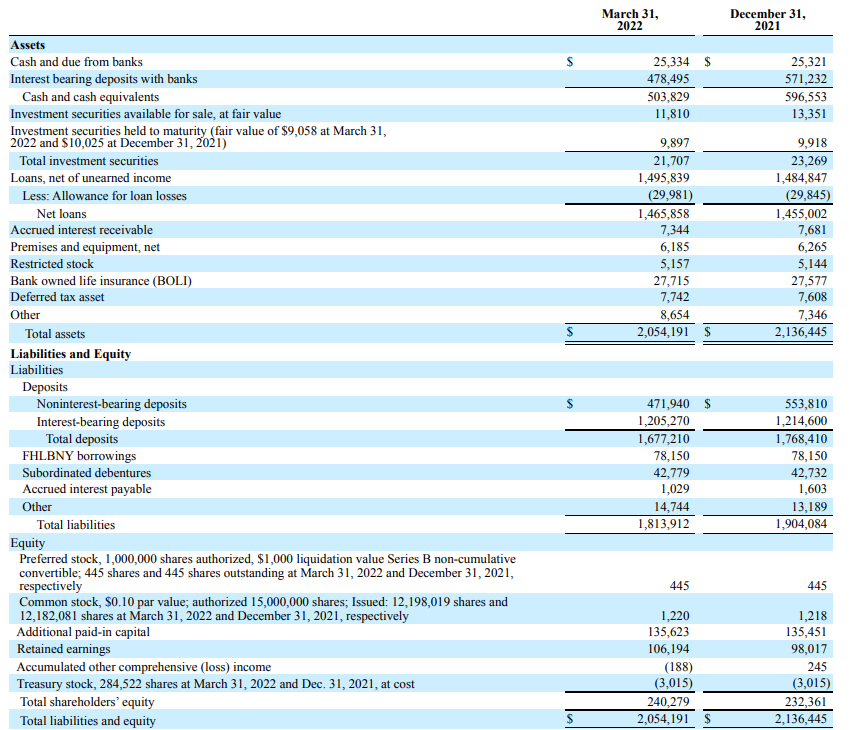

The balance sheet remains cash-rich and securities-poor

Some of its ‘competitors’ (they aren’t true competitors in the sense of fishing in the same pool of customers and loans, but merely banks in the same smallcap segment) like Ames National (ATLO) and Midland States Bancorp (MSBI) felt the pain of higher interest rates as the fair value of their investment securities decreased which directly impacted the book value.

And here is where Parke Bancorp does things different. As you can see below, the bank’s balance sheet barely contains any securities (just under $22M for just over 1% of the balance sheet) which also means it is not hit as hard by the eroding value of these securities.

Parke Bancorp Investor Relations

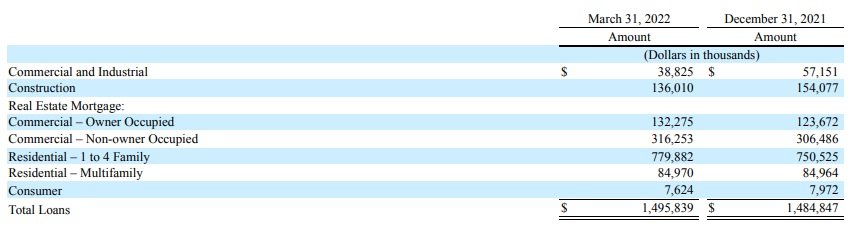

This also means the main driver of the [net] interest income is the loan book which had a total size of approximately $1.5B. as you can see below, the majority of this loan book consisted of residential real estate loans, which accounted for in excess of $850M of the loans.

Parke Bancorp Investor Relations

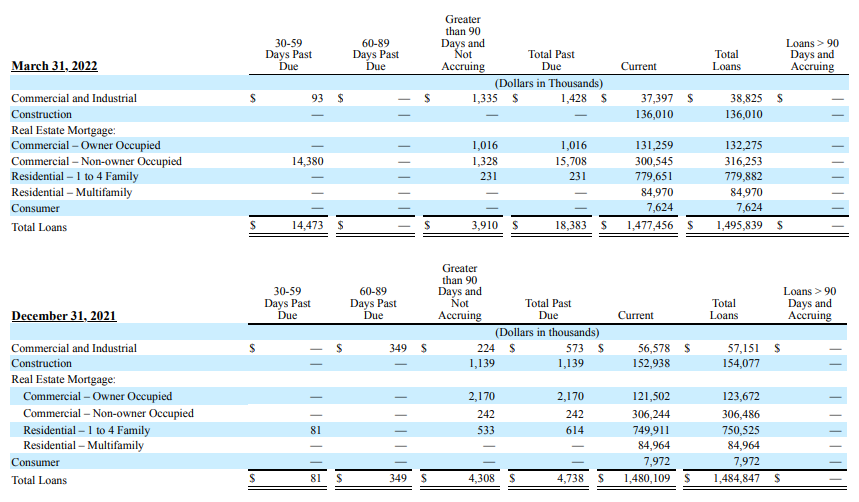

And the total amount of loans past due is pretty low as well. We do see a substantial increase from just $4.7M in loans past due to in excess of $18M but this is entirely related to one commercial real estate loan which has entered the ‘past due’ stage. While this is definitely something to keep an eye on, keep in mind this loan is backed by real estate assets and Parke Bancorp should be able to recover most, if not all, of its exposure.

Parke Bancorp Investor Relations

The total amount of non-performing loans stood at just under $4M as of the end of March, and as Parke Bancorp has a total loan loss allowance of almost $30M, I understand why the bank didn’t feel the need to record an additional loan loss provision during the first quarter despite seeing the CRE loan becoming past due.

Investment thesis

As of the end of March, Parke Bancorp had a tangible equity value of approximately $240M and divided over the just over 11.9M shares outstanding, the tangible book value per share has increased to just over $20. This means that although the share price has increased by approximately 10% compared to when the previous article was published, the premium to the tangible book value has decreased to just around 10%.

Combine this ratio of 1.1X TBV with the earnings multiple of just around 7-8, and Parke Bancorp is getting increasingly attractive. The 3% dividend yield is a good compensation for waiting but investors need to keep in mind Parke Bancorp retains the majority of its earnings on its balance sheet and the book value per share is increasing on a quarterly basis.

I currently have no position in Parke Bancorp but I’m getting increasingly interested in this small bank with a residential real estate focused portfolio.

Be the first to comment