dima_zel/iStock via Getty Images

In the last week or so, I heard a report about the successful process of deploying some of the delicate equipment onboard NASA’s James Webb Space Telescope, the latest piece of expensive equipment launched into orbit to help understand our universe more. This massive project was conceived even before the Hubble telescope was in space in the late 1980s, and construction started in the early 2000s, taking more than 15 years from the of beginning of construction to its launch in December 2021. In the middle of that assembly process, multiple struts were added, specifically ones designed and patented by a relatively small American supplier to the defense and aerospace industries, Park Aerospace (NYSE:PKE). I have covered the investment pros and cons in Park Aerospace multiple times over the past couple of years, but have not updated my views since November 2021.

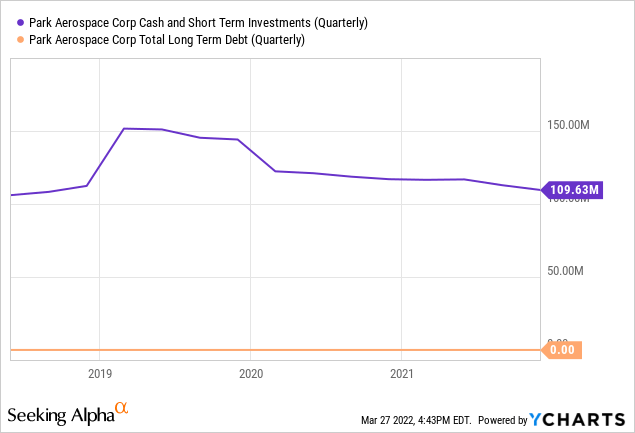

My past bullishness has gradually shifted to a more neutral position. The core of the original thesis revolved around Park’s sizable $100 million cash position with no debt, conservative management that saw it through the worst of the pandemic, a fair dividend yielding around 3%, and organic growth in conjunction with more production capacity coming online. However, so far there has been no benefit to Park’s shareholders from the cash position and no change in capital allocation, and efforts at acquisitions or joint ventures have not materialized as of yet. At this point, the fundamental question remains how those and other factors look moving ahead into 2022 and beyond.

Most Recent Quarterly Financial Performance

Park operates on a fiscal year of March – February, so the most recent available quarterly results are from the period September – November of 2021, considered Q3 of 2022 (the full year results are not typically released until the second week of May, so there are still 6 or 7 more weeks to go until those will be in hand).

For the third quarter, Park saw revenue of $13.9 million, inline or just over its guidance, and well above the previous year’s Covid-19 impacted figure of $10.4 million. While that was a strong result, EBITDA margins and gross margins dropped compared to the prior quarter. This pressure was due to booking one particular low margin sale of $2.4 million in the quarter that had been expected for the fourth quarter, but was pulled ahead by the OEM customer. That particular low-margin sale is for a sort of component material that Park actually holds onto for its OEM customer and then incorporates into another sales process for much better margins. In the end, Park saw an EPS of $0.09, and adjusted EBITDA of $2.67 million for the period.

On the cash and debt side of things, as already mentioned Park holds zero debt, and the cash and cash equivalents position has held fairly stable in the $100 million-plus range for several quarters now, coming out of Q3 with $109.6 million.

The capex required to complete the facility expansion is about $1.5 million out of a total investment requiring between $19 and $20 million (explaining a good deal of where the cash has been going since the peak at $150 million in 2019), and the company does have a somewhat sizable total tax liability of $16.3 million, divided as $12.6 million non-current, current tax of $2.5 million, and deferred taxes of $1.2 million. The overall amount due has been working its way down, and will paid off over the next few years, being completely paid by calendar year 2025. The only other significant use of cash is the dividend, which has been steady at $0.10 per share, and costs just over $2 million per quarter. Apart from the routine capex, the tax liability, and dividend payments, there is really no dedicated use of cash to put much of a dent in that $109 million balance.

Outlook for Fiscal Year 2023 and Beyond

Like other industries across the United States, Park Aerospace has its operational challenges at the moment, including higher costs from raw material supply chains, freight availability, and labor market tightening, just to name a few. While these challenges are tough, they are a sort of leveler in the sense that any of Park’s competitors or peers are dealing with the same or similar challenges – these macro headwinds come and go, and at the moment they are pretty significant.

In spite of the difficult terrain, Park has been positioned well within the aerospace supply line, specifically due to its participation in the General Electric (GE) LEAP engine program that builds and maintains engines for OEMs like Europe’s Airbus (OTCPK:EADSF) and the US manufacturer Boeing (BA). In Park’s case, its business is keyed into the Airbus engines for its single aisle craft the A320neo and not Boeing, with some other exposure to Bombardier (OTCQX:BDRBF) and the Chinese effort COMAC. Airbus is the healthiest counter party of them all (although too hard to really know about COMAC), and recently recommitted to the goal of increasing production for its A320 line from the current 45 per month to more than 60 per month in 2023 in spite of the supply chain challenges, and up to as high a figure as 75 per month by 2025. While such a result may or may or may not happen in reality, the underlying direction of the guidance suggests that Park will be doing a good deal more for the GE engine program over the coming one to three years. It expects to end the 2022 fiscal year with over $26 million in GE-related sales in total across all the engine programs, but at the very highest end could see $30 million sales run rate on the A-1 LEAP engines alone by 2025. That is not new guidance, but has been out there for a couple of quarters at least, so the rational assumption is that is already factored into the market’s valuation of Park.

While doing more business on the A-1 LEAP engines is all well and good, the company’s valuation has been range bound, I believe on account of waiting for additional clarity on just how the company would deploy its cash. There have been some false starts in the acquisition possibilities, with nothing coming to fruition. However, Brian Shore, the company’s CEO, began to address a little more about growth initiatives on the January earnings call. First, in relation to the factory expansion:

There is additional space in a new plant, which is set aside for new project initiatives, including two potential project initiatives we’re currently working actively on. Both of these projects involve a purchase installation of major new equipment lines, which would bring new capabilities and market offerings to Park. One relates to a joint development project with an important customer, another project, something we would do on our own…if we went forward with these projects, it’s probably about $6 million to $9 million purchase of equipment and installation costs.

Secondly, there is an informal collaboration starting to take place with another un-named aerospace manufacturer in which the two companies are participating together on defense contract submissions. On the same call as quoted above, Mr. Shore indicated that the collaboration has already generated one new contract for each company, and that a second submission was in process at that time. It is impossible to predict how any of these will shake out long-term or modeling what it could mean in terms of revenues, profits, or cash flows, but the information is more concrete than anything else suggested recently.

Valuation Sweet Spot

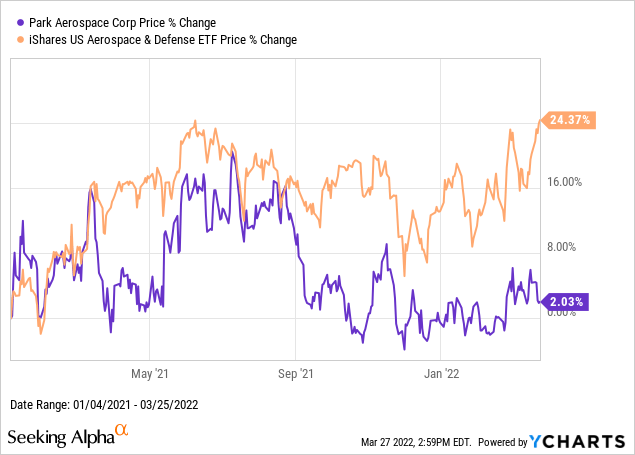

None of the company’s plans may matter all that much if the expectations in the market was already stretching the valuation. But for a company not impacted negatively by increases in interest rates (in fact, the increase in rates should marginally benefit the rate of return on their cash pile eventually), the shares have traded pretty sideways for several months, clearly under-performing the broader industry since January 2021.

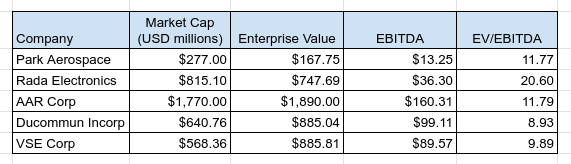

This suggests that either Park Aerospace was relatively over-valued 15 months ago, or the market does not believe the growth prospects are significant. With so much cash on the balance sheet and no debt, I like using the enterprise value to EBITDA approach with Park Aerospace for considering valuation – stripping out the cash on hand and considering how much EBITDA it expects to create helps to peel back a layer behind the cash value and see if I like what I see.

Park Aerospace EV/EBITDA Comps (Author’s spreadsheet; data from Seeking Alpha)

The comparisons are less than perfect, as finding similarly sized publicly traded industry peers who focus on the same sorts of business lines is almost impossible. These comps were selected more for their market caps under $2 billion and being suppliers into the aerospace and defense industries rather than their product line-ups competing head-to-head with Park. Nevertheless, enough data points emerge I think to fairly show that Park is valued in-line on this basis; the real question is just how much more EBITDA the company can generate with its initiatives that would really drive that multiple (realizing that the cash deducted from market cap to calculate the EV could be $10 million lower as it invests in new equipment for its plant in pursuit of both new initiatives for the available space). Some quick math on the assumption of an EV of $177 million would show that it would need EBITDA at $15 million to keep the same multiple, or about a 13% increase, and anything more than that starts bringing the multiple down and making the valuation more attractive. Given that I expect a modest uptick in EBITDA on the basis of the Airbus engines alone, this valuation seems even better than it looks on the surface, even if not a raging signal of market mispricing.

Concluding Thoughts

Investors should certainly cheer the steps towards expanding Park’s capabilities and maximizing the return on its expansion of its production site. Furthermore, I think it is indicative of management’s overall conservatism to be looking at opportunities that would only require in the range of $10 million in new investment and continue to keep plenty of cash on hand for future expansion opportunities, or eventually returning a portion to shareholders via buybacks or special dividends. This conservatism has been a frustration point to a degree. For example, Far View Capital Management’s managing partner Brad Hathaway was the only person asking questions on the Q3 call in January, and his overall questions were laser-focused on how the cash was going to benefit shareholders, and further how the company could find an acquisition now for a valuation it could live with when it couldn’t find one during the heights of the pandemic. Brian Shore did not have any easy answers for him, in part acknowledging:

And this is probably a little bit of maybe good frustrating discussion for you and some other shareholders because all we can do is say we’re working on things, a number of things, but we really can’t identify or quantify what those things are, including acquisitions. And I know we’ve been talking about it for a long time, so I wouldn’t blame some shareholders being a little skeptical of that…To us, this is our opportunity money for the future. And whether we do something or other – we’ve done a lot of dividends in the past. We continue to pay a regular dividend. That’s something that, obviously, we always consider.

I have to imagine the company’s leadership is as frustrated in some regards as its other shareholders, but sometimes the best decision in the moment is deciding to do nothing immediately, rather deciding to wait for something better. Assuming for now that some of these initiatives do take off, the organic growth will come and supplement the nice boost from the GE 1-A LEAP engines for Airbus, then prospects are pointing in the right direction. Given the valuation, fair 3% dividend, organic growth prospects and flexibility the cash offers, the long-term view for capital gains remains promising. However, I am keeping a “hold” to very marginal “buy” rating at the moment for the near-term due to the supply-chain uncertainties, while waiting to hear more about what will be filling out the new production facility space – to date, these “initiatives” are not yet concrete business decisions. If the shares drift under $12.25, I would considering adding more or initiating a starter position, otherwise I am content to play wait-and-see.

Be the first to comment