MixMedia

There is one stubborn, durable truth prevailing in the entire entertainment ecosystem today. Its only two words. But those two words are a far better, and reliable cypher to decode that most of what you’ll read in the financial media about buy, sell or hold Paramount Global (NASDAQ:PARA).

The two secret words that tell all:

Skip ads.

In those two words, investors can probably substitute hours of eye strain clicking away on dozens of sites where media analysis gurus are stuffing endless metrics about the prospects for the besieged streaming sector’s participants.

The short of it is our premise that Skip ads is a telling signal that the streamers want life both ways. They thirst for reliable flows of ad money to support versions of their site while at the same time, they convey the subliminal message: Hey, we know you think commercials are an obnoxious pain in the butt. So here’s a button you can click and save yourself from yet another idiotic commercial of a politically correct, diverse group of millennial actors crowded on a couch holding beers, high fiving between roaring laughter at a touchdown.

In reviewing the vast proliferation of sometimes savvy and sometimes pitifully naïve takes on the investment prospects of the wild west of the current entertainment ecosystem, we find a wide spectrum of opinion. No surprise there. Some observers believe the bare knuckled battle for subscriber growth among the players in the space is coming to an end. What more proof of that than the news that friend Warren Buffett has taken a position in the stock to the tune of 78.4m shares valued at $2.5b? Not much, right behind him sits BlackRock and Vanguard. So why has the stock taken a major league beating regardless of this act of faith from the Pope of Omaha?

Warren or not, Mr. Market seems unimpressed, believing, with some hard thinking, that the battle has gotten so bloody with accumulating losses showing no end in sight. And that the only inoculation to tame the bacteria of an overcrowded, often confused state of play is consolidation.

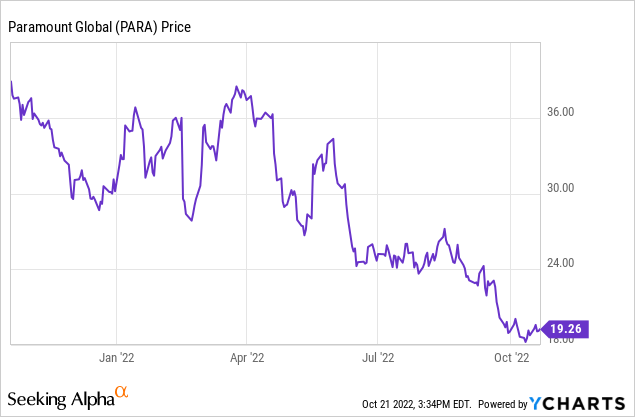

Above: Not very pretty but indicative of what overcrowding of a sector vertical can produce. Sales growth and losses. Ask the operators of sports betting who have the same problem.

The streamers are facing two rock-hard realities: the entertainment ecosystem’s overall growth is slowing though there could be intermediate spurts. Secondly, Old Man Recession just around the corner will have a predictable impact on slowing ad spend. So, seeing ad-supported streaming as a savior may be more wishful thinking than a lifesaver.

Among other moves, PARA has already dropped a combined ad-supported bundled price deal. It’s far from a panacea. To think that, in a sliding ad spend macro world, rescue lies in reducing monthly fees by offering ad supported content, and that this will be the crisis solver, is problematical. It won’t, but some happier prospects for ad supported streaming do come with Para’s PLUTO TV channel, aimed at the gut of the budget subscriber who will endure ads to snare a cheaper monthly bill. It’s a crap shoot – not a wild proposition bet – but a good odds bet: you bet the line and take the odds. Long-term hold on craps is promising if you don’t waste money on bad prop bets.

We are of the school that believes that a merger or buy out of Para looms as a possibility. Yet we look at the genetic history of Ms. Shari Redstone and see a different story. The inclination we believe is to fight on, alone to the end, when EBITDA finally glows gold every quarter.

The numbers may say yes, but the genes aren’t easy to convince

(You will pardon the author’s slight edge into hypocrisy for this brief, Don’t-Skip intro because we believe it brings real context to our ultimate guidance on the stock).

To get a perspective on the Paramount Global state of play, in our view, we must go way back in the day to March 29, 1979. On that day, a massive fire broke out at the legendary Copley Plaza Hotel in Boston. Caught between floors, theater magnate Sumner Redstone, then a mere boy of 56 (he lived until 97), ran up the stairs to the roof. As flames licked ever closer on the roof, Sumner climbed over the edge and hung there by his thumbs, during an incredible amount of time awaiting rescue. (Estimates of how long he held on are far too many to be totally credible. Though all agreed it was an astonishing endurance.)

But that was only part of the story. The rest was Redstone’s battle through over 30 hours of surgery to literally save his skin and life. Against all naysayers, not only did he survive, but went on to bull his way to the top of the entertainment business by building Viacom from his theater chain. We cite this little tale – you’ve already guessed it – because over many years, investors have learned how those Sumner genes have clearly passed onto his daughter, Ms. Shari Redstone.

Google

Above: Father and daughter, boxing gloves off, between rounds of their longstanding fight to the finish.

From the days when father and daughter went brutally mano y mano on so many issues, ’til today when Ms. Redstone rules the Paramount roost, we have concluded that she’s got her thumbs on the rooftop and isn’t going anywhere awaiting a rescue. She’s prepared to do a flip and jump to safety on her own. It could happen, but nothing hints at it now.

Shari’s defined sense of ownership, we believe, is part of why the company overall, with so many great assets, will need to remain dead-pooled in its current trading doldrums before she can finally fall into a fireman’s net and say, take me, I’m yours.

That fireman could be Buffett, who has been a known value bloodhound for decades. On the other hand, it is fair to present a bull case on PARA that may well find a deep-pocketed suitor who sees its current trade at $19. Even a modest premium could provoke dancing in Omaha.

This genetic history will never find its way into any current appraisals of the stock, or management or deep-dive analysis of its future potential. But several of our ex-colleagues in the industry from way back in the day who know her and knew daddy well agree: Its Shari’s bat, her ball and glove, and if she walks, the company will. If she doesn’t, she’ll still call the balls and strikes and umpire the game.

Paramount: A realistic bull case

Stipulation: In reviewing the vast coverage of PARA published over the past several months and comparing some of the conclusions with industry pros I have known for decades, all believe a degree of recency bias has infused much guidance.

Citing PARA’s blockbuster successes in Yellowstone (check out the marvelous prequel “1883“), and factor in the Top Gun sequel, and find that many analysts lean their valuations on the skill sets that enabled PARA to mount such great shows as a stalking horse for more to come. It’s a false premise, both for PARA and any of its competitors. Great movies are as much accidental as purposeful targets of the most innovative of producers. A long-time colleague who was a close-in viewer of the tortured process from the Mario Puzo bestseller The Godfather, to the final blockbuster opening, told us:

“These Paramount guys pulled the guts out of Coppola for years, fighting him every step of the way. They were convinced they’d made a colossal flop ’til almost the premiere. Nobody but Coppola himself had the guts and staying power to absorb the abuse and prove his point.”

Our point here is that baking in potential earnings power into Para stock based on some dreamlike supposition that it has another Godfather or Yellowstone it can just pluck out of its development department is delusional. Thunderbolts can indeed happen. But what you want to see in Para is a slate of solid, economic quality content pouring out of its many verticals with a shorter lifespan from script to payoff.

In truth, the famous words of the brilliant screen writer William Goldman (d.2018) apply here to Hollywood and all filmed entertainment pretenses. He said, “Nobody knows anything.” His premise: at best, picking projects for potential blockbusters is a total crap shoot. So, to bake in the prospects of PARA or its competitors to repeat past victories is no way to value the forward earnings of their stocks.

More telling, we believe, is how well a media giant like PARA can be producing solid genre films that appeal to general as well as niche audiences at a cost that virtually assures an ultimate profitability to the producers. That’s the apparent route Warner Bros. Discovery (WBD) boss David Zaslav has laid down for his company. And, to us, not a bad model for Paramount to consider.

Paramount has proven it can do this. Its film library does, of course, have its family jewels: Star Trek, The Godfather, Top Gun, as noted overall totaling 3,000. These include lots of golden oldies like the famous Bob Hope/Bing Crosby buddy “Road” pictures as well as the “Butch Cassidy” films which appeal to a much older demo. This can’t be a business living in this competitive miasma focused on one, single golden millennial demo. Far too many subscribers are shaking their heads bemoaning the mantra, “Thousands of shows, nothing to watch.”

The PARA library has an estimated value of $1.35b according to STATISTICA. The current total market cap sits at $12.522B. The horses in the PARA stable, like many of its peers, contain thoroughbreds as well as candidates for the glue factory. Paramount Pictures, CBS (broadcast with NFL deals as well), Sponge Bob, Nickelodeon, and of course Paramount + with its impressive, but relatively ho hum, 46m subscribers.

Good idea number one: Para has announced their intention at some point to merge Paramount + and its legacy Showtime channel. It’s a good idea because they can’t continue to play second fiddle to HBO going forward. Yet it has done some outstanding shows like Billions, Ray Donovan. It hews to the current formulaic content which suffuses many of its shows with sex, mystery, brutality, hostility among citizens city and country, and the appropriate bow to woke-isms. The bottom line here: Para does excellent content, but to be brutally frank, so does everyone else.

Except PARA’s 46m subscriber base sets up a far tougher climb to profits than does Netflix (NFLX) (74m subs), Disney+ (137m subs), WBD (100m), and Amazon (AMZN) (Over 200m prime members globally). So the question is raised: Where does PARA fit?

TTM:

Revenue: $29.7B Quarterly revenue growth 18.50%.

EBITDA: $3.39b

Short ratio: 5.53

EV/EBITDA: 4.83b

Projected EBITDA: $3.5b

Best estimate for bulls: Valued at 7X EBITDA

Market cap at writing: $12.522b

Operating margin: 10.10-kind of meh.

Quarterly revenue growth: 18.50% strong, mainly tied to Paramount+ and Pluto TV.

Balance sheet highlights

Total cash (mrq) $4.04B. A solid number indicative of good cost discipline in many areas (not all).

Total debt: $17.3B—this is a heavyweight number and investors need to really consider that as one of the downsides of the stock’s ability to move north. Efforts at debt reduction have been made, refis have put maturities comfortably into the future 5/6 years. The company’s current ratio is a very comfortable (mrq) 1.47

Book value per share: $35. A stock trading so far below book would normally signal heightened interest among value investors. But analyst earnings estimates for 2022 are 2.3b and for 2023: $1.62b.

Revenue estimated consensus:

2022: $30.5b

2023:$ 30.79b

EPS trend: 2022: 2.3

2023: 1.62

Each of Para’s verticals face challenges: CBS worries about sagging ad spend ahead despite what management had to say about happiness about their upfront advertising results.

Paramount+ sits in a difficult place, just as we pointed out in our recent piece of Lions Gate: The dilemma: Too small to build a footprint anywhere near the giants and too small to just sit fat dumb and happy with what they have with a big debt load to manage through. Inflation has run up the costs of production, with the time span from script to payoff running far too long for healthy cash flow.

But at its current size, and looking forward to a revenue flow that appears to run flat, its price at writing of $19.11 seems to us to show a pathway to a diverse entertainment portfolio modest buy. Call it underweight or a toe-dip on prospects, but we do think the stock, given all the weakening of the entertainment ecosystem we are now seeing, presents an attractive entry point. Its asset base is undeniably diverse. We do see an echo in management statements about monetizing the library better than what has been done in the past.

That strategy comes straight from the successful playbook of Messers Eisner and Katzenberg, the two ABC executives brought into The Walt Disney Company (DIS) by Walt’s brother Roy in 1984. Their first move was to find ways to market and repurpose existing legacy Disney characters and stories. Without initially spending a ton on new content development, the pair trotted out Mickey Mouse, Donald Duck, and company in dozens of new “clothes” and set the company on its long march to becoming an earnings machine. PARA’s extensive film and TV library can embark on just such a path to ignite new sources of revenue from established pop culture sources they control. They could also build Paramount+ in the space of cost conscious new content that adds value to the channel making it far more competitive with the giants.

Overall we do see it as a price play. Downside risk is somewhere around $10.50, when and if their announcements on new subs may possibly disappoint Mr. Market. Upside, given a management awakening about imposing good controls on producing viable content could have a $27.50 price by Q2 2023.

But overall, our best bet for PARA stock is the obvious arrival of a real solid bidder to either merge or buy the company at a nice but not punitive premium that would make everyone happy. Yet, there appears to be no strong sentiment at the moment based on what we surmise (yes, it’s an educated guess, not more) would not be a welcome sale of the company.

But if the company continues to slog along on earnings call happy talk about great new content and rising subscriber numbers, we don’t see much of a rationale for the stock.

That’s why, if you got in anywhere between the current price and the low twenties, it’s a hold. If you are not in the stock, it’s definitely got enough value for a toe dip buy.

Be the first to comment