imaginima

Kinder Morgan, Inc. (NYSE:KMI) is one of the largest and most well-known midstream companies in the United States. Kinder Morgan has been a favorite company of income investors for many years now due to its historically high dividend yields. Indeed, the company currently boasts a 6.06% yield, which is quite attractive in today’s market. Admittedly, Kinder Morgan has not appreciated nearly as much as many other companies in the energy sector, but it has still given investors a reasonable return over the past year. Kinder Morgan also boasts some significant growth opportunities, which gives it a marked advantage compared to some of its peers. Therefore, let us have a look and see if this midstream favorite could be right for your portfolio.

About Kinder Morgan

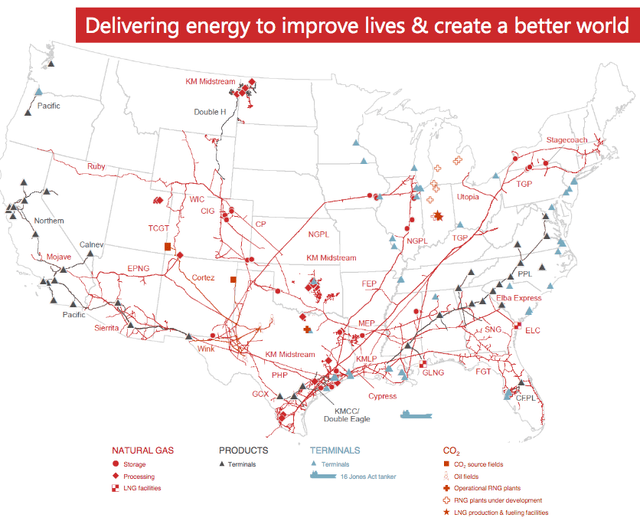

As stated in the introduction, Kinder Morgan is one of the largest midstream companies in the United States. The company has operations stretching across the entire United States:

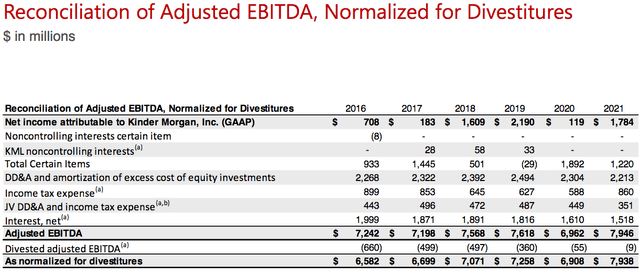

The company boasts 71,000 miles of natural gas pipelines, 10,000 miles of crude oil and refined products pipelines, and 1,500 miles of carbon dioxide pipelines. This actually makes the company the largest transporter of natural gas, refined products, and carbon dioxide in the country. The company also owns 141 terminals, which makes it the largest terminal operator in the nation. This incredible breadth gives Kinder Morgan exposure to every major basin in which hydrocarbons are produced. This is nice because each of these basins has vastly different fundamentals. For example, regions such as the Marcellus Shale are targeted for the production of natural gas whereas the Bakken Shale is primarily targeted for the production of crude oil. In addition, production costs vary between basins so their output is affected differently by changes in resource prices. However, Kinder Morgan itself is not particularly affected by changes in energy prices. This is because of the business model that the company uses. In short, Kinder Morgan enters into long-term contracts under which the company transports resources for its customers and is compensated based on resource volumes, not their values. This allows Kinder Morgan to not be affected very much when energy prices decline, such as in 2020. We can see this by looking at the company’s adjusted EBITDA over time:

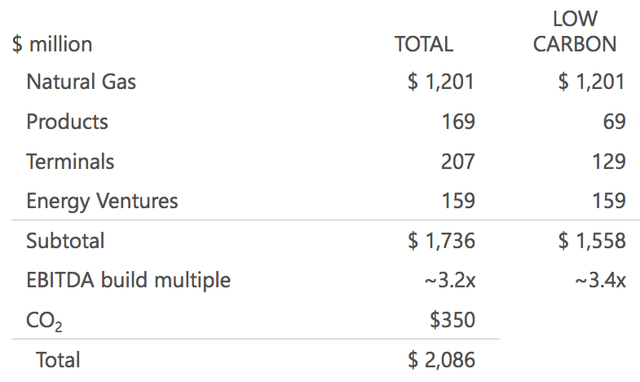

We can clearly see too that the company’s cash flows have generally grown over time. This is quite nice for any investor because we do not like to see stagnation in a company in which we are invested. In fact, Kinder Morgan has managed to grow its adjusted EBITDA by 9% and its free cash flow by 82% over the 2016 to 2022 period. The company appears likely to be able to continue this growth going forward. As Kinder Morgan’s infrastructure only has a finite capacity of resources that it handles and the company’s cash flows depend on the volume of resources that the company transports, the only logical way to do this is to add new infrastructure. Kinder Morgan is doing exactly this, as the company currently has $2.1 billion worth of growth projects at various stages of development:

Unlike many of its peers, Kinder Morgan does not provide the completion date for any of these projects. However, about 30% will be completed during the second half of 2022, about 50% will be completed in 2023, and 20% will be completed in 2024. Please note that all of these percentages are based on the proportion of the total $2.1 billion that each of these projects represents. The nicest thing about these projects is that each of them has already secured a contract for its use from Kinder Morgan’s customers. This is nice because it ensures that Kinder Morgan is not spending a great deal of money to construct infrastructure that nobody wants to use. In addition to this, Kinder Morgan knows in advance how profitable each project will be in advance so it knows that each will generate a sufficient return to justify the investment. As we can see in the chart above, Kinder Morgan’s projects should generally pay for themselves in just over three years (the EBITDA multiple). This is one of the most attractive payback periods among any midstream company, which is quite nice and should be very appealing to any investor.

One of the big things that we notice above is that Kinder Morgan is investing very heavily in low-carbon projects. Indeed, we can see that the company is spending almost as much on these projects as it is on its traditional operations. Although there are one or two other midstream companies investing into renewable energy, such as Enbridge (ENB), Kinder Morgan is fairly unique in the very large proportional amount being dedicated to this. Admittedly, Kinder Morgan may be doing this to appeal to those people that are only investing in those companies with very strong environmental, social, and governance credentials, which is reinforced by the fact that the company is devoting a great deal of effort to discussing its credentials in this area during recent investor presentations. This may not be a bad thing as environmental, social, and governance funds control an enormous amount of money, as I pointed out in a previous article. When we consider these assets under management, it should be obvious what sort of impact these funds could have on Kinder Morgan’s stock price should they become interested in the company, investors could likely be okay with the company’s heavy investment in this area, even if they are only interested in Kinder Morgan’s midstream business. This is particularly true because Kinder Morgan’s renewable projects are all renewable natural gas, which can easily use existing natural gas infrastructure. As such, these projects supplement the company’s current business much more than if it was investing in wind or solar energy (like Enbridge).

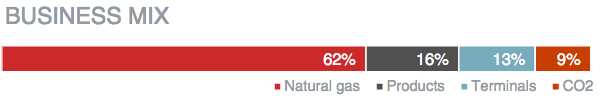

Despite the company’s substantial investments in low-carbon projects, all of its money is currently still coming from traditional sources. This is mostly because none of the renewable energy projects have come online. Here is the company’s business mix in terms of cash flow generated:

Kinder Morgan

As we can see, the overwhelming majority of Kinder Morgan’s cash flows come from its traditional natural gas business. This is not likely to be surprising given the scale of the company’s natural gas operations as opposed to the rest of its operations. After all, we have already seen that its natural gas infrastructure is far more expansive than any of the other business segments. This is also a very good place for Kinder Morgan to be due to the incredibly strong fundamentals for natural gas when compared to those of any other fossil fuel. This should lead to growing volumes over time due to the fact that its cash flows are directly linked to the company’s volumes, as we have already discussed.

Fundamentals Of Natural Gas And Crude Oil

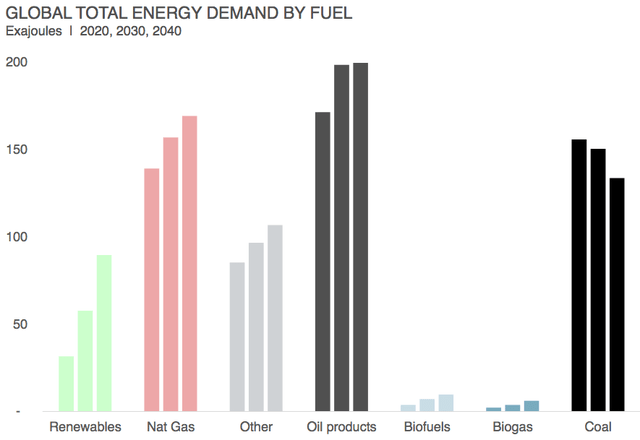

As we have just seen, Kinder Morgan derives the majority of its cash flows from the volumes of natural gas that it transports, although the crude oil and refined products transportation businesses play a not insignificant part of the company’s cash flows. Fortunately, the demand for all of these products seems likely to grow over the coming years. This may be surprising considering that most of the people reading this have probably been exposed to the constant efforts of our governments to reduce the consumption of these fuels. However, according to the International Energy Agency, the demand for all forms of energy except for coal will increase over the next two decades:

Kinder Morgan/Data from IEA 2021 World Energy Outlook

We can see that the demand for both renewables and natural gas is expected to grow significantly over the next two decades. These two products are in fact intrinsically linked. The cause of this is global concerns about climate change. These concerns have led governments all over the world to impose a variety of incentives and mandates that are intended to reduce the carbon emissions of their respective nations. The most common method that is being used is to encourage utilities to retire their old coal-fired power plants and replace them with renewables. This explains both the coal consumption decline and the increase in renewable consumption. However, renewables have one major problem, which is their lack of reliability. After all, wind power does not work when the air is still and solar does not work when the sun is not shining. The common solution to this is to use natural gas turbines to ensure that the electric grid will remain operational when renewables are unable to do so. Thus, we can clearly see that this will cause a sharp increase in natural gas consumption.

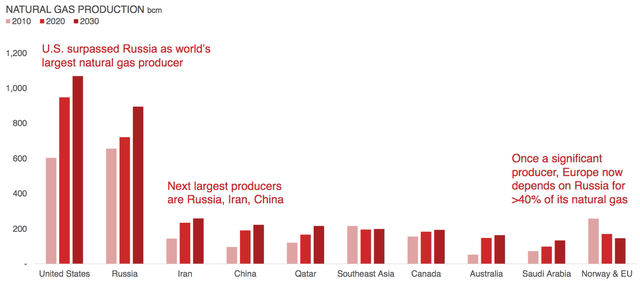

The United States is one of the only nations in the world that has the ability to increase its production of natural gas to meet this demand. This is exactly what the International Energy Agency expects to happen:

Kinder Morgan/Data from IEA 2021 World Energy Outlook

Kinder Morgan should benefit from this due to owning the largest natural gas transmission network in the United States. It should be fairly easy to see why this would be the case. After all, someone will need to move the incremental production from the basins where it is extracted from the ground to the market where it can be sold. This is the exact business that Kinder Morgan is in so this will very easily result in the company seeing much higher volumes moving through its network. As the company makes its money based on resource volumes, Kinder Morgan should see growing cash flows going forward.

Dividend Analysis

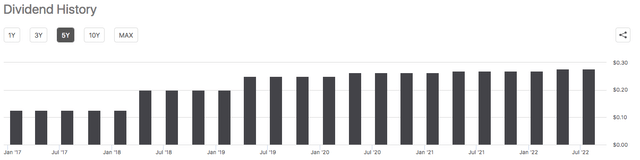

As stated in the introduction, one of the biggest reasons why investors have traditionally bought shares of Kinder Morgan is because of the high dividend yield that the company has historically boasted. This thesis certainly remains valid as the company’s 6.06% yield is substantially above the 1.48% yield of the S&P 500 index (SPY). Kinder Morgan also has one of the best track records of any midstream company with respect to its dividend as it not only did not cut in response to the unprecedented events of 2020 but has also increased its payout on an annual basis for many years:

The fact that the company’s dividend is consistently being increased is quite attractive during inflationary times, as we are experiencing today. This is because inflation is continually reducing the number of goods and services that we can purchase with the dividend that the company pays us. This can make it feel as though we are getting poorer and poorer with time. The dividend increases help to offset this effect and at least help the purchasing power of the company’s dividend remain the same over time, although admittedly right now inflation is substantially higher than recent dividend increases have been.

As is always the case though, it is critical that we determine whether or not the company can actually afford the dividend that it pays out. After all, we do not want it to suddenly reverse course and cut the dividend since that would reduce our income and likely cause the stock price to decline. The usual way that we analyze a company’s ability to pay its dividend is by looking at its distributable cash flow. Distributable cash flow is a non-GAAP metric that theoretically tells us the amount of cash that was generated by the company’s ordinary operations and is available to be distributed to the common stockholders. In the second quarter of 2022, Kinder Morgan reported a distributable cash flow of $1.176 billion, which represents a significant increase over the $1.025 billion that the company reported in the prior-year quarter. This works out to $0.52 per share but the company only pays out $0.2775 per share. Thus, Kinder Morgan has a dividend coverage ratio of 1.87x, which is reasonably attractive. Analysts generally consider anything over 1.20x to be sustainable but I am somewhat more conservative and like to see this over 1.30x in order to add a margin of safety to the investment. As we can clearly see, Kinder Morgan easily surpasses this on both counts so it appears that investors should not have to worry about a dividend cut here.

Conclusion

In conclusion, Kinder Morgan continues to earn its place as a favorite of dividend investors. The company has a long history of rewarding its investors with a high yield and has been focusing on raising its dividend, which helps a lot in our inflationary world. The company’s recent forays into renewable natural gas are interesting and supplement its business well. They could also be quite profitable as the global demand for natural gas continues to grow. Overall, there is certainly a lot to recommend Kinder Morgan to anyone looking for growth and income.

Be the first to comment