Oselote

Pan American Silver Corp. (NASDAQ:PAAS) is a silver mining stock that we have traded many times over the years. Gold and silver prices have suffered a bit this year with a very strong dollar amid rising interest rates and a relentless battle against inflation. Last week, we called for a strong buy in precious metal miners and enjoyed rapid-return gains. The question is, can it continue for these types of stocks?

Recall, precious metals, while having industrial uses, are also a popular hedge against inflation. Pan American Silver is a name we like in the space. It has worked to control costs, and improve efficiency at its many mining sites. It is also working with Agnico Eagle Mines (AEM) on a combined acquisition of Yamana Gold (AUY). Based on the bids made, it is our opinion that it is a good deal for both Pan American and Agnico Eagle, and an “okay” deal for Yamana shareholders. The market has been punishing Pan American in recent sessions since this new bid for Yamana was made, and with the deal possible, in addition to general operations of the company, we think the stock is a buy at these depressed levels.

Gold and silver prices ebb and flow, and we believe when the strong dollar relaxes, as is likely next year if and when the market has finally bottomed and rates are done being hiked, both precious metals will do much better. In the present column, we review the critical metrics you should be aware of from Pan American Silver’s just-reported Q3.

Strong production figures

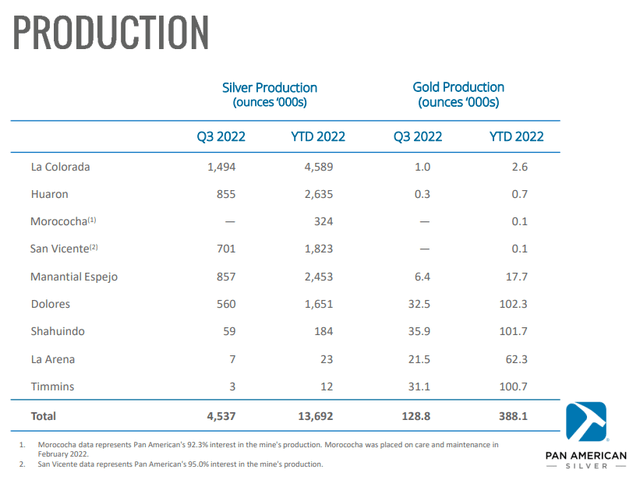

We liked what we saw on the production front, though the headline numbers might confuse some. This was reflected in all lines of performance. Pan American produced 4.5 million ounces of silver.

This is down 6% year-over-year from the 4.831 million ounces in Q3 2021. So what happened? Here is a look at mine-specific production:

Min

So we see some mines accelerated production and others reduced production. Morococha has been placed on maintenance much of the year, accounting for much of the year-over-year drop.

Consolidated gold production was 128,800 ounces in Q3, which is down sharply year-over-year from the 142,600 ounces a year ago. They have slowed production, too, as costs are not favorable. In reality, the Q3 results reflect the industry-wide challenge of softening precious metal prices combined with inflationary cost pressures.

Cost trends in Q3

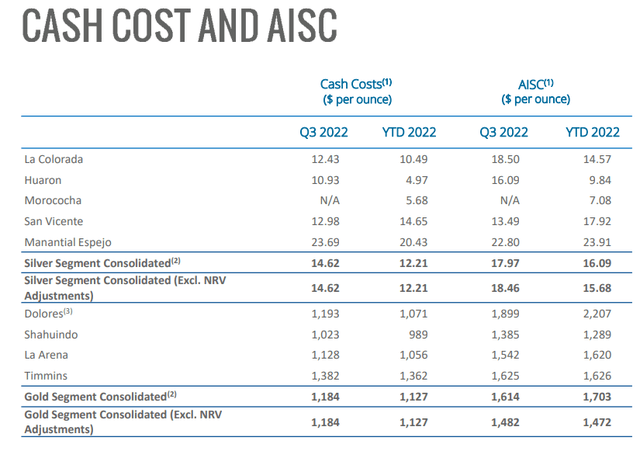

We have to tell you that one of our primary concerns in the last two years has been the costs to do business in the mining space. It is expensive, despite a lot of efforts by many miners to rein in costs. With a lower silver and gold price compared to several years ago, the only way to preserve income was to lower costs.

Miners with huge cost increases right now for production should be avoided. PAAS has maintained strong fiscal discipline, but costs rose in many areas in Q3. While some mines saw increases, others saw decreases, but the overall story here was that total costs did rise from last year.

Compared to the pace year-to-date, the Q3 costs rose, so costs are on the rise. The “Silver Segment” cash costs rose to $14.62 in Q3, compared to $11.92 per ounce in, while All-in Sustaining Costs (or AISC) exploded in Q3 2022 to $17.97 from $16.30 per silver ounce sold. This was most disappointing in our opinion.

The “Gold Segment” cash costs and AISC also rose from last year. They came in at $1,184 and $1,614 per gold ounce sold, respectively. These figures are up 28%, and 37%, respectively. This reflects the crushing nature of inflationary costs. Ouch.

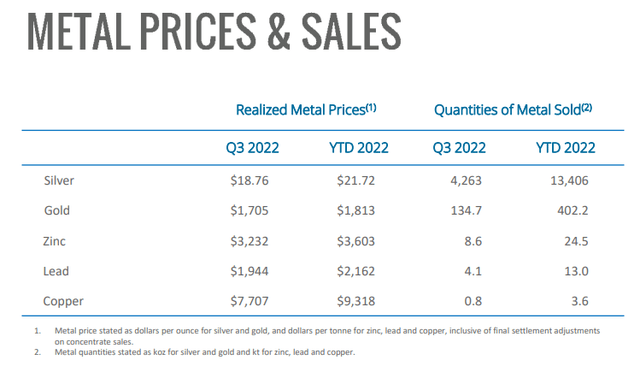

Gold/silver/base metal prices all down, except for Zinc

Metal prices fell badly. The average realized price of silver dropped to $18.76 per ounce, down from $24.16 a year ago. However, gold prices were a bit more stable, but still down to $1,705 per ounce versus $1,782 per ounce a year ago.

Base metals also took a hit. A lot of this has to do with the global efforts to combat inflation and base metals as commodities were some of the earliest soldiers to fall in the battle. Copper fell To $7,707 per ton versus $9,399 per ton a year ago. Lead was down to $1,944 per ton from $2,286 per ton, while zinc prices were a long bright spot rising to $3,232 per ton from $2,989 per ton a year ago.

Revenue fell heavily and lead earnings lower

For Q3 2022, we thought $350 million in revenues was within reach. Analyst consensus was about $346.5, and Pan American Silver saw revenues that missed these estimates, thanks to lower metal prices, and lower volumes. The company saw $339 million in revenue, dropping 26.4% from last year. Net loss was $$71.2 million or $0.34 per share. This reflects mine operating earnings of $54 million in cash flow, but heavy inventory adjustments at Dolores and other mines, mine closure costs, and losses on investments. Backing those out, adjusted earnings were a loss of $2.8 million or $0.01 per share and that was a sizeable beat versus expectations of $0.05.

The Yamana Gold agreement

So Gold Fields Limited (GFI) had put in a low ball bid for Yamana. Agnico Eagle and Pan American joined forces to put out a superior bid. Yesterday, the company confirmed the deal was cancelled with Gold Fields, so now Pan American and Agnico are the lone, but joint, suitors. The basic details of the consideration are that there would be 153,539,579 common shares in the capital of Pan American and $1.0 billion in cash contributed by Agnico Eagle along with 36,089,907 common shares in the capital of Agnico Eagle. Under the Binding Offer, each Yamana Share would be exchanged for approximately US$1.04 in cash, 0.1598 Pan American Shares, and 0.0376 Agnico Eagle Shares, for an aggregate value of US$5.02 per Yamana share. Considering the assets of Yamana, think it is a good deal for Pan American and Agnico Eagle, and an “okay” deal for Yamana shareholders.

Final thoughts

Silver and gold prices have been hit by the Fed’s actions to reduce inflation. The strong dollar further has hurt these metals. Costs are up due to inflation, and we need to see an effort to reign these in. We believe metals prices should recover to a degree once the dollar reverses course, and we believe this will happen when the Fed hike cycle is complete, if not sooner. The balance sheet is relatively strong, and the dividend is still being paid. We like the assets of Yamana, and think Pan American is getting a good deal.

Be the first to comment