MF3d

Palo Alto Networks (NASDAQ:PANW) is a tech stock but has not dropped nearly as much as many tech peers. PANW is still boasting enviable growth rates and is also flowing cash albeit on a non-GAAP basis. The cybersecurity sector remains highly desirable even amidst the broader tech crash, but that premium may already be reflected in the stock price. While there might be still upside to be had here, much of that will depend on the stock’s ability to sustain a premium multiple.

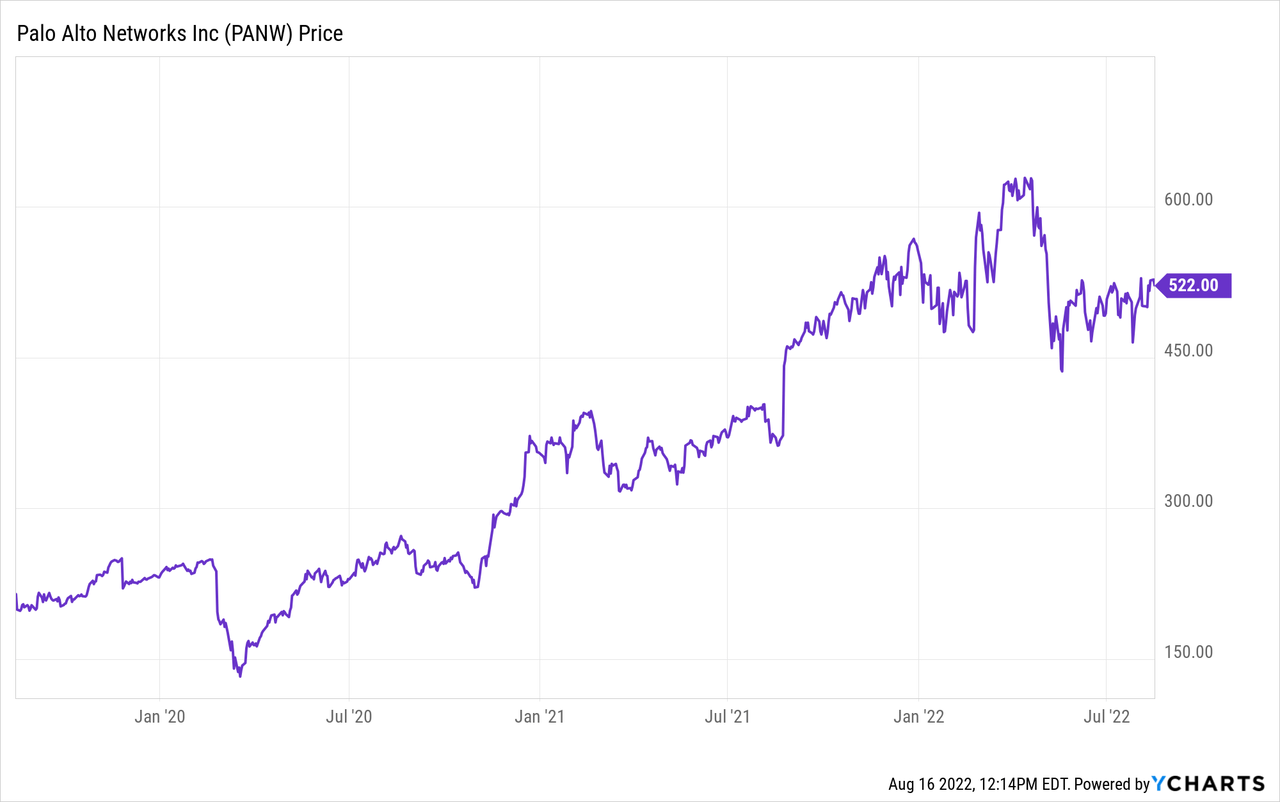

PANW Stock Price

PANW peaked at $640.90 per share earlier this year but has since pulled back 18%.

Now trading around $523 per share, the stock is up 43% over the past year and 94% over the past two years. Cybersecurity stocks as a whole experienced a significant re-rating since the pandemic and appear to have sustained that premium even amidst the recent tech crash.

What is Palo Alto Networks?

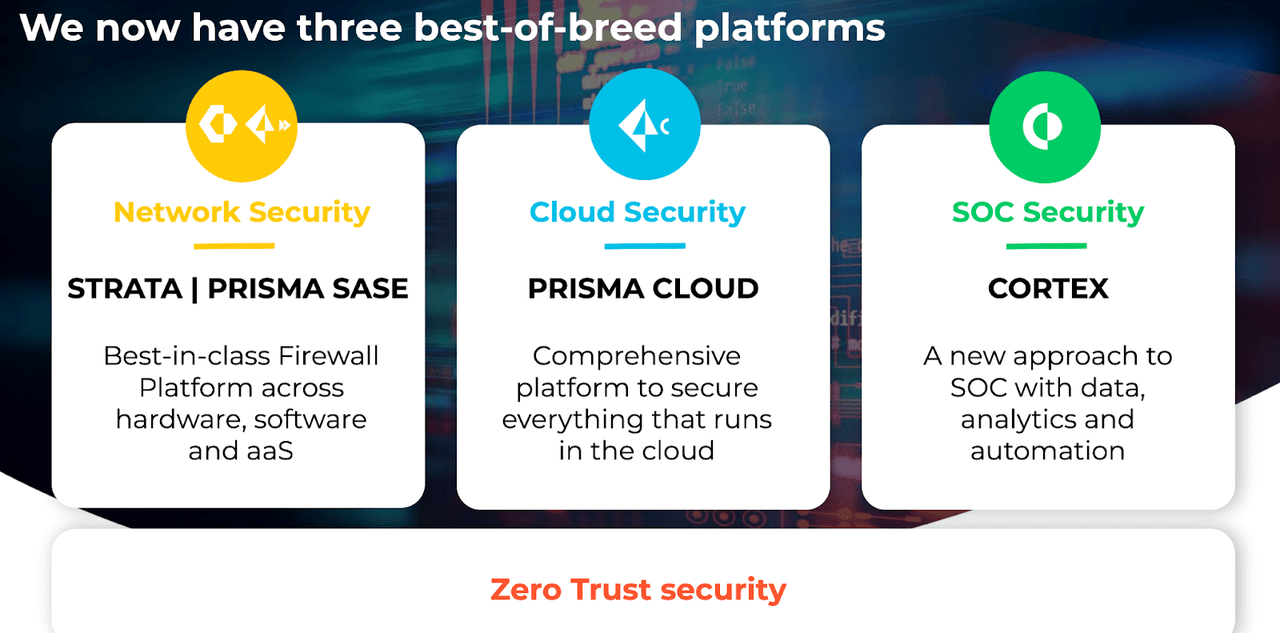

PANW is best thought of as a top-tier firewall provider. In plain English, a firewall is a cybersecurity mechanism which monitors incoming and outgoing traffic and determines which traffic should be blocked. Firewalls are one of many cybersecurity products that a customer might use to protect their data.

2021 Investor Day

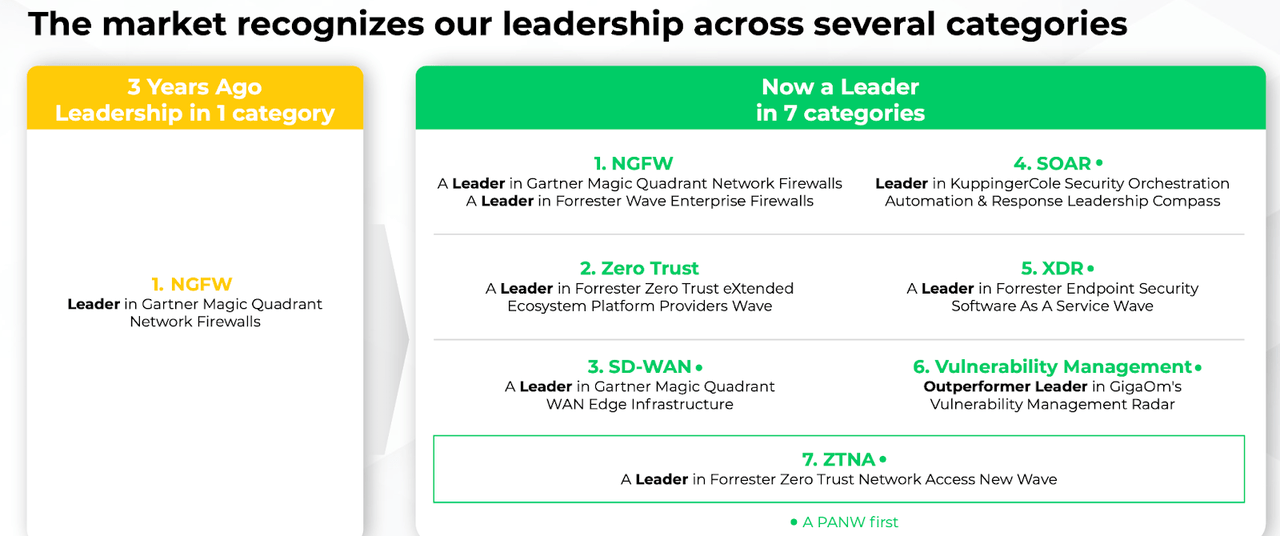

Over the past three years, PANW has succeeded in broadening its product offerings, now being a leader in seven distinct categories.

2021 Investor Day

PANW Stock Key Metrics

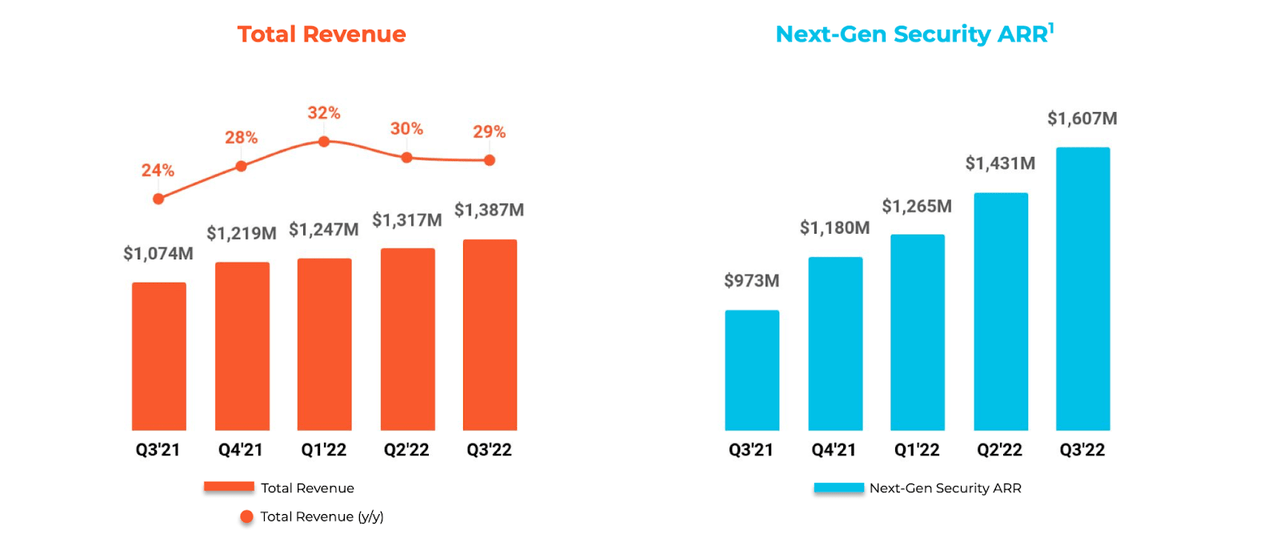

In the latest quarter, PANW generated 29% year over year revenue growth, which is a tremendous achievement considering the tough comparables during the pandemic.

2022 Q3 Slides

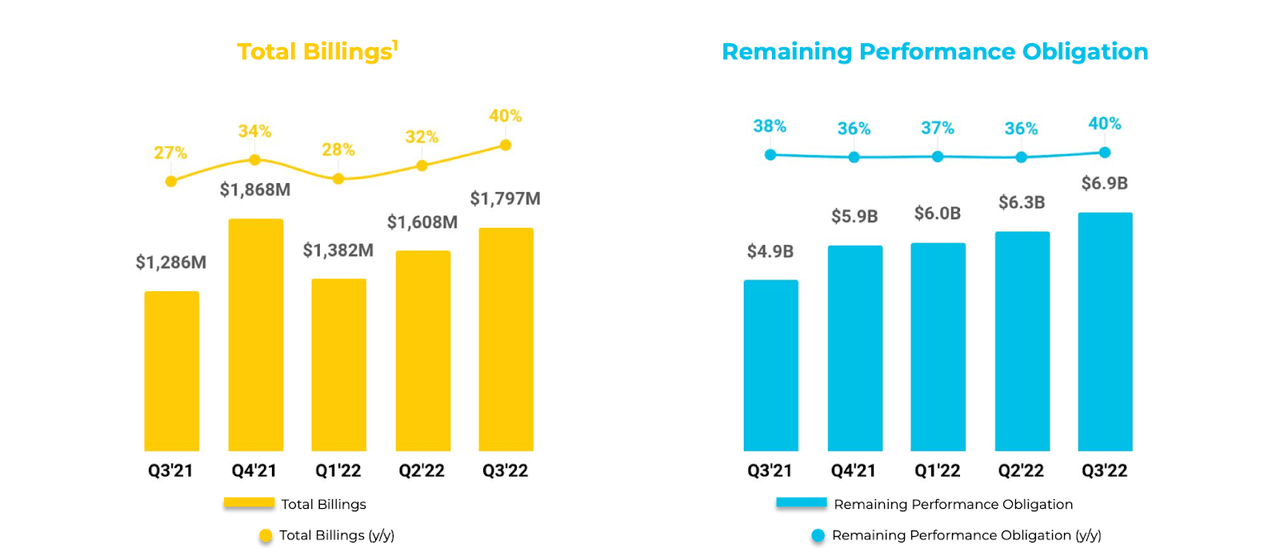

PANW also generated strong billings and remaining performance obligation growth, which helps support the belief that 2023 growth should remain strong.

2022 Q3 Slides

While PANW is still not profitable on a GAAP basis, it did generate 18.2% non-GAAP operating margins and 25.3% non-GAAP free cash flow margins. The company generated $1.79 in non-GAAP EPS.

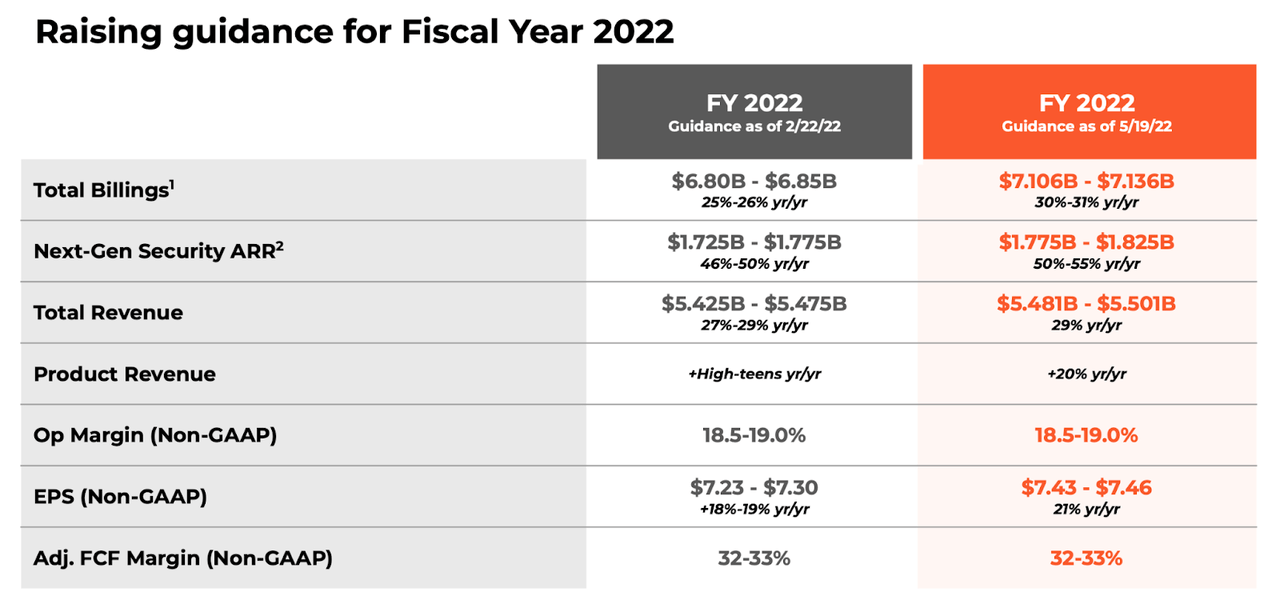

PANW raised full year guidance to see up to 29% revenue growth and 21% growth in non-GAAP EPS.

2022 Q3 Slides

PANW ended the quarter with $4.6 billion of cash and investments versus $3.7 billion of convertible notes. Both the 2023 and 2025 convertible notes are already “in-the-money” with conversion prices less than $300 per share, meaning that PANW will likely have to address those issues soon. PANW also has $5.9 billion of deferred revenue – this is a good moment to note that free cash flow margins are significantly higher than operating margins due to deferred revenues. I find it possible that free cash flow margin may decline in the future once deferred revenues catch up – PANW’s balance sheet may appear to have $0.9 billion of net cash, but deferred revenue makes up a large part of the cash balance.

PANW Stock Earnings

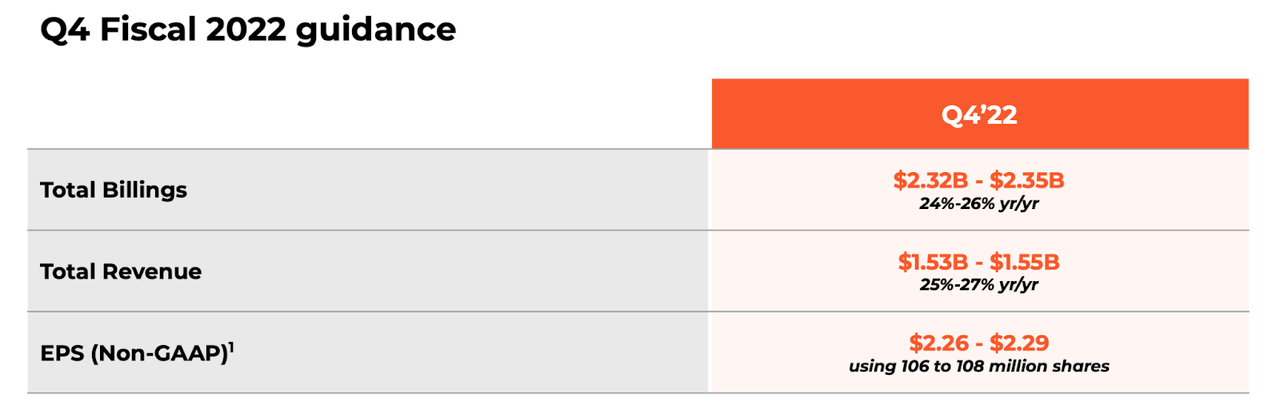

Looking forward, PANW has guided for the next quarter to see up to $1.55 billion revenue growth and $2.29 in non-GAAP EPS.

2022 Q3 Slides

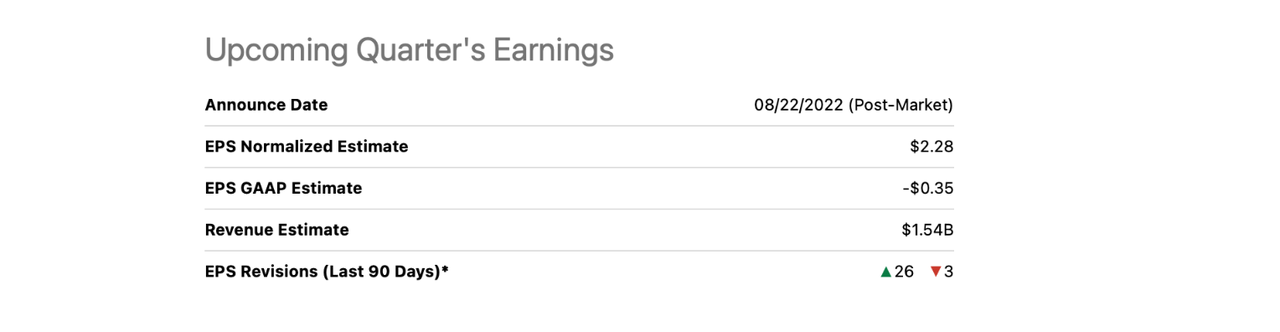

Consensus estimates call for $1.54 billion in revenue and $2.28 in non-GAAP EPS.

Seeking Alpha

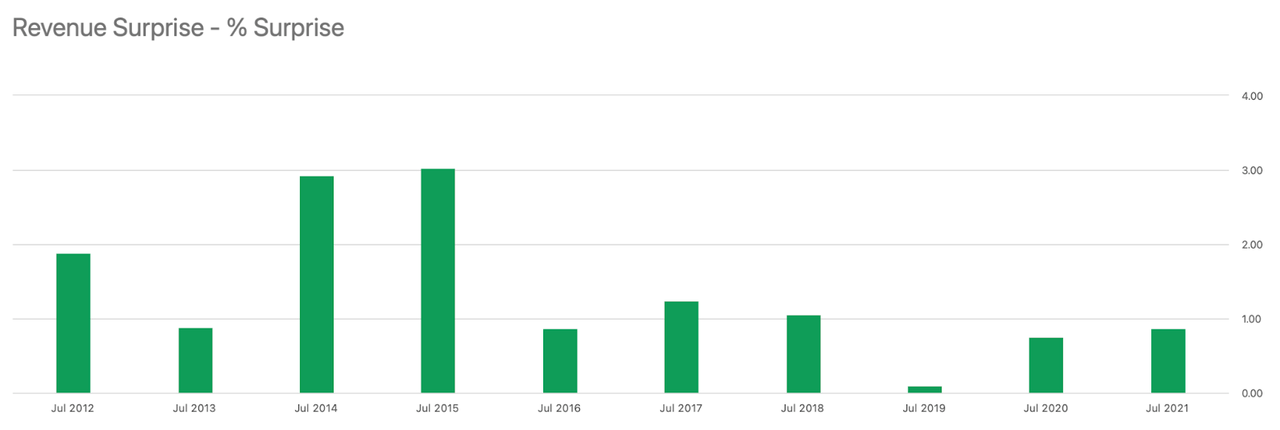

PANW has a long history of surprising against consensus estimates.

Seeking Alpha

Based on the strength seen across enterprise tech, I expect PANW to at least slightly beat on its guidance and consensus estimates.

Is PANW Stock a Buy, Sell, or Hold?

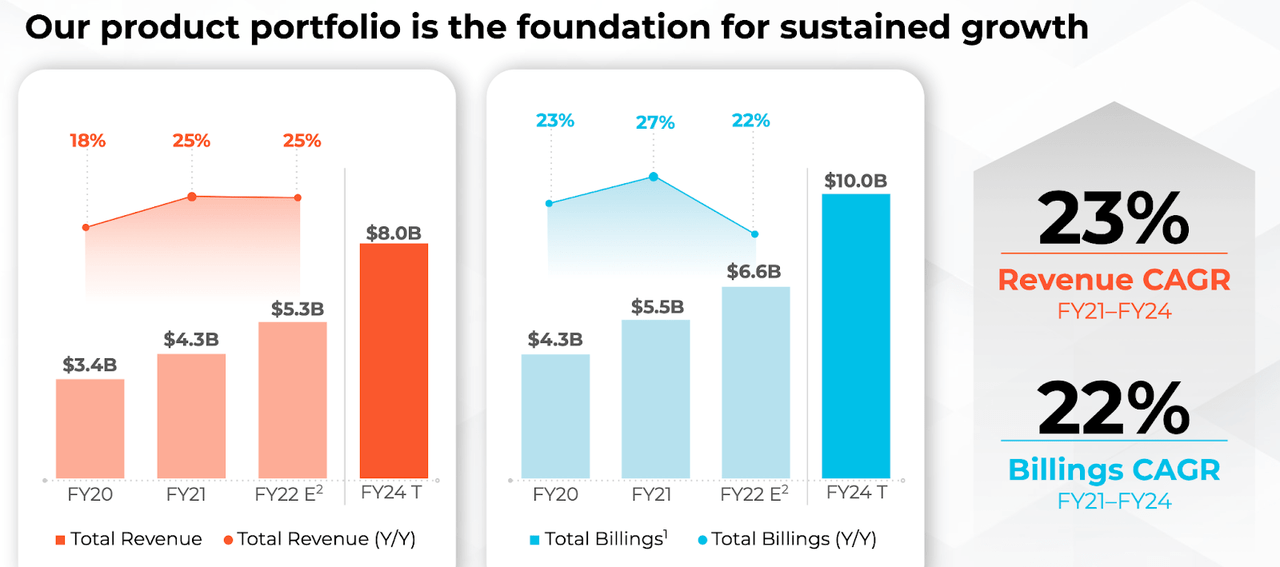

Given the poor sentiment for tech stocks, a reasonable concern for investors might be both valuation and the potential for growth rates to fall off a cliff. At its 2021 Investor Day, PANW guided for 23% compounded revenue growth through 2024, expecting to end up at $8 billion in revenue.

2021 Investor Day

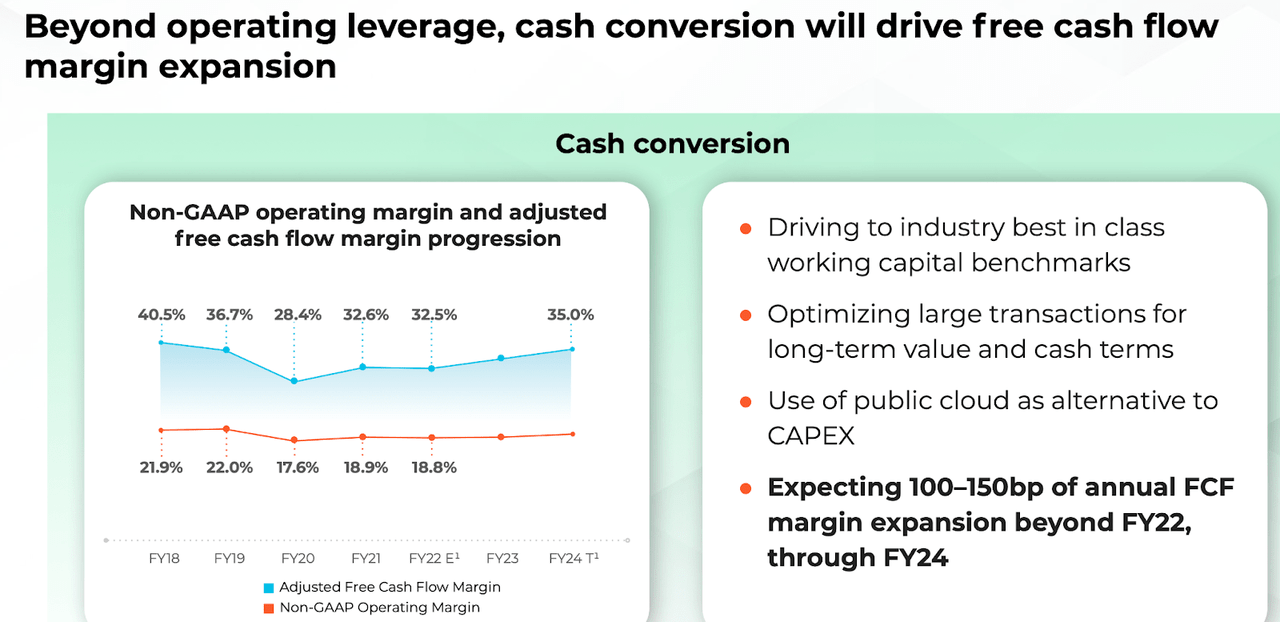

PANW also expects some operating leverage with free cash flow margin expected to reach 35%.

2021 Investor Day

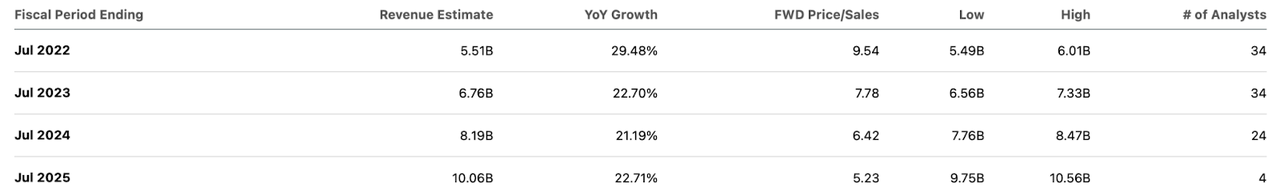

Unlike many other tech sectors, cybersecurity is one in which analysts have more or less remained confident in forward projections. Consensus estimates actually call for $8.19 billion in revenue in 2024.

Seeking Alpha

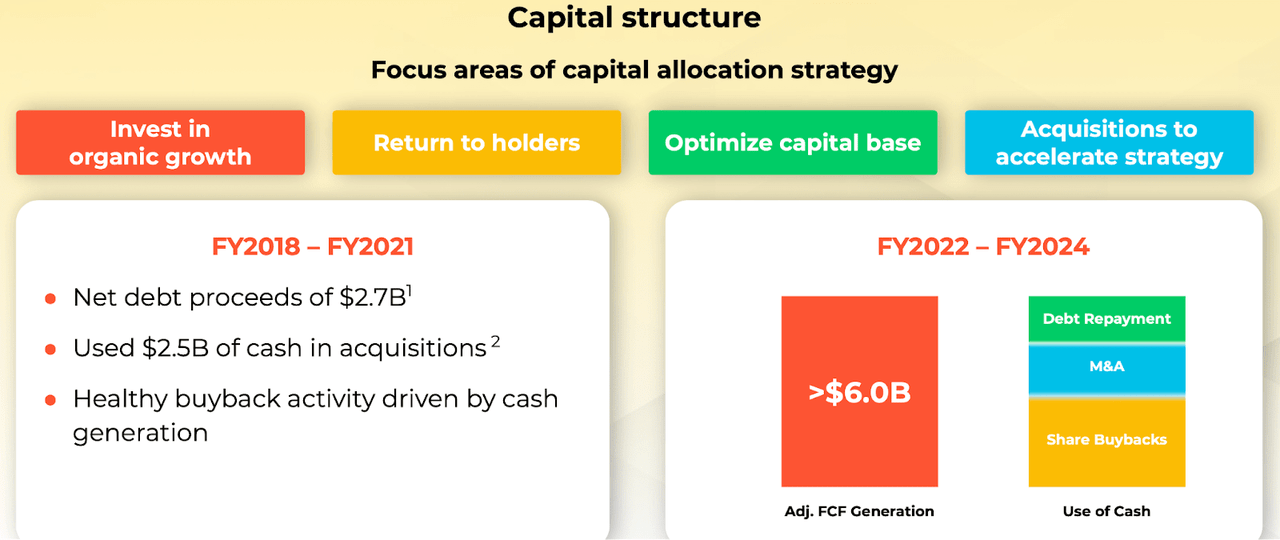

PANW expects to use future free cash flow primarily towards debt paydown, followed by M&A, and finally share repurchases.

2021 Investor Day

Through the first six months of 2022, PANW repurchased $550 million of stock but I note that due to the company still being not profitable on a GAAP basis, those repurchases were not enough to fully offset dilution.

Let us now calculate a fair value. I see PANW generating 25% GAAP net margins over the long term (again, non-GAAP operating margin currently stands at 18%). Applying a 1.5x price to earnings growth ratio (‘PEG ratio’) and assuming 20% growth in 2025, PANW might trade at 7.5x sales in 2024, implying a stock price of $617 per share or only 18% upside over the next two years. Cybersecurity stocks have typically traded at large premiums, so perhaps a PEG ratio of 2x to 2.5x would be more likely – that would increase the upside by 33% to 67%. Similar to what is seen at cybersecurity peers like CrowdStrike (CRWD) or Zscaler (ZS), much of the future upside has already been priced in – even in spite of the broader tech crash.

Key risks here include the inability to hit projected growth targets as well as the potential for 2025 growth to be significantly lower than my 20% projection. Another risk is if the cybersecurity market becomes saturated, with competition eating away at growth rates and margins. At the moment I do not find that likely due to the ever-increasing relevance for cybersecurity products. I find PANW to be buyable here in spite of the big premium largely due to my high conviction in the cybersecurity thesis, as these are names which carry great likelihood of outperforming guidance and sustaining premium multiples.

Be the first to comment