blackdovfx/E+ via Getty Images

Introduction

Several months ago I analyzed Global X Cybersecurity ETF (BUG) and found it to be an attractive investment. I believed that the theme of cybersecurity will enjoy significant demand due to external trends. The ETF holds a diversified portfolio of cybersecurity solutions. Some for home users and others for corporates. Some sell hardware and some sell software.

My favorite holding in the ETF is Palo Alto Networks (NASDAQ:PANW). The company is growing, it is profitable and generates cash and it holds a diversified portfolio of products. I believe that Palo Alto is an interesting company, which is worth additional analysis. The company doesn’t pay a dividend and is not forecasted to do so in the foreseeable future. In this article, I will analyze the share of Palo Alto Networks.

I will analyze the company using my methodology which is similar to the one I use for analyzing dividend growth stocks. Since there is no dividend, I will focus on the free cash flow. I will look into the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

According to Seeking Alpha’s company overview, Palo Alto Networks provides cybersecurity solutions worldwide. The company offers firewall appliances and software, Panorama, a security management solution for the control of firewall appliances and software deployed on an end-customers network and instances in public or private cloud environments, as a virtual or a physical appliance. It also provides subscription services covering the areas of threat prevention, malware and persistent threat, uniform resource locator filtering, laptop and mobile device protection, and a firewall.

Wikipedia

Fundamentals

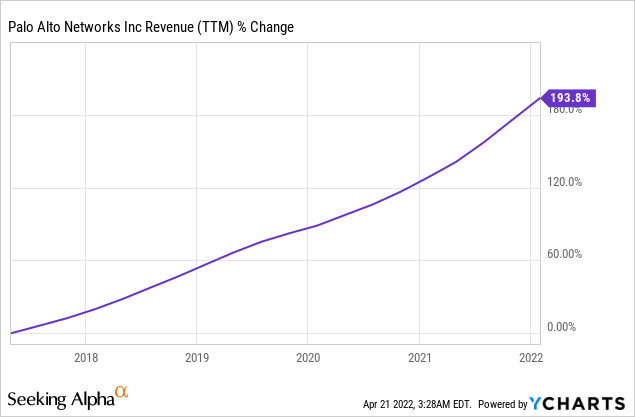

Over the last five years, sales of Palo Alto have almost tripled. In 2021, sales have reached $4.26B. Palo Alto is growing both organically and through M&A. Over the last five years, Palo Alto has acquired over ten companies to expand its portfolio and improve its existing product. The combination of organic and inorganic growth has fueled the intense revenue growth. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects Palo Alto to keep growing sales at an annual rate of ~25% in the medium term.

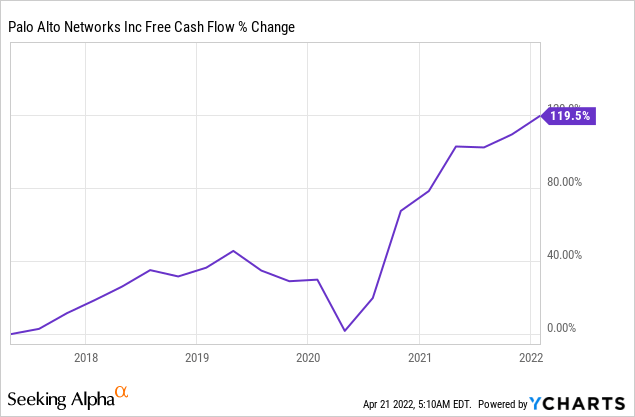

The company is not only a growth stock with extremely fast sales growth, but it also generates cash. In 2021, the company’s free cash flow has reached an all-time high of $1.5B. The company turned roughly one-third of its sales into FCF (free cash flow). Over the last five years, the FCF has more than doubled, and as Palo Alto generates higher sales, the FCF will grow accordingly. The company is also growing non-GAAP EPS (earnings per share). Going forward, the consensus of analysts, as seen on Seeking Alpha, expects Palo Alto to keep growing its non-GAAP EPS at an annual rate of ~22% in the medium term.

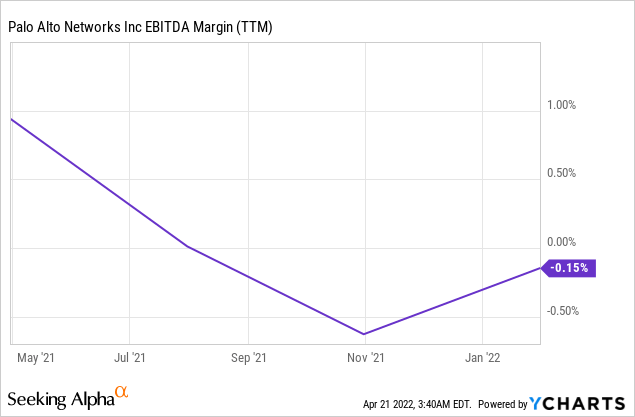

The company is growing its profitability on a non-GAAP basis. The graph below shows that the company is breakeven when looking at GAAP EBITDA margins. However, when looking at the company’s FCF margin, it has increased from 13% in 2013 to 39% in 2021. Therefore, it is not only that the company generates significant amounts of cash, but it is also growing in terms of cash conversion. Therefore, if the company manages to keep executing well, in the future more sales will be translated into more free cash flow.

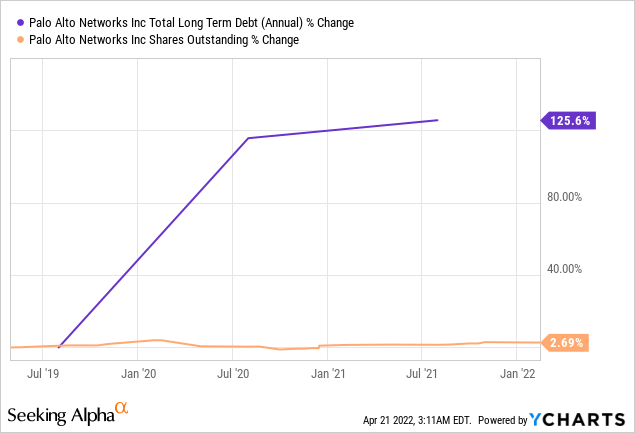

Another positive sign is the growth in debt while the number of shares outstanding is stagnated. When companies are growing, in the beginning, they issue shares to fund growth and dilute shareholders. As they gain trust from investors, they gain access to the credit markets, and investors are not being diluted anymore. Palo Alto seemed to gain trust from the credit markets, and it can keep growing steadily by issuing more debt to acquire companies.

Valuation

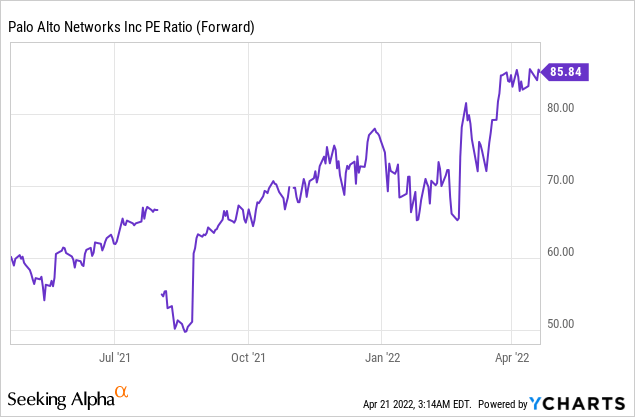

The company’s P/E (price to earnings) ratio has increased significantly over the last twelve months. Palo Alto is trading for 86 times its forecasted 2022 earnings (its FY 2022 ends in July). This is the highest valuation seen over the last year, and it is very hard to justify such a high valuation even when taking into account the company’s fast growth rate both in terms of sales and in terms of EPS.

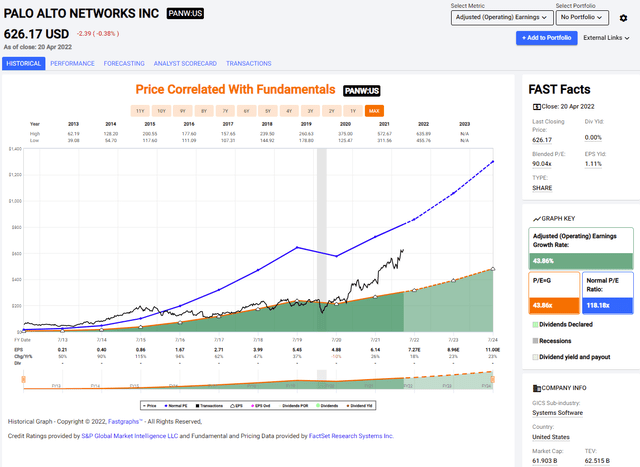

The graph below from Fastgraphs.com may be a bit misleading if not examined carefully. The company is trading for a P/E of almost 90. However, Palo Alto since its IPO has been trading for almost 120 times earnings. Yet, investors should pay attention to the fact that Palo Alto is also growing at a slower pace compared to what investors are used for. Current estimates are 22%, and the past growth rate was over 40%. Thus, while the valuation is below average so is the company’s growth rate.

To conclude, Palo Alto has extremely strong fundamentals. Great growth in both sales and free cash flow. The company is on the verge of being profitable on a GAAP basis and shifting its capital raising strategy to debt from equity as the markets gain more trust in Palo Alto for the long term. The company grows fast, but the valuation is challenging at almost 90 times earnings, forcing it to execute extremely well.

Opportunities

The geopolitical tensions in Europe are increasing the need for cybersecurity solutions. The Russian Federation is constantly threatening to use cyber attacks against countries that are unfriendly to Russia. China is also utilizing cyberattacks to gain information. Therefore, there is a constant need for cyber protection.

The company is also extremely diversified. It offers both hardware and software, and it provides solutions across the value chain. From cyber threat intelligence to SOAR (Security Orchestration, Automation, and Response) solutions. It also offers solutions to different clients whether their data is on-premise or on the cloud. The ability to offer a high-end solution for every client is a growth opportunity.

In addition, Palo Alto is great at innovating and reacting to trends. The company has caught the trend of cloud migration on time to become a cloud leader. The company is agile and reacts quickly either by developing its solutions or by acquiring a prominent startup or a more mature company that can supplement the portfolio and ride the current megatrend in the realm of cybersecurity.

Risk

The competition is the first risk and is the most significant one for Palo Alto. Palo Alto is not one of the big tech companies. It doesn’t have tens of billions of dollars in free cash flow, and it has to compete with larger competitors like Check Point (CHKP) and Microsoft (MSFT) as well as smaller competitors and countless startups. The company has fewer resources than its large competitors and it still has to constantly innovate.

In addition, the company doesn’t offer investors any margin of safety. We have already seen in the past how companies can react to changes in market sentiment. Block (SQ) is an example of a company that kept executing well, the company still suffered immensely as there was a change in the market sentiment and investors sold their growth stock for value stocks.

Moreover, there is also an execution risk. Even if the market agrees to award Palo Alto this generous valuation, it may not be able to perform so perfectly. Companies that grow fast, and suddenly their growth slows down are being punished very harshly by investors. It happened lately with Netflix (NFLX) which saw its P/E ratio slashed to adapt the share price to the new growth rate.

Conclusion

Palo Alto is an amazing company. The company is less than 20 years old, and already owns a large portfolio of diversified cybersecurity products and solutions. The company has significant free cash flow and enjoys impressive growth with optimistic views for the future. The company is enjoying significant IT and geopolitical trends to increase future sales with relatively limited risks.

However, this investment comes with a prominent valuation risk. When trading for 90 times forward earnings, the company has no margin of safety. Every additional interest increase or slight miss or guidance revision may hurt the stock as we just saw with Netflix and Block. Investors should either wait for a lower P/E ratio, probably around 60 or add gradually on a monthly or quarterly basis.

Be the first to comment