Galeanu Mihai

Investment Thesis

Palo Alto Networks (NASDAQ:PANW) is a very compelling cybersecurity stock on many fronts. Not only is the company guiding for GAAP profitability in the upcoming twelve months, but more importantly, it has a really broad-based portfolio of products.

Indeed, we should expect Palo Alto to reiterate the message of a path to GAAP profitability next Thursday, together with its Q1 results.

Even though Palo Alto is a cybersecurity vendor, the company doesn’t try to strangle its customers’ content on its own platform. It partners alongside customers allowing data interoperability.

As more enterprises and small businesses embrace a hybrid work environment, the legacy network offerings don’t solve breach problems.

Palo Alto is able to solve customers’ data breaches by having a portfolio of 14 products that work on the network, at the edge, and in the cloud. Palo Alto is one of the biggest cybersecurity companies in the world. But despite its size, there’s a lot of ongoing innovation under its hood.

There’s a lot to be bullish about here as we head into earnings.

What’s Happening Right Now?

Right now, the market is range bound. Investors get some good news, and it’s off the races!

And the next day, there’s a realization that the problems that got us here in the first place, haven’t been solved. Hence, stocks then proceed to give back their gains.

My recommendation, as difficult as it may be, try not to play that game. Don’t play the game of being a hero. Don’t leverage your portfolio and use leveraged options. Buy into a compelling business, and learn to sit still.

You might not get stellar returns in the coming month or six months, but at least from this point over the next year, you’ll preserve your capital. Your firepower. Your flexibility. Without firepower, everything falls apart.

Why Palo Alto Networks?

Palo Alto is not a pure-play endpoint security platform like SentinelOne (S) or CrowdStrike (CRWD). Palo Alto bundles its network, edge, and cloud product capabilities for network and endpoint cybersecurity solutions.

This is arguably the main distinguishing feature from some of the fastest-growing cybersecurity peers. It’s not a best-of-the-breed cybersecurity player, it’s a highly specialized vendor.

Palo Alto holds a large number of legacy products under its Next-Generation Firewalls. But the next growth opportunity will come in its ability to deploy AI in a meaningful manner to predict likely breach incidents, and not have to react post-fact.

Palo Alto Networks’ Near-Term Prospects

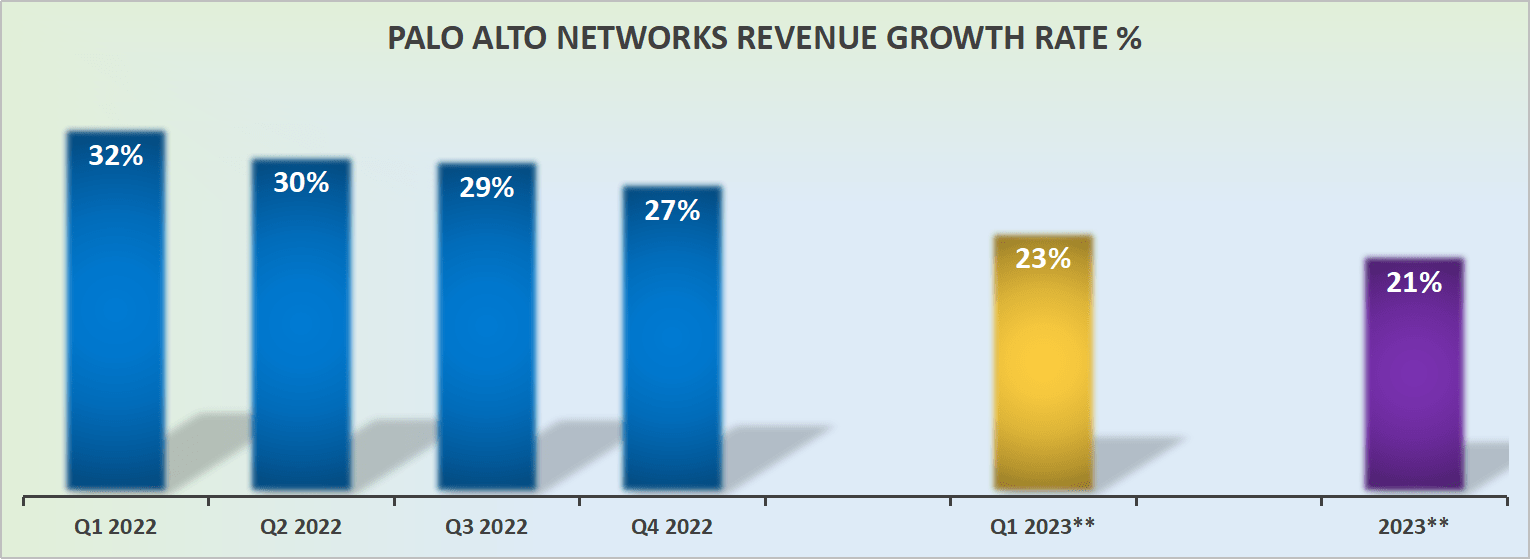

Author’s work; **guidance

As a reminder, billings are a forward indicator of revenue growth. With billings high, particularly above revenue growth guidance, that implies that there’s still more ”revenue” to be booked in time. There were some minor timing issues, and without these impacts, on an adjusted basis, billings would have come in around 35%.

But that’s not where the bull case is. The bull case is that roughly a third of Palo Alto Networks’ business is derived from its Next Generation Security (NGS) portfolio. You’ll see this mentioned a lot, Palo Alto’s NGS portfolio.

This is a portfolio of products that are growing really fast, that’s where the innovation is coming from.

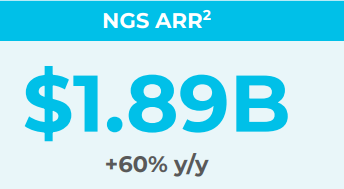

PANW Q4 2022

As you can see above, this growth unit just printed 60% y/y ARR last quarter. Those are not small numbers. Yet, the point that I’m making about Palo Alto is that the business isn’t just about growth. There are plenty of fast-growing cybersecurity names out there that haven’t yet figured out how to reach profitability.

Profits Matter, More Today Than for a Long While

In a period of 0% interest rates, the market wasn’t focused on profitability. But today, profitable enterprises are where investors need to be positioned to help them survive this bear market.

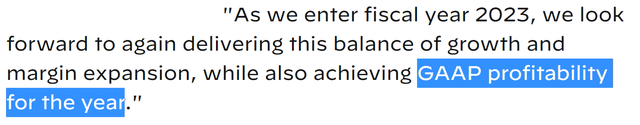

PANW Q4 2022

What you see above is Palo Alto’s guidance. They are signaling to investors that in fiscal 2023, which started already in the current quarter, Palo Alto is striving for GAAP profitability.

Recall, Palo Alto finished fiscal 2022 with GAAP net income margins of negative 4.9%.

What this means is that Palo Alto believes that it has what it takes to improve upon its nearly negative 5% net income margin and end the year in the black on a clean GAAP basis.

PANW Stock Valuation — 49x Forward non-GAAP EPS

Presently, analysts following Palo Alto expect that by the end of fiscal 2023 (ending July 2023), Palo Alto will see around $3.16 of non-GAAP EPS. That puts the stock priced at 49x forward non-GAAP EPS.

Clearly, that’s not ”that cheap”. But on the other hand, we are talking about a cyclical stock that is likely to see demand fall off a cliff either, as is the case with cyclical stocks.

I won’t go so far as to declare that Palo Alto is recession-proof. In truth, very few businesses are recession-proof. But I do believe that Palo Alto is recession-resistant.

For context, if we were to adjust CrowdStrike’s (CRWD) fiscal year to July 2023, this puts CrowdStrike at 85x forward non-GAAP EPS. I recognize that CrowdStrike has a lot of positives, and I can’t be too bearish about CrowdStrike. But I do believe that it’s fair to say that investors’ expectations towards CrowdStrike are very high.

The Bottom Line

Palo Alto may not be for every investor. It’s a ”boring” stock. For investors that seek out some pizzaz, the obvious player would be CrowdStrike.

But for investors that aren’t risk-seeking, I believe that Palo Alto Networks is a perfect match. It’s clearly growing at a reasonable rate. Under its relatively new CEO, Nikesh Arora, Palo Alto is extremely focused on its bottom-line profitability, which is so important today.

And there’s enough scale and history of innovation to positively surprise investors in the near term. Particularly, when we observe that amongst cybersecurity names, Palo Alto is one of the cheapest players available.

Stay tuned for updates!

Be the first to comment