gorodenkoff

The following segment was excerpted from this fund letter.

Leidos Holdings Inc (NYSE:LDOS)

As we continue to familiarize our clients with our Focused SMID portfolio, we wish to introduce Leidos, one of our largest holdings in the portfolio. Leidos is a technology, science, and engineering service provider primarily to the U.S. government, with a significant focus on the U.S. military and intelligence communities. Large customers include the U.S. Department of Defense (DoD), the U.S. Intelligence community, the Department of Homeland Security, and Federal Aviation Administration, plus the Department of Veteran Affairs.

Aside from the U.S. government, which represents nearly 90% of the Company’s revenues, Leidos also provides services to some commercial customers and to allied foreign governments and their military and intelligence services. Leidos has grown over several decades from a base of scientific and engineering expertise into a provider of a variety of services, retaining a primary focus on advanced technological areas, but spreading into many tangential areas where the Company’s scale, and its long relationships with its customer base, have allowed it grow.

Our thesis behind our initial purchase in September 2020 was fairly straightforward: in a strong market at high valuations, Leidos generated solid growth at attractive returns, it had demonstrated strategic and financial competence in a series of acquisitions and divestitures over the previous several years, and it was trading at an attractive valuation by its own historical standards and in relation to the broad market.

Although we have built the stock into a significant position as fundamentals have evolved over time, we took only a small initial position because the attractive valuation, to a large degree, was driven by the market’s caution around the Company’s intermediate-term outlook in the case of an election victory for the Democrats – with the Company primarily viewed by the market as a defense contractor, the market tends to see greater opportunities for Leidos, and the rest of the defense industry, under a Republican rather than a Democratic administration.

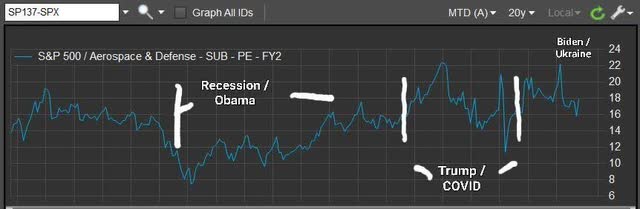

If you consult the graph below, showing a 20-year illustration of the market’s valuation of the broad S&P 500 Aerospace & Defense subsector, you will see how the market has reacted to changes in U.S. administrations, especially early in each president’s term. Of course, the Democrats did win control of both the presidency and Congress, and the market did in fact take a dim initial view on the future prospects for the defense industry.

20-year graph of S&P 500 Aerospace & Defense subsector’s Price-to-FY2 Earnings

20 year graph of S&P 500 Aerospace & Defense subsector’s Price-to-FY2 Earnings (Source: FactSet)

During our initial work on Leidos, and continuing during the early part of our holding period, several things made us comfortable with the company’s fundamental outlook, despite the fact that valuation expansion opportunities would be unlikely for some time. For example, commentary from the Biden campaign during the election indicated it was unlikely that the defense budget, or its priorities, would change drastically.

Long before anyone feared that an actual shooting war might break out, we thought any risk to the defense budget was more likely to be in areas such as weapons, fighter jets, or missile systems; we expected a continuation of focus, however, in areas such as intelligence gathering and analysis, cybersecurity, and technological upgrades – all areas in which Leidos operates at scale.

Despite the market’s worries about possible Democratic cuts to the defense budget, President Biden’s initial request for the Fiscal Year 2022 DoD budget – his first as president – came in at $715 billion, which represented a modest 1.6% increase to the FY2021 budget. Congress eventually added to this request, though, and the final DoD budget ended up at $740 billion, or a greater than 5% increase.

We note that within this budget, the DoD’s Research, Development, Test, and Evaluation funding – areas of focus for Leidos – increased more than 10% to greater than $120 billion. Then, early in 2022, the world’s military and political situation changed dramatically, with Russia’s invasion of Ukraine. This, unfortunately, as it were, has resulted in several emerging long-term benefits for Leidos.

First, and most importantly, the funding environment for Leidos’s largest customer, the U.S. DoD, has improved significantly. Although the Biden administration’s initial FY2023 DoD budget request called for a roughly 4% increase in funding, Congress added to the budget considerably, eventually approving an increase greater than 10%.

This budget again saw record funding for the DoD’s Research, Development, Test, and Evaluation accounts; although we have not seen a final number for this yet, the initial request of $130 billion would represent an increase of approximately 8%. We also note that Congress has approved tens of billions of incremental dollars of emergency Ukraine-related funding within the FY2022 budget.

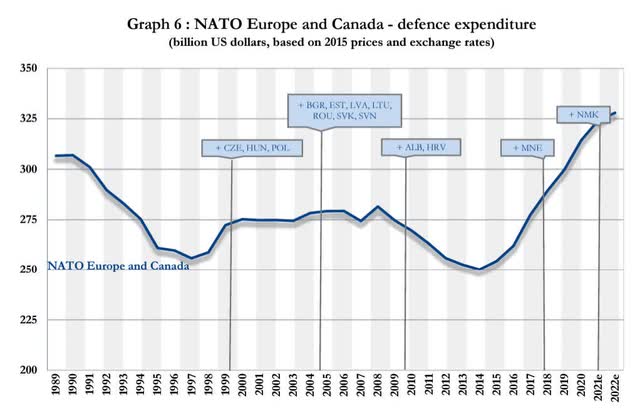

Second, we would point out that the spending outlook for the U.S. military allies also suddenly looks much better. Although Leidos’s exposure to government customers outside of the U.S. is much lower (currently less than 10% of revenues), we think this portion of the business can grow considerably. While we will not quote a variety of news headlines from the United Kingdom, Germany, Canada, and other NATO allies, as well as from Australia, concerning current and longer-term defense spending upgrades, we will share the graphic below to highlight the potential opportunity from the U.S. allies.

As you may know, NATO’s defense ministers agreed in 2006 to spend at least 2% of their countries’ GDP on defense; however, as you will see below, most countries in the alliance have not been doing so. We have struggled to find an exact number for what the non-US NATO members spend as a percentage of GDP, but we estimate, using a variety of sources, that this number was perhaps 1.5-1.75% of GDP prior to the Ukraine war.

NATO Defense Spend

NATO Defense Spend

Furthermore, as you can see below, total defense spending by the alliance outside of the U.S. actually fell by more than -$50 billion in real terms (at 2015 dollars and exchange rates) in the 25 years between 1989 and 2014 despite the addition of 12 new countries to the alliance in that time.

Between Russia’s invasion of Crimea in 2014, and NATO’s recommitment to the 2% of GDP spending targets in response to pressure from the Trump administration, you can see that NATO ex-U.S. spending has recovered significantly in the past 8 years, although total spending by the non-U.S. portion of the alliance is still only roughly 6% higher than 1989 levels in real, 2015-indexed terms.

If we use NATO’s estimate of $328 billion of spending by the non-U.S. portion of the alliance and use our best guess that this represents perhaps 1.65% of those nations’ GDP, a full 2% allocation of their GDP would represent total defense spending of nearly $400 billion – representing a one-time incremental step-up of over 20%. For Leidos, the much larger U.S. defense spending obviously is the greatest opportunity, but we believe increased funding from allies only adds to the company’s total longer-term opportunity.

NATO Europe and Canada Defense Spend

NATO Europe and Canada Defense Spend (Source: NATO press release, 6/27/22)

Now that we have laid out the enhanced longer-term opportunity for the Company’s fundamentals, let us turn to the opportunity in the stock. For a start, we point out that consensus estimates for Leidos haven’t moved at all since the outbreak of the war in Ukraine. We find this nearly laughable. The market expects sales growth of only 4-6% per year through 2024. This is well below the levels of growth Leidos generated for five of the last six years, and that was before we had an outbreak of actual war and the high likelihood of a new Cold War.

While the government procurement process does not move quickly, and the opportunities created by the world’s new political and military situation will not appear overnight, there will be a significant increase in the budget of Leidos’s largest customer (the U.S. DoD) in the October 2023 fiscal year, which starts imminently, and we expect the Company to benefit. More importantly, we believe there will be an elevated funding tailwind for Leidos for years to come, and eventually we expect the market to catch on.

Furthermore, we believe the greater long-term opportunities for Leidos will lead to an opportunity for valuation expansion, regardless of which party happens to control Congress or the presidency. While the market may still be more willing to pay up under a Republican, rather than a Democratic, administration, we believe the valuation bar will be adjusted higher in either case.

We would argue we already have seen some modest benefit on the valuation front already this year, with Leidos’s valuation roughly holding steady at an admittedly low level in a market that has seen broad valuation contraction; we expect to see both estimates and valuation moving higher in the next several years. Until we see this play out, we expect to continue to hold a significant position in the stock.

|

The information and statistical data contained herein have been obtained from sources, which we believe to be reliable, but in no way are warranted by us to accuracy or completeness. We do not undertake to advise you as to any change in figures or our views. This is not a solicitation of any order to buy or sell. We, our affiliates and any officer, director or stockholder or any member of their families, may have a position in and may from time to time purchase or sell any of the above mentioned or related securities. Past results are no guarantee of future results. This report includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. These comments may also include the expression of opinions that are speculative in nature and should not be relied on as statements of fact. Wedgewood Partners is committed to communicating with our investment partners as candidly as possible because we believe our investors benefit from understanding our investment philosophy, investment process, stock selection methodology and investor temperament. Our views and opinions include “forward-looking statements” which may or may not be accurate over the long term. Forward-looking statements can be identified by words like “believe,” “think,” “expect,” “anticipate,” or similar expressions. You should not place undue reliance on forward-looking statements, which are current as of the date of this report. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. While we believe we have a reasonable basis for our appraisals and we have confidence in our opinions, actual results may differ materially from those we anticipate. The information provided in this material should not be considered a recommendation to buy, sell or hold any particular security. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment