Epstudio20/iStock via Getty Images

AI (Artificial Intelligence) is constantly in the news and rightfully so. The future of the human race may well depend upon its success and although we are in the early stages of AI’s development some potential key players have emerged. Two of those companies are Palantir (NYSE:PLTR) and CrowdStrike Holdings (CRWD).

Although PLTR and CRWD use AI for different purposes, their growth has come from implementing those AI schemes to solve real-world problems.

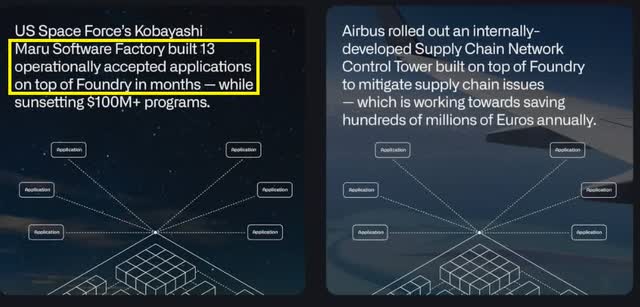

In PLTR’s case, it is using AI to integrate huge amounts of unrelated data from varying sources quickly and easily. Application code is effectively generated to effectively access that data and new data paths and relationships are created in a very short period of time.

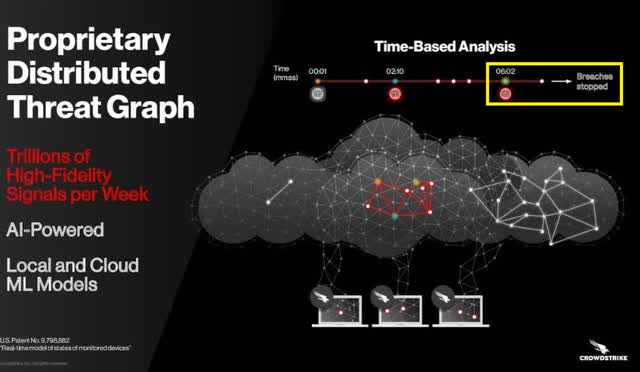

On the other hand, CRWD concentrates on network security threats, a constant and growing threat to everyone, everywhere.

Note both emphasize the speed-of-solution which is, of course, what AI brings to the table.

In Palantir’s case, developing 13 usable applications in months was and is virtually unheard of in the world of software development. I should know, I did exactly that for more than 3 decades.

CrowdStrike emphasizes how fast its AI-infused threat detection software finds and halts “Breaches”. Who among us hasn’t had to deal with that issue recently?

I have written previously about PLTR “Palantir: The Microsoft Of Artificial Intelligence” and “Palantir Is About Data And Data Is The Future”.

Here are 3 reasons why I think Palantir is a buy and CrowdStrike is a sell.

1. PLTR’s financial metrics are better than CRWD’s.

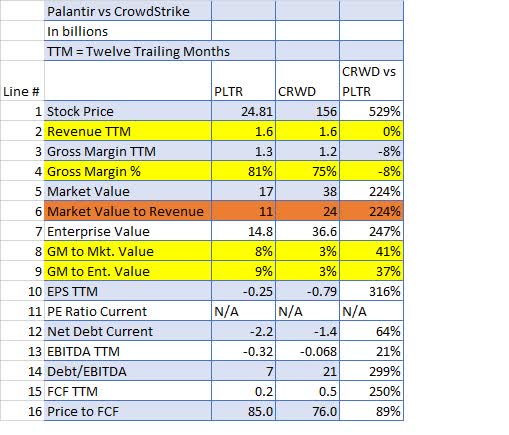

In looking at the financial metrics of both companies over the TTM (Trailing Twelve Months) we can see several advantages to PLTR.

Seeking Alpha and author

Although revenue for both companies is virtually identical and GM (Gross Margin) is extremely high for both companies the GM to Market value and GM to Enterprise Value percentages (Lines 8 and 9) are much higher for PLTR than CRWD. This would indicate, all other things being equal, that PLTR is underpriced relative to CRWD.

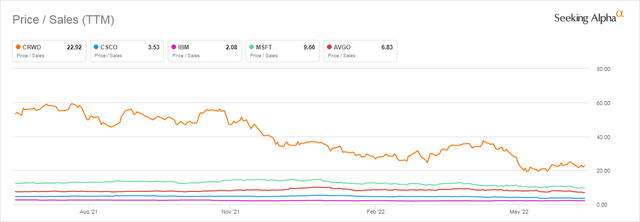

But the real eye-catcher is line 6 in red which shows PLTR has less than 1/2 the market value/revenue (AKA Price to Sales Ratio) compared to CRWD. This is important from an investment strategy because ever since PLTR come to market in late 2020 one of the big market negatives was its extremely high market value to revenue ratio. At one time PLTR’s ratio exceeded 50 whereas currently, it sits at about 11.

This means at its current price, PLTR is very reasonably priced for a leading-edge AI company with real opportunities to expand its sales going forward.

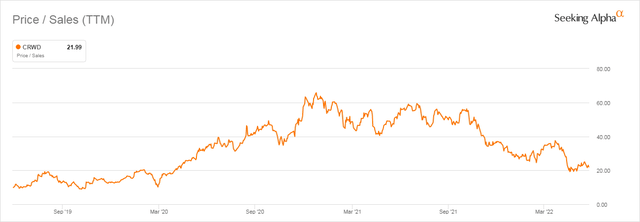

CrowdStrike on the other hand though down from its previous nosebleed high of 60x sales still sits at 24x more than twice PLTR’s level.

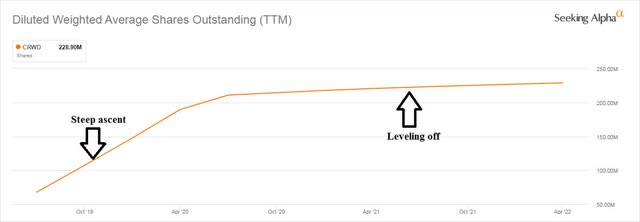

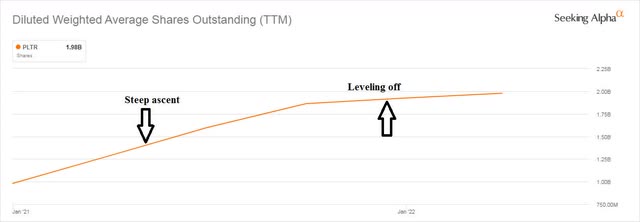

2. Increased share counts have slowed for both companies.

One of the more common complaints about PLTR is its SBC (Stock-Based Compensation) causing many shares to be issued to PLTR employees raising the share count to the detriment of the other shareholders.

It turns out CRWD had exactly the same problem early in its public existence as shown by the following chart:

Notice the 90% drop in stock issuance over several quarters from 27% to 2%.

In fact, CrowdStrike has done away with its 2011 SBC plan altogether and has replaced it with a stock plan limited to 2% of the shares outstanding at the end of each fiscal year per the most recent 10k.

I would suspect PLTR is on the way to a similar plan as indicated in the following Seeking Alpha chart.

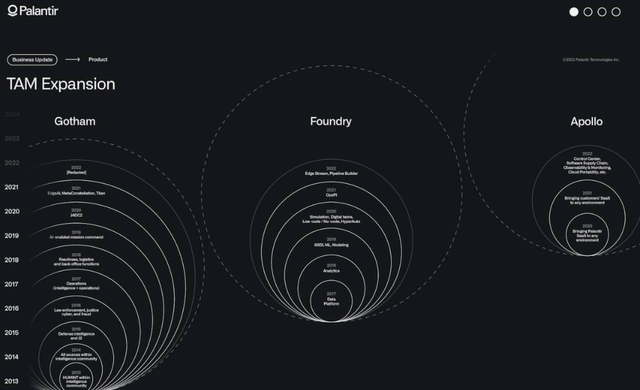

3. Palantir’s products are much more unique than CrowdStrike’s.

Ignoring for the moment corporate marketing, CRWD products look a lot like many other, much bigger companies’ offerings. Of course, security is a top priority for all customers large and small which is why there is so much competition in that market.

Looking at the top security products/services you can see many very big competitors all of whom sell for a much lower Price/MV ratio than CRWD.

Included in that long list of big competitors are such behemoths as Cisco, AWS, Microsoft, IBM, and Symantec.

Cisco

Obviously, CrowdStrike is growing very rapidly and security is 100% of their revenue as opposed to some smaller percentage for the big companies but still as CRWD grows the competition will become more and more fierce.

How long will CWRD maintain a Price/Sales ratio twice that of MSFT? And that is without considering the lack of profits at CRWD and the huge R&D capacity of the above list compared to CRWD. Over the next 3 years, CRWD’s Price/Sales ratio is more likely to come down than go up.

PLTR, on the other hand, has a more unique product offering. Although there are some similar products I really don’t know any direct competitors to Apollo, Foundry, and Gotham.

Risks to this analysis.

There are more risks than normal when comparing two volatile stocks like PLTR and CRWD with their relatively short trading history.

Going long PLTR over the last year has definitely been the wrong choice. In addition, PLTR is currently very dependent on government contracts and must expand its reach into the commercial market to be ultimately successful.

CWRD has grown rapidly thus far and if it continues to be competitive may continue to grow at a very high rate in what is a rapidly growing market with a huge TAM (Total Addressable Market).

If either or both of these risks turn out to be true then my thesis will end up being unviable.

Conclusion:

Both Palantir and CrowdStrike have had precipitous price collapses in the last year, but PLTR’s has been so great that it now looks like a bargain especially if you have a long-term 5-year investment horizon.

When you add the competitive environment for each company’s products, it also seems likely that PLTR’s uniqueness will likely result in an expansion of its Price/Sales ratio while CRWD’s Price/Sales ratio seems likely to fall over the same period.

Since they both are starting with identical TTM revenue Palantir looks like the better option.

Therefore, PLTR is a strong buy, and CRWD is a sell.

Be the first to comment