Andreas Rentz

Originally backed by the CIA, Palantir (NYSE:PLTR) is a global software company that has created a suite of gold standard products for large organizations, governments and military customers. The company is poised to ride the growth in the “Big Data” industry which is forecasted to be worth $273 billion by 2026. In addition, the recent Ukraine-Russia conflict has heightened geopolitical tensions and made the company’s software even more appealing.

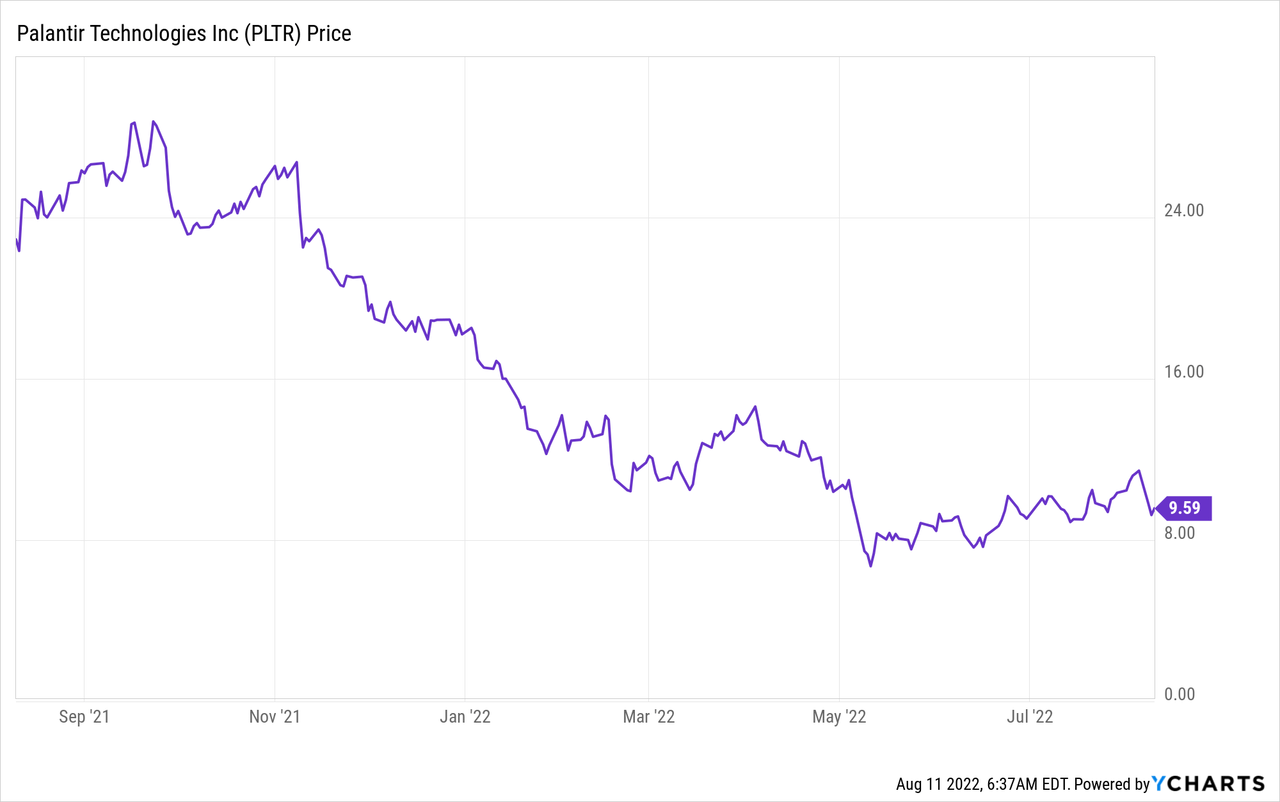

In my previous post on Palantir Stock, I highlighted the stock as having a “Fair value of $10 per share” and stated at the time when the stock was trading at $7/share it was 32% undervalued. Since that post the stock price popped by ~42%, so congratulations to those who invested. However, the company has recently announced muted financials for the second quarter of 2022 and highlighted slowing revenue growth. Thus in this post I’m going to breakdown the latest financials and revisit my valuation with the lower growth rates taken into account, let’s dive in.

Gold Standard Software

There is a lot of mystery around what exactly Palantir does and I personally believe many investors do not fully understand the business, as very few people have explained it simply. Therefore here is a quick overview of its main products;

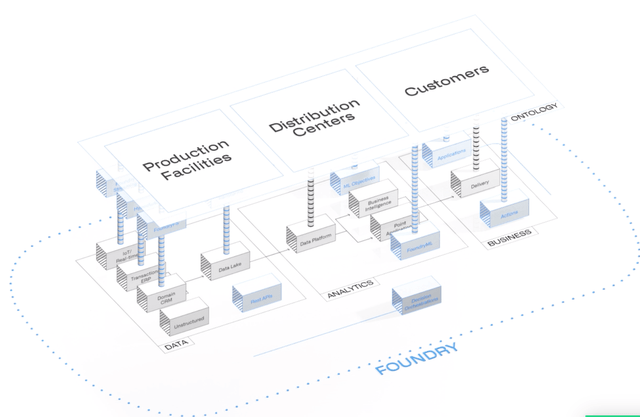

Foundry

This is dubbed “The Operating System for the Modern Enterprise ”. Enterprises (large Organizations) tend to have siloed data across multiple business units and require a system that can bring this data together in a safe, secure and intelligent way. Data is only as powerful as the ability to use it, but when siloed it cannot be used effectively for overall business intelligence. Foundry can also use this data to create “Digital Twins” of manufacturing and logistics setups, which is a great way to plan changes and capture data in real time.

Gotham

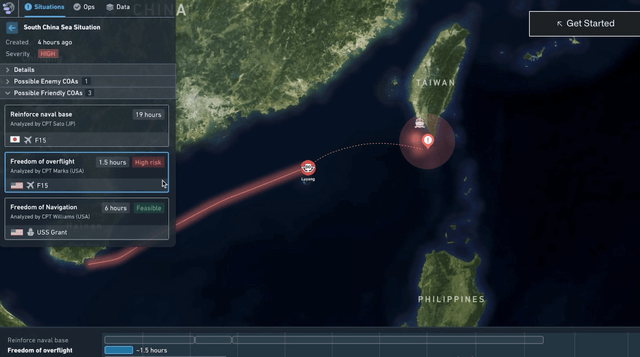

Gotham has been dubbed “The Operating System for Global Decision Making”. This platform enables complex situations with multiple reacting entities to be simulated with real time data feeds to enable faster decisions. A key example, is with the US Army and tracking Chinese Battleships around the coast of Taiwan. The Army generals can see the action in real time and setup automated scouting drones to fly to areas for surveillance, should there be any unusual activity in a region.

Palantir Gotham China Taiwan War Example (Palantir)

Given the Russia-Ukraine War and increased political uncertainty, the need for militaries from around the world to have software like this is becoming even more vital. Their tagline is “Thousands of Users, Millions of Sensors, A Single Pane of Glass”, basically this means a single dashboard to monitor real time operations.

Apollo

The Apollo platform is used for managing production software across major organizations across multiple industries from Airbus to Hyundai and even Rio Tinto, one of the largest mining companies in the world. The sheer range of industries automatically expands the total addressable market for Palantir’s software and thus makes the future growth runway huge.

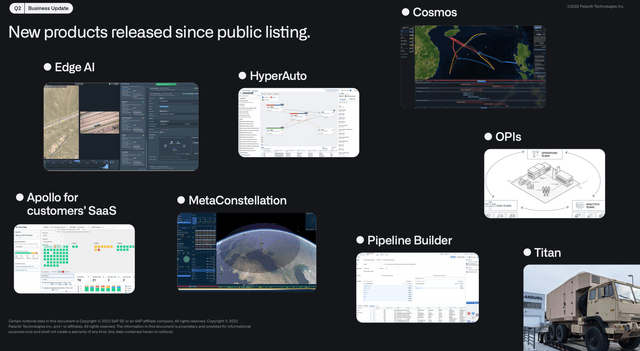

Palantir Products (Q2 Earnings Report)

MetaConstellation

The MetaConstellation product enables the power of Satellite constellations to be harnessed on earth. This even enables Artificial Intelligence models to be leveraged in Orbit, which truly is the next frontier of business intelligence. Space is the next battleground for businesses from Elon Musk’s Starlink to SpaceX and even Bezos Blue Origin. Palantir has recently scored a partnership with Satellogic a leader in Satellite Sub-Meter resolution imaging. “Sub-Meter” effectively means each pixel from a Satellite photograph is less than a meter in width and thus enables the monitoring and tracking of activities on earth. Applications include crop monitoring, disaster relief, military surveillance and even National Security. For all you traders, Satellite imagery has even been used to track oil reserves in containers and thus it can be used to calculate the supply/demand balance and then oil prices. Google also has a Satellite play called “SkyBox”, which it acquired for $500 million a few years back. Google’s platform seems to be focused on improving it’s mapping than for national security applications, like with the Palantir product.

High Retention Rate – Competitive Advantage

Palantir had a net dollar retention rate of 119% as of the second quarter. This means customers are staying with the company and spending more through upsells. In the second quarter conference call, Palantir Founder and CEO Alex Karp spoke in detail about the “stickiness” of Palantir’s products with customers. He states that;

“In the end, all software products actually have to be measured by is this replaceable, how easy could it be replaced, is the underlying platform durable or fleeting, and could a third party highly technical with massive distribution disrupt these products?

It would take many, many years of the world’s best engineers to build them — and you would be building them as we’ve improved them and as we capture the market.” – Palantir CEO Alex Karp

Slowing Second Quarter

Palantir released mixed financial results for the second quarter of 2022. Revenue increased by 26% year over year to $473 million. Now although growth rates were slower than prior quarters such as 30% YoY in Q1, they actually beat analyst estimates by $1.29 million.

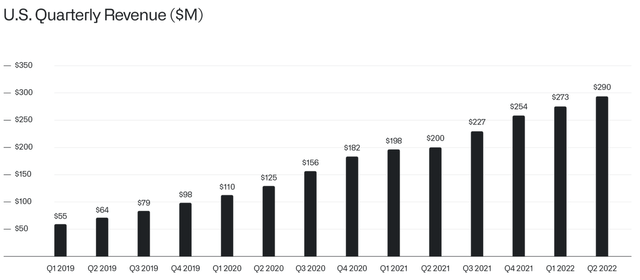

US Revenue (Q2 earnings report)

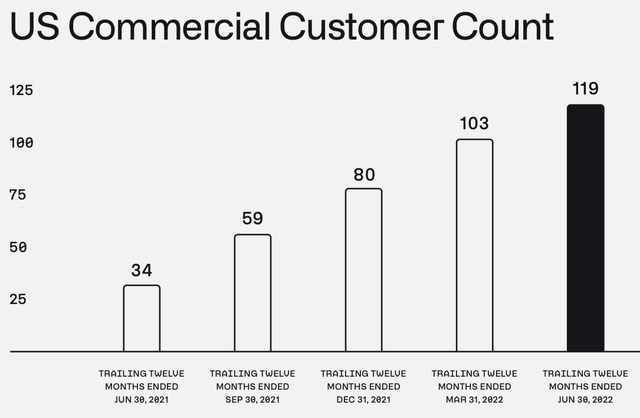

US only revenue popped by 45% year over year to $290 million and commercial revenue also grew a rapid 46% year over year. US commercial revenue was the shining light, as this increased by a blistering 120% year over year. With US Commercial customer count increasing by 250% year over year. This is a big deal as the company had just 34 US commercial customers in Q2 2021 and grew this to 119 customers by Q2 2022.

US Commercial Customers (Q2 Report)

Palantir’s Healthcare segment also showed rapid growth of 267% year over year, from $42 million to $153 million in revenue. The company has previous scored partnerships with the National Health Service (NHS) in the UK.

As a software company, Palantir has an extremely high adjusted gross margin of 81%, which has stayed fairly constant (only dipping by 1% percentage point year over year).

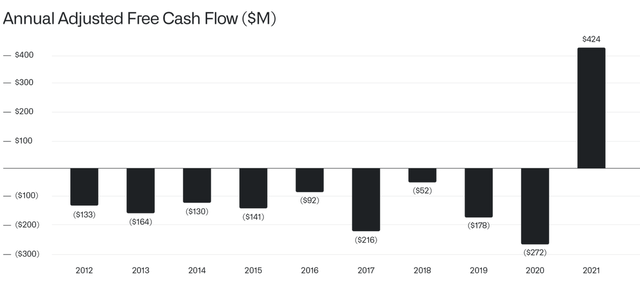

However, the company did produce a heavy loss of $42 million in Q2,22. Earnings Per Share (EPS) was -$0.01, which missed estimates by $0.04. This may seem terrible, but the company states it was driven primarily by losses in Marketable securities. This is a common trend I have seen across earnings reports for companies, as the rising interest rate environment is squeezing the multiples of growth stocks. The good news is Adjusted free cash flow was $61 million, which represents a 13% margin and the seventh consecutive quarter of positive free cash flow.

The company also has a fortress balance sheet with $2.4 billion in cash and cash equivalents and no debt. In July the company expanded its revolving credit facility by adding $450 million in term loan facility and the option for an additional $950 million if required.

Revised Guidance

Management has revised its guidance down to $1.9 billion for FY22, this would represent just a 23% growth rate year over year. This is a far cry from the 41% growth rate achieved in the year FY21. CEO Alex Karp stated, this lower guidance was due to the “uncertainty toward the end of the year” and goes onto say;

“As organizations around the world face more pressure and experience more pain, there will be a slowdown in the rate of spending and lengthening of sales cycles, but it will also reveal gaps in enterprises operations, gaps our software can solve. In the short term, this means less revenue now. But on longer time horizons, it accelerates our business” – Palantir CEO Alex Karp

However, Karp remains “very optimistic that the next three years will look a lot like the last three years”.

Advanced Valuation

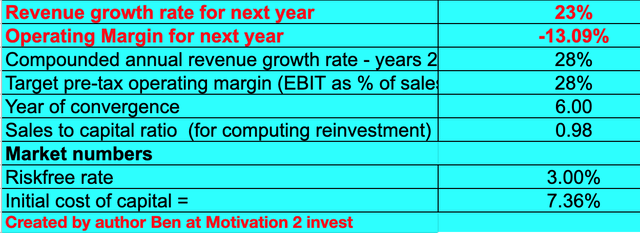

In order to value Palantir I have plugged the latest financials into my valuation model, which uses the discounted cash flow method of valuation. I have revised down my prior Revenue estimates of 30% to a 23% growth rate for next year and 28% over the next two to five years. As I believe high inflation won’t last forever and the macroeconomic situation will improve. In addition, I suspect management may be “sandbagging” slightly to lower expectations and then surpass them.

Palantir Stock Valuation 1 (created by author Ben at Motivation 2 invest)

I have also forecasted its operating margin to increase to 28% over the next 6 years, as the company benefits from high operating leverage from its software platform. In addition, to the high customer retention and upsells mentioned previously.

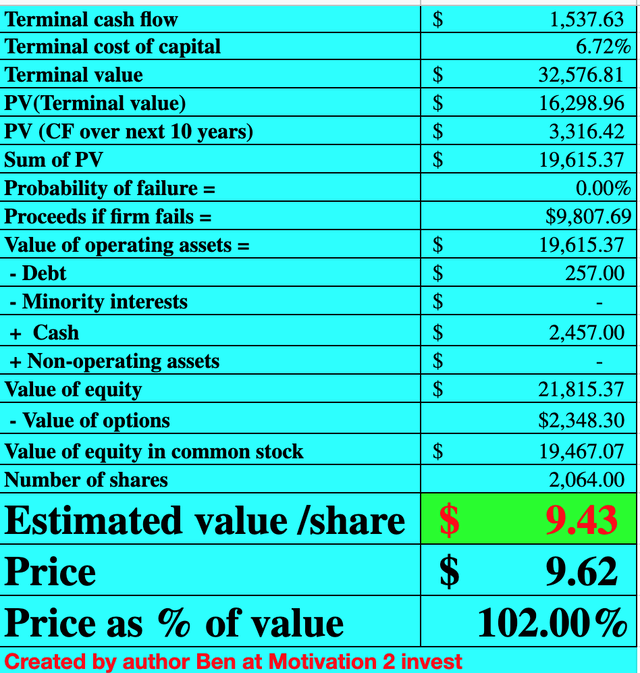

Palantir Stock Valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $9.43 per share, the stock is trading at ~$9.62 and thus is fairly valued at the time of writing.

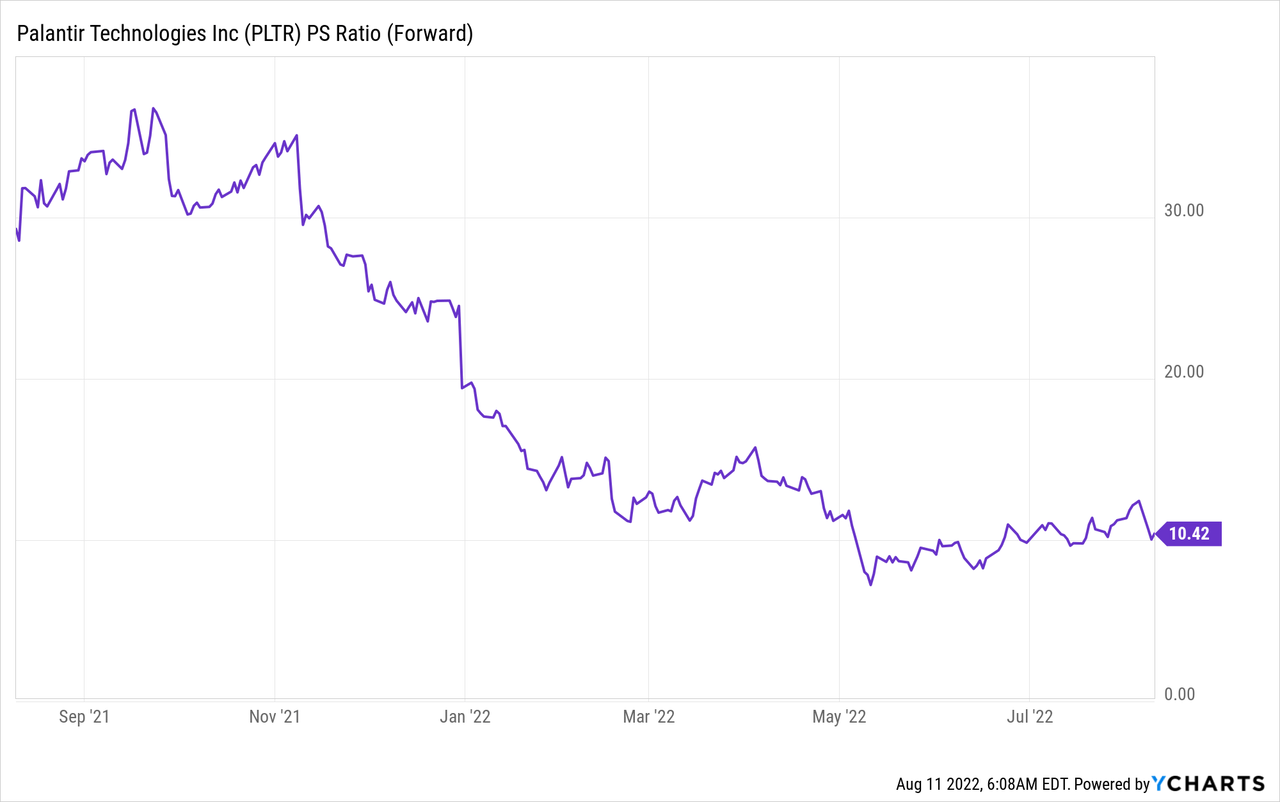

As an extra data point Palantir has seen its Price to Sales Ratio compress substantially from over 30 in 2021, to approximately 10 at the time of writing.

Risks

Macroeconomic uncertainty

The high inflation and rising interest rate environment has caused many analysts to forecast a “Recession”. We have already seen multiple companies start to cut costs and although I believe a lot of this is fear driven, it can lengthen the sales cycle for Business to Business product adoption.

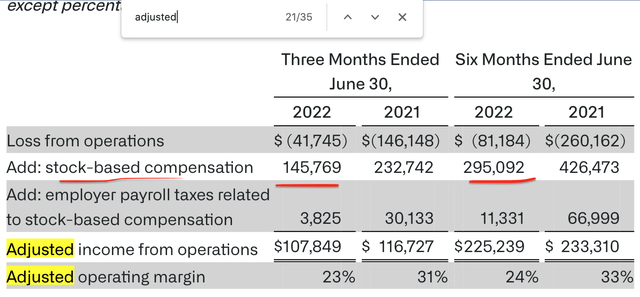

Stock Based Compensation

Palantir states a lot of their earnings are “Adjusted”. In fact the word “Adjusted” is used a staggering 35 times in their recent press release. This Adjustment excludes “Stock Based Compensation” which was a staggering $146 million in Q2,22 or a whopping 30% of its $473 million in revenue. Now although this is having improved since the $233 million in Q2, 2021, it is a substantial expense which is overlooked. On a positive note, recruiting high quality talent is extremely challenging these days and thus companies must offer lucrative stock compensation packages to attract the best. As long as the amount of stock based compensation relative to total revenue declines over time, then this can be an effective strategy and thus it’s an indicator to watch.

Palantir Stock based Compensation (created by author Ben at Motivation 2 Invest)

Final Thoughts

Palantir is a best in class leader in software for enterprises and national security applications. The founder led company is growing its commercial revenue strong and has a large TAM to attack. However, the slowing growth, “fair” valuation and monstrous stock compensation makes this stock speculative in the short term, therefore I have labeled the stock as a “Hold”.

Be the first to comment