Kativ

Triumph Group’s (NYSE:TGI) backlog and long-term agreements with large corporations would imply a valuation higher than the current market price. Management also communicated that the supply chain does not seem to represent such a large issue for the company. Even taking into account a declining commercial aerospace market and a decrease in the US Defense budget, I believe that the company is a buy at the current price mark.

Triumph Group

Triumph Group, Inc. designs, engineers, and manufactures aerospace and defense systems and structures for the global aviation industry.

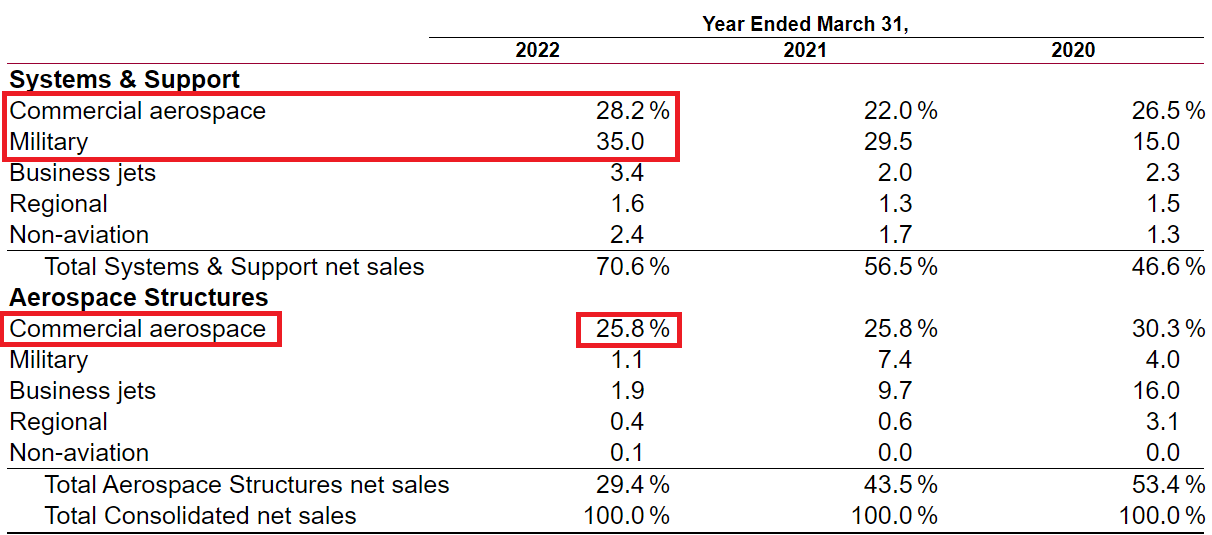

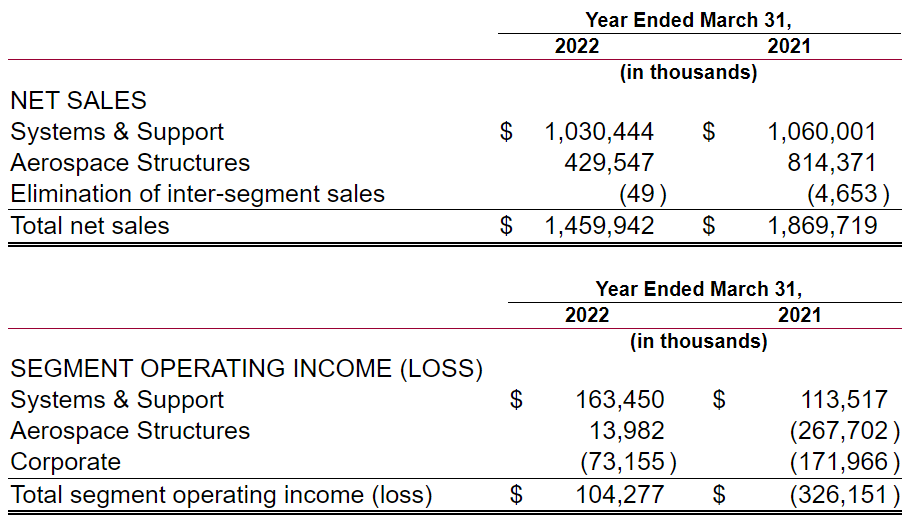

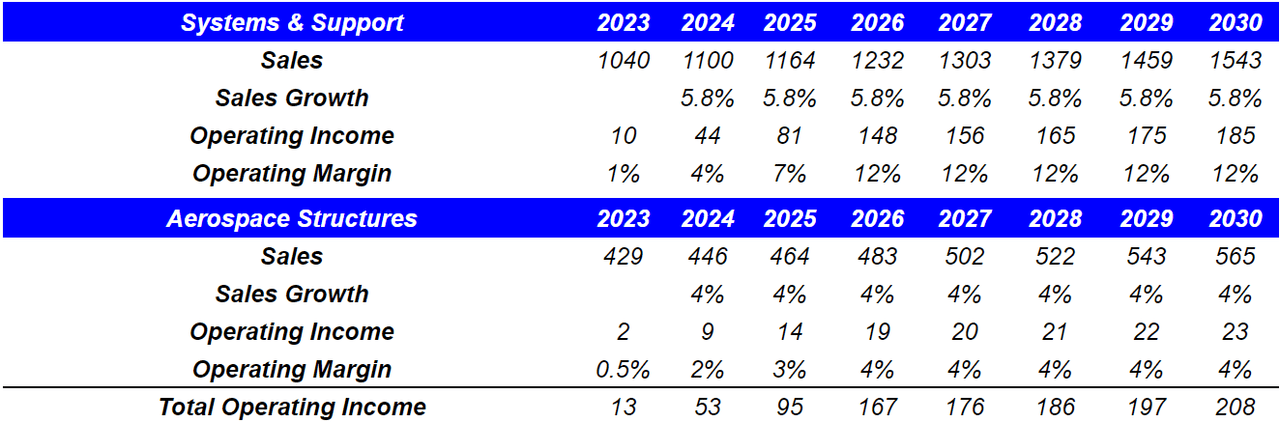

The company’s net revenue is reported in two business segments, Systems & Support and Aerospace Structures. Systems & Support segment is the most relevant in terms of net sales, and works mostly for commercial aerospace clients and military clients. Aerospace Structures manufacturers large metallic and composite structures. I made this distinction because my financial model takes into consideration that net sales from Systems & Support may grow at a faster pace than that of Aerospace Structures.

10-k

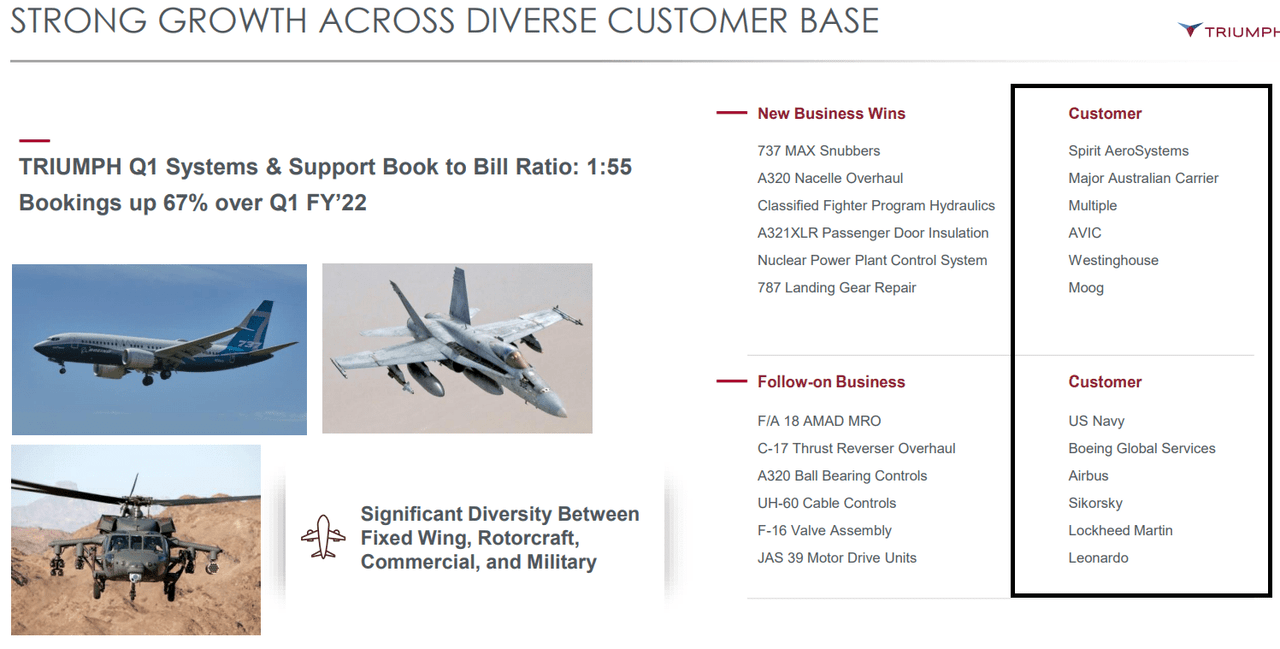

Triumph Group signs agreements with large and established customers, so I believe that net revenue will likely be stable over time. The US Navy, Airbus (OTCPK:EADSF), Boeing (BA), Leonardo (OTCPK:FINMF), and Westinghouse (WAB) are some of the company’s clients.

Q1 FY 23 Earnings Presentation

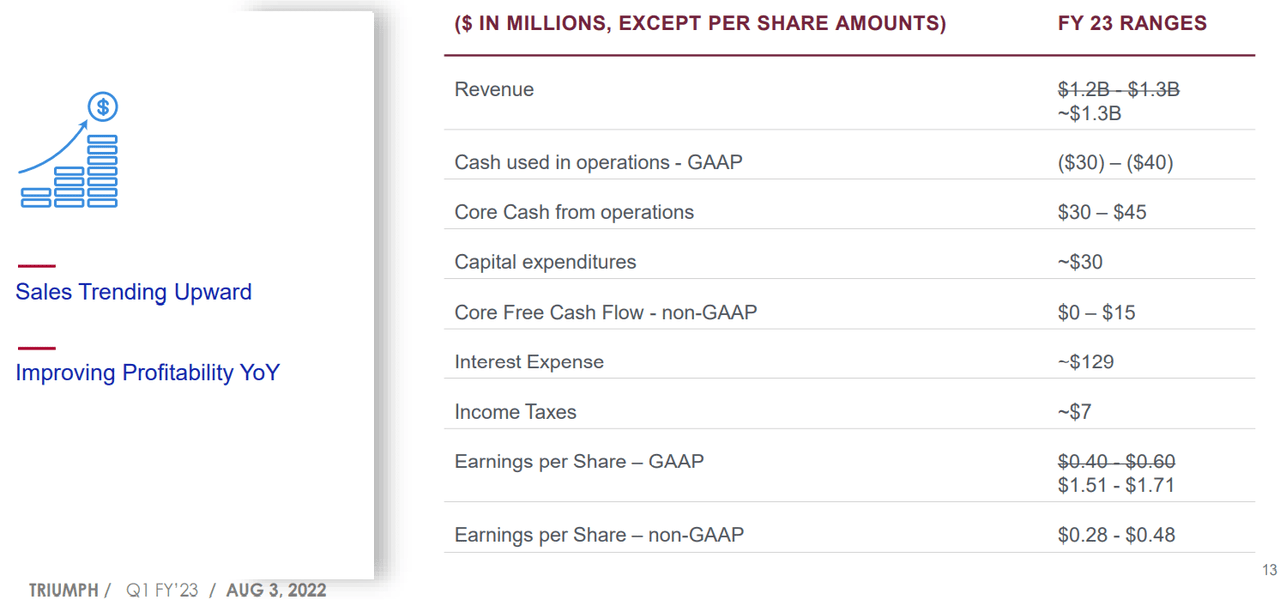

Guidance for The Year 2013 Increased And Includes 2023 Sales Of $1.3 Billion

In a recent presentation to investors, Triumph noted that sales are trending up, and profitability continues to improve. Management believes that the year 2023 could include core cash from operations of about $30-$45 million, revenue around $1.3 billion, and earnings per share at $1.51-$1.71. After further increases in the guidance of the company, I decided to launch my own financial forecast about the future of Triumph Group.

Q1 FY 23 Earnings Presentation

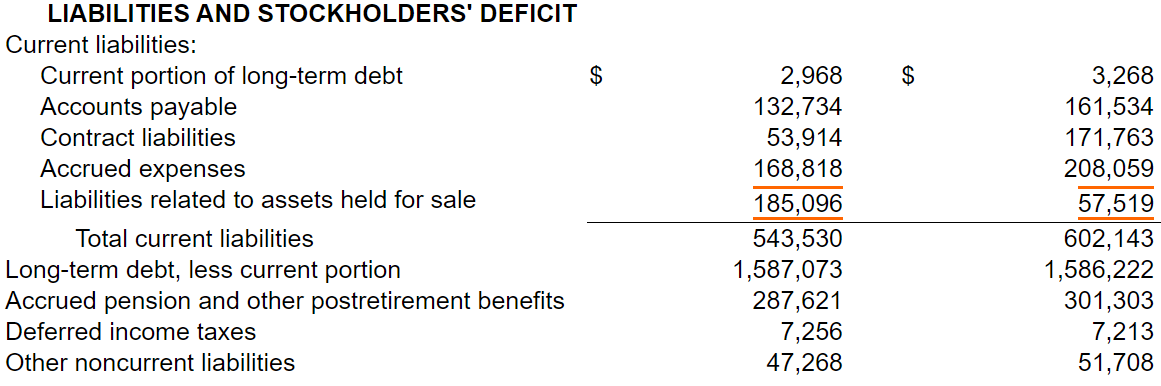

Balance Sheet

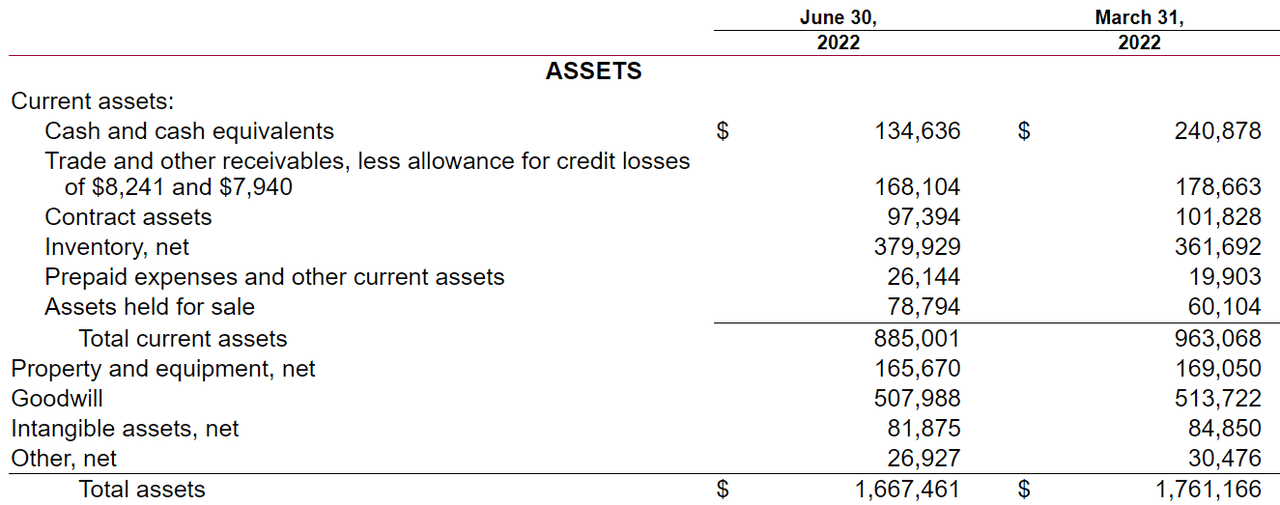

As of June 30, 2022, the company reported $134 million in cash and cash equivalents, $1.6 billion in total assets, and goodwill worth $507 million. Considering the total amount of goodwill, I would say that Triumph has an outstanding expertise in the M&A markets. Inorganic growth will most likely play a role in the future of the company.

10-Q

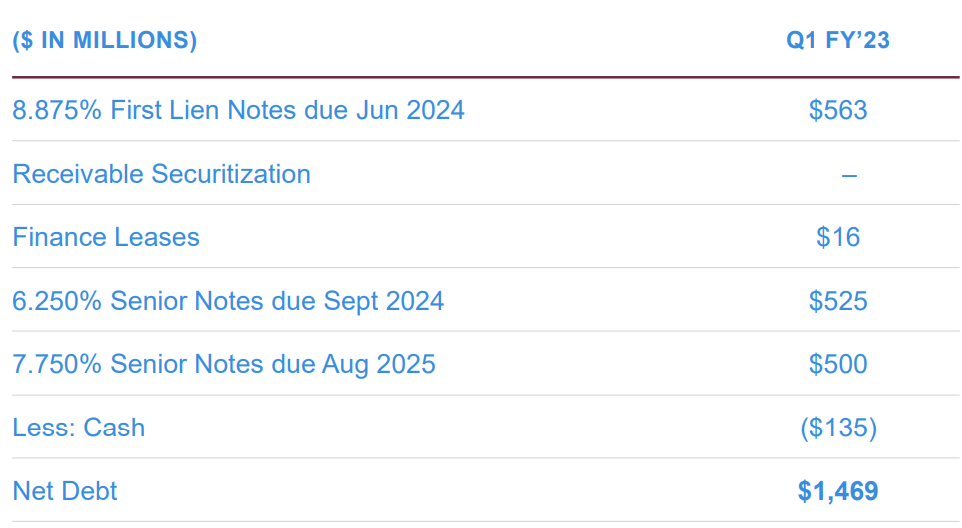

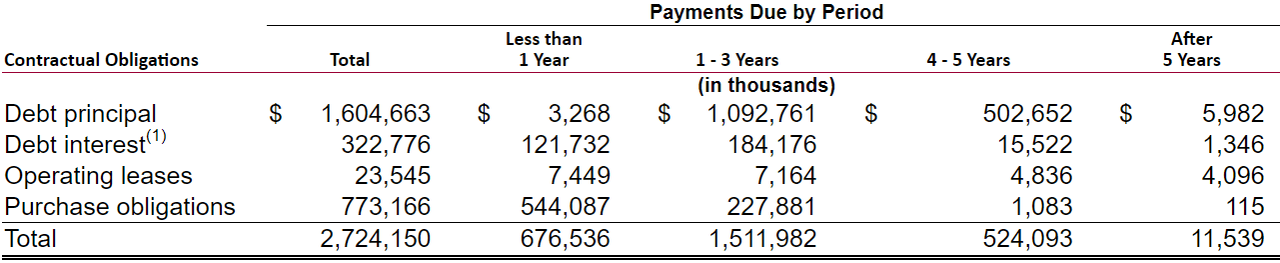

Triumph’s total amount of debt is not small. Total debt stands at more than $1.589 billion. The net debt is equal to $1.46 billion. With this in mind, I had a close look at the company’s contractual obligations and when they are due.

10-Q Q1 FY 23 Earnings Presentation

The list of contractual obligations includes $0.67 billion in less than one year and $1.511 billion in one to three years. The company has long-term contracts with large partners, so most investors may not worry about the total amount of debt. With that, let’s be clear that the company may not be for ultra conservative investors.

10-k

My Base Case Scenario: Successful Long-Term Agreements And Human Capital Management Could Lead To A Fair Price Of $31 Per Share

In my view, under normal circumstances, Triumph Group will continue to see backlog growth because the company has a number of long-term agreements with several large clients. I couldn’t identify the amount of recurrent sales reported by Triumph Group. However, with long-term agreements, we could say that future revenue growth is likely:

As of March 31, 2022, we had outstanding purchase orders representing an aggregate invoice price of approximately $1.42 billion, of which $1.17 billion and $0.25 billion related to Systems & Support and Aerospace Structures, respectively. Source: 10-k

I also expect that Triumph will continue to deal with any potential supply chain issue as management did in the most recent history. In this regard, let’s include some of the optimistic words from management:

Our actions to mitigate supply chain constraints and work with our customers and suppliers to ensure continuity and affordability continue to differentiate TRIUMPH. With a growing and profitable backlog, TRIUMPH is well positioned to benefit from continued strength across nearly all of our end markets. Source: Triumph Group – TRIUMPH REPORTS FIRST QUARTER FISCAL 2023 RESULTS

Under my base case scenario, Triumph successfully develops new technologies, so it will be able to attract and identify the best human capital. Let’s note clearly that Triumph Group mentioned that human capital management is a key priority for Triumph Group.

Our human capital management strategy places significant importance on attracting and developing a talented and diverse workforce by creating a workplace that is engaging and inclusive and promotes a culture of innovation, excellence, and continuous improvement. Source: 10-k

In the year ended March 31, 2022, Triumph’s Systems and Support business segment reported net sales of $1.03 billion and an operating margin of 15%. Aerospace Structures reported net sales of $429 million and an operating margin of 3%. In my view, future financial ratios will most likely not be far from these figures.

10-k

The growth for the Aerospace and Defense Condition Monitoring System is expected to be close to 5.8%. With this in mind, I believe that it is fair to expect sales growth of 5.8% y/y for the Systems and Support segment. Besides, I would be expecting sales growth of 4% for the Aerospace Structures business segment because the aerospace parts manufacturing market size grows at that pace:

The global Aerospace and Defense Condition Monitoring System market is expected to rebound at a healthy CAGR of 5.8% during the forecast period to reach a value of US$ 460mn in 2027; states Stratview Research. Source: Aerospace And Defense Condition Monitoring System Market

The global aerospace parts manufacturing market size was estimated at USD 851.5 billion in 2021 and is expected to expand at a compound annual growth rate of 4.0% from 2022 to 2030. Aerospace Parts Manufacturing Market Size Report, 2022-2030

Under the previous conditions, I obtained 2030 net sales of $1.5 billion for the Systems and Support business segment and operating income of $185 million. The Aerospace Structures business unit would report 2030 net sales of $565 million and operating income of $23 million.

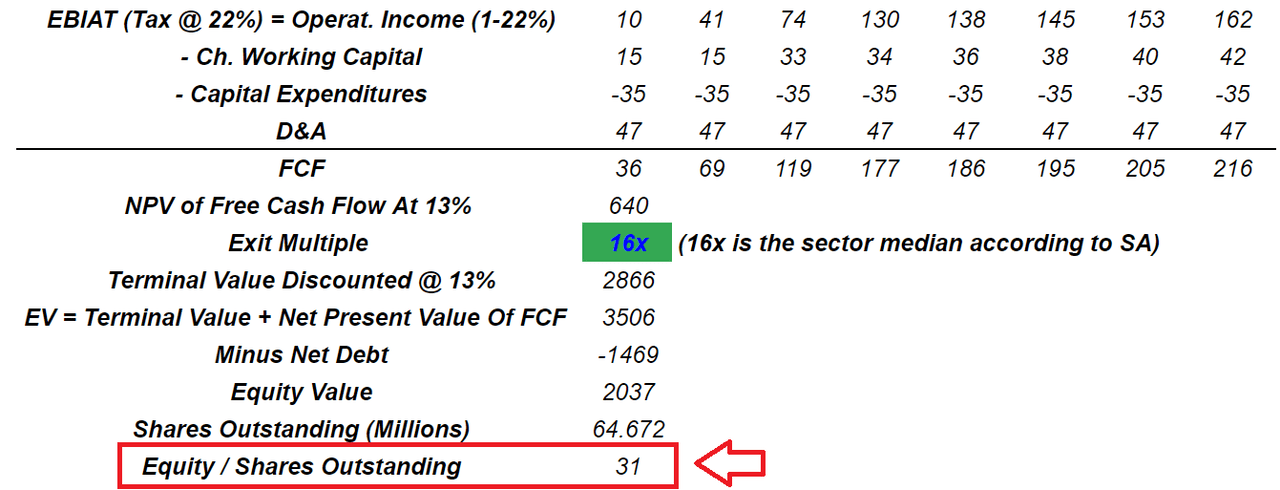

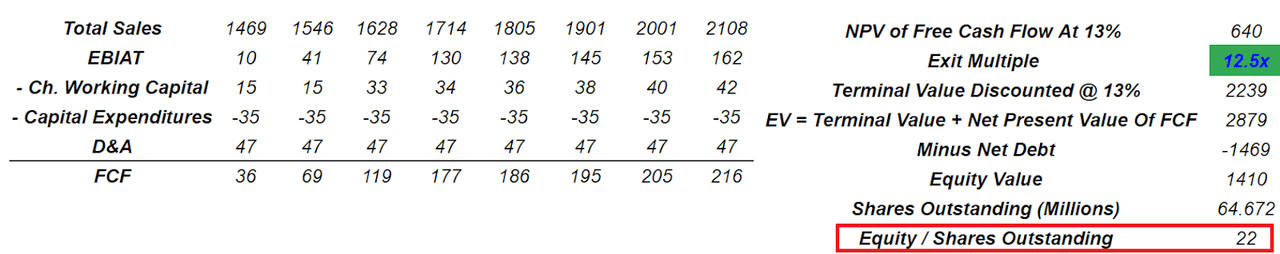

My DCF Model

With the total operating income obtained from both business units, I made an assumption of an effective tax of 22% to obtain the earnings before interest and after taxes. My results include free cash flow around $36 million in 2023 and $216 million in 2030.

Like other investment analysts, I remained very conservative while choosing the weighted average cost of capital. I used a discount of 13% and an exit multiple of 16x. Note that according to Seeking Alpha, the median EV/EBIT for the sector is 16x. The sum of future FCFs discounted at 13% and the terminal value implied an enterprise value of $3.5 billion. If we subtract the net debt, the equity value would stand at close to $2 billion, and the equity per share would be $31 per share.

My DCF Model

If we create a case scenario a bit less optimistic, with an exit multiple around 12.5x, the equity valuation would be $1.4 billion. Finally, the equity per share would stand at $22 per share.

My DCF Model

My Bearish Case Scenario Would Include Decrease In Defense Budgets, Higher Oil Prices, And Bad Conditions For The Commercial Aerospace Market

Triumph Group depends on the commercial aerospace market, which is quite cyclical. It means that in an environment of recession, customer demand will likely decrease, which would lead to a significant decrease in the free cash flow. Diminishing free cash flow expectations will likely lead to decreases in the share price.

Let’s also point out that the company works with several commercial airlines, which appear to be suffering financial difficulties. Even with those clients receiving federal assistance, it is quite unlikely that Triumph Group would be able to obtain considerable assistance. Under this case scenario, I assumed that help from federal agencies will not be enough to stop the stock price from going down.

Finally, under not so unlikely circumstances, an eventual increase in the oil price could result in pressure on the operating costs of airlines. If airlines can’t pass on increases to customers, Triumph Group may see a deterioration in its FCF margins. An increase in operating costs will likely lead to less stock valuation.

Systems and Support business segment obtains a significant part of its revenue from programs with the U.S. Department of Defense. In the future, defense budgets may decline as a result of changes in the political environment, U.S. foreign policy, or macroeconomic conditions. In any case, Triumph may suffer a significant decline in the amount of revenue, which would lead to stock price declines.

In the last annual report, Triumph Group warned about the consequences of failures in the development of new technologies. If Triumph can’t meet the demand of customers, or expenses are larger than expected for certain technologies, both revenue and free cash flow will likely decrease. The following is a list of issues, which management may find in the future:

New programs with new technologies typically carry risks associated with design responsibility, development of new production tools, hiring and training of qualified personnel, increased capital and funding commitments, ability to meet customer specifications, delivery schedules and unique contractual requirements, supplier performance, subcontractor performance, ability of the customer to meet its contractual obligations to us, and our ability to accurately estimate costs associated with such programs. Source: 10-k

Finally, I believe that the revenue concentration may be an issue for Triumph. The company appears to have a strong relationship with Boeing. Under detrimental circumstances, Boeing may require less products from Triumph Group, which would lower the company’s revenue significantly. The results would include a decline in the stock price.

As disclosed in Note 19, a significant portion of our net sales are to the Boeing Company. Refer to Note 19 for specific disclosure of the concentration of net sales and accounts receivable to these customers. A significant reduction in sales to Boeing may have a material adverse impact on our financial position, results of operations, and cash flows. Source: 10-k

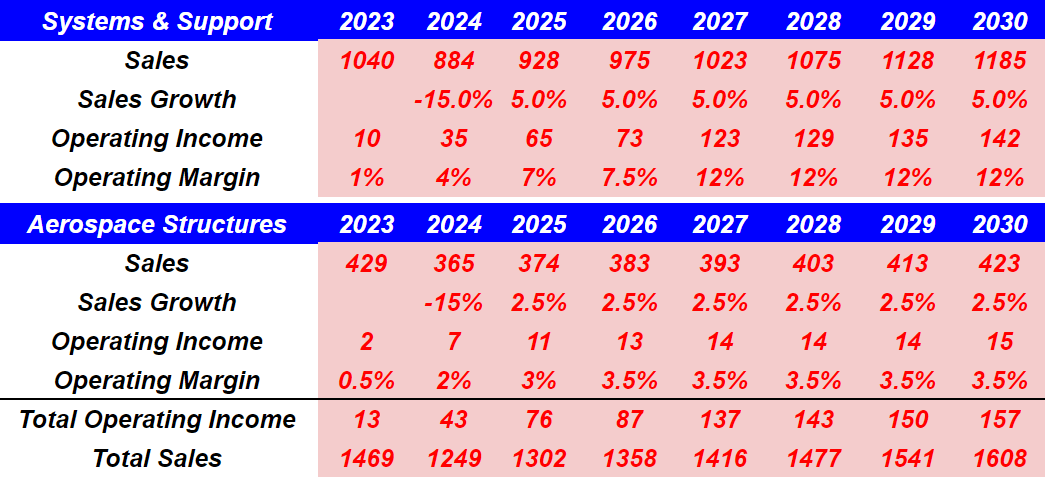

Under bearish assumptions, I believe that sales growth of -15% in 2024 could happen. I also included growing operating income in both business segments. The results would include 2030 total sales of $1.6 billion and 2030 total operating income close to $150 million.

My DCF Model

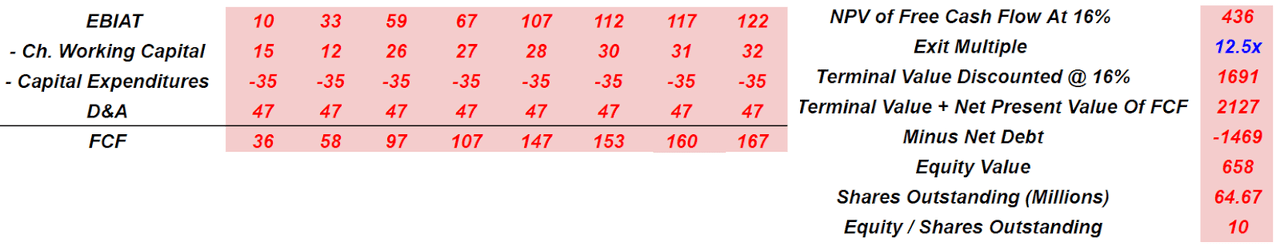

With an effective tax of 22%, 2030 EBIAT could stay close to $122 million. Besides, after subtracting conservative changes in working capital and capex, and adding the depreciation, 2030 FCF would stand at close to $167.1 million. With a discount of 16%, the discounted terminal value would be $1.691 billion, and the sum of future free cash flows would be $436 million. Finally, we would be talking about an implied enterprise value of $2.12 billion, and with almost a share count close to 65 million, the implied stock price would be $10.

My DCF Model

Takeaway

Triumph Group reports a significant backlog thanks to long lasting agreements with large corporations. Management recently communicated that the company is successfully solving potential supply chain issues. Under normal circumstances, in my view, future revenue and free cash flow will likely trend north. Even considering some potential risks from a detrimental commercial aerospace market or decreases in the US Defense budgets, I believe that the company is a buy. Keep in mind that my DCF model delivered a valuation of around $31 per share, which is significantly higher than the current stock market price.

Be the first to comment