prill/iStock via Getty Images

Investment Thesis

Since our last analysis, Palantir Technologies Inc (NYSE:PLTR) had fallen further by 15.26%, from $10.55 on 3 May 2022 to $8.94 on 3 June 2022. It is apparent that our deductions on the perceived bottom then were not on point, given the negative sentiments and overly bearish market.

Nonetheless, I believe it is important to learn from our mistakes while understanding that the market is generally punishing many tech stocks since November 2021, given the hypergrowth during the two years of the COVID-19 pandemic. Even the S&P 500 Index fell by -10.52% in the past six months, though PLTR sustained even bigger damage of -52.45% at the same time.

As a result, it is evident that the time of maximum is not even here yet, given the potential deceleration of revenue growth in FY2022. Therefore, we are revising our rating on PLTR to hold for now, despite our previous bullish stance on the stock.

PLTR Still Executed Well In FQ1’22, Though FQ2’22’s Softer Guidance Is Worrying

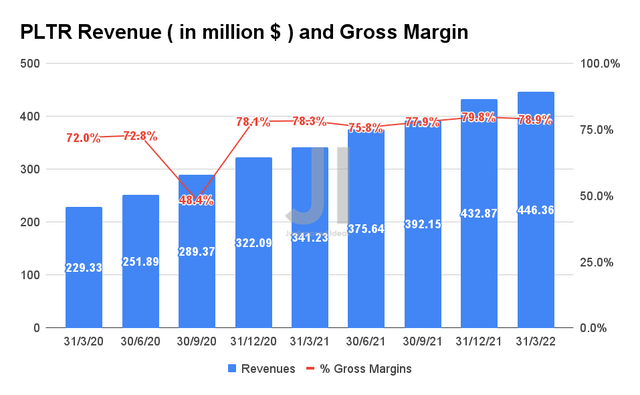

PLTR Revenue and Gross Margins

In FQ1’22, PLTR reported revenues of $446.36M and sustained gross margins of 78.9%, representing an excellent revenue improvement of 3.1% QoQ and 30.8% YoY. The company also ended the quarter with an increasing remaining deal value of $3.5B and performance obligations of $1.2B, representing YoY growth of 26% and 86%, respectively. Furthermore, PLTR reported exemplary net dollar retention of 124% in FQ1’22, while also growing its total consumer count by 86% YoY from 149 to 277.

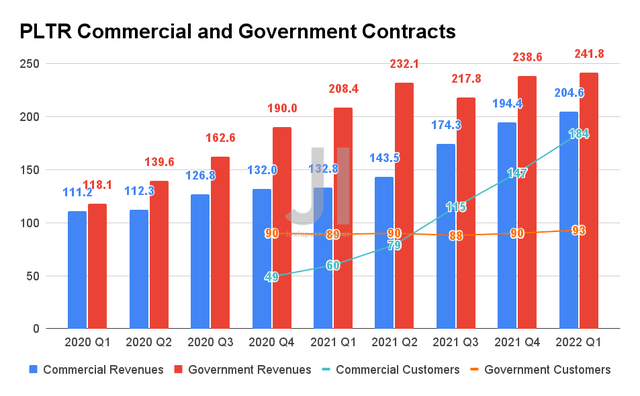

PLTR Commercial and Government Contracts

Though PLTR has historically relied mostly on governmental contracts, it is apparent that the demand for its technology in the commercial sector is growing exponentially. By FQ1’22, the company reported that the commercial segment accounted for 45.8% of its revenues, as compared to 42% in FQ1’21. While the government sector seems to have peaked in revenue growth since FQ2’21, the commercial segment continued to grow at an impressive CAGR of 35.62% in the past two years. In addition, PLTR’s number of commercial customers continues to grow almost linearly in the past three quarters, pointing to its robust demand and adoption over time.

Assuming that PLTR’s commercial revenue growth continues at such a rate, we may expect the sector to easily exceed the government sector in the next two quarters. The number of commercial consumers is also expected to triple at the same time, compared to the plateauing consumers in the government sector. Nonetheless, given the rising interest rates and a potential recession, we may also see temporary headwinds for global commercial spending as more companies tighten their belts in the next few quarters, thus the softer FQ2’22 guidance. We shall see.

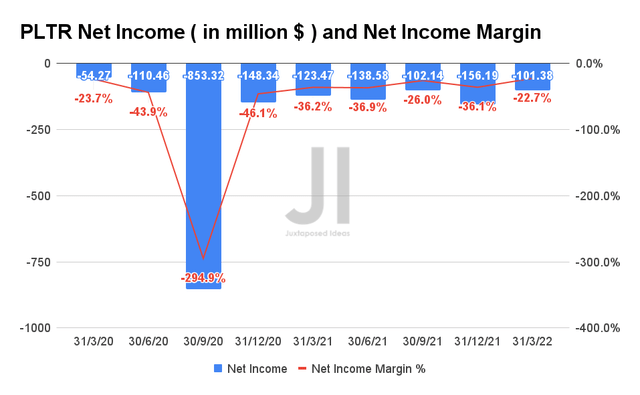

PLTR Net Income and Net Income Margin

In FQ1’22, PLTR also reported an improved GAAP net losses margin of -22.7% with net losses of -$101.38, representing an increase by 13.5 percentage points and of 21.7% YoY. Nonetheless, it is also clear that given the current trajectory in operating expenses and Stock-Based Compensation (SBC) expenses (to be discussed later), it is unlikely that the company will report GAAP net income profitability any time soon. As a result, we do not expect the stock to report a massive recovery or rally in the next few quarters, given that its lack of profitability and historical SBC expenses are two of the sorest spots for many investors.

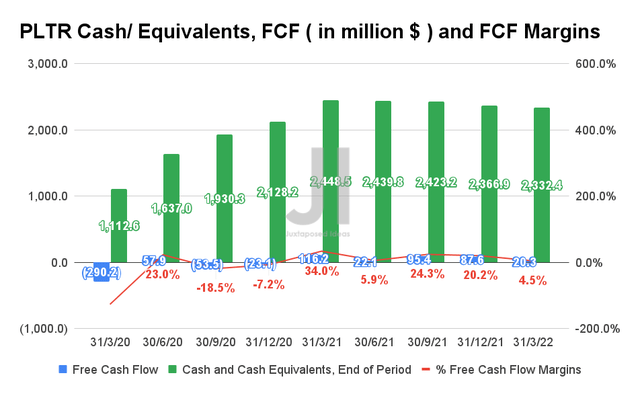

PLTR Cash/ Equivalents, FCF, and FCF Margins

Nonetheless, PLTR has also been reporting positive Free Cash Flow (FCF) in the past five months, with $20.3M of FCF and 4.5% of FCF margins in FQ1’22. Though there is an apparent decline in FCF margins in the latest quarter, we are not concerned, given its massive war chest of $2.33B in cash and equivalents on its balance sheet. In addition, we also expect a higher FCF margin in FQ2’22, given its improving operating margins.

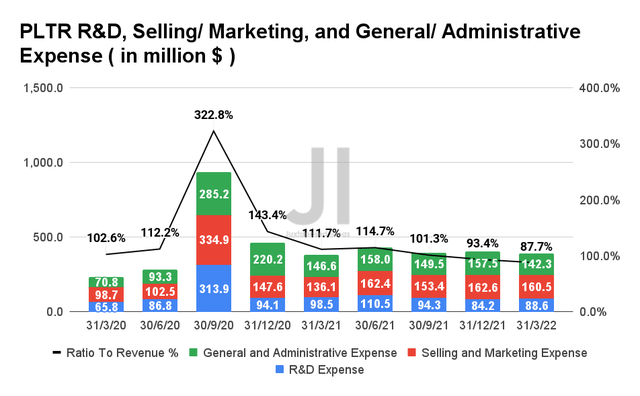

PLTR R&D, Selling/ Marketing, and General/ Administrative Expense

It is also evident from the chart that PLTR has been prudent in its operating expenses, given its growing revenues and lower FCF profitability. In the past five quarters, the company has spent a somewhat sustained operating expense with improved operating margins. In FQ1’22, PLTR spent 87.7% of its revenues on R&D, Selling/ Marketing, and General/ Marketing Expenses, as compared to 111.7% in FQ1’21 and 93.4% in FQ4’21. Therefore, based on its $470M revenue guidance for FQ2’22 and assuming similar operating expenses in FQ1’22, its operating metrics would improve to 83.2% for the upcoming quarter. We shall see.

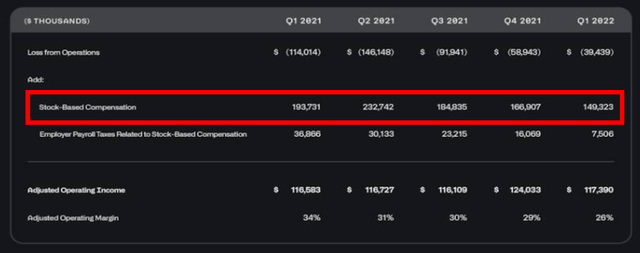

PLTR Stock-Based Compensation

In addition, PLTR has been reducing its SBC expenses over time, from $193.7M in FQ1’21 to $149.3M in FQ1’22, representing 56.7% and 33.4% of its revenues, respectively. So, investors who had been concerned about the company’s historically high SBC expenses can rest assured of their share ownership moving forward. As a result, we believe that the company is well poised for the potential slowing down of the economy and deceleration of revenue growth, assuming a lowered revenue guidance for H2’22 as well.

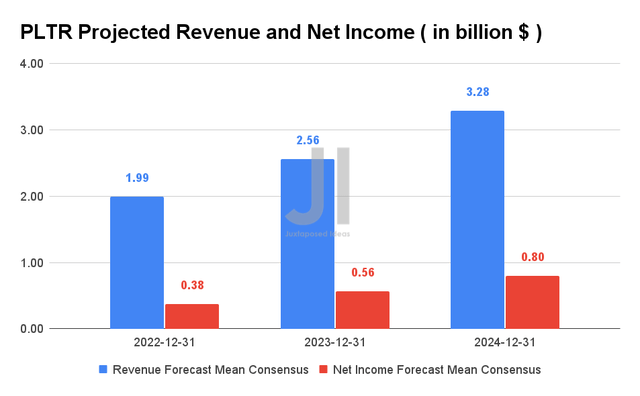

PLTR Projected Revenue and Net Income

Since our last analysis in May 2022, PLTR’s revenue and adj. net income growth have remained largely in line with no further downgrades. In addition, these numbers have already been upgraded by at least 28%, since our February 2022 analysis. It proves that despite the lower FQ2’22 guidance, the consensus is still optimistic about the PLTR’s capability in catching up by H2’22. As a result, we are not that concerned and shall continue monitoring its progress moving forward, though macro prospects do not seem promising for now.

In the meantime, we encourage you to read our previous article on PLTR, which would help you better understand its position and market opportunities.

- Palantir: The Bottom Is Here, Buy At Excellent P/E Valuations

- Palantir: SBC Is Definitely A Concern, But The War Is An Even Bigger Problem

So, Is PLTR Stock A Buy, Sell, or Hold?

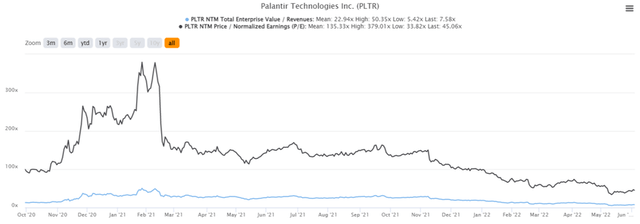

PLTR 2Y EV/Revenue and P/E Valuations

PLTR is currently trading at an EV/NTM Revenue of 7.58x, NTM P/E of 45.06x, and Market Cap/ FCF of 41.47x, lower than its 2Y mean of 22.94x, 135.33x, and -1186.93x, respectively. The stock is also trading at $8.94 on 3 June 2022, down 69.4% from 52 weeks high of $29.29. As a result, it is evident that PLTR has been massively moderated and looks rather attractive now after the hype is over.

PLTR 2Y Stock Price

However, given the market’s bearish sentiments and PLTR’s lower FQ2’22 guidance, consensus estimates have downgraded the stock to hold for now. In addition, given its “meme stock” status and continuous price declines, the stock, the management/ CEO, and its prospects have often been bashed by the investing community. In addition, the stock has continued to decline to below IPO levels since May 2022, thereby signaling the ongoing pain for existing PLTR investors.

Nonetheless, we believe that there are still many possibilities for PLTR and its technology, given its uniquely competitive moat and long-term governmental contracts. Therefore, we are still holding to our personal bullish stance on its eventual stock recovery in the next few years. Furthermore, we could be seeing its real potential now that the company is openly participating in Ukraine’s defense during the ongoing war, with a potential office opening in the country. Ukraine Minister of Digital Transformation, Mykhailo Fedorov, said:

We are actively working not only on the digital blockade of the Russian Federation, but also to attract top international companies to Ukraine. This is one of our priorities today. Modern warfare has changed the rules, and technology plays a big role in it. (Defense News)

However, though we would love to still rate PLTR as a buy for speculative investors with excess capital and over much patience, given that the stock will be a potential winner in the next few years, we believe it is time to take caution and revise our rating to Hold for now. Our best bet would be to monitor the situation further and see how the stock market performs in the coming weeks/months, given that PLTR’s stock performance is no longer reliant on its fundamentals and prospects.

Maybe the bears will prove me right, in that the PLTR stock could decline to $6 or even $5 during the darkest hours, which would prove to be a more attractive entry point for interested investors. Only time will tell.

Therefore, we revise our rating on PLTR stock as a Hold for now.

Be the first to comment