Michael Vi/iStock Editorial via Getty Images

A great deal of emphasis is being laid on how rising interest rates and the slowing down economy are going to hurt growth stocks, especially the unprofitable ones, in the quarters ahead. While this is a logical assessment for growth stocks in general, it’s resulted in an aggravated selloff in Palantir (NYSE:PLTR) in recent weeks even though it’s not overly susceptible to these risk factors. In this article, I’ll attempt to explain why this bear case for Palantir is exaggerated and why the stock makes for a good buying opportunity at current levels. Let’s take a closer look to gain a better understanding of it all.

The Interest Rate Risk

There’s no denying that rising interest rates will result in increased interest payments for individuals and companies alike. Firms that are profitable and/or cash flow positive would be positioned well to absorb these added expenses. However, companies that are loss-making and/or haven’t figured out their path to profitability, may have to dilute their shareholders and maybe even raise debt to meet their interest payments.

A broad swath of technology stocks falls into the latter category, faced with uncertain prospects and some with even the bankruptcy risk, so a sharp selloff in their shares is understandable and justified. However, Palantir doesn’t quite fit the latter criteria and its operating activities should more or less remain unfazed in a rising interest rate environment. Notice I used the term “operating activities” instead of talking about the company overall.

Fact of the matter is that Palantir is debt-free. Although it has a revolving credit line, it was undrawn at the end of the last quarter. This essentially means that the company won’t be negatively affected by rising interest rates, at least not directly. On the contrary, Palantir’s interest income grew by $171,000 last quarter in lieu of rising interest rates. This is a miniscule figure when compared to its top line, but it corroborates our assessment that rising interest rates won’t weigh down on the company’s operating results.

From Palantir’s last 10-Q filing:

As of March 31, 2022, no borrowings were outstanding under our revolving credit facility…Interest income increased by $0.2 million for the three months ended March 31, 2022 compared to the same period in 2021 primarily due to an increase in U.S. interest rates on interest earned from our cash, cash equivalents, and restricted cash.

From Palantir’s last earnings call:

At the end of Q1, we had a very strong war chest, $2.3 billion in cash and no debt.

Now I’m not trying to portray that Palantir is immune from interest rate hikes. The company has invested in some arguably speculative stocks that have sold off in recent weeks and are likely to sell further with more rate hikes.

But the silver lining here is that these losses on marketable securities will be non-recurring in nature and Palantir’s operating results, at least, won’t be impaired by rising interest rates.

Sustainability Concerns

The next point of contention is that Palantir isn’t profitable yet and that it will be forced to raise capital in order to sustain its operations. This, inevitably, will create an interest expense burden on the company. But that’s not necessarily the case.

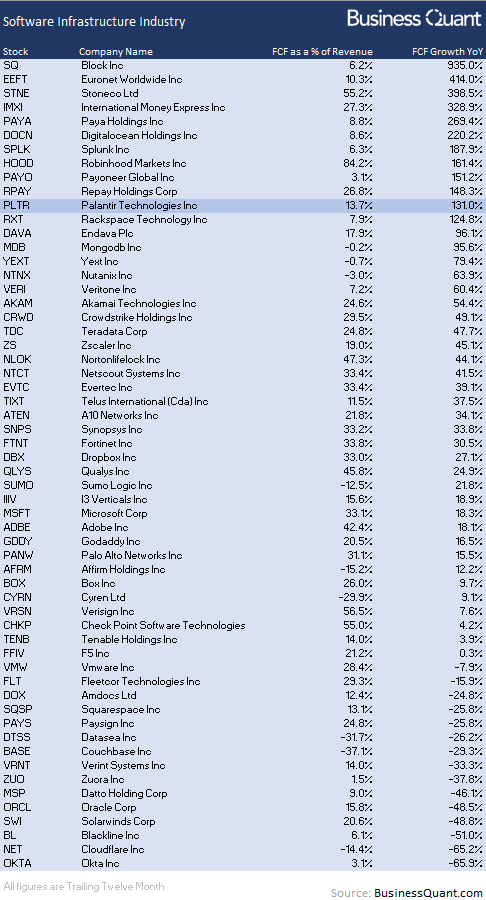

It’s worth noting that Palantir is free cash flow positive and that it’s grown at a significant pace over the last one year alone. Let’s look at the table below to put things in perspective. Per our database at Business Quant, Palantir’s free cash flow as a percentage of revenue is higher than 56% of other stocks belonging to the software infrastructure industry. Also, Palantir’s free cash flow growth is higher than 81% of the other companies present in our study group.

BusinessQuant.com

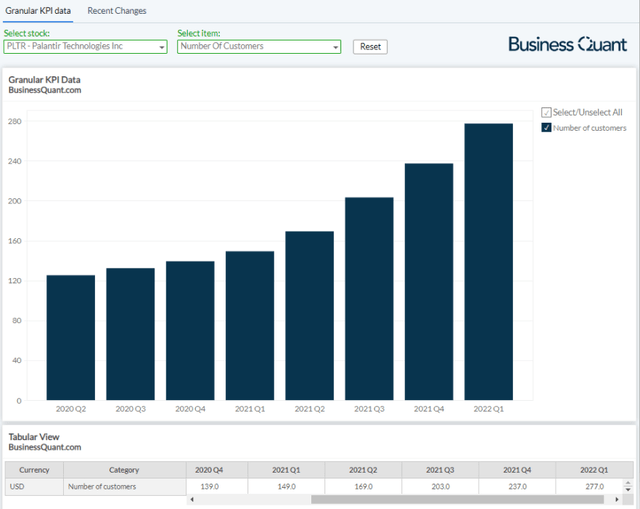

This suggests that Palantir has ample cash flow cushioning, and its free cash flow growth is also high enough, to alleviate any sustainability-related concerns in a recessionary environment. This isn’t a one-off event. Palantir has tactfully undertaken several initiatives over the last year – such as adopting flexible payment plans, expanding sales team, focusing on securing commercial clients, and offering free trials – to boost customer growth.

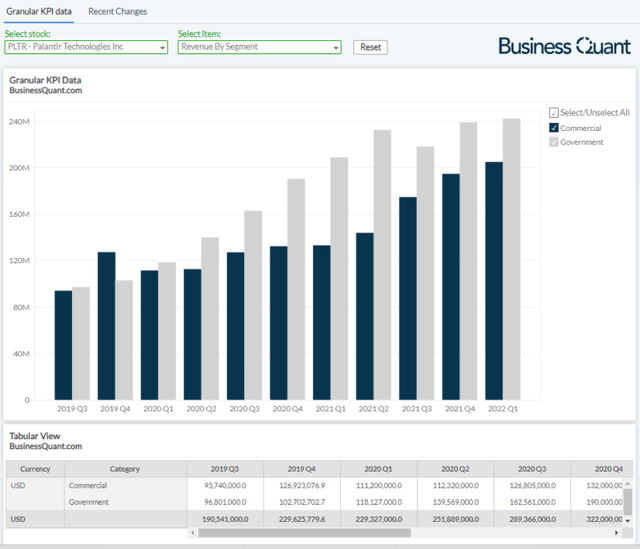

These customer additions have surely boosted Palantir’s revenue growth in recent quarters. However, I contend that the new customers added in the last year would be in the process of integrating Palantir’s platforms in their workflows, training their personnel around them, and preparing to switch from their legacy analytical tools. They’re likely to increase spending on Palantir’s platforms only once they pass this critical stage and are ready for full-fledged deployments. So, I anticipate Palantir’s revenue growth to continue on in subsequent quarters as well.

Attractive Valuations

Next, Palantir is often criticized for its bloated valuation. The stock is trading at over 10 times its trailing twelve-month sales and investors are wondering if the price premium is justified.

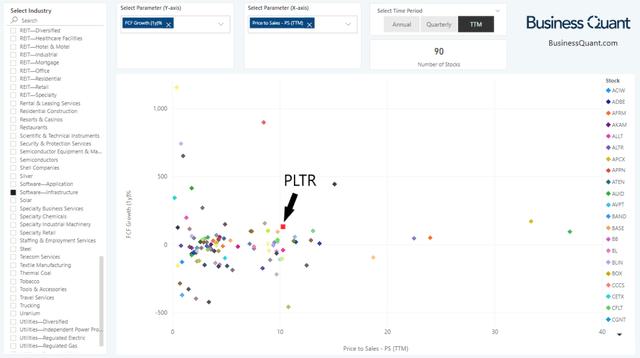

The chart below should put things in perspective. The Y-axis plots the free cash flow growth for 90 US-listed stocks belonging to the software infrastructure industry. Note how Palantir is vertically positioned higher on the plot, indicating that the company’s free cash flow growth is higher than a broad swath of its peers.

Now let’s shift attention to the X-axis, which plots the price-to-sales (or P/S) multiples for the same set of companies. Note how Palantir is horizontally positioned towards the right, confirming that its shares are, in fact, trading at a premium compared to its peers.

The collective takeaway from both the axes here is that Palantir’s shares are trading at relatively higher trading multiples but that’s because of its higher-than-average pace of growth. This, in essence, justifies Palantir’s price premium. There are just 10 other stocks in the industry that are growing faster than Palantir but trading at lower P/S multiples. So, I find Palantir’s shares to be attractively valued at current levels, when factoring in its growth momentum.

Final Thoughts

The point I’ve tried to make in this article is that all growth stocks are not equal and not all of them will be crippled in an inflationary and/or recessionary environment. But Palantir’s shares have been hammered down nonetheless, down 60% year to date, in tandem with the ongoing selloff in growth stocks. The company seems well-positioned to continue growing even during challenging economic conditions and its shares are attractively valued at current levels. This makes Palantir a buying opportunity, especially now that its shares are available at a steep discount. Good Luck!

Be the first to comment