amenic181/iStock via Getty Images

The Update

On January 13th, I wrote Palantir: Dark Days. I said that I was bullish on Palantir (NYSE:PLTR), but I also added some melancholy notes:

Unfortunately, the price action has been terrible for most growth stocks and the macro environment doesn’t look favorable for PLTR in H1 2022. Unless there is some kind of huge announcement, or SBC drops precipitously, PLTR is most likely going to remain well under $25. In fact, it will likely languish in the $18-22 range in H1 2022, given what we know what right.

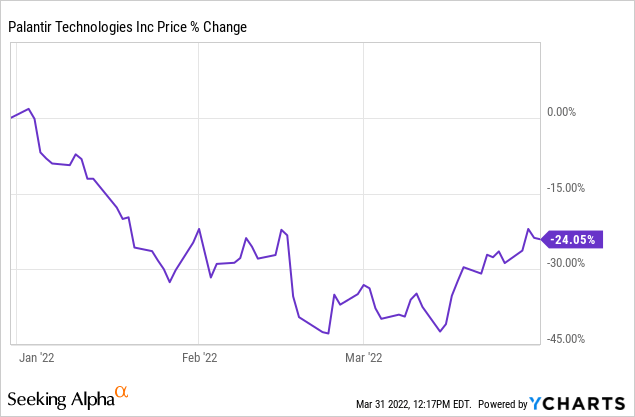

Back in the middle of January, PLTR was down about 8% year-to-date. Well, here’s how that looks now:

Yes, we’re down 24% from January 1st through today. In terms of price action, perhaps the only good news is that PLTR isn’t down 40-45% this year.

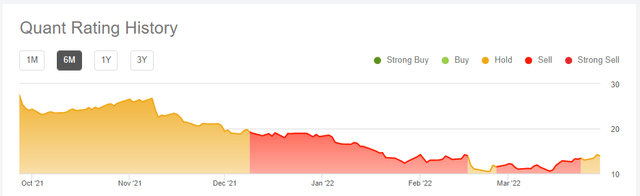

The quantitative view continues to be ugly:

PLTR QUANT RATINGS (Seeking Alpha)

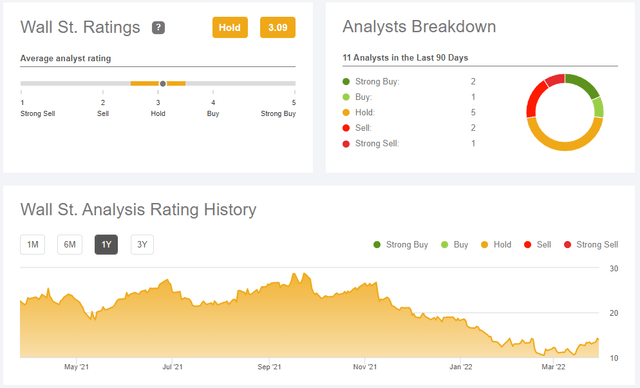

Wall Street is mostly neutral with an overall “Hold” rating.

WALL STREET on PLTR (Seeking Alpha)

All of this said, I think it’s fair to say that nearly all the indicators are flat, or they are pointing down. PLTR is still in the dark days.

Some Quick Comparisons

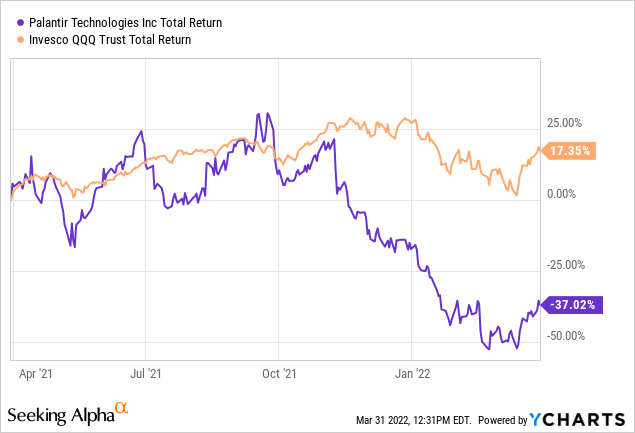

It’s often a good idea to think about a company in relation to some peers, and the market as a whole. While I don’t believe that PLTR has direct competition, except for the government itself, I do think that overall pressure on growth stocks is worth considering.

Here’s some bad news. One year ago, PLTR was moving up and down in price faster than the Nasdaq 100 Index (QQQ). That is, we were seeing far more volatility, but at least PLTR was roughly was tracking the index. However, in November of 2021, PLTR started to fall off a cliff. Clearly, the QQQ also declined, but the drop was far worse for PLTR, into 2022.

It’s worth digging into the greater than average market pain.

Relentless Downward Pressure on Growth

Although PLTR has a market cap of just under $30 billion, it’s still relatively small, and more prone to violent moves up and down. But, the real kicker is that PLTR is an aggressive growth stock. That’s what investors wanted, and that’s what it delivered. But, the macro environment changed and what I’ll call the “Growth Leverage” is now working strongly against PLTR.

Here’s a hint, from the New York Times, back in November 2021.

The Fed has been buying $120 billion in bonds each month and has kept interest rates near zero, policy moves that have helped make borrowing cheap and keep money flowing through the economy. Earlier this month, the Fed took the first step toward withdrawing support for the economy when it announced that it would begin scaling back its Treasury bond and mortgage-backed security purchases by $15 billion a month starting in November.

Fast forward about one month, and Bloomberg added:

The new rate projections marks a major shift from the last time forecasts were updated in September when officials were evenly split on the need for any rate increases at all in 2022. The new projections also showed policy makers see another three increases as appropriate in 2023 and two more in 2024, bringing the funds rate to 2.1% by the end of that year.

Adding it up, the short-term outlook is quite negative. Indeed, depending on your definition, the medium-term outlook is equally negative. Dare I say that I’m bearish in Q2 2022? That doesn’t mean I’m screaming “SELL” from the top of my lungs. Instead, as I’ll explain below, it’s more like my expectations are modest, until H2 2022.

Some “Green Shoots”

I largely agree with Forbes on these points:

… Palantir further sees its revenues growing at levels of over 30% each year between 2021 through 2025. The longer-term opportunity also looks solid. The company’s artificial intelligence (AI) software tools are trusted by the U.S. government and these technologies are becoming increasingly valuable in the commercial space as well, as AI plays a greater role in the economy.

I believe that PLTR will continue to see 30% or higher revenue growth over the next 2-3 years. And, I see artificial intelligence spending to ramp up. Nvidia (NVDA) CEO Jensen Huang broke it down like this:

- $300 billion in sales to the auto industry.

- $300 billion in chips and systems.

- $300 billion in enterprise software.

- $100 billion in the video game industry.

That’s one trillion dollars. And, for each industry, there’s a true, deep need for data analytics, data management, strategic decision making, and far more. That’s where PLTR fits in, and that’s mostly in the commercial space. We know that PLTR is very strong in government, of course. From the Q4 2021 report:

Government revenue growth year-over-year:

- Q1 2021 = 76%

- Q2 2021 = 66%

- Q3 2021 = 34%

- Q4 2021 = 26%

And, for good measure…

US commercial revenue growth year-over-year:

- Q1 2021 = 72%

- Q2 2021 = 90%

- Q3 2021 = 103%

- Q4 2021 = 132%

For both segments, customer value is up, customer count is up, and more. Gross margins are over 80%. Operating margins are stable. PLTR is still working through post-DPO issues, such as the stock-based compensation. As I explained last year, it’ll work out just fine, just slower than investors want.

As a relevant aside, the Q4 2021 earnings report that dropped in February 2022 wasn’t exactly wonderful: Non-GAAP was $0.02 but missed by $0.02. Revenue is expected to be above consensus in Q1 2022 at least. We’ll see.

The point is that there’s stability or growth in nearly all parts of the business. It’s not a perfectly running machine but it’s a strong company. And, as I like to point out, it’s not going bankrupt because of this:

No debt problems.

“Green Shoots” Part 2

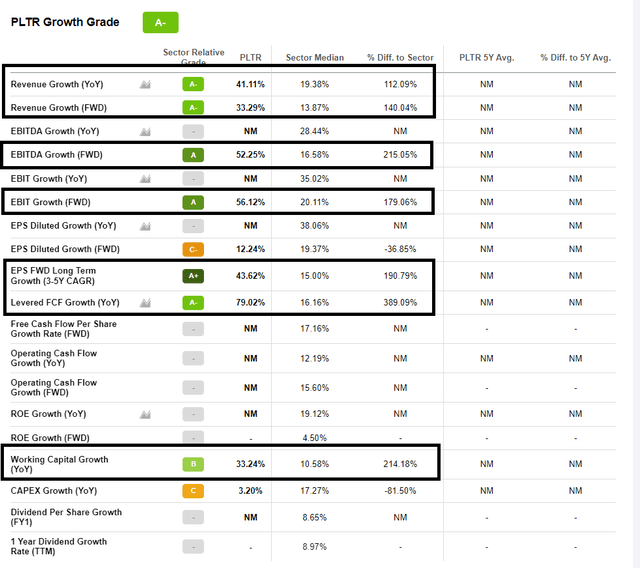

So, investors are generally aware of PLTR’s customer growth. But, it’s useful to consider the other financial metrics of growth.

Financial Green Shoots for PLTR (Seeking Alpha)

It’s all there, in plain view. Clearly, revenue is growing like crazy, even when compared to the Sector. And, both EBITDA Growth and EBIT Growth are crushing the Sector Median; very healthy. Looking forward, EPS forward growth is also outstanding. Even Working Capital is in good shape, which I see as just another buffer against a weak environment for growth.

I also encourage investors to look here:

- Gross Profit Margin is higher than the Sector Median

- Levered FCF Margin is higher than the Sector Median

- Cash from Operations is higher than the Sector Median

All of this indicates to me that true profits are coming, just not in Q2 2022.

Wrap Up

We’re stuck right now because of valuation, stock price, SBC, missing Wall Street expectations in Q4 2021, and the macro environment. The big picture is that PLTR is rightfully suppressed. But, digging into the details, it’s also true that PLTR is a growth machine with a bright future.

Summing it all up, I can say this: I’m not selling PLTR. I’ll continue to hold. Or, said differently, I’m neutral about PLTR in the short run, but bullish in the long run. Now is not a bad time to accumulate, or to start a position. Dollar-cost averaging, or dripping, is equally rational for some investors.

Be the first to comment