Michael Vi

Thesis

Palantir Technologies (NYSE:PLTR) reported its Q2 2022 earnings release (“ER”) on August 8, 2022. The ER disappointed the market and its stock prices dropped by about 14% afterward, plunging from $10 into the single-digit range (with an $8.51 close). Its Q2 profit remained in the red and adjusted EPS dialed in at a loss of $0.01 while the market expected it to earn a small net profit. Even worse, PLTR lowered its growth prospects and withdrew its goal of 30% revenue growth until 2025. Leading analysts responded with a wave of downgrades (more on this later). For example, Deutsche Bank downgraded the shares from hold to sell with an $8 price target.

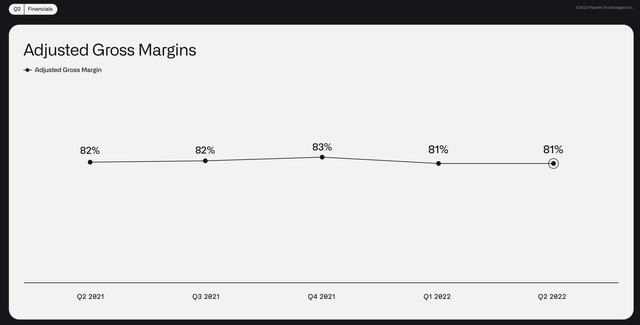

PLTR stock price has remained in the single-digit range after the Q2 ER. And the thesis of this article is that it will remain in the single digits for the near future (say the next ~2 years or so). On the positive side, PLTR features leading AI-powered platforms which are highly scalable. The business currently enjoys superb gross margins on the order of ~80%, and I think it can further edge higher in the next few years to the low- to mid-80% range. At the same time, the need for the U.S. government and its allies to modernize their defense and security systems provide a long-term tailwind.

However, there are strong forces in the near term to keep pressure on the stock prices. And I see these forces having an upper hand in the next ~2 years or so.

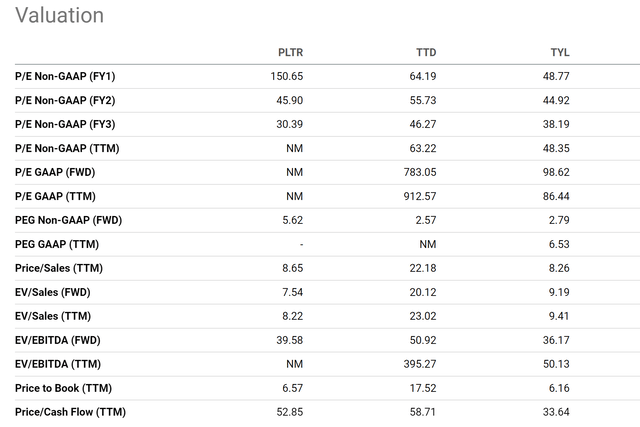

There are a number of uncertainties. The top one is the possibility of slowing government spending. The expansion into the commercial sectors is facing heightened competition and also slowing demand from customers given the current macroeconomic climate. As a result, it might take a while before the company becomes profitable and its cash burn rate needs to be carefully monitored. Finally, the valuation is still quite expensive, both in absolute terms and relative terms compared to its peers. The current valuation itself will take quite a bit of growth to catch up.

The Good: leading technology and efficient operation

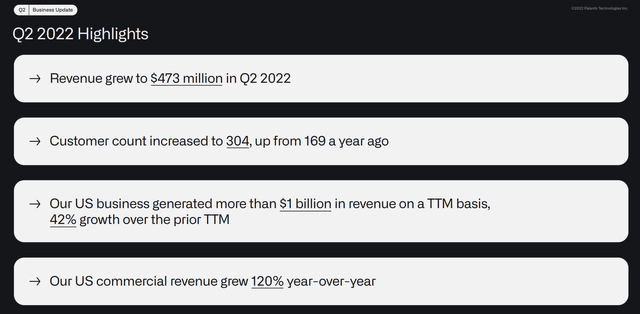

The highlight from Q2 is the addition of customers. Customer accounts increased to 304, up from 169 a year ago and an increase of almost 80%. PLTR features leading AI-powered platforms which are highly scalable. As a result, the gross margin remained higher and could become even higher, as fewer incremental investments are required for additional sales.

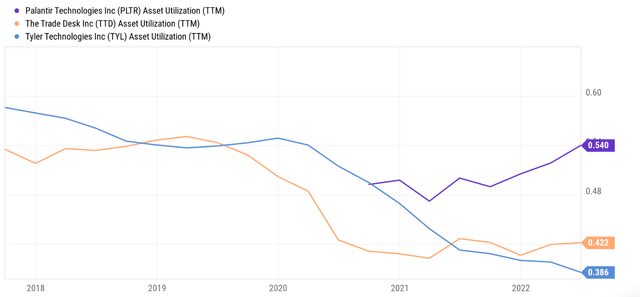

The scalability and operation efficiency can also be appreciated from the following comparison of its asset turnover rate, especially in comparison with its comparable peers such as The Trade Desk (TTD) and Tyler Technologies (TYL). PLTR’s asset turnover has been around 0.48x in 2020 and has climbed to the current level of 0.54x as its customer base expands. An asset utilization of .54 is not only at a peak level in its own history, but is also significantly above TTD’s 0.422x by almost 30% and above TYL’s 0.386x by almost 40%.

The bad: mixed profitability metrics

Thanks to its leading technology, scalability, and efficiency, the business has been enjoying superb gross margins. As CFO Dave Glazer commented during the ER (abridged and emphases added by me):

Turning to our margins and expense. Adjusted gross margin, which excludes stock-based compensation expense was 81%. Second quarter adjusted income from operations, excluding stock-based compensation and related employer payroll taxes, was $108 million, representing adjusted operating margin of 23% ahead of our prior guidance of 20%.

To put the above comments in perspective, its margin has been hovering above the 80% level consistently in recent quarters, as you can see from the chart below.

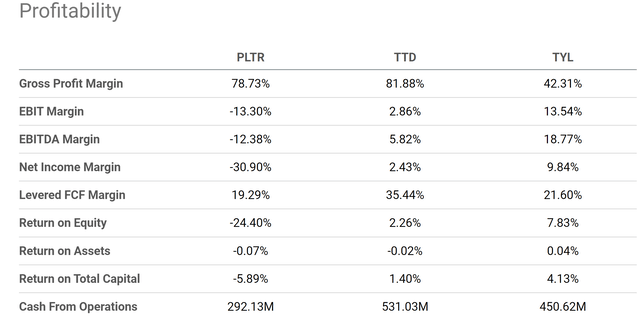

To broaden the view a bit further, the next chart compares PLTR to TTD and TYL again. As seen, its ~80% margin is also very competitive in this horizontal comparison. It is essentially identical to TTD, whose gross margin currently also stands around 82%. And it is almost 2x higher than TYL’s 42%. I see it is very like that PLTR can sustain such a high gross margin or even further expand it in the next few years (say to the low- to mid-80% range)

However, the picture becomes a little bit mixed when we move onto bottom line-oriented profitability metrics. As you can see, its EBIT margin (-13%), EBITDA margin (-12%), and net income margin (-30%) are all in the red. In contrast, TTD and TY L have been reporting positive profit metrics.

Next, because of the lack of profit, we will see that the stock is still expensively valued despite recent price corrections.

The ugly: lofty valuation and muted growth ahead

In terms of valuation, PLTR is currently trading at a large premium, both in absolute terms and relative terms compared to its peers. As just mentioned, its lack of profit makes its PE in the astronomical range. FY1 PE stands at 150x, more than 2x above TTD’s 64x and more than 3x of TYL’s 48x.

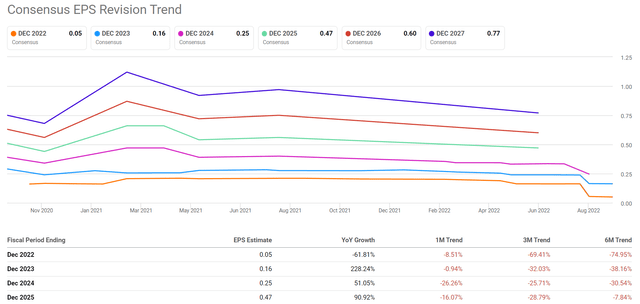

Furthermore, because of the many headwinds anticipated above, its earnings outlook is quite bleak, as reflected in the consensus estimates in the second chart below. As such, the current valuation will require a longer time to catch up. The earnings revisions for the last 3 months for the upcoming fiscal year paint a quite pessimistic picture. No one expects an EPS growth, and a total of 9 analysts revised the EPS downward. The consensus EPS in 2024 and 2025 are now in the range of $0.25 to $0.47, more than 30% and 8% lower than they were only 6 months ago.

The silver lining here is the operating cash flow. The business has been reporting a positive cash flow from operations (“CFO”). Its CFO has been hovering around the breakeven point in the March quarter of 2021 and has turned/remained positive since then. The business reported $35M of CFO in the Mar 2022 quarter and $62M in the June 2022 quarter. Although its price to cash flow multiple, currently at 53x, is not cheap either by any standard.

Moreover, in order to sustain growth, it has to spend a part of the CFO on capital expenses (a small part because of its scalability mentioned above). Although, as a SaaS business, it needs to spend aggressively on R&D or OPEX (operating expenses) in general. To put things into perspective, its CAPEX expenditures have been consistently around or below $5M on a quarterly basis on average and were $5.5M in the past quarter. In contrast, it, on average, spends around $90M in the past few quarters on R&D and around $400M on overall OPEX.

Going forward, it is likely that operating expenses could further rise with the general inflation and its cash burn rate should be carefully monitored, as elaborated on next.

Source: Seeking Alpha data Source: Seeking Alpha data

Other risks and final thoughts

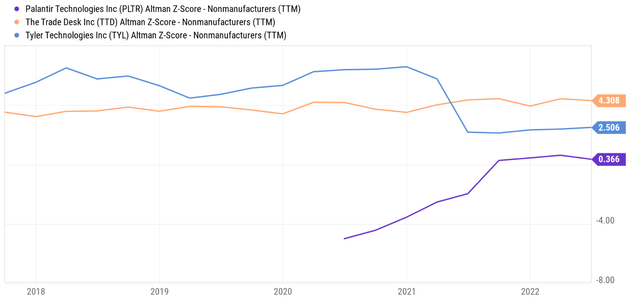

Besides the above risks, its financial position is also worth examining, given the business is yet to earn a profit. Currently, PLTR has about $2.46 billion of cash on its ledger, translating into $1.15 per share. It has a debt burden of $256M, substantially lower than the cash position. As a result, it carries a net cash position of about $1.03 per share, about 14% of its current share price of $7.48 as of this writing. When we subtract the cash out of the stock price, the valuations would become about 14% cheaper, but still won’t change the overall expensiveness. Also note that comparatively speaking, PLTR is also in a weak financial position than similar stocks such as TTD and TYL as reflected in its lower Altman Z-score (0.366 vs 2.5 for TYL and 4.3 for TTD). As a general rule of thumb, for non-manufacturing businesses, a Z-score above 2.9 is deemed safe, a Z-score above 1.2 and 2.9 is deemed on alert, and a Z-score below 1.2 signals non-negligible risks for financial embarrassment.

To conclude, in the long term, PLTR could be a beneficiary of the U.S. government and its allies’ efforts to modernize their technology platform. Government customers tend to be sticky once acquired. And with its scalable platforms, it could proliferate into the commercial sectors with minimal capital requirements.

However, there are strong forces in the near term to keep pressure on the stock. These forces include the possibilities of slowing government spending, heightened competition, and also rising operating expenses. On top of all these, the combination of expensive valuation and lack of net profit puts another lid on the price. All told, I see these forces having an upper hand in the next ~2 years or so to keep Palantir’s stock prices in the single-digit range.

Be the first to comment