Andreas Rentz

Palantir Technologies (NYSE:PLTR) co-founder and CEO Alex Karp recently stated on CNBC Squawk Box that he believes that “terrible times” are coming. In this article we are going to delve into what he said, offer our take on it, and provide an updated valuation model for the stock.

Karp: Terrible Times Are Coming

During the interview, Alex Karp stated:

What I think is going to happen is we are going to have a couple years of terrible times, those companies that are most robust will survive and thrive, you’ll get credit for it in a couple years…

He also spoke of how the upcoming period with “deadly” macroeconomic conditions will cause many of its data analytics and software company rivals to fail:

Bad times are incredibly good for Palantir … bad times really uncover the durable companies, and tech is going through bad times … interest rates are the reason…Will this deadly tidal wave wipe out some companies? Yes it will.

As a result, he expects this to benefit PLTR over the long-term as it will reduce competition for top talent in the sector while also enabling PLTR to win some new business. We largely agree with Mr. Karp’s thesis about both the broader macroeconomic situation as well as its long-term impact on PLTR, which we will detail in the remainder of this article.

Our Macroeconomic Outlook

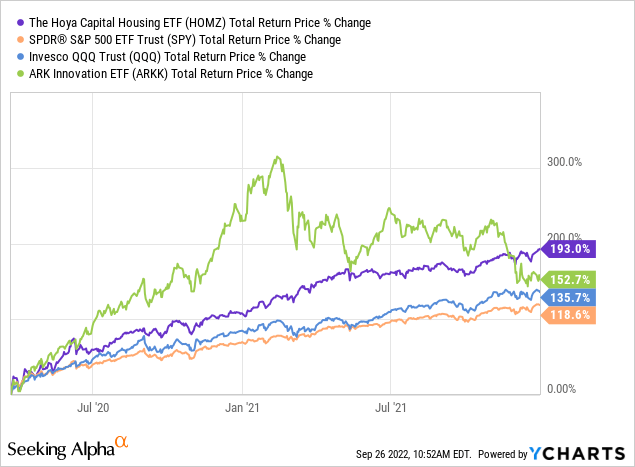

Thanks to artificially low interest rates and easy access to both debt and equity capital in recent years, the stock (SPY) and housing markets (HOMZ) experienced an incredible boom coming out of COVID-19. This was particularly evident in technology (QQQ) – especially high growth disruptive tech (ARKK) – as the low level of profitability in these businesses combined with lofty growth expectations made them a big beneficiary of lower interest rates, which make future cash flows worth more on a net present value basis:

However, year-to-date, this boom market has turned into a bear market with access to capital drying up due to soaring interest rates and an increasingly pessimistic outlook for the future of the global economy due to soaring inflation, weak GDP numbers from major economies, and the war in Ukraine straining global supply chains further.

With the Federal Reserve doubling down and if anything increasing the hawkishness of their rhetoric after their latest 75 basis point interest rate hike, it appears that more pain is ahead. The more the Federal Reserve feels the need to hike interest rates, the more the Fed-fueled bubble will deflate as equity valuations continue to plummet and the cost of capital continues to increase. As a result, it will become harder and harder for cash-burning businesses – of which the technology sector has more than its fair share – to continue to finance their long-term oriented investments and instead will have to refocus their business models in an attempt to conserve cash and reach profitability sooner.

For some businesses, this will ultimately prove impossible and they will have to fail. For others, this will result in permanent impairments to their previous intrinsic value estimates as they will have to significantly reduce their plans to penetrate their often lofty estimates of “total addressable market” by rolling back research and development budgets as well as hiring and marketing budgets.

The good news for PLTR is that – while they are not yet profitable on a GAAP basis, they have no debt and plenty of cash (~$2.5 billion in cash and short-term investments) on the balance sheet. While it is true that they continue to issue a considerable amount of equity for stock-based compensation, they also continue to grow at a solid pace and eventually – especially as their relationships with individual clients mature and the more labor-intensive portions of those contracts subside – they will grow to a point where their stock-based compensation is not so destructive to profitability.

On top of that, Mr. Karp stated on the latest earnings call that he expects PLTR to be profitable in 2025, which is not too far away, especially when you consider how much cash the company has on its balance sheet. As a result, while PLTR’s stock could very well face continued pressure in the short-term due to rising interest rates and the broader risks facing its sector, we do not see any significant risk to the solvency or even long-term potential value of the business from current macroeconomic conditions. If anything, these conditions could prove to be a tailwind over the long term by eliminating some of PLTR’s competition for top talent, business, and capital.

Updated Palantir (PLTR) Stock Model

Given the current macro environment, we factor in three major assumptions for PLTR’s valuation model:

First, the suppressed share price means that PLTR will likely experience some additional dilution due to stock-based compensation. In order to compensate an employee with $100,000 in PLTR stock, they will have to issue more shares today than they did previously when their share price was considerably higher. This will permanently impair the value of outstanding PLTR shares, so this is definitely a negative consequence of the current macro environment.

Second, the rising geopolitical tensions between the West and Russia, China, and a few other major military powers means that demand for PLTR’s Gotham platform and additional innovations on or related to it will likely grow moving forward. This could be a major boon for PLTR because – while their U.S. Gotham business has been stellar and indeed PLTR’s core business for nearly two decades now – it has struggled to gain traction among U.S. allies and partners. Now, with countries like Japan, South Korea, Germany, and France increasingly threatened by Russian and Chinese aggression and military ascendancy, they are much more likely to prioritize implementing the PLTR Gotham platform into their country’s defense technology architecture. PLTR has played a key role in the current conflict in Ukraine and is credited with helping the inferior Ukrainian military outperform against one of the most powerful armies in the world. This increases our assumptions for international Gotham growth.

Third, we assign a lower fair value multiple to PLTR shares given that interest rates have increased.

Taking these three assumptions into account, we are making the following adjustments:

- We are reducing our normalized earnings per share estimate from the analyst consensus of $0.60 in 2026 to $0.55 to compensate for increased share count issuance, though this is somewhat offset by the improved outlook for international government demand growth.

- We are reducing our 2026 fair value P/E ratio from 40x to 30x to account for increased interest rates.

What this leaves us with is an assumed fair value of $16.5 at the beginning of 2026. Discounting that back to the present share price of $7.5 implies a total return CAGR of 27.5%, making the stock a Strong Buy at the moment.

Investor Takeaway

The current macro environment is devastating to most disruptive, high-growth tech stocks. Between a soaring cost of capital and increased economic uncertainty leading to a hesitancy to incorporate costly and unproven technologies among potential clients, tech companies are finding it harder than ever to grow and ultimately achieve profitability.

Thanks to the fact that its products are mission critical to clients that are primarily very large, investment grade enterprises ranging from the U.S. Government to leading corporations, PLTR is not dealing with this issue quite as much.

With a strong balance sheet and high quality products, PLTR’s growth profile and risk profile remain attractive. However, there will be some headwinds from stock-based compensation, so investors should keep that in mind. Nevertheless, thanks to a sharp pullback in the share price, the stock looks undervalued here and offers considerable total return potential over the next several years.

Be the first to comment