cemagraphics

Introduction

Software company Palantir Technologies (NYSE:NYSE:PLTR) has been a serious bone of contention for market enthusiasts since it made its debut on the bourses back in Sep 2020. At one end of the spectrum, you have the cynics that will never take PLTR seriously, tagging it as your textbook meme stock, with a kooky and deluded leader at the helm of affairs. At the other end, you have a bunch of loyalists, swayed by the company’s unique data processing tech, which they believe is at the forefront of revolutionizing the digital landscape of government entities and commercial enterprises.

I, for one, am torn about the Palantir stock’s prospects and find it difficult to nail my colors to one mast or the other; thus, needless to say, I have a HOLD rating on the stock. Nonetheless, I will attempt to flag some of the notable bullish and bearish themes that may be useful for prospective investors.

Bearish View Of PLTR

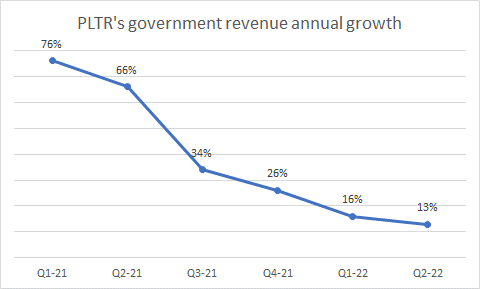

Palantir’s main focus market (58% of sales) is the government sector, which is slowing (much of the sequential growth was driven by renewals rather than new wins), and without any major government awards for the rest of the year, the company has been forced to curtail its total FY22 guidance. Meanwhile, the pace of growth delivered by this segment has come off quite markedly over the past 5 quarters and recently only came in at 13%. When the wheels of your core business are coming off at such a rapid pace, it’s unrealistic to expect the market to look at you in favorable terms.

PLTR Quarterly Presentations

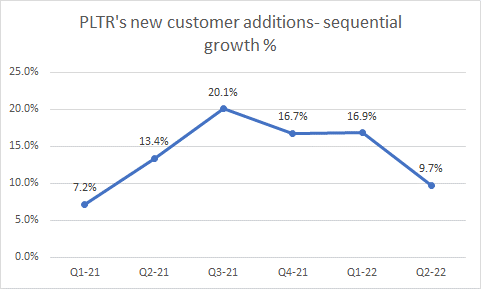

The pace of future revenue growth will also, in large part, be dictated by the pace at which you’re bringing new clients to the table. Even here, it appears as though the level of customer additions per quarter has been slowing; we can see that the sequential growth in customer additions per quarter, peaked in Q3-21m and since then things have been sliding.

PLTR Quarterly Presentations

Structurally as well, I believe there are quite a few flaws with PLTR’s business model which make it vulnerable at this stage of the economic cycle. Recently, in the commercial space, the company has been making a pivot towards startups and early-stage corporate clients. These are the sort of companies that remain in the worst position to engage in tech-related discretionary spend at this stage of the economic cycle. It also doesn’t help that as part of wooing these clients, PLTR, during its “Acquire” phase, provides pilot deployments of its platforms at little or no cost. It’s also worth noting that, unlike other application software peers that typically have shorter sales cycles of less than 4 months or so, PLTR’s sales cycles are a lot longer at between 6-9 months. All in all, it’s fair to say that PLTR could well be in an environment where it could be burning a lot of cash with little to no return.

There’s also the FX angle to consider when 43% of the company’s business comes from abroad. Typically, PLTR’s non-US contracts are denominated in USD, and the ongoing appreciation of the dollar will make PLTR’s platforms less appealing to foreign customers as it will be more expensive for them.

Nonetheless, considering all that I’ve written so far, it’s little wonder that important stakeholders of the PLTR universe don’t feel too optimistic about the company’s near-term prospects.

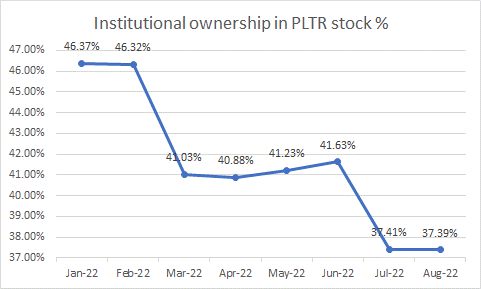

Firstly, let’s start with the Sell-side analyst community, whose opinions can be very influential in dictating flows towards and away from any specific stock. Currently, only 28% of the analysts who cover PLTR have a ‘Buy’ rating on the stock. It’s fair to say that this has been instrumental in influencing the guys with the deep pockets – the Institutional investors. Except for a brief uptick in May and June, PLTR’s ownership by institutions has been on a declining trend since the turn of this year. You may get a few short-covering bounces here and there, but I suspect unless this cohort comes back to the table, it would be difficult to envisage a strong and sustainable uptrend in the PLTR stock.

YCharts

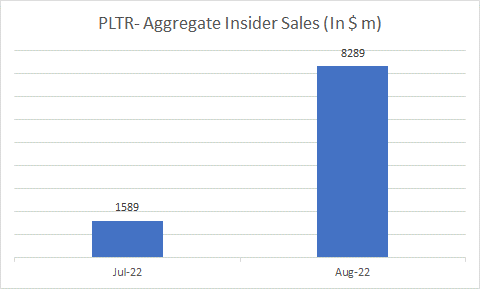

It isn’t just the institutions; even the folks in house appear to be bailing at a rapid pace. For instance, in Q3-22, note the sequential spike in aggregate sales during August, compared to July; last month we saw $8.3bn of insider sales, over 5x the level of selling seen in July.

Guru Focus

Bullish View Of PLTR

Given that we’re in an environment where interest rates appear to be spiraling upwards at a rapid pace, it helps that PLTR’s balance sheet is in a good place, and can help it withstand a downturn. Cash and liquid investments have been hovering around the $2.5bn mark for 4 straight quarters now, and incidentally account for an impressive 78% of total assets; this is quite unusual for a growth company. Incidentally, the cash component alone is the highest it’s ever been, at $2.35bn!

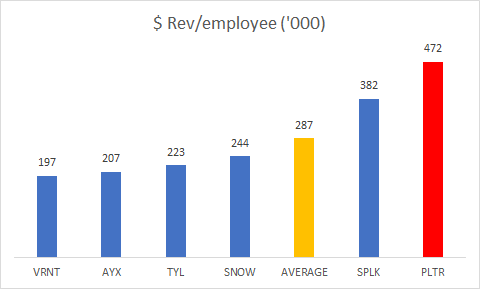

Then, one aspect that doesn’t get highlighted an awful lot is PLTR’s level of optimization with its workforce, which appears to be really well-controlled, enabling the company to extract solid value from its human capital. To highlight this angle, I’ve compared PLTR to five of its peers that compete with it in the commercial and public sector arenas. We can see that PLTR derives almost half a million worth of sales from one employee alone; this is substantially higher than the likes of Snowflake (SNOW), Tyler Technologies (TYL), Alteryx (AYX), and Verint Systems (VRNT).

Seeking Alpha, Author’s calculations

For the uninitiated, PLTR does not follow labor-based contracting when monetizing its platforms, quite unlike most of its peers that typically license or sell their software via labor contracts (future updates and maintenance of these software will once again call for additional labor). Besides all these, firms also supplement their software with a burgeoning sales force, which can often be underutilized and a drain on cash. With PLTR, there isn’t a great level of emphasis on leveraging the expertise of a deep sales force; reportedly only 1.5% of its employee base consists of sales agents.

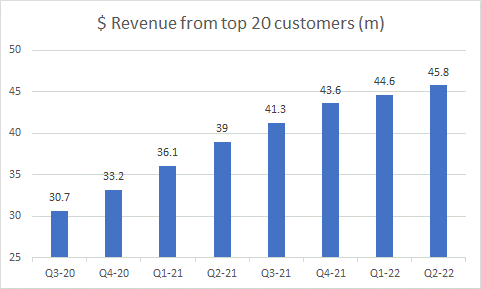

It also appears that PLTR doesn’t push the envelope to retain clients; PLTR management is on record stating that some of its clients that initially left the company returned over time, once they gauged the quality of sub-standard alternatives in the market. Meanwhile, as some old clients return, PLTR’s largest clients continue to rely even more on the company’s expertise, highlighting the growing stickiness of this cohort; the image below shows how the top-20 revenue contribution has been growing sequentially for 8 straight quarters.

PLTR 10-Q, 10-K

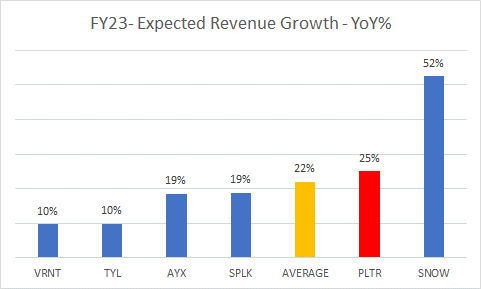

A lot has been made of PLTR’s pace of business growth, but it’s not as if the company has turned into a total washout overnight. YCharts consensus estimates show that this is a company that can still generate 23-25% annual revenue growth over the next 3 years. To be more specific, FY23 sales point to a figure of $2.4bn, which would imply annual growth of 24.5%; you’d be interested to know that besides Snowflake, none of the other peers offer a superior growth runway.

YCharts

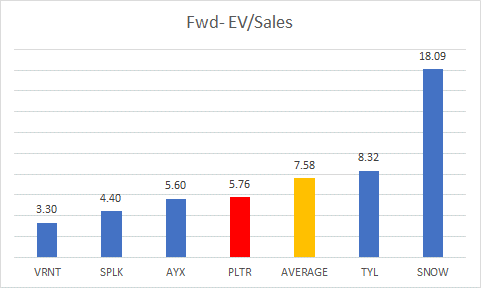

Given the relatively decent revenue run rate ahead, and a useful net cash position for a growth company, I do believe that PLTR’s EV/sales multiple of 5.75x is not too bad, coming in at a discount to the peer set average.

YCharts

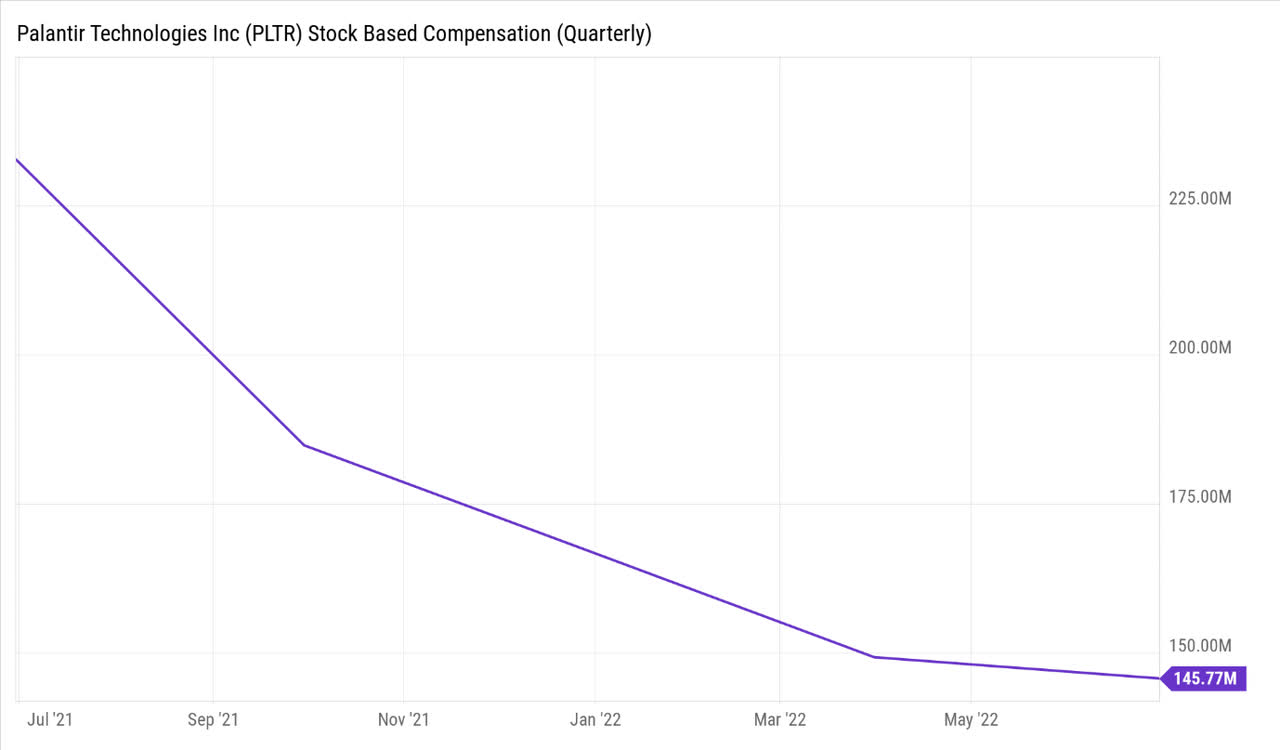

There’s also been a lot of concerns over PLTR’s elevated appetite to dole out stock-based compensation, which of course brings its share of dilution risk, but there are some silver linings to be gleaned by the fact that the level of stock-based compensation has been on a declining trend over the last 5 quarters, and recently came in at less than $150m in Q2.

YCharts

I’m also beginning to warm up to some of the technical developments associated with the PLTR stock.

Those of you who are fishing for bargains in the mid-cap growth space ought to have PLTR on your watchlist; its relative strength ratio versus the Russell mid-cap growth index looks extremely oversold, trading well below the mid-point of the range. The ratio has also interestingly dropped to the lows last seen in May, from where it had made a rebound. Could we see a repetition of the same?

StockCharts

Then, if you consider PLTR’s daily chart we can see that relative to the wild swings seen across most of its trading history, the price action has been flattening out since May, with some tenuous signs of a bottom formation. The volatility contraction is also validated by the halving of the default ATR (Average True Range) from levels seen at the turn of this year. When volatility contracts, it usually signals a good time to build positions before the next major move.

Investing

I also don’t know if there’s a great deal of merit in shorting the stock at current levels, particularly when you look at the risk-reward dynamics on the larger time frame chart – the weekly chart. We can see that the price is trading close to support levels, and is a long way off its downward sloping boundary, implying good risk-reward for a prospective long position.

Investing

Be the first to comment