Michael Vi/iStock Editorial via Getty Images

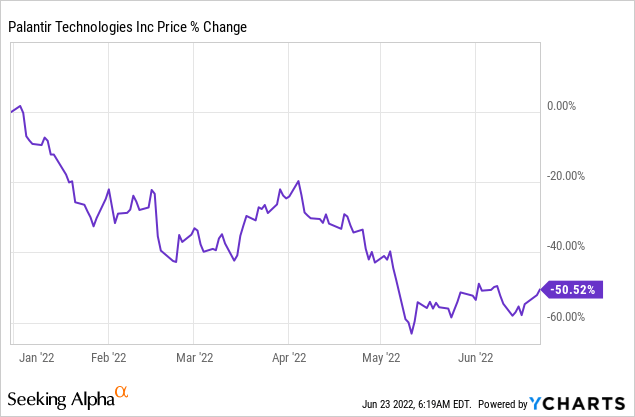

Shares of software analytics company Palantir Technologies Inc. (NYSE:PLTR) have so far lost 50% of their value year to date. This is despite Palantir making significant progress regarding customer acquisition and improving monetization. The market may currently not favor Palantir, but the company represents compelling value for investors in a recession: Palantir has a stable government business with predictable revenues and a very promising commercial business that is seeing accelerating momentum. I believe shares are too cheap given the firm’s potential in the big data niche, and the risk profile around $9 is highly favorable!

Palantir: Down But Not Out

Shares of Palantir have cratered this year as investors swapped growth stocks for value stocks. Inflation is soaring, higher interest rates are starting to create headwinds for stocks, and the Ukraine-Russia conflict has amplified supply chain disruptions. However, I believe Palantir’s government business offers stability and predictable revenue growth during more uncertain and volatile times, while the commercial business provides upside potential.

Its Government Business Stabilizes Palantir In A Recession

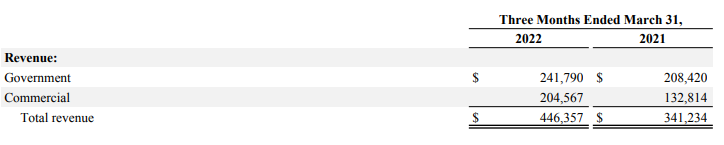

Palantir’s reliance on government contracts is a key asset for the software analytics company, especially if a recession makes it harder for companies to earn a dollar. Palantir’s government business generated $241.8M in revenues in the first-quarter, showing an increase of 16% year over year. Commercial revenues increased at a rate three times faster, as more companies adopt Palantir’s Foundry platforms. Government revenues accounted for 54% of Palantir’s revenues in Q1’22. Going forward, the U.S. government is going to remain Palantir’s largest and most important client.

Palantir

In the first week of June, Palantir announced that the U.S. Space Systems Command awarded the company a $53.8M contract increase related to deployment of Palantir’s Data-as-a-Service platform. The total deal value has since risen to $175.4M.

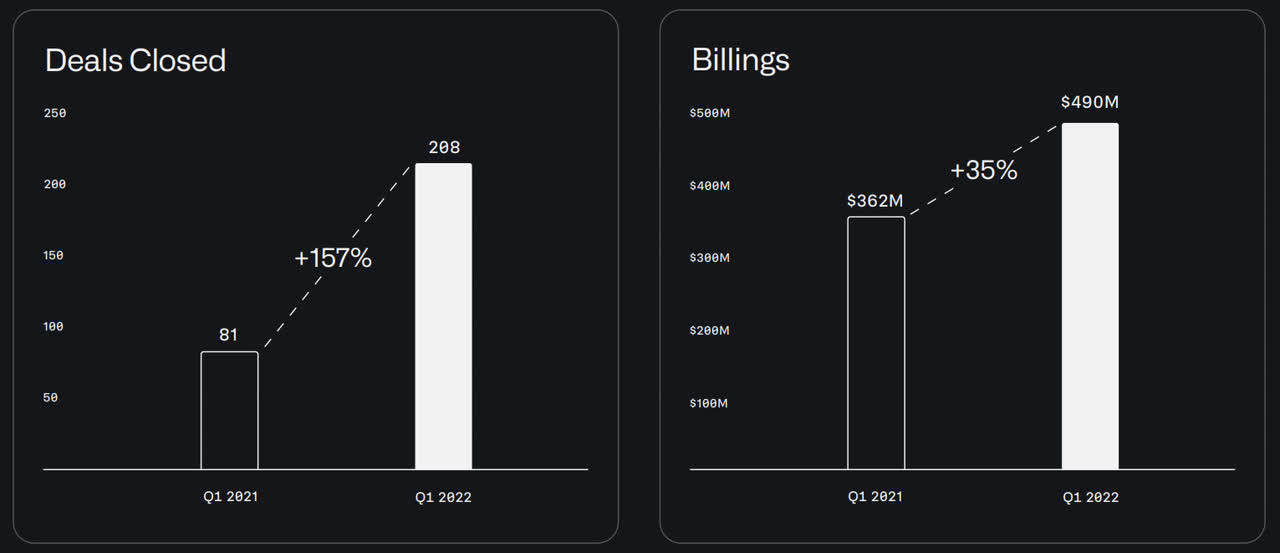

The deal with the U.S. Space Systems Command is only one deal the company has struck lately, and Palantir has been exceptionally successful in growing its combined deal value over time. Palantir ended the first-quarter with a total remaining deal value of $3.5B, showing 26% year-over-year growth. The number of new deals closed soared 157% in Q1’22 to 208, while billings increased 35% year over year to $490M.

Palantir

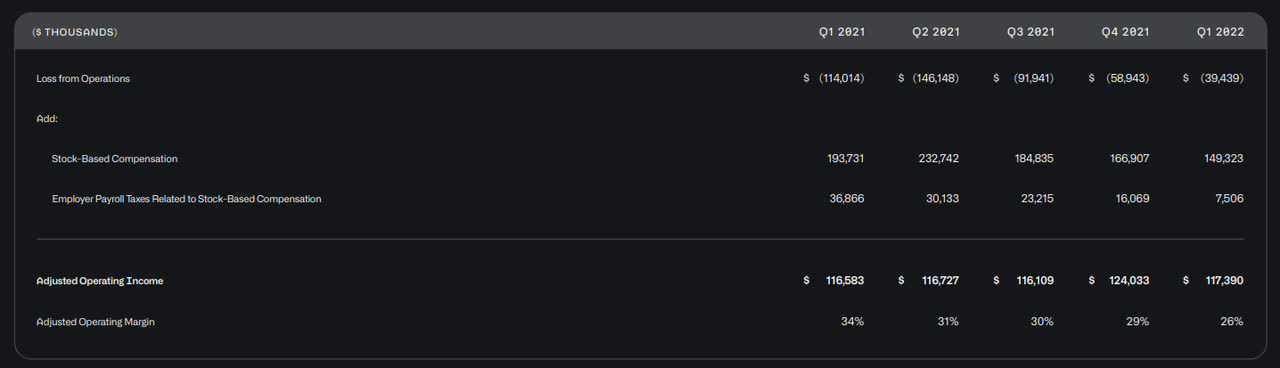

As the company onboards more clients this year, especially in the commercial business — which is where Palantir’s acquisition momentum is — the firm has a real chance of growing its operating margins and achieve profitability. Palantir generates adjusted operating margins of around 30% right now, but could achieve margins between 35-40% longer term as customer monetization improves.

Palantir

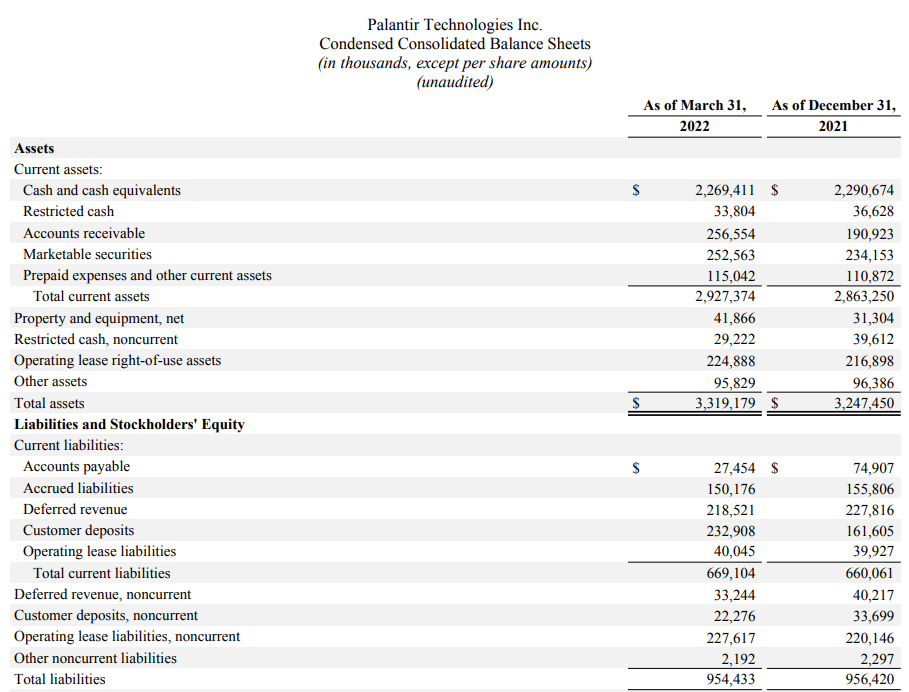

Recession-Proof Balance Sheet

Besides a strong government business, Palantir has a fortress balance sheet that protects the firm against recession-induced downside. The big data company had $2.3B in cash on its balance sheet at the end of the first-quarter, and the company did not have any financial liabilities.

Palantir

Palantir’s Growth Is Discounted

There is no denying it: the market doesn’t value growth stocks very much right now… and this is why shares of Palantir have revalued to just $9. However, I believe Palantir represents deep value at this price and valuation level, in large part because the firm will continue to grow its top line at impressive rates. Management recently reaffirmed its outlook for 30% annual revenue growth until FY 2025, and I believe this is a very achievable goal.

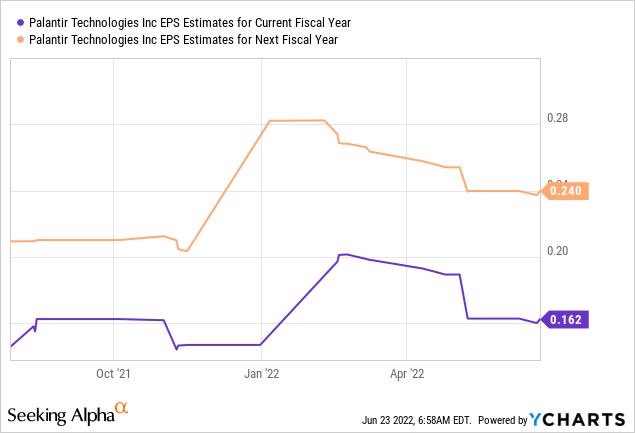

Palantir is just on the cusp of being profitable, too. Estimates call for $0.16 per-share in profits in FY 2022 and $0.24 per-share in FY 2023. Based off of FY 2023 estimates, Palantir has a price-to-earnings ratio of 38X… which is not a high ratio for a company that expects 30% annual revenue growth.

Risks With Palantir

A major risk for Palantir would be if the U.S. government, which is responsible for the majority of Palantir’s revenues, decided to reduce its spending on the firm’s products and services during a recession. Another risk is that the company is diluting shareholders… for which Palantir’s management has been rightfully criticized. I would change my mind about Palantir if the company were to scrap its long term guidance of 30% annual revenue growth or if customer acquisition rates deteriorated.

Final Thoughts

Palantir may be down big at the moment, but the long term outlook for revenue growth is unchanged. Palantir has a very profitable government segment that should help stabilize the firm in a recession, and the balance sheet looks very robust as well.

At the same time, the commercial segment has upside potential through incremental customer acquisition and stronger monetization. Recent contracts wins and Palantir’s massive order backlog all but guarantee steady cash flow for Palantir in the coming years. Shares of Palantir have become way too cheap, and the risk profile remains heavily skewed to the upside!

Be the first to comment