sorn340/iStock via Getty Images

A large global economy necessitates the existence of large equipment that can build the buildings and other structures needed for said economy to be maintained and to continue growing. These days, there are a number of companies dedicated to providing various equipment and other products and services aimed at meeting these needs. Some companies have vast portfolios of different offerings, while many others focus on more specific solutions. One company that fits into the latter category is The Manitowoc Company (NYSE:MTW). Fundamentally, this is a difficult company to be either excited or scared about. For instance, it does have some problems like a mixed operating history that involves some rather sizable net losses and cash outflows. But on the other hand, recent performance has been encouraging and shares of the enterprise look attractively priced at this moment. For investors who don’t mind the uncertainty that this kind of business offers, it could well generate an attractive return. But for those who can’t handle wild fluctuations in performance, this might be a good business to steer clear of.

A possible lift for your portfolio

The Manitowoc Company has a long operating history. The business was originally founded back in 1902 and, since then, has seen a lot transpire both internally and externally. Today, the current version of the business acts as a provider of engineered lifting solutions. To be more specific, the company produces and sells, as well as supports, a comprehensive portfolio of mobile hydraulic cranes, lattice boom crawler cranes, boom trucks, and tower cranes. It does all of these activities under the Aspen Equipment, Grove, Manitowoc, MGX Equipment Services, National Crane, Potain, and Shuttlelift brand names. In addition to providing this lifting equipment, the company also sells parts associated with their equipment, as well as commissions and disassembles cranes. Management also says that they offer training, remanufacturing services, field service work, and routine crane maintenance.

Operationally, the enterprise has three segments that it reports. These are based on geography. The largest segment is the Americas segment. Naturally, this segment focuses on the most western part of the western world. During the firm’s 2021 fiscal year, this segment was responsible for generating 44% of the company’s overall revenue and 59% of its segment profits. The next largest segment is the EURAF segment, which consists of its operations in Europe and Africa. This unit was responsible for 39.4% of the company’s revenue but just 9.2% of its segment profits. And finally, we have the MEAP, of Middle East and Asia Pacific, segment of the enterprise. In 2021, it accounted for 16.6% of revenue but was responsible for 31.8% of overall profits.

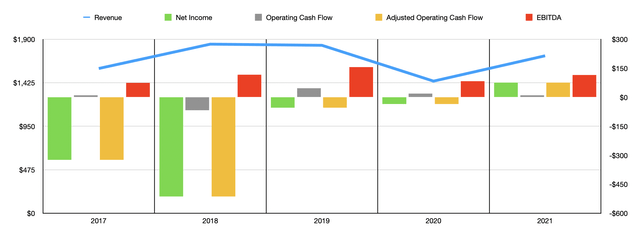

Over the past few years, financial performance achieved by the company has been rather mixed. This was true even before the pandemic. For instance, from 2017 to 2018, sales increased from $1.58 billion to $1.85 billion. In 2019, revenue dipped slightly to $1.83 billion before plunging to $1.44 billion in 2020. The good news for investors is that the decline was short-lived. Revenue in 2021 recovered some, rising to $1.72 billion for the year. What really is great for investors is that management anticipates growth continuing into the 2022 fiscal year. Some of this is due, no doubt, to strong demand following the weakness that came about because of the COVID-19 pandemic. However, the company also made a couple of acquisitions in 2021 that will certainly add to its top line. According to management, overall sales for the year should be between $2 billion and $2.2 billion. However, this guidance was given before management came out saying that they were winding down their sales in Russia because of the conflict in Ukraine. The good side to this is that management said sales to Russia account for less than 2% of the company’s overall sales.

If you think revenue has been volatile, fasten your seatbelts because profitability has been a different animal entirely. In 2017, the company generated a profit of $10 million. This turned into a $66.9 million loss in 2018 before recovering to a $46.6 million profit one year later. In 2020, the company lost only $19.1 million despite the pandemic. And last year, profits came in at $11 million. Other profitability metrics for the company have also been similarly volatile. Over the past five years, operating cash flow has ranged from a lower point of negative $512.8 million to a high point of a positive $76.2 million. If we adjust for changes in working capital, however, cash flow has been consistently positive. Last year, this metric would have been $73.1 million, up from the $34.8 million generated one year earlier. Following a similar trajectory has been EBITDA. According to management, this metric totaled $116 million in 2021. That’s up from the $83.1 million generated in 2020, but it’s still below the $156.6 million management generated in 2019.

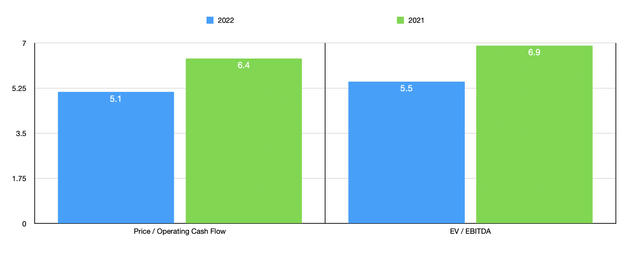

When it comes to its 2022 fiscal year, management has offered some guidance. For instance, EBITDA for the company should be between $130 million and $160 million. Earnings per share, meanwhile, should be between $0.65 and $1.35. Between how large this range is and the company’s historical volatility on its bottom line, I do not believe that net income is a good measure of the company’s potential. Instead, I believe that investors should pay attention to cash flow. Unfortunately, management has not provided any guidance when it comes to this metric. However, if we assume that the adjusted equivalent of this will increase at the same rate that EBITDA should, then a reading of around $91.4 million should be anticipated.

Using these figures, we can see that shares of the company are rather cheap. On a price to adjusted operating cash flow basis, The company, using its 2021 results, should be trading at a multiple of 6.4. This drops to 5.1 if we rely on 2022 estimates. Using the EV to EBITDA approach, the multiple would be 6.9 for 2021 and this would drop to 5.5 if we use the 2022 figures. To put this into perspective, I compared the company to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 5.4 to a high of 24.8. Only one of the five firms was cheaper than The Manitowoc Company. Meanwhile, using the EV to EBITDA approach, the range would be from 8.3 to 15.5. In this scenario, our prospect was the cheapest of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| The Manitowoc Company | 6.4 | 6.9 |

| Meritor (MTOR) | 19.6 | 8.3 |

| The Greenbrier Companies (GBX) | 24.8 | 12.8 |

| Caterpillar (CAT) | 17.4 | 13.6 |

| Trinity Industries (TRN) | 5.4 | 15.5 |

| Westinghouse Air Brake Technologies (WAB) | 15.6 | 14.9 |

Takeaway

At present, I feel rather conflicted about The Manitowoc Company. Looking at the company strictly through the lens of how cheap or expensive it is, I am incredibly intrigued because it seems to offer attractive upside potential. But this comes with the downside of significant volatility, especially when it comes to its bottom line. Having said that, between renewed demand for its products and services, as well as thanks to the expected growth the firm should achieve this year as a result of its aforementioned acquisitions, I would tilt in the direction of being bullish about the company rather than bearish.

Be the first to comment