Cancan Chu/Getty Images News

Lenovo Group Limited (OTCPK:LNVGY) reported record quarterly results for the quarter ended December 2021, with “historic highs” for the company’s revenues and profits, as well as its first USD 200 billion quarter. Net income rose at a rate of more than 50% for the sixth consecutive quarter, with Q3 2021 net income jumping 62% YoY to a record USD 640 million while net margins improved by nearly one percentage point, putting the company on track of reaching its goal of doubling net margins in three years. Revenues rose 17% YoY to USD 20.1 billion with all major business segments reporting double digit revenue growth. Intelligent Devices (PCs, notebooks, and smart devices) reported revenue growth of 16% YoY to USD 17.6 billion. Infrastructure Solutions (data center infrastructure) reported a 19% YoY growth in revenues to USD 1.9 billion. Solutions and Services (subscription-based data center hardware and IT services) reported a 25% YoY rise in revenues which reached USD 1.5 billion for the quarter.

Pandemic-driven PC boom could be cooling off suggesting near-term slowdown

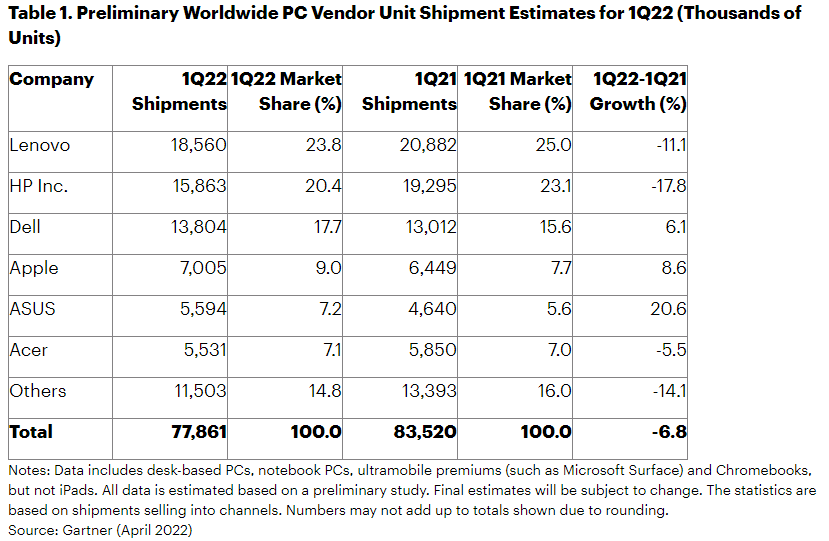

After two strong years of rapid PC sales growth, short term tailwinds from pandemic-induced remote working and online learning trends that had driven a global PC boom appear to be tapering off as worldwide lockdowns restrictions ease. Global PC sales dropped 5.1% in Q1 2022 according to IDC.

Gartner estimates global PC shipments dropped 6.8% in Q1 2022, a stark contrast to the same quarter a year earlier when global PC shipments rose around 15% – their fastest growth in 20 years, after a decade of slow or no growth – as consumers rushed to buy desktops and laptops for remote working and learning. Canalys estimated global PC shipments dropped 3% in Q1 2022, the first year on year shipment decline since Q1 2020.

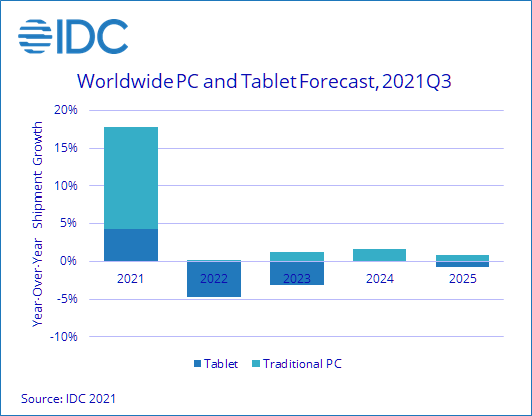

With the education segment approaching saturation and the consumer segment largely fulfilled after a wave of pandemic-driven consumer buying over the past two years, global PC shipments is expected to see relatively muted growth over the next few years until the next consumer refresh cycle. IDC expects a 3% CAGR in global PC shipments to grow 3.3% until 2025.

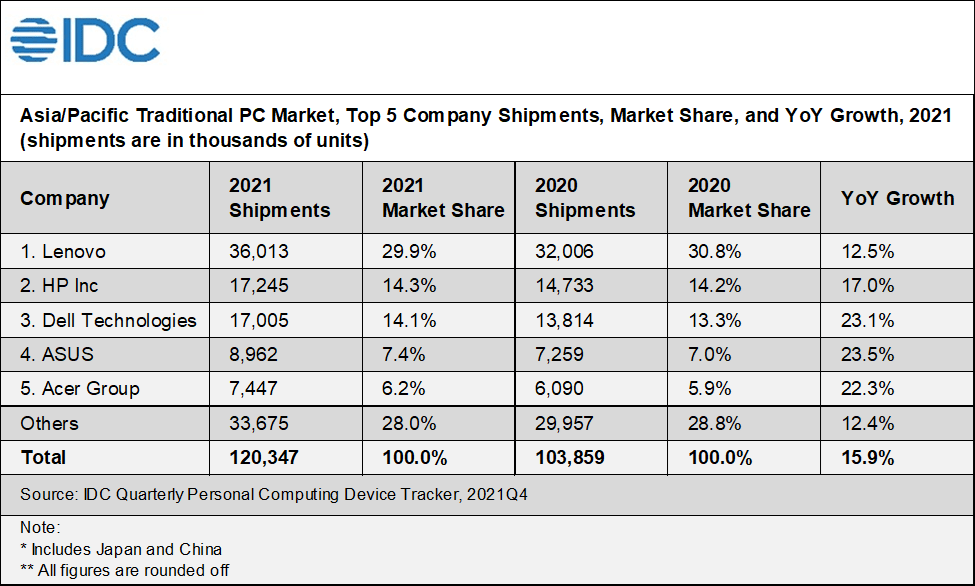

IDC

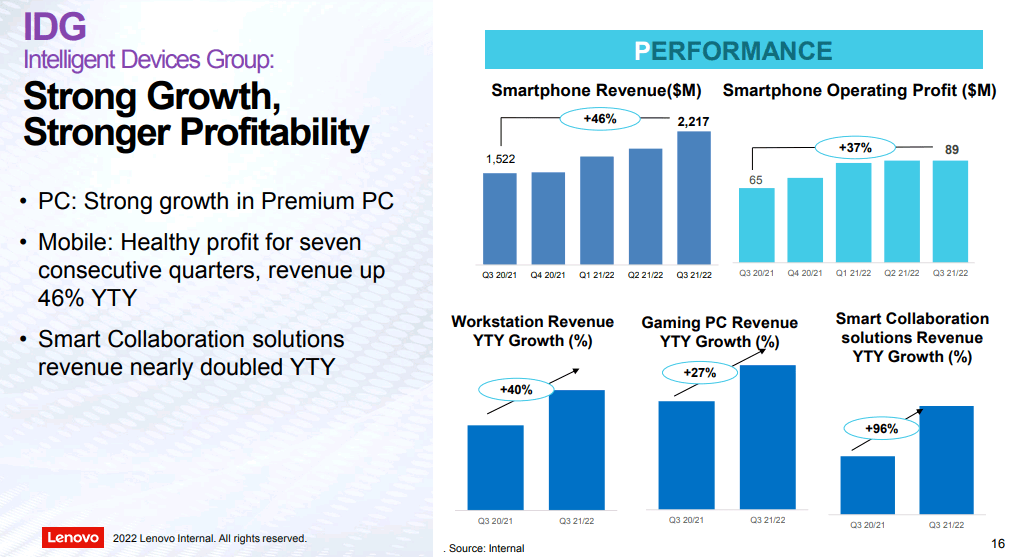

The slowdown could impact Lenovo, whose Intelligent Devices Group (IDG) business segment, which includes sales from its PCs, tablets, and smartphones, accounts for the bulk of the company’s revenues. For Q3 2021, this division generated USD 17.6 billion in revenues (a 16% YoY increase), accounting for 87% of the company’s total revenues of USD 20.127 billion for the quarter.

Longstanding world market leading PC company

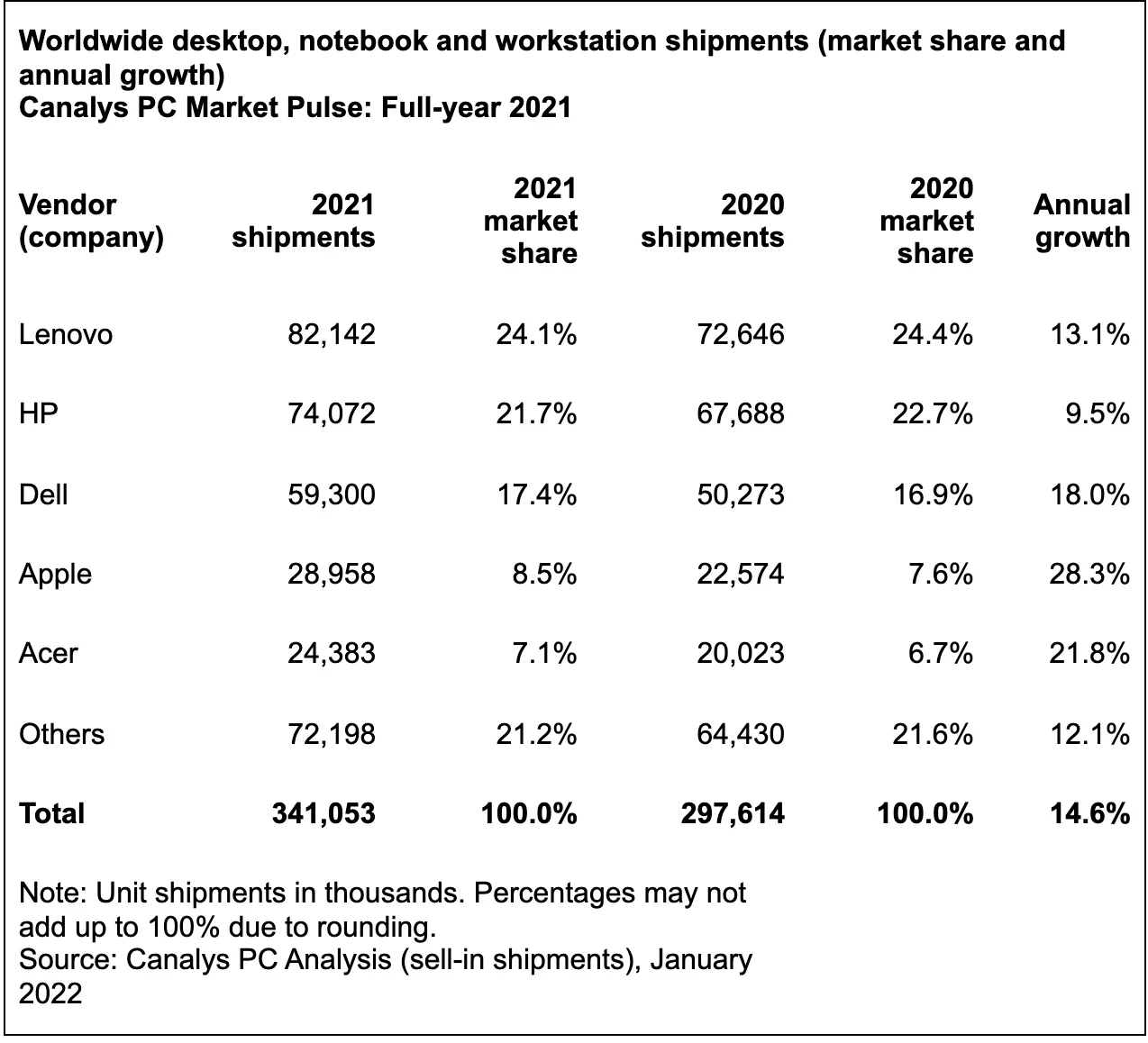

Global PC shipments rose 15% in 2021. Lenovo led the market with a market share of 24.1%, ahead of HP (market share 21.7%) (HPQ) and Dell (17.4%) (DELL), according to data from consultancy firm Canalys.

Canalys

Lenovo maintained its market leading position in Q1 2022, although the company lost market share during the quarter according to IDC, Gartner, and Canalys (Asus, Dell, and Apple saw market share gains while Lenovo and HP lost share). This was due to Lenovo’s relatively large exposure to the Chromebook segment (which saw a steep drop in shipments, driving down overall PC shipments during the quarter).

Like Lenovo, HP’s market share decline was also due to its relatively large exposure to Chromebook sales while Dell had minor exposure to this market). Excluding Chromebook sales, the worldwide PC market grew by a modest 3.9% year over year helped by business PCs which saw an uptick in sales as hybrid work and the return to offices drove demand for desktop devices according to Gartner. The trend helped Dell – who has a relatively larger exposure to the commercial PC market – gain share during the quarter.

Gartner

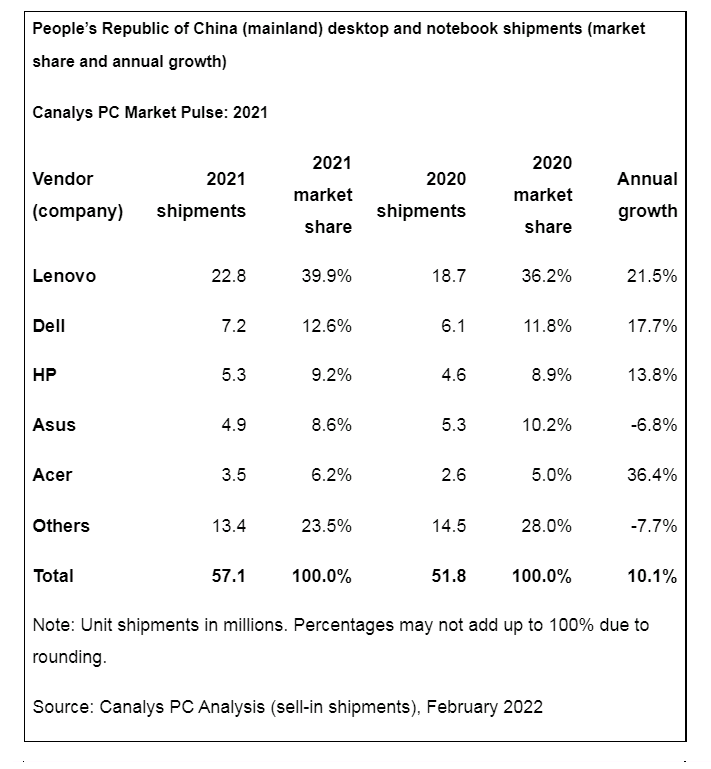

Lenovo is likely to maintain its market leading position going forward, barring any unforeseen events. Since surpassing HP in 2013, Lenovo has long maintained its market leading position in the global PC market, driven by a “protect and attack” strategy which saw the company defensively protect its market share in its home market – China – while offensively growing internationally – particularly in emerging markets. Operational advantages such as a wide distribution network, and local market knowledge have helped Lenovo heavily dominate China’s PC market with a market share of 40% as of 2021, up from 36% in 2020. Dell is second with 12.6% and HP a distant third with 9.2%.

Canalys

On the offensive front, Lenovo has successfully cornered the Asia-Pacific PC market with a market share of 30%, far ahead of HP’s 14% market share.

IDC

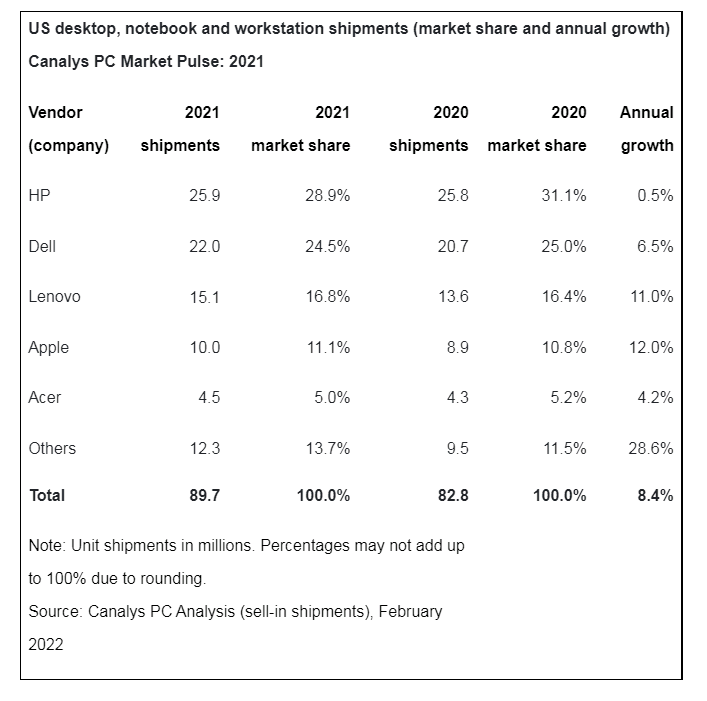

Lenovo has also enjoyed stellar performance in Europe over the past few quarters, with the company overtaking HP to emerge as market leader (however HP is not far behind, and the possibility of HP retaking the crown cannot be ruled out). Lenovo is also trying to gain share in the U.S. market, where it currently holds a third position. However, while Lenovo has managed to gain share in this mature market, HP leads by a wide margin with a market share of 30%, compared with Lenovo’s 17% which suggests Lenovo could face a long road in its effort to close the gap.

Canalys

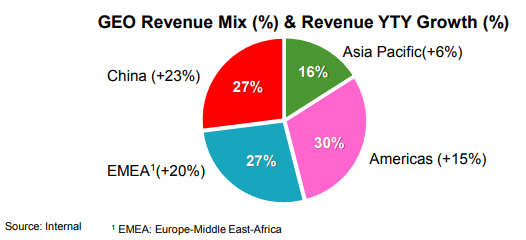

Lenovo has a broad, rather evenly distributed geographic exposure with revenues from each region accounting for no more than a third of the company’s revenues.

Lenovo

Strategically moving into higher margin segments

In its core PCs, and notebooks business, Lenovo is pushing into the premium segment and the company is already generating results. For Q3 2021, Lenovo’s premium PC segments delivered strong growth with workstation and gaming PC revenues growing 40% and 27% YoY respectively (workstations and gaming PCS generally have higher specs, are more powerful, and therefore also more expensive than typical PCs). Strong performance in its premium PC segment may have contributed to the segment’s profitability which significantly improved during the quarter – segment profit rose 21% YoY to USD 1.4 billion outpacing segment revenue growth of 16%. Segment operating margins improved to 7.7% versus 7.4% the same quarter a year earlier.

Lenovo

Lenovo’s Solutions and Services Group (SSG) which covers the company’s IT-as-a-Service business segment – accounts for a relatively minor proportion of revenues (7.1% as of Q3 2021), but the segment is its highest margin business and is growing rapidly, recording double digit YoY revenue growth over the past few quarters. SSG revenues grew 25% YoY in Q3 2021, 30% in Q2 2021, and 38% in Q1 2021. Remote and hybrid working trends are expected to help drive this business in the future, and Lenovo is positioning itself to capitalize on this opportunity.

Business segment performance

|

Segment operating profit margin (%) |

Segment revenue growth YoY (%) |

|

|

Intelligent Devices |

7.7% |

16% |

|

Infrastructure Solutions |

0.9% |

19% |

|

Solutions and Services |

22% |

25% |

Lenovo is investing heavily in R&D into this segment as part of its goal of transforming into a solutions and services company. R&D expenses for the quarter was up 38% YoY, much of which were poured into technologies focused on emerging IT technologies (or “New IT” as Lenovo terms it) such as client device edge, edge computing cloud, cloud computing, high-speed networks, etc. (“Client-Edge-Cloud-Network-Intelligence”). Lenovo is intensifying its push to develop capabilities in these emerging technologies with the company planning to add 12,000 R&D staff over the next three years. This is in addition to the 5,000 that joined in the last fiscal year. For perspective, Lenovo had a headcount of approximately 71,500 worldwide at the end of March 2021.

Financials

Lenovo’s margins are nowhere as close as its Western rivals Dell and HP. This is probably due to Lenovo’s relatively higher exposure to cost-conscious emerging markets. However, the company’s gradual penetration into the high margin PC segment, and developed markets, could help the company potentially improve margins going forward. Lenovo’s margins have been creeping up in tiny increments over the years.

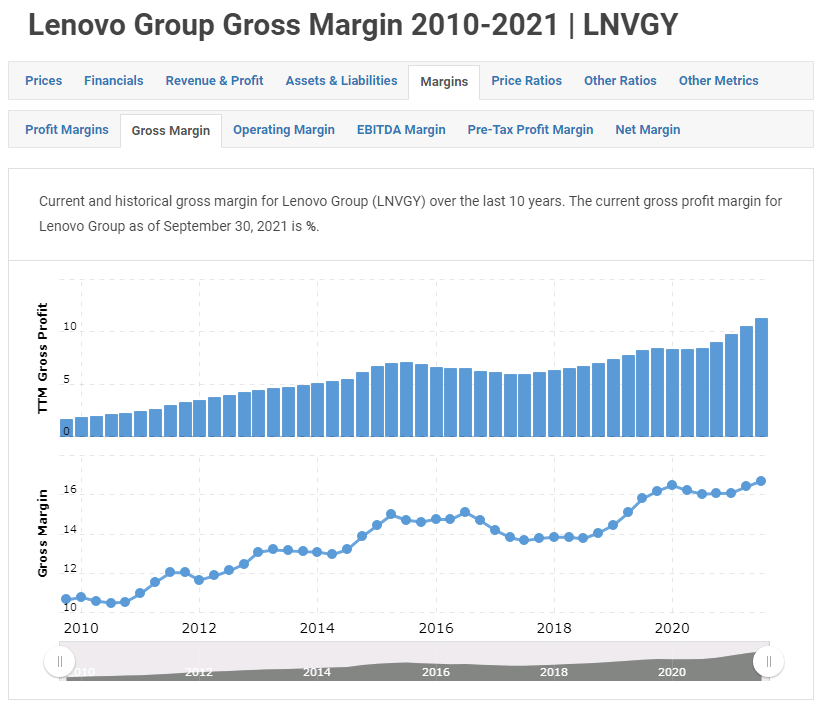

Longer term, Lenovo has a track record of improving gross margins, perhaps thanks to economies of scale and brand power from its market leading position.

Macrotrends

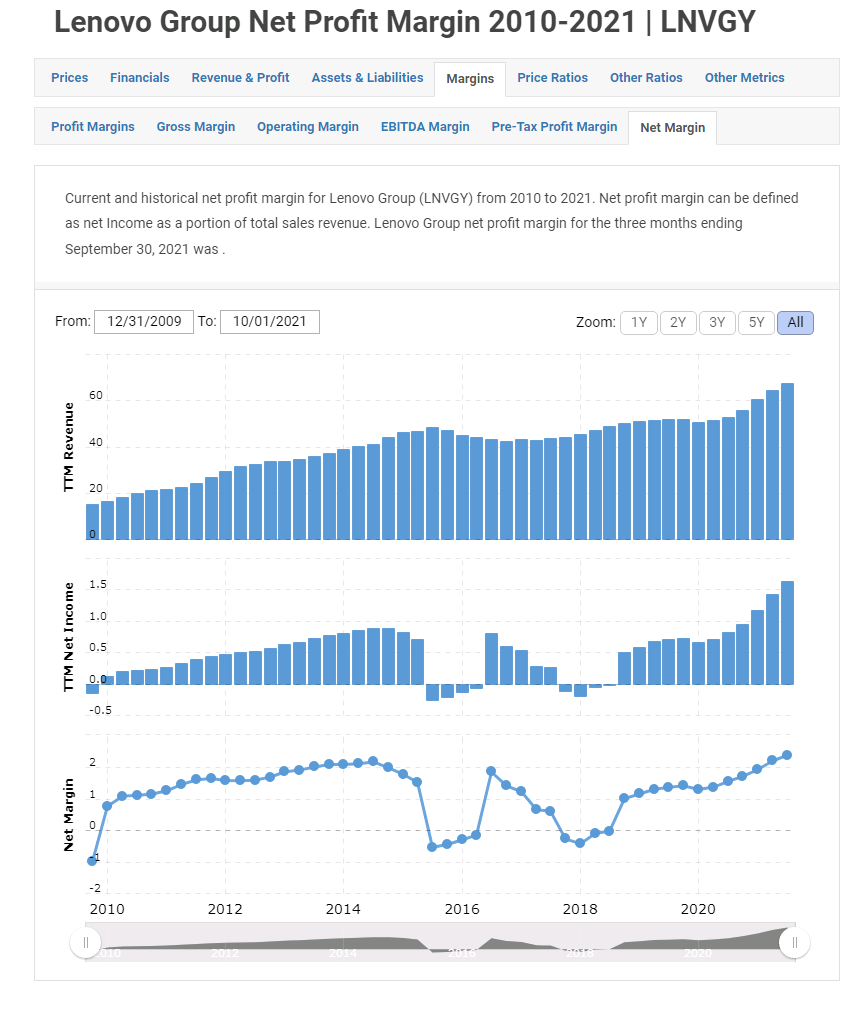

Net margins have been choppy but have been on an uptrend over the past few years.

Macrotrends

Summary

Global PC market leader Lenovo has benefited from short term tailwinds from the pandemic, however such tailwinds are subsiding, and given that this is the company’s largest business, a demand slowdown may dampen Lenovo’s performance going forward. Longer term, the company is aggressively investing in R&D to grow its IT services capabilities, a small business currently but is rapidly growing and offers positive long term prospects due to 5G-related emerging technologies such as cloud, edge computing, and high speed networks.

It remains to be seen how successful Lenovo’s R&D efforts will be in generating results for this lucrative segment; however, early signs are positive, with the segment so far delivering robust growth.

Be the first to comment