Michael Vi

Palantir (NYSE:PLTR) is a software company offering services related to data and analytics. In the past the company has focused on the defense and intelligence sectors, but is now trying to expand its commercial business. Palantir’s business model is service heavy and involves high-touch customer relationships, which raises questions about the company’s long-term margins and ability to effectively penetrate smaller customers. Given these uncertainties, and current customer concentration, Palantir’s stock is still relatively expensive.

Market

Palantir estimates that their total addressable market is approximately 119 billion USD across the commercial and government sectors. The commercial opportunity is estimated to be approximately 56 billion USD based on an assumed annual contract value for each of the estimated 6,000 potential customers with more than 500 million USD in revenue. The government opportunity is estimated to be approximately 63 billion USD. This was calculated by assuming that 5% of relevant government department spending is on software and consulting services, and that Palantir’s software can capture a certain percentage of this software and consulting spend. The estimated TAM in the US government sector is 26 billion USD and the estimated TAM in the international government sector is 37 billion USD.

The estimated market opportunity is large, but broadly in line with estimates of other companies in the space. Given the diversity of use cases included in market estimates and how fragmented the data and analytics landscape is, it is questionable whether any one company can address more than a fraction of the market, or capture a large share of the market they do address.

Palantir

Palantir was founded in 2003 to assist in counterterrorism investigations and their Gotham platform was released in 2008 for customers in the intelligence sector. Defense agencies subsequently began utilizing Gotham to investigate potential threats and help protect soldiers from improvised explosive devices. Palantir is a company with strong political views and has chosen to limit distribution of its software to the US and its allies. This may limit the size of their market, but probably better aligns Palantir with their government customers.

Palantir later began working with corporations in industries like energy, transportation, financial services and healthcare, as they sought to leverage the capabilities of their platform outside of the government sector. The Palantir Foundry platform was released in 2016 to address the needs of these large corporate customers.

Palantir provides generalizable platforms for modeling the world and making decisions. Their software primarily aims to replace custom software tools and applications that are failing organizations. They have two principal software platforms:

- Palantir Gotham (“Gotham”) – constructed for analysts at defense and intelligence agencies

- Palantir Foundry (“Foundry”) – aims to become the central operating system of organizations

Gotham and Foundry create an integrated data asset that users can build on top of and aim to enable users to manage and extract insights from data. Palantir’s background in defense and intelligence forced them to develop strong capabilities around monitoring, securing and controlling access to data, which is potentially attractive to institutions with sensitive information. The software also has a strong focus on data transparency and accountability through integration, versioning, orchestration, provenance, security and compliance.

Palantir’s platforms can be deployed in a public cloud, a private cloud, on-premises data centers, air-gapped networks in classified environments, edge computing environments, on laptops, and on specialized hardware.

Palantir’s main products are Gotham, Foundry, Nexus Peering, MetaConstellation and Apollo.

Gotham

Gotham enables users to identify patterns hidden deep within datasets, ranging from signals intelligence sources to reports from confidential informants. It also facilitates handoffs between users, helping with the planning and execution of operations. Gotham is now used broadly across government functions.

Foundry

Foundry aims to create a central operating system for customers’ data, where all data is integrated and can be analyzed in one place. Foundry also has native modeling and simulation capability that enables customers to interact with a digital twin of their enterprise. All commercial sector customers now use Foundry, as do several government customers.

Palantir has been working to reduce friction in the Foundry platform, including the introduction of no-code application and pipeline builders. Palantir recently introduced a no-code application development to Foundry called Workshop. This allows users without coding experience to build applications on top of data warehouses. More than 10,000 developers are now building applications within the platform.

Pipeline Builder brings a no-code approach to building data pipelines, enabling business analysts to perform data engineering in Foundry. Palantir has also introduced an experimental feature that leverages OpenAI’s GPT-3 to build pipelines with oral input.

Nexus Peering

Nexus Peering enables Gotham to reason about the causality of a distributed system of nodes. These nodes can independently edit the same objects at the same time and Nexus Peering allows the edits to be synchronized across the network. Nexus Peering is now being offered as a stand-alone capability for customers to build their own data fabrics on top.

MetaConstellation

MetaConstellation allows customers to harness the power of satellite constellations to drive decision-making. MetaConstellation integrates with existing satellite constellations and applies machine learning to sensor data to generate insights.

Apollo

Foundry was built as a cloud-native SaaS with a microservice architecture. Apollo was built to power Foundry’s public cloud SaaS infrastructure. Apollo is a SaaS solution for application teams who build, continuously deploy, and continuously secure software on Kubernetes in one or many environments.

Apollo orchestrates updates across heterogeneous deployment targets, unlocking fleet-wide autonomous management that has been a step-change in the efficiency of Palantir’s operations. Apollo is configured to decide what to upgrade, when to do it, and how. It monitors developer releases, resolves dependencies, and deploys new versions. Apollo enables the automation of DevSecOps and can help speed up the release of products by over 25X and cut DevSecOps costs by 50%.

Palantir’s past focus on defense and intelligence has meant the company has historically had a small direct sales force and that senior management (including the CEO) have had significant direct involvement in sales. This indicates a relationship heavy sales process, and the reliance on key personnel introduces risk. With Palantir now expanding more into the commercial space, they are having to build out a sales organization and develop channel partnerships.

Palantir’s customer acquisition strategy targets large and complex opportunities at bigger government and commercial institutions. The company views the high installation costs, high risk of failure and long sales cycles associated with these opportunities as barriers to entry. It is these same barriers that make Palantir as much a service organization as a software one though.

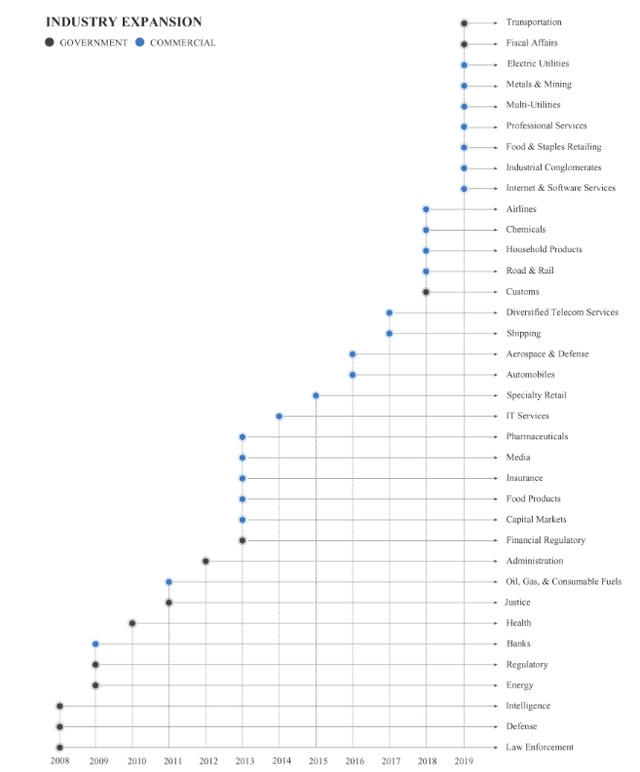

Figure 1: Palantir’s Expansion into New Industries Over Time (source: Palantir)

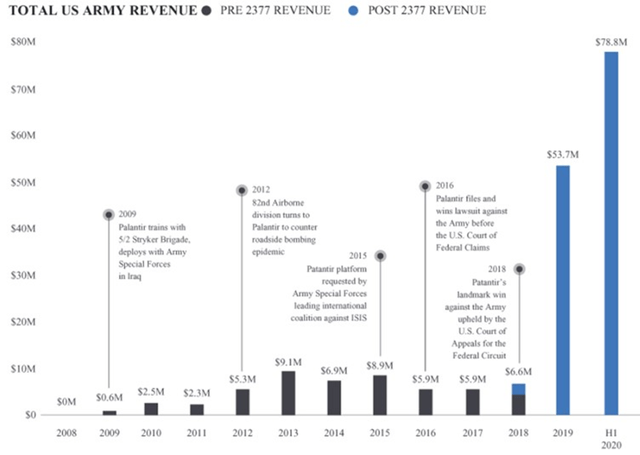

Part of Palantir’s recent success is due to their successful lawsuit against the US Army in 2018, enforcing the Federal Acquisition Streamlining Act of 1994. This law requires the US federal government to consider commercially available software before attempting to start custom-development projects on its own. While this has accelerated revenue growth for Palantir, it is not clear how it has impacted Palantir’s relationship with its customers.

Figure 2: Palantir US Army Revenue (source: Palantir)

Forrester named Foundry the leader in AI platforms as part of the Forrester Wave AI / ML Platform’s Q3 report. Palantir’s Foundry operating system received the highest possible scores in the product vision, performance, market approach and applications criteria. DataRobot and C3 AI (AI) were also assessed as leaders in the space.

There are a large number of open-source and proprietary tools available for data management and analytics. Palantir appears to be primarily differentiated by their vertical focus, developing a large number of use case specific applications in a similar manner to C3 AI.

Financial Analysis

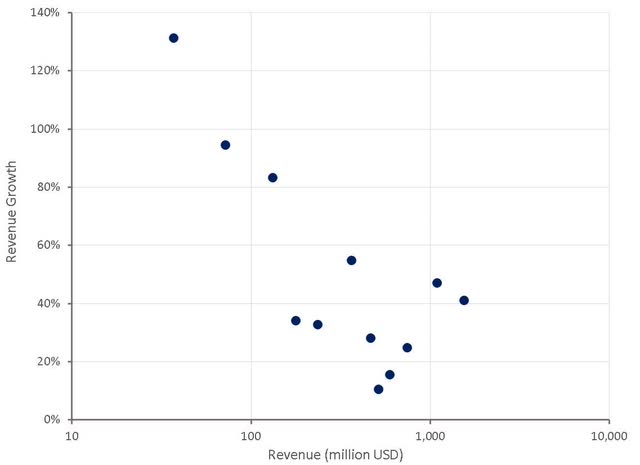

Palantir’s focus on governments and large enterprises means that they generally deal with large contracts. As a result, Palantir currently has some customer concentration risk and faces potentially lumpy growth. Given the deterioration in the macro environment over the past few months, Palantir lowered full-year revenue guidance to 1.9 billion USD. While this is a significant growth deceleration relative to 2020 and 2021, it puts revenue growth back in the typical range of the 2010s. At this point it is difficult to say to what extent 2022 has been impacted by macro weakness versus a return to more normal performance after an extraordinary period of growth.

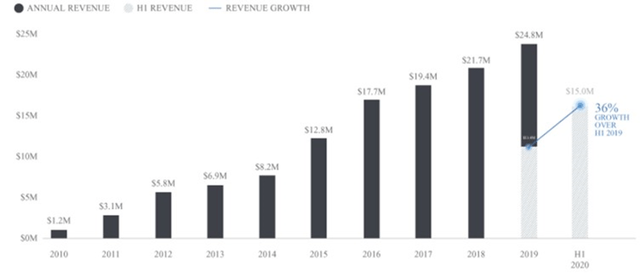

Figure 3: Palantir Revenue Growth (source: Created by author using data from Palantir)

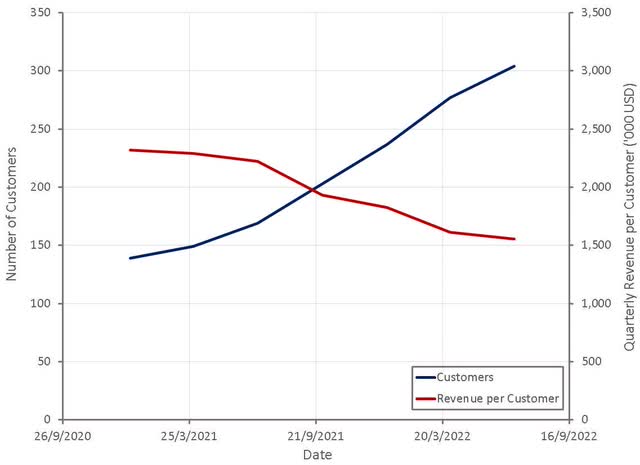

Palantir is growing its customer base, although it still has only 304 customers. As Palantir expands its customer base the average revenue per user is declining rapidly.

Figure 4: Palantir Customers (source: Created by author using data from Palantir)

Palantir’s average revenue for their top twenty customers is approximately 46 million USD. These customers account for approximately 67% of Palantir’s revenue. Palantir’s top three customers accounted for around one third of revenue in 2018 and 2019. The loss of one of these large customers would be a serious blow to Palantir’s financials, but this concentration risk is likely to decline as the customer base expands.

Driving increased spend by larger customers has been a key source of growth for Palantir in the past, but there will be a natural limit to how much customers spend on the platform. With Palantir’s largest customers already spending so much, this may become an issue sooner rather than later. Dollar based net retention is still a relatively robust 120%.

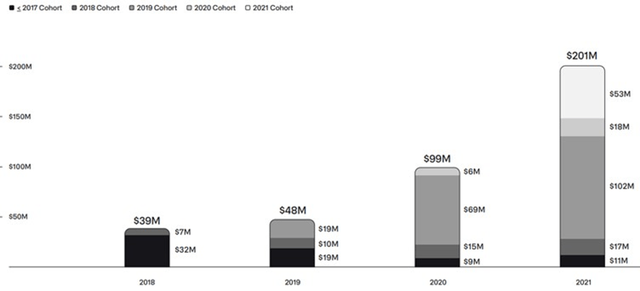

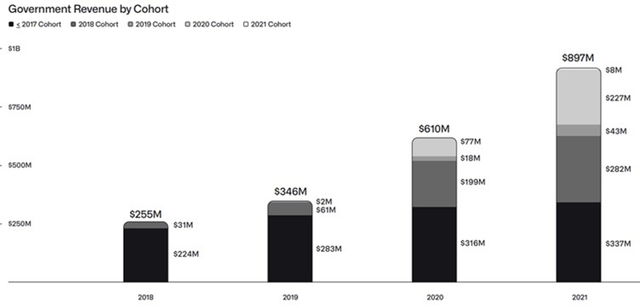

Figure 5: Average Revenue of Top 20 Palantir Customers (source: Created by author using data from Palantir) Figure 6: Palantir US Commercial Revenue by Cohort (source: Palantir) Figure 7: Palantir Government Revenue by Cohort (source: Palantir)

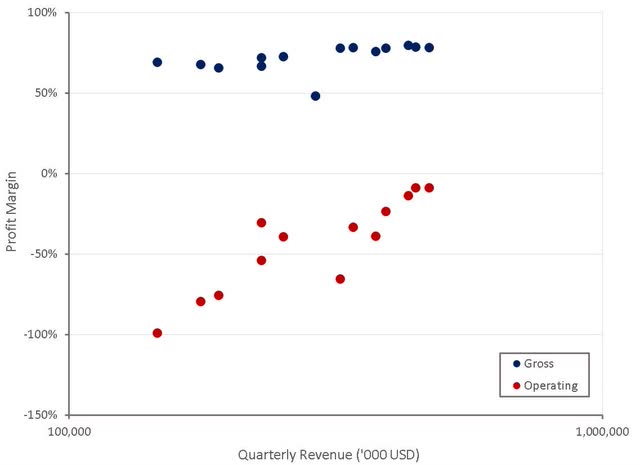

Palantir’s profit margins have shown consistent improvement as the business scales. Palantir attributes this to a significant decrease in the time and number of software engineers required to install and deploy their software platforms. The time required to setup a customer has decreased more than five-fold since Q2 2019, to an average of 14 days in Q2 2020. This is still a relatively long time though and indicates the complexity of the software and the service heavy nature of the business. Palantir has also invested in infrastructure to deliver software updates, which has more than doubled the number of upgrades their engineers can manage.

Figure 8: Palantir Profit Margins (source: Created by author using data from Palantir)

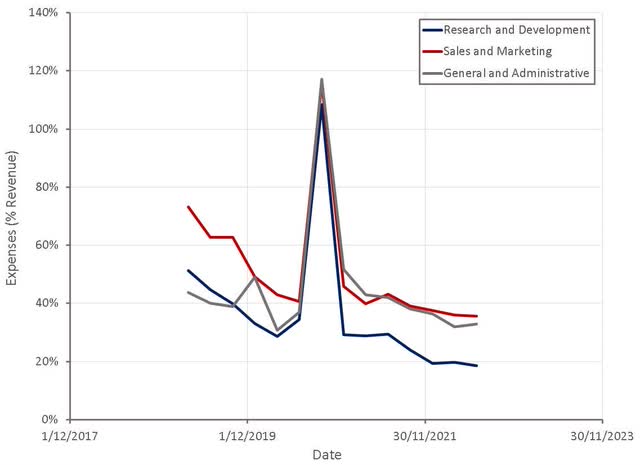

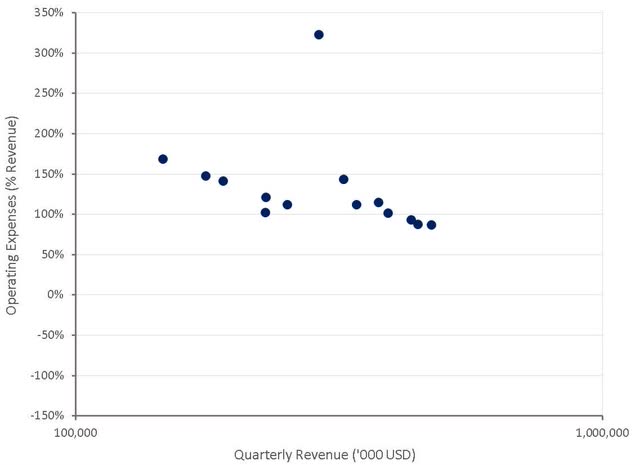

Palantir is currently realizing operating leverage across R&D, sales and marketing and general and administrative expenses. Palantir is targeting profitability and 4.5 billion USD revenue in 2025. Margin expectations are inline with the company’s current trajectory, but the growth target appears optimistic.

Figure 9: Palantir Operating Expenses (source: Created by author using data from Palantir) Figure 10: Palantir Operating Leverage (source: Created by author using data from Palantir)

At the end of 2019, Palantir had 2,391 full-time employees, of which 929 were software engineers or technical staff. Palantir’s software engineers rotate between field and development functions to ensure lessons learned from working with customers are incorporated into the platform. This points to the fact that Palantir has a service heavy business model that will likely always require a relatively large number of technical employees. Revenue per employee is increasing though, which will be a crucial component of improving margins going forward.

Table 1: Palantir Revenue per Employee (source: Created by author using data from Palantir)

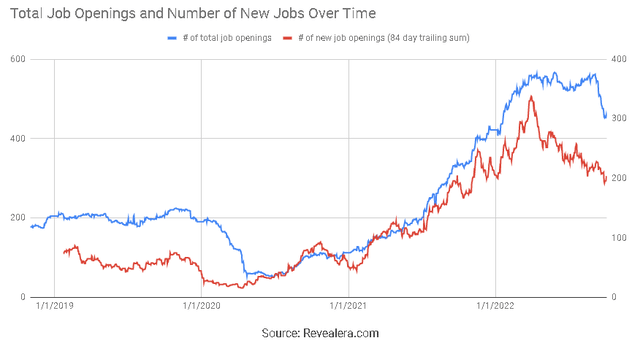

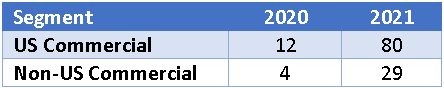

Like many software companies, Palantir has hired fairly aggressively over the past few years. The pace of hiring has moderated recently, which could be viewed as a negative indicator of future growth. Much of this headcount growth has likely been directed towards building out a sales organization that can effectively target a larger number of commercial organizations.

Figure 11: Palantir Hiring Trend (source: Revealera.com) Table 2: Palantir Sales Headcount (source: Created by author using data from Palantir)

Valuation

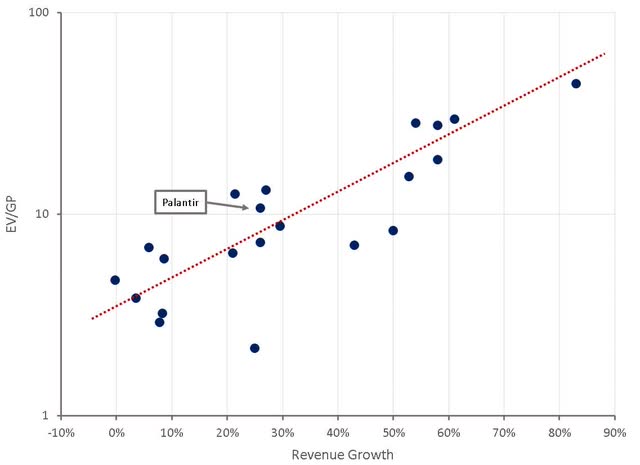

Despite declining significantly over the past 18 months, Palantir’s stock is still far from cheap relative to peers. It could be argued that the company’s focus on defense and intelligence provide it with more stability through economic cycles and that the stock should therefore be valued at a premium. Based on a discounted cash flow analysis I estimate that Palantir’s stock is worth approximately 10 USD per share.

Figure 12: Palantir Relative Valuation (source: Created by author using data from Seeking Alpha)

Conclusion

Palantir has a strong balance sheet and their focus on government contracts may also protect them somewhat through a recession. There are questions around the company’s use of stock-based compensation and the stock is still relatively richly valued. Much of Palantir’s future success will depend on their ability to develop a successful commercial sales organization and the margins they can achieve with a relatively service heavy business model.

Be the first to comment