Vladislav Chorniy

Thesis Summary

Palantir Technologies Inc. (NYSE:PLTR) has just reported its second quarter earnings, and the results were lackluster. The company’s growth is slowing, and profitability is still nowhere to be seen.

In this article, I review the latest results, as well as insights from the earnings call. Ultimately, though Palantir is a great company, and there’s a chance it could surprise in the future, there are better investments out there.

Recent Earnings

In my previous article on Palantir, I talked about how the company was showing positive growth and improvement in its cash flow and reached a fair value of $14 for the company. While I maintain this belief, the recent results show a worsening trajectory and limit the potential upside.

Palantir has just reported its second-quarter results, and the market is not happy, as the stock fell over 10% on the news. Palantir missed analysts’ estimates on EPS and also offered weak guidance. The company expects to end the year with $1.9 billion in revenues, which is lower than the analyst’s estimate of $1.98.

Having said this, there’s much more to unearth than headline numbers. Let’s break down some other significant metrics.

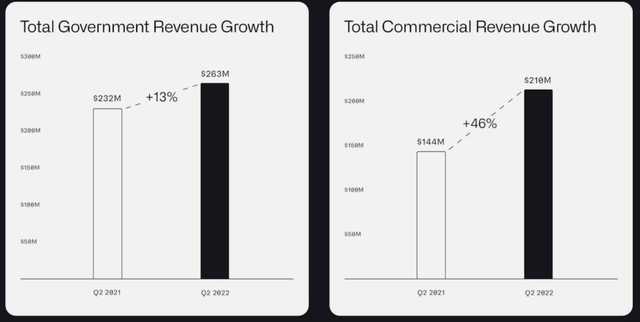

Revenue Breakdown (Earnings Presentation)

The revenue growth came in at 25.9% YoY, actually beating estimates. If we break that down into segments, we can appreciate that Commercial revenue growth is the most significant part of this equation. Meanwhile, government growth has been lackluster at 13%.

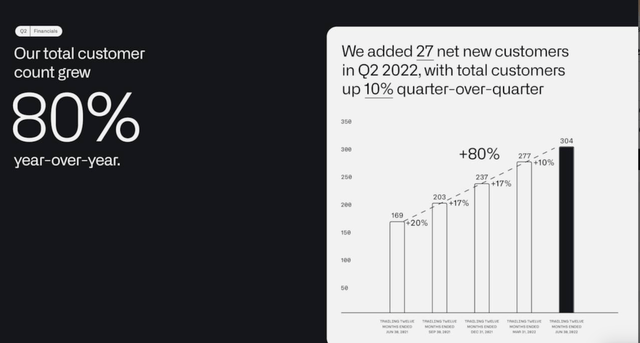

Customer Count (Earnings Presentation)

Now, the customer count grew over 80% YoY, which sounds impressive. However, we can see on the right that quarterly growth has slowed. The company only added 10% of new customers in Q2.

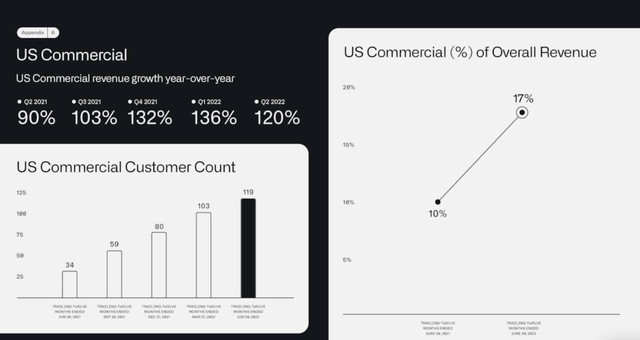

US commercial revenue (Earnings Presentation)

On a slightly more positive note, Palantir has experienced substantial growth in the U.S. commercial sector, with 120% yearly growth. Yet, once again, if we look at the quarterly numbers, customer count growth is slowing down. Last quarter, the company added 23 new customers in the U.S., and this time it has only added 16.

Lastly, let’s look at profitability.

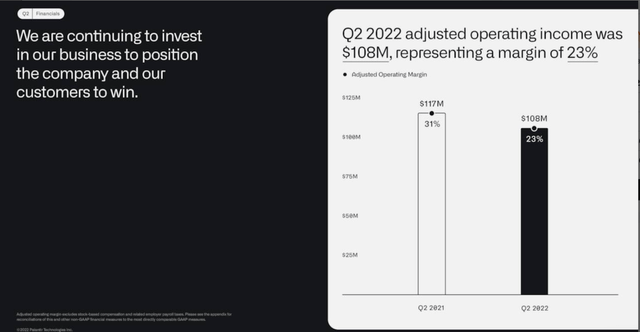

Operating Margin (Earnings Presentation)

Operating margins are substantially lower than a year ago at 23%. The company is continuing to invest in its technology and growth, but this is coming at the expense of the bottom line, with questionable results.

Insights From the Earnings Call

Apart from the usual overview of the financials, a lot was said in the earnings call about the growth in the U.S. commercial sector and the strength of the products as a whole. In fact, Karp made it very clear that this is his primary concern.

We see enormous traction on our products. You’re also getting this at a price because we run this company as owners and do not run it purely to make people happy quarter-to-quarter. I honestly don’t pay a lot of attention to that. I’m paying attention to where the company will be in 2 years and what the products will be like in deployment. Will they be adopted? Who’s building them? How are they going to be built? And are they, in fact, in front of the market?

Source: Earnings Call (Alex Karp)

While his intent to satisfy customers and ensure that Palantir’s product is the best it can be is commendable, Karp has made very clear that investor concerns are not his priority. This really begs the question: When, if ever, will Palantir be profitable?

This question was also answered in the earnings call.

That combination of radical optionality on expenses and what we perceive to be macro conditions converging with product conditions allow us to kind of see what we think will be a profitable company in 2025.”

2025 is not that far away, but it might be a long time for investors to hold out. That’s going to be a lot of unhappy quarters.

Source: Earnings Call (Alex Karp)

Lastly, Karp made some interesting remarks on the government side of the business.

So a number that — I don’t know, I think we shared in one of our earnings calls was that our government U.S. business has a CAGR over a decade or more of 35%. During that time, we’ve had a number of years that were flat, and this is frustrating. Believe me, it’s more frustrating for us than anyone else because we would prefer an even lower CAGR, but having more certainty.

And so nevertheless, you can ask yourself the question, does it appear that the last 10 years were less dangerous or the next 10 years are going to be more or less dangerous than the last 10 years?

Source: Earnings Call (Alex Karp)

It is quite an interesting way of looking at things. Karp states that flat years of growth are normal in the government sector, but the company has in the past achieved significant growth over the long term.

And, he answers the issue of growth with one simple question. Is the world becoming more dangerous? It’s undeniable that the geopolitical landscape has become more challenging, and this should translate to more business for Palantir, as long as their product is strong.

Closing Remarks

All in all, answering the question of whether Palantir is a good investment is proving to be complex. On a surface level, the latest results paint the picture of a company that is struggling to maintain its previous levels of growth. On top of that, profitability seems like a far-fetched dream. While margins were improving last year, the last few quarters have been less profitable.

Palantir has a great product, and it is doing its best to serve national interests, as well as the needs of its clients. What it isn’t prioritizing though is serving the interest of investors.

With that said, some interesting points are made in the earnings call, which makes me think that the bulls could be on to something. It does seem reasonable to believe that the need for Palantir’s services should increase in the future, given the current geopolitical tensions. Furthermore, if the success Palantir has had with U.S. companies could be replicated abroad, it would be enough to bring back growth to a level that justifies no earnings.

Ultimately, I maintain my previous valuation of $14 for Palantir, but with every passing quarter, I become more skeptical that the stock can deliver significant appreciation. For this reason, I am moving to a HOLD rating as I see a limited upside. Palantir is a great company for the world, but there are better companies out there for investors.

Be the first to comment