Marco Bello

Article Thesis

Palantir Technologies Inc. (NYSE:PLTR) has seen its shares drop by double-digits following its quarterly earnings release. The company lowered its revenue guidance for the current year, which was the main issue the market identified for this growth stock.

That being said, not everything was awful in the report, which is why we’ll highlight the pros and cons in this article.

Palantir Q2 Earnings – The Headline Numbers

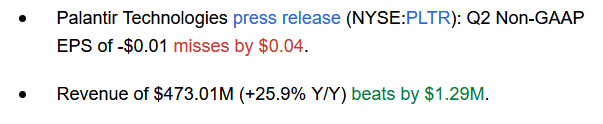

The headline numbers of Palantir’s second quarter earnings report can be seen in the following screenshot:

Seeking Alpha

At first sight, that doesn’t look too bad. Sure, profitability was slightly worse than expected, but the analyst community didn’t really anticipate meaningful profits anyway. Revenues actually came in slightly above expectations, with year-over-year growth of 26%, which is weaker than what PLTR has delivered in the past, but which is still a pretty solid growth rate.

That being said, the market chose to focus on Palantir’s revenue guidance for the current year, which was weaker than expected – the company now sees revenue coming in at $1.9 billion in 2022, which is comparable to the Q2 run rate. Analysts had forecasted revenue to come in at $1.98 billion this year, so this basically was a 4% miss versus the consensus estimate when it comes to Palantir’s revenue guidance for the current year. One can argue whether that justifies a massive selloff, but the market seems to think so – the stock is trading down 14% at the time of writing. One should note, however, that Palantir had recovered steeply in recent months, and even factoring in this double-digit drop, Palantir trades 50% above its 52-week low.

Delving Into PLTR’s Data: The Good And The Bad

When we look beyond the headline numbers, there were good things and bad things in the report.

First, commercial revenue continued to grow at a hefty pace. During the second quarter, commercial revenue was up 46% year over year, thereby being responsible for the vast majority of the company’s overall revenue growth. This trend has been in place for some time, as Palantir’s commercial business has been overtaking its government business growth-wise in recent quarters. This has several advantages. First, the commercial opportunity is larger than the government opportunity, as the market is just so much bigger. Second, Palantir will, as its commercial business grows, become less dependent on government contracts. Politics, government budgeting, and other issues will be less impactful as time goes by, as Palantir will generate a rising portion of its overall business with commercial customers. Government contracts also usually have long lead times, whereas commercial contracts can be done quicker as processes aren’t as lengthy, which could make Palantir’s business growth more agile over time.

In the commercial space, especially US-based companies have become a huge avenue for growth, as Palantir’s US commercial revenue rose by a hefty 120% year over year. Forex rates play a role in the fact that US commercial revenue is growing faster than international commercial revenue, as a strengthening US Dollar means that contracts in Euro, Pound Sterling, Yen, etc. are worth less once translated into USD. But even when we account for that, US commercial revenue growth outperforms commercial (and non-commercial) revenue growth in other regions. This possibly is the result of Palantir’s investments in its US sales team in recent quarters. The fact that the US economy is more tech-focused overall, compared to the European economy, for example, likely also plays a role.

When a car company closes a deal to sell a car, it can recognize all of that revenue immediately. That’s not the case for Palantir, as its contracts are oftentimes lengthy. When the company closes a deal with a government or commercial customer, it can’t recognize all of that deal value immediately. Revenues thus only tell one part of the story. When we want to look at the underlying business growth rate, it makes sense to also look at Palantir’s total contract value that was closed during a specific period. In the second quarter, Palantir closed $792 million worth of contracts. That’s not only easily ahead of the GAAP revenue that was recorded during the period by more than 50%, but the contract volume that was closed during Q2 points to a $3+ billion annual run rate. Even if there is no growth in the value of contracts that Palantir closes in future quarters, an eventual revenue run rate of more than $3 billion would be made possible based on the current pace of dealmaking.

So when Palantir is closing large amounts of high-value deals, why is its revenue guidance for the current year so meager, at least relative to expectations? Palantir’s management argues that this is partially the case of forex headwinds for its non-US business, as shown above, but the timing of government contracts also plays a role, according to Palantir’s executives. Government contracts can be lumpy, as in payments are not made equal over all periods. This can result in above-trend revenue recognition during some periods, and in below-trend revenue recognition during other periods. According to management, this will be a headwind this year. If that holds true, then 2023 might see an above-average revenue growth rate for the government business, as timing leads to revenue being shifted from 2022 to 2023. It’s worth keeping an eye on that over the next couple of quarters to see how this evolves and whether there will indeed be a better 2023 for the government business.

Still, revenue guidance below expectations naturally isn’t positive at all, especially for a growth stock. And Palantir most certainly still is a growth stock, as it does not offer any value stock or income stock characteristics. That being said, even at the $1.9 billion guidance for the current year, Palantir would still generate revenue growth of 23% this year. Considering the headwinds from forex movements and the timing of government revenue recognition, that’s not too bad, although higher growth would be better, of course.

Looking at Palantir’s profitability, we see that the company continues to generate losses on a GAAP basis. That’s not really surprising, though. Looking at how margins have evolved over time, we see that clear improvements have been made. The company is now running with a GAAP operating margin of -9%, which is far from great, but which is more than 3000 base points better than one year ago. If Palantir were to repeat the margin improvement at the same level next year, its operating margin would be north of 20%. There are stocks that generate steadily growing revenues and steadily growing losses. That points to a deeply unprofitable, unworkable business model, I believe. Palantir does not belong to that group. Its revenue is growing, and even though it’s still generating losses, its margins are clearly improving as well. Operating leverage seems to work just fine, and current trends indicate that Palantir should be able to start earning money on a GAAP basis in the not-too-distant future as long as its revenue continues to grow, which will allow for further tailwinds from operating leverage.

On an adjusted/non-GAAP basis, Palantir is profitable already. But since share-based compensation is backed out here, despite SBC coming at a real cost to shareholders due to the dilutive impact of share issuance, I believe that adjusted earnings aren’t telling the whole story. That being said, dilution has become less of a problem over time. During the second quarter, Palantir’s weighted average diluted shares outstanding have risen by 18 million, relative to Q1. With 18 million shares being added to Palantir’s share count in one quarter, we get to ~70 million per year at the current issuance pace. That’s equal to around 3.5% of the company’s share count. There still is dilution, but at a way more benign level compared to the past. Over the last two years, the share count has climbed by around 30%. Relative to that, a 3.5% annual dilution pace is pretty small. We can thus say that shareholders still experience dilution, but at a massively reduced pace – dilution is a low-single-digit headwind right now, which is way better than what we have seen in the past.

Valuation And Final Thoughts

Palantir was a formerly high-flying growth stock. It still is a growth stock, but today it is trading at a much more reasonable level, as the hype around the company has waned.

Today, Palantir trades for ~10.5x forward sales. That’s not a low valuation in the traditional sense at all. But when we look at the valuations of other tech companies, it doesn’t seem outrageously high, either. Microsoft (MSFT), one of the largest software companies in the world, is trading at 9.5x forward sales right now. Microsoft, of course, is a higher-quality company than Palantir, with higher margins, stronger cash flows, less dilution, etc. But Microsoft is also growing at a slower pace, and its growth potential in relative terms over the coming years is smaller, I believe. And yet, both trade at relatively comparable valuations.

Palantir thus doesn’t seem ultra-expensive to me. Success is not guaranteed, of course. But Palantir generates compelling growth, especially in the commercial space, margins are improving, dilution has become less impactful, and there is massive potential for Palantir’s technology over the coming years and decades. Palantir surely isn’t a low-risk pick, but I do believe that the current price could be more than justified in the long run – at least if execution is solid.

Be the first to comment