JONGHO SHIN

Quick Background

There’s a small pile of bad news for Palantir (NYSE:PLTR) investors. First, on August 8th, we received the Q2 Earnings Report:

- Revenue grew 26% YoY, US Revenue grew 45% YoY

- US Commercial Revenue grew 120%, US Gov’t Revenue grew 27%

- Cash from Ops was $62 million, Adjusted FCF was $61 million

On the surface that’s not terrible news. What hurts much more is missing the forward expected Q3 revenue. PLTR is now expecting about $475 million, but analyst consensus estimates for Q3 was about $505 million. Likewise, for FY 2022, PLTR is expecting $1.9 billion in revenue versus a larger $1.98 billion consensus.

The raw news isn’t awful. The problem is that growth isn’t in line, or growing. In this environment, growth stocks are still being punished. PLTR is all but required to demonstrate that the growth story is intact, or even better now. We’ll come back to this shortly.

There are two more key points to cover. First, there is the psychological impact of negative earnings. Specifically, even after adjustments, PLTR lost $0.01 per share. While revenue is up 26%, the company is in the red. That’s with all the wiggles and tweaks.

As a reminder in Q1 2022, the GAAP loss per share was ($0.05) but the adjusted earnings were a positive $0.02. Therefore, it feels like PLTR has taken a step backward. While “lumpy” earnings can be just fine, right now we’re in a negative sentiment environment for growth stocks.

The other piece of recent bad news is related to the news and sentiment. Specifically:

Deutsche Bank downgraded the data analytics software company after it issued second-quarter results, citing concerns about a slowdown in its government business.

Like many analysts, the expectation of Deutsche Bank analyst Brad Zelnick is that government business should be steadily growing. Most analysts have been more worried about the viability of the commercial business. It grew 13% from Q2 2021 to Q2 2022, which isn’t satisfying enough. The point isn’t that there’s negative growth. Instead, it’s that government growth appears to be decelerating.

Adding it up:

- Adjusted earnings flipped from positive to negative.

- Full year revenue guidance is short of expectations.

- There is a lot of growth but it’s not fantastic.

I should point out that there is plenty of good news. For example:

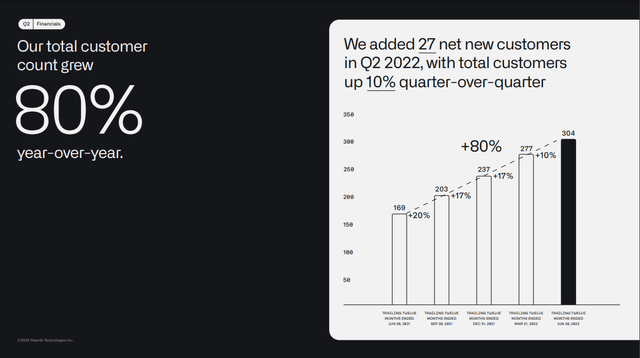

PLTR Customer Growth (Seeking Alpha & PLTR)

Clearly, there is growth. The business is powering forward but it’s not happening how analysts and investors desire. It’s too lumpy, it’s not fast enough and there’s nothing spectacular to ease fears and frustrations.

The Very Bad News

Let’s start with this comment by CEO Alex Karp:

That combination of radical optionality on expenses and what we perceive to be macro conditions converging with product conditions allow us to kind of see what we think will be a profitable company in 2025.

If that’s not clear enough, there are also these two follow-ups:

I am driving the company to get to $4.5 billion in 2025. I believe in driving the company that way.

And…

So I believe that we will get to the 2025 goal. I tend to view the business the way I view our most important segment of the business, which is there will be ups and downs. Again, the 10-year CAGR on USG is 35%.

Putting these together, this doesn’t sound confident or inspiring. But, there are also some other cracks in the numbers. The CAGR has been historically established at 35% but that’s on the government side of the business. We know that in Q2 2022, it fell to 27%.

So, now PLTR is on watch because if they don’t get 40-45% growth, for example, that 35% USG CAGR average will decay. In PLTR’s defense, the contracts are not smooth; snake eating elephant. But, it’s still a concern.

Now, here’s the most damning news of all. I’m thrilled that Sanjit Singh pushed hard on Alex Karp about this:

I noticed that you guys didn’t reiterate the 30% outlook. And some sense, that makes sense because deals are uncertain. But I thought it was interesting that you guys took back the 30%…

In response, and per the quotes above, Karp is less firm and certain:

- “think we will be profitable”

- “driving the company”

- “believe we will get to the 2025 goal”

The glory, inspiration and hope have largely evaporated from PLTR’s leader. Maybe some of the hubris has worn off. Maybe reality has smacked him around a bit. Maybe it’s simply the legal team pounding on his table. It’s really not too clear except that perhaps the growth story is no longer super strong in the eyes of PLTR’s leadership. It just feels like the flame was snuffed out.

Wrap Up

I’ve certainly been bullish on PLTR for a while. And, to emphasize, there’s a lot of good going on with the business that I didn’t even really touch:

- Average Revenue of the Top 20 Customers is up 17%

- Deals Closed is up by 67%

- Billings are up 5%

- Total Remaining Deal Value is up 4% YoY

- Gross Margins are stable at 81-83%

- $2.4 billion in cash and zero debt

As I’ve said before, PLTR is a special company. And, it’s not going to suddenly go bankrupt or anything like that, as far as I can tell. But, I will tell you this, my assumption of relentless 30% growth is now greatly disturbed.

In late June 2022, I wrote this:

While 30% revenue growth isn’t at risk, PLTR probably needs to see 40% growth, if not 45-50%, to get out of the dumps.

I was wrong. 30% revenue growth is at risk now. I wrapped up that “Behind The 8 Ball” article like this:

I sincerely believe PLTR has a great future but the timing does matter. It could still be many more quarters before we get that strong leg up, with a shift in sentiment plus a fundamental blast upward.

I believe that PLTR is still a Hold. Furthermore, I would not consider buying unless we see the price dip below $8, although that might not be low enough to get me to pull the trigger. We’re in rough waters right now. But, again, I do think this is very unique and special company, that should do well over the very long term.

Be the first to comment