hapabapa

Lucid Motors (NASDAQ:LCID) reported quite a dismal quarter, missing heavily on revenues while slashing a previous production guidance of 12,000 to 14,000 units this year in half. Questions about Lucid’s ability to reach an original 20,000 unit target for 2022 have lingered since May 2021, over a year ago, with Lucid nailing the coffin shut with Q2, with production guidance nearly 70% lower. With CEO Peter Rawlinson having mentioned multiple times prior that the OEM had enough chip supply as peers faced impacts from chip shortages, Lucid’s Q2 adds even more questions to the mix — what went wrong? Can the OEM meet targets? How will growth evolve and scale? Such doubt on Lucid’s 2H and transition into 2023 clouds the outlook on shares.

Q2 Recap

Here’s a brief recap highlighting some of the key items from Lucid’s Q2 report that raise more questions about the company’s progress and outlook, without digging too much into the details of the Q2 report:

- Revenues of $97.3 million, missing expectations for $157 million

- Reservations of 37,000 representing ~$3.5 billion in revenues

- Production cut of 50% from prior guidance to 6,000 to 7,000 vehicles

- Ability to scale, with production levels practically flat q/q

- Limited levels of deliveries to date, just 1,039 in 1H

These five key pieces from the report have raised numerous questions about Lucid’s situation, from production to sourcing to pricing.

Revenue Miss

While Lucid’s revenue miss ultimately boiled down to weaker production and a failure to scale deliveries higher through the back half of the quarter, the revenue miss provides insight into a weakening average selling price [ASP] trend.

The majority of vehicles sold in Q1 were likely the Air Dream edition, evident within the manufacturer’s ASP of ~$160,300. As Air Grand Touring edition deliveries began in Q1 and scaled throughout Q2, it is clear that ASP would fall, and that it did, down ~11.7% to $141,500.

Lucid did hike prices, but noted during Q1’s call that “the pricing actions that will be effective June 1st won’t start to impact our financials in a meaningful way, likely until 2023.” Lucid “announced pricing for the Grand Touring Performance at $179,000…reflecting cost increases in the commodity, supply chain and logistics and market,” while updating pricing on the remaining models to “$154,000 for Grand Touring, $107,400 for Touring, and $87,400 for Pure.” The pricing increases are ~10-13% higher than Lucid’s original pricing scheme, but have not yet translated into higher ASPs in the reservation book.

The nearly 40% revenue miss highlights struggles at Lucid to continuously scale revenues via a solid order book — following the completion of Air Dream edition vehicles, Lucid switched to delivering the Grand Touring edition, which was expected to align with a slowdown in revenue due to a lower ASP (just 1.8% above the Grand Touring’s original pricing of $139,000). However, the reservation book shows further substantial declines ahead for ASP.

The declining trend within ASPs and further revenue misses ahead should Lucid struggle with production output was further highlighted with reported reservation figures. Even with a larger sequential jump of ~7,000 (excl. deliveries) from May to August, compared to ~5,000 from late February to May, ASPs still look likely to fall.

Reservation Update

Lucid provided another update to its reservation book, noting that reservations have grown to over 37,000 vehicles, representing about $3.5 billion in revenue. The prior updates showed a reservation book of over 30,000 for $2.9 billion in revenue, and 25,000 for $2.4 billion in revenue. Lucid added a significantly higher amount of reservations during the past three months, about 7,000 vehicles, backing up Lucid’s remarks that it “continued to see strong customer demand for our vehicles” during Q2.

Breaking down ASPs from Lucid’s reservation book shows:

- ASP of ~$96,000 in Q4’s update

- ASP of ~$96,700 in Q1’s update

- ASP of ~$94,600 in Q2’s update

While these figures are not likely to be exact, since Lucid does not provide exact reservation figures, the reversal in ASP along with a jump in reservations during Q2 (when pricing increased on June 1) indicates that consumers are reserving the lowest-priced Air Pure at a greater degree.

This raises a few key questions regarding affordability, production, and margins.

soaring prices of commodities like lithium, an essential ingredient in batteries, helped raise the average sticker price of an electric vehicle 14 percent last year to $66,000, $20,000 more than the average for all new cars, according to Kelley Blue Book.

Lucid’s price raise has taken effect with the recent reservation update, but ASPs look likely to fall — are customers primarily reserving the Air Pure, as it is the cheapest model on the lineup? More moderately priced EVs such as Ford’s (F) Mach E are “effectively sold out,” with affordability and high demand meeting limited supply.

With trends in ASP pointing to a higher level of Air Pure models in the reservation book, this adds questions to Lucid’s margin profile. Lucid is still operating far below breakeven, with a -200% gross margin, meaning that deliveries will need to scale significantly to reach a positive gross margin, and more to reach a positive operating margin. However, given that the Air Pure is the entry level facelift, it likely has the thinnest vehicle margin, which would in turn pressure Lucid’s margins as deliveries scale should the Air Pure dominate the product mix.

In addition, Lucid seems to be phasing in production per each facelift, noting in Q1 that the “Air Grand Touring Performance deliveries [are] expected in June; Air Touring and Air Pure later this year.” With Air Pure deliveries commencing alongside the Touring in Q4, Lucid could see a slow ramp to deliveries if a majority of its reservations are for the Pure.

50% Production Cut, Flat Production Q/Q

Lucid slashing its full-year production guidance by 50% should raise some major concerns with sourcing and scalability, as Rawlinson had “said the global semiconductor shortage hasn’t personally affected Lucid,” before production commenced in 2021,” as he reportedly “revealed its purchase teams preempted the shortage, and made savvy supply agreements to mitigate the risk of running out of chips.”

Rawlinson made this comment when Lucid was still forecasting 20,000 units of production in 2022 — if Lucid does in fact have enough chips to reach this level of production, the production cuts indicate that Lucid is severely behind in sourcing other critical parts, thus inhibiting production. If chips are not the problem, Lucid has made a critical miscalculation in its sourcing that is now pushing its 20,000 unit production milestone six to nine months later than originally forecast.

In Q1, Rawlinson noted that while it had faced supply chain related constraints, Lucid was still “reiterating our 12,000 to 14,000 vehicle production guidance for 2022 based on the information we have at this point combined with our mitigation plan.” However, he explained that “extended disruptions could result in an impact to our production forecast.” Lucid was “comfortable” with its ability to mitigate supply chain issues and meet the 12,000 to 14,000 target; however, Q2 flipped the switch and saw a much larger impact.

During Q2’s call, Rawlinson said that Lucid “experienced supply chain and logistics challenges along with the entire industry, [and] the limitations of our logistics system have compounded the challenge.” He noted that the firm saw about 2.5 weeks with no daily production, from planned retooling downtime and unplanned downtime due to logistics issues.

Logistics issues are unlikely to clear quickly, and the scope of the production cut signifies that major parts/components are in disarray. While Rawlinson explained that Lucid “made a significant number of vehicles that we did not factory gate instead electing to hold them back in order to ensure that these cars met the highest standard of quality,” digging deeper into the numbers shows a steep slowdown in production during May and June.

Lucid produced nearly 700 units production in Q1, suggesting around 700 units production in Q2, given 1H’s total production volume of 1,409. Lucid has a challenging task ahead of itself to reach it 6,000 to 7,000 unit guidance — again, such a dramatic cut to outlook suggests deeper, persisting problems that are not quick to resolve. With such negative production guidance, sourcing components may become more challenging, as suppliers could prefer established OEMs with volume ahead of Lucid with a 67% decline in guided production from original guidance. On the flip side, if Lucid does produce ~10,000 vehicles, it raises a key question of trust — why cut guidance that much if it does not reflect the situation?

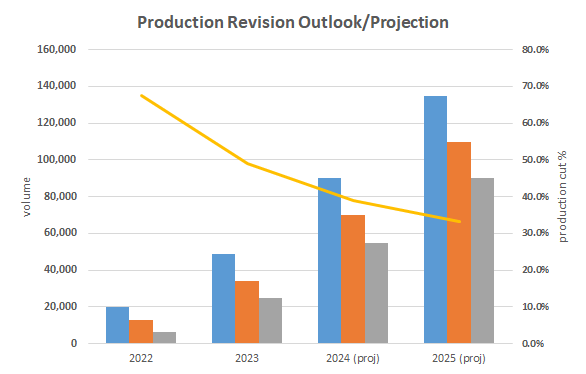

Lucid, author calculations

Over the long-run, Lucid’s production cut and Q4 launch for the Pure and Touring threaten its growth ramp. At the moment, unless Lucid can substantially boost output at a higher rate than originally forecast, it runs the risk of falling 30% short of its originally guided 135,000 unit production in 2025, with projected growth rates placing production closer to 90,000 units. With ASPs near $96,000, that translates to revenues of ~$8.6 billion if Lucid can produce and deliver approx. 90,000 vehicles in 2025.

Limited Deliveries

Lucid has delivered just 1,039 vehicles this year through Q2, showing a slowdown in the second half of Q2 due to the aforementioned downtime and logistics challenges.

Lucid noted that it had delivered over 300 vehicles during the month of April, leaving less than 400 deliveries spaced across May and June. Regardless of how that is split (~200 in both months, 150/250, 50/350, 350/50, etc.), Lucid has seen quite a heavy slowdown in deliveries, likely not reaching a new monthly high during the quarter.

This degree of a delivery slowdown, along with the logistics and potential component sourcing issues, suggest that Lucid will have a difficult time scaling through Q3 and Q4. With both the Touring and Air commencing deliveries in Q4, as of now, Lucid’s Q3 is relying solely on the Grand Touring model to drive growth.

With a weaker than expected Q2, growth may be limited to ~1,800 units or so in the quarter, as ASP calculations place the Grand Touring’s reservation figures around 4,800 to 5,500 units. Lucid is unlikely to clear half of that reservation backlog by Q4, especially as it shifts to producing the remaining two facelifts, which likely command ~85% of total reservations.

Outlook – More Questions Than Answers

Lucid’s abysmal Q2 highlighted more questions than answers, as revenues missed expectations by nearly 40% as the quarter headlined a 50% production guidance cut.

Lucid’s revenue miss highlights that Lucid may be seeing declining demand and volumes of its higher-priced facelifts, further supported by a negative trend in ASPs per updated reservation figures. Digging into the reservation book, Lucid may have only ~13-15% of its 37,000 reservations for the Grand Touring, with the overwhelming majority likely in the Pure (~50-60%). This declining trend in ASPs and a higher volume of the lowest priced edition raises questions about gross and vehicle margin performance as Lucid continues to spend to scale and work through logistics and supply chain challenges.

The production cut highlights potential miscalculations in sourcing critical components, as Rawlinson had previously noted minimal impacts from chips before the first production cut hit. With Lucid’s current production outlook ~67% lower than original guidance for 20,000 units, it raises doubts about ability to scale during persisting shortage headwinds as well as sourcing abilities, with suppliers likely to prioritize established OEMs with growing volumes as opposed to shrinking. Q4 launches of the Touring and Pure suggest a possible slow ramp in Q3, with just deliveries of the Grand Touring on stage.

The combination of factors and doubts arising from Q2 are unlikely to be quickly resolved, enhancing risk to Lucid’s shares via a potential to miss revenues amid lower ASPs, weaker margins, lower-than-expected deliveries, and possibly weaker targets heading into 2023.

Be the first to comment