Andreas Rentz

Updated Thesis

My very first bearish article on Palantir Technologies Inc. (NYSE:PLTR) was published over a year ago, when most investors still believed in the unlimited growth of the stock, even amidst its price-to-sales forward ratio of about 30x at the time. As I suspected at the time, it could not end well for those who kept buying above $20 a share, then above $15, then $10, and so on.

From my first article on PLTR, [October 5, 2021]![From my first article on PLTR, [October 5, 2021]](https://static.seekingalpha.com/uploads/2023/1/6/49513514-16729825131259432.png)

I use the word “ridiculous” again in the title of my 10th-anniversary piece on Palantir stock because the bullish aura surrounding the company does not trigger any other emotions in me.

This time, I am again forced to rate the stock as “Sell” because, in my opinion, it is still too overvalued to buy at the current price level. As before, I see a relative overvaluation of PLTR compared to other SaaS (Software as a Service) companies. This time, however, I’ll go further and explain why the $5 price target that some bears like SA fellow On the Pulse have written about here on Seeking Alpha may even be considered too optimistic in terms of discounted cash flow (“DCF”) modeling. Let us dive deeper.

Bear With It: Palantir Is Just An Average Company With A Poor Reward-to-Risk Ratio

When I compare the company to others in the traditional SaaS business, Palantir proponents say I can’t do that because: a) the company’s product is unique; and b) it is critical to the U.S. defense industry. The second argument – according to the bulls – should defeat any bearish thesis from the outset, because anything critical to the U.S. military should trade at a huge premium and will grow over the long term.

But why would anything with the words “AI, Cloud, Data” in the description of business processes be more critical for military purposes than, say, engine and aircraft component replacement parts manufactured by HEICO Corporation (HEI)? Or the multi-mission intelligence, surveillance, and reconnaissance (ISR) systems that L3Harris (LHX) manufactures?

What Palantir is really good at is cultivating an air of mystery and exclusivity around its products, which are only accessible to a select few. The marketing team generates significant attention and buzz for even the smallest sales, which are actively discussed on Reddit, Seeking Alpha, and elsewhere.

Let us think a little further – let us assume Palantir actually has an AI-based platform that is absolutely indispensable for military purposes. Does that mean the company has pricing power when contracting with the government? I do not think so. Yes, there will be volume/backlog accumulation, but that’s not the moat everyone so often claims when talking about PLTR indispensability.

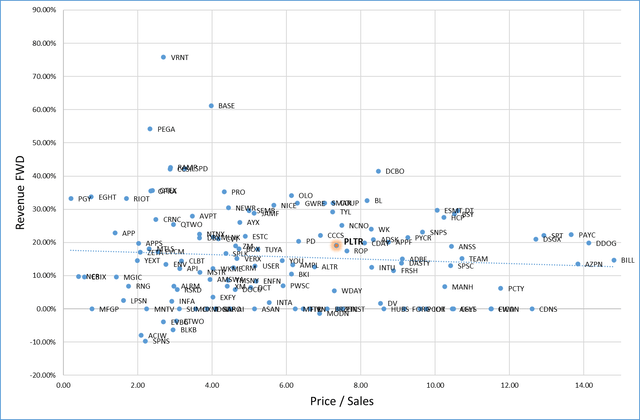

I do not hate the company – I just try to examine it without succumbing to the general hype. Is PLTR worth its multiples, which have been contracted many times since the beginning of last year? If compared only with Application Software peers, then rather “no” than “yes”:

Author’s calculations, based on Seeking Alpha

Note: the sample was reduced from 214 stocks to 133 to eliminate <$500M caps and outliers.

The median price-to-sales (TTM) multiple in the sample equals 5.13x while the median revenue next-year growth rate is about 18.13% (YoY). Palantir is trading for 7.35x P/S with a forwarding sales growth of 19.06%, according to the screener. So it looks pricey.

However, the biggest difficulty in valuing Palantir is its two-part business model. As PLTR develops the commercial sector, we are forced to build a sum-of-the-parts (SOTP) financial model to value it based on multiples and growth rates.

If you read my previous calls on Palantir, you probably remember how I calculated its “relatively fair” value per share based on SOTP – if you are not familiar with the model, I recommend you familiarize yourself with it at this link.

In short, I modified the Sum-Of-The-Parts valuation model by using the price-to-sales ratios of Palantir’s peers in both of its business segments and comparing them to the projected revenue growth rates for the following year. This allows us to gauge the extent to which the revenue-based valuation is influenced by the market’s expectation of revenue growth.

Compared to other stocks from different segments, PLTR is still somewhat overvalued – and that’s without taking into account the risk of possible earnings revisions.

| Government = | 42.68% | |

| Company name | P/S (FWD) | Sales growth FY2023, YoY |

| Booz Allen Hamilton (BAH) | 1.5 | 9.43% |

| Science Applications International Corp. (SAIC) | 0.78 | 2.63% |

| Leidos Holdings (LDOS) | 1 | 5.16% |

| CACI International (CACI) | 1.09 | 6.61% |

| L3Harris Technologies | 2.34 | 3.67% |

| HEICO Corporation | 8.1 | 16.58% |

| Curtiss-Wright Corporation (CW) | 2.48 | 5.61% |

| Average | 2.470 | 7.10% |

| Commercial = | 57.32% | |

| Company name | P/S (FWD) | Sales growth FY2023, YoY |

| Tyler Technologies (TYL) | 7.2 | 7.94% |

| Verint Systems Inc. (VRNT) | 2.71 | 2.44% |

| Splunk Inc. (SPLK) | 4.22 | 29.96% |

| Cognizant Technology Solutions Corp. (CTSH) | 1.56 | 4.02% |

| Alteryx (AYX) | 4.21 | 16.49% |

| Snowflake (SNOW) | 20.45 | 68.21% |

| Average | 6.73 | 21.51% |

| Gov’s P/S per 1% sales growth | 34.80 | |

| Com’s P/S per 1% sales growth | 31.26 | |

| Palantir’s Gov growth, FY2023, YoY | 18.50% | |

| Palantir’s Com growth, FY2023, YoY | 23.26% | |

| Palantir’s P/S (FWD) | 7.2 | |

| implied PLTR’s FWD P/S | 6.92 | |

| vs. current P/S (FWD) | -3.95% |

Source: Author’s calculations

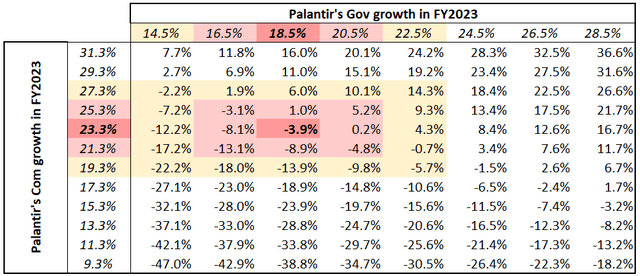

Sensitivity analysis, author’s calculations

As last time, the situation has not turned out well for PLTR in terms of risk-reward profile – at least if my SOTP valuation model makes sense to you. If the company’s growth is 2% higher in 2 business segments (Government and Commercial) at once, then PLTR is undervalued by about 14.3%. However, if actual revenue growth is 2% lower (again for 2 segments at once), then the overvaluation is more than 1.5 times higher – about 22%.

From all the comparative analyses I have outlined above, only one conclusion can be drawn – by relative valuation metrics, PLTR is still quite overvalued. I last came to the same conclusion a little less than a month ago, but since then PLTR has fallen more than 18%, and as we can see, that has not changed.

DCF Modeling Based On Bull’s Expectations

The bulls’ main argument is Palantir’s bright and shining future, where the success of the company’s product in the commercial segment will provide shareholders with years of free cash flows and a very high return on investment.

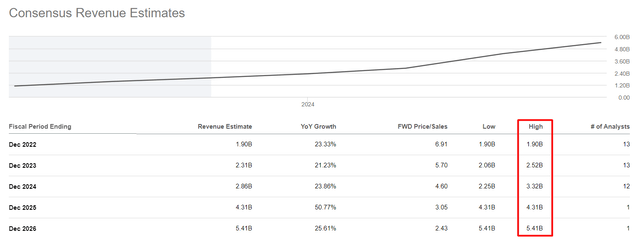

I propose to test the validity of these arguments with a little math. Let us build a DCF model based on the stock market’s most optimistic forecasts – the highest estimates for PLTR’s sales growth over the next few years:

Seeking Alpha, PLTR, author’s notes

According to these optimistic forecasts, PLTR sales will grow 29.9% annually through 2025. [I’d like to remind you that TTM sales (by quarters) increased by 27.88% in the last period and we are likely to see a recession in the US].

Analysts forecast 3.5x EPS growth in FY2023 – I will reflect this in an increase in the company’s EBITDA margin to 25% in FY2023, rising to 32% by and including FY2026. EBIT margin will consistently lag EBITDA margin by 5%. The ratio of depreciation and amortization to sales will be constant at 1%.

Trade receivables and trade payables as a percentage of sales will gradually decline, yet these balance sheet items will continue to grow at CAGRs of 16% and 21%, respectively, throughout the forecast period. The ratio of CAPEX to sales will remain approximately the same throughout the forecast period (1.625% on average).

Calculating WACC is always a bit tricky, especially for high-growth companies whose beta is sometimes many times greater than 1. I assume a risk-free rate of 3.5%, a cost of debt of 5%, and a tax rate of 20% (PLTR’s capital structure is only very loosely tied to debt financing, so these assumptions are not that important). Assuming an average historical market premium, I arrive at a WACC of 12.12%. If there are a large number of fixed-income instruments in the market with good credit ratings and yields of 10% or even higher, I think the resulting WACC is quite conservative under current circumstances. Once the Fed lowers interest rates back to low levels, PLTR’s WACC will also drop significantly. More on this later.

So what do we have in the end? Assuming the company grows at a 7% rate [Gordon’s g rate] in 2027 and beyond, the fair value per share is $5.03 – 20.4% less than yesterday’s closing price of PLTR.

Risks To My Thesis

My analysis carries a number of risks that I must warn against in order to be as honest as possible with the readers who have read this far.

First, my SOTP model relies on a number of assumptions based on PLTR’s peers. If any of those names are grossly overestimated or underestimated, it might significantly distort all conclusions. Therefore, last time I decided to expand the sample to somehow smooth out this effect, which unfortunately cannot be completely eliminated.

Second, a large number of new contracts as well as the launch of Apollo can really be a good trigger for growth in the upcoming months. However, the successful commercialization of Apollo, analogous to other products of the company, is doubtful, so this fact does not convince me personally.

Third, once the Fed starts its policy, this will significantly lower the firm’s WACC. The sensitivity of my DCF model is quite high – if WACC falls to, say, 10%, then all else being equal, the “fair value” output will amount to about $10 per share. In 2023, however, I do not expect the Fed to cut interest rates.

The Verdict For Palantir Stock

Despite the many people who have high hopes for Palantir Technologies Inc.’s growth in 2023, I again take a contrarian position and recommend buying PLTR only when: a) the company returns to its targeted growth rate; b) its valuation falls to reasonable levels; and c) the Fed begins to reverse its monetary policy.

Even with the most optimistic forecasts and very generous estimates for the company’s margins over the next 5 years, the DCF model shows a fair value for the stock in the region of $5, which is about 20% below yesterday’s closing price. Comparative valuation – the usual comparison of valuation multiples with growth rates and a more sophisticated SOTP model – confirms the findings of the DCF. Palantir stock is still too expensive – as an investor, you can get the same level of growth cheaper elsewhere.

I do not recommend buying Palantir Technologies Inc. even after the 18% drop from my previous call.

Thanks for reading!

Be the first to comment