Michael Vi

Palantir Technologies (NYSE:PLTR) investors have had a rough year, to put it mildly. But the stock’s decline does not necessarily mean the company has been sitting idle. Far from it. From expanding its work with the Food and Drug Administration (FDA) to winning an $85 Million contract to support Army Materiel Command, Palantir has been strengthening its foothold in the Government space. But by signing a multi-year partnership with Hertz (NASDAQ:HTZ), Palantir is also proving it can be a player in the private sector as well.

Hence, the news that Palantir and Lockheed Martin (NYSE:LMT) have teamed up with the aim of delivering modern software to support Navy combat systems should surprise no one given Palantir’s already strong but growing reputation as the leader in data analytics. We find this news particularly interesting and a nice reflection of Palantir’s ability to work with both government and corporate entities because Lockheed is as close one can get to being a proxy for the government’s spending intent while being a private company.

The intent of this article is not to shower Palantir with accolades due to the contracts won. Investors are right to be skeptical as the company is not yet profitable, despite being in existence for nearly 20 years (16 as private). Not to mention, the value of some of these contracts have not been made public. The point is, however, that it is extremely easy to be negative on Palantir with all the noise around start up bankruptcies and Palantir’s own slowing growth. This article instead highlights a few reasons why the stock may not be a bad long-term bet, especially if you manage to pick up shares lower. We offer one such trade to give yourself the opportunity to buy Palantir lower. Let us get into the details.

Long Term Business Fundamentals

Given the fact that Government contracts are usually multi-year with strict bidding requirements, the stickiness factor is enhanced. Estimates for Total Addressable Market (TAM) range from $120 Billion to $230 Billion. Serviceable Addressable Market (SAM) and Serviceable Obtainable Market (SOM) are better metrics since TAM generally includes global estimates and the impact of unknown competitors may be underestimated. Nonetheless, with a market cap of just about $15 Billion, Palantir is likely scratching the surface here. Obviously, these are lofty expectations but it is no secret that Government agencies at any level: Municipal, State, and even Federal are usually behind in embracing technological advancements. Some of their (government) concerns are valid, especially around data security concerns. And that is where Palantir’s reputation comes into the picture.

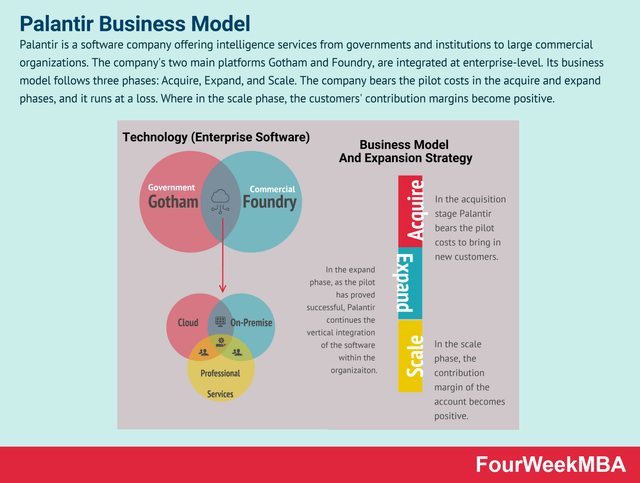

This article was published in 2020 when Palantir went public, explaining Palantir’s main Platforms (Gotham and Foundry) and their expansion strategy. Since then, Palantir has seen success with Apollo as well and this is the platform Lockheed is planning to leverage. But more to the point, the company’s business strategy remains the same: Acquire, Expand, and Scale.

- Acquire: This is the phase where the company acquires customers. The fact that Palantir is being selective in the type of customer it goes after is evident from the list of signings so far with most of the customer base being Government entities or well-known Private sector brands. The key takeaway here is that during this phase, Palantir bears most of its overall cost here. Not every pilot turns out to be successful (be it customer or product) but the ones that turn do turn out successful are likely to be homeruns.

- Expand: This is the stage where Palantir upsells its products and services horizontally with an existing customer base, often after the customer produces at least $100,000 in revenue. Palantir’s expenses (or investments depending on how you see it) is high enough here to warrant a mention but is lower than in the first stage.

- Scale: This is where the customer is being profitable after Palantir has installed its platforms and the customer is self-sufficient. Also known as, the stage where Palantir makes money at scale.

What stage do you believe Palantir is in, just two years after going public? While different customers will be in different stages, the company by and itself is very much in the Acquire stage. That means, while the cost of business is high without much reward on surface yet, Palantir knows the rewards are waiting in the next two phases. To provide some context here, in 2020, customers in the three phases: Acquire, Expand, and Scale brought in $0.6 Million, $176 Million, and $565 Million respectively.

Technical Indicators

From a technical stand point, while the stock is trading below most of the commonly used moving averages, it seems to have formed a solid base in the $7 range. The chart below shows the stock bouncing from or at least not falling through its established base around $7 where it is trading now. But please note that with its 60% loss year-to-date, additional pressure from tax-loss harvesting is to be expected till end of the year.

An Attractive Trade

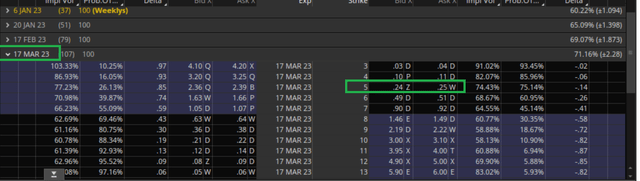

If you interested in Palantir as a long-term investment but are skeptical of buying here at $7, then the trade below might be of interest where in you may set aside funds (cash secured puts) to be able to buy Palantir at a lower price and get paid a premium for doing so. The chain below is one we are interested in.

PLTR Options Chain (Think or Swim)

- Strike Price: $5

- Expiration Date: March 17th, 2023

- Premium: $0.25/share, for a total of $25 for each contract (100 shares) you are willing to sell.

In simple words, the put seller will be collecting $25 to buy 100 shares of Palantir at $5 if the stock reaches $5 or below by March 17th, 2023.

Return: The premium collected ($25) for setting aside $500 represents a return of 5% for about three and a half months.

Outcome #1: If Palantir stays above $5 by the expiration date, the put seller retains just the premium above and will not be obligated to buy the shares. A 5% return for the opportunity to buy at a lower price isn’t too shabby.

Outcome #2: If Palantir goes below $5 by the expiration date, the put seller will be forced to buy 100 shares at $5, irrespective of where the stock trades at that time. Keeping the premium netted in mind, the average cost in this case will be $4.75 ($5 minus $0.25).

Outcome #3: As an option seller, one can “buy to close” anytime instead of waiting till the expiration date, irrespective of whether you have made or lost money on the premium.

In short, you either end up owning Palantir about 30% below its current price and/or get a 5% return for setting aside $500 (per contract).

Conclusion

Palantir stock certainly did deserve to have its bubble pop. No question about it. But how much is too much? If you end up selling the put explained above and eventually get assigned the shares, you will be owning the stock at a multiple of 31, which isn’t bad at all for a company expected to grow at more than 25% per year for the next five years. Furthermore, at $5, cash on hand per share will represent 23% of the stock’s value. Again, not bad at all. And given how Palantir’s stock has been pummeled, being “not bad at all” may just be enough for the stock to reward shareholders from here.

Be the first to comment