Florent Molinier/iStock via Getty Images

Article Thesis

In this article, I’ll lay out a pair trade idea that would combine a long position in PayPal Holdings, Inc. (NASDAQ:PYPL) with a short position in Block, Inc. (NYSE:SQ). My thinking is based on a way more reasonable valuation for PayPal, better earnings quality for PayPal, better growth momentum for PayPal, and Block’s exposure to cryptocurrencies that should be a major headwind in the current crypto bear market, whereas PayPal is less exposed to cryptocurrencies.

Reason 1 For PayPal Outperformance: Growth Momentum And Cryptocurrency Exposure

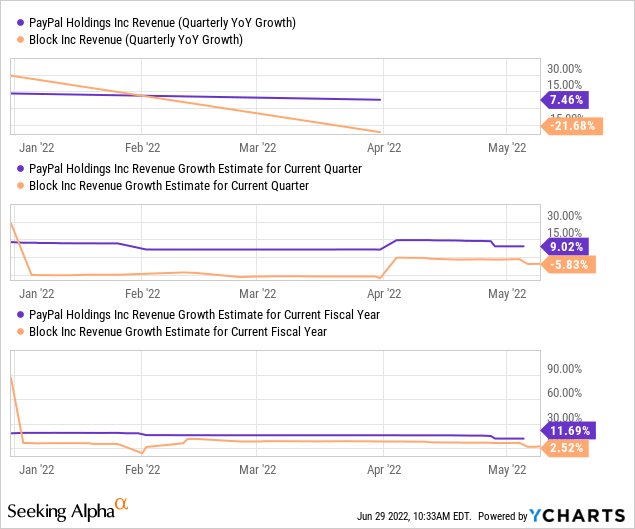

PayPal has seen its shares drop significantly over the last year, which also holds true for Block. In PayPal’s case, the share price drop was based on a too-high valuation one year ago, combined with the realization that its growth will not be maintained at an ultra-high level forever. Nevertheless, PayPal continues to grow, and at a faster rate than Block:

PayPal has delivered significantly better growth during the most recent quarter, with a 7% increase year over year, while Block’s revenue dropped more than 20%. For the current quarter, a big difference in favor of PayPal is forecasted as well. Looking at the current fiscal year, PayPal is forecasted to grow 4x-5x as much as Block. Block will, when the analyst community is right, deliver negative growth in real terms this year once we account for a high-single-digit inflation rate, whereas PayPal will deliver at least some growth in real terms.

PayPal’s better revenue growth is partially driven by its smaller exposure to cryptocurrencies, whereas Block is heavily exposed to cryptocurrencies via its Bitcoin transactions. Block’s cryptocurrency exposure allowed it to generate strong revenue growth during the crypto boom during the pandemic. But the volatile nature of the crypto universe leads to regular steep downturns, such as the one we are experiencing right now that has made Bitcoin drop from around $70,000 to less than $20,000. At the same time, cryptocurrency trading volume has declined, which is why Block’s cryptocurrency exposure has turned into a major headwind for now. With lower Bitcoin prices and fewer transactions, that side of Block’s business, which was seen as an important future growth driver by its leadership (hence the name change), will generate less revenue and less gross profit. Since operating expenses will likely not drop in line with the unit’s revenue, operating leverage will likely work against Block when it comes to its crypto business.

PayPal, with its more traditional business of facilitating transactions between users and more nuanced exposure to cryptocurrencies (e.g., via cryptocurrency firm Curv which it acquired this year), is not as vulnerable to the current crypto bear market and guides towards a compelling transaction volume growth rate in the mid-teens range this year.

Reason 2 For PayPal Outperformance: Way Better Earnings Quality

Most companies do report adjusted or non-GAAP earnings on top of reporting GAAP earnings. They explain the adjustments they make in their earnings releases. Some of those adjustments do generally make sense, e.g., when companies back out one-time gains on asset sales or one-time restructuring charges. Companies oftentimes back out another important item where it is way more questionable whether the adjustment makes sense: Share-based compensation. Share issuance to employees and management is oftentimes done by tech companies, and sometimes also by other companies. That makes sense, as it helps attract talent and since it aligns employee goals and shareholder goals, at least to some degree. Share-based compensation is thus not an issue per se, but investors should know that this comes at a cost. Even though share-based compensation is a non-cash item, it has a real impact on shareholder value, as existing shareholders get diluted over time.

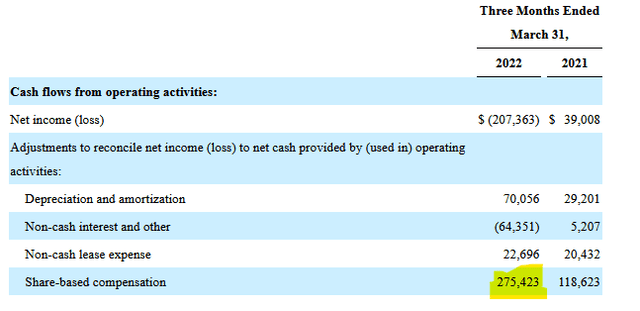

Block states that the company has earned $0.18 per share on an adjusted basis during the most recent quarter. That makes for $97 million in non-GAAP profit during the period. At the same time, Block has issued a massive amount of shares to its employees and management:

Issuing $275 million worth of shares over three months in order to generate $97 million of non-GAAP earnings is far from great. When we account for the massive share issuance, Block thus is not profitable at all. In fact, the company would have lost more than $175 million, or around $700 million annualized without issuing shares. Shareholders thus get diluted massively while no real value is created — shareholder equity is only generated through stock issuance, not through actual earnings.

PayPal is issuing shares as well, as is almost every tech company. But in PayPal’s case, the issuance of new shares is way more in line with actual underlying profitability. PayPal earned $0.88 per share on an adjusted basis last quarter, which makes for $1.03 billion of non-GAAP profit. Over the same time, PayPal issued $429 million worth of shares to its employees, according to its 10-Q. Actual earnings, or SBC-adjusted earnings, were thus still very positive, at around $600 million for the period. In other words, Block issues around $2.80 in new shares in order to generate $1 in non-GAAP earnings, while PayPal issues around $0.40 in new shares in order to generate $1 in non-GAAP earnings. Share issuance, relative to non-GAAP profitability, is thus around 7x higher at Block. PayPal’s earnings quality is by far not perfect, but it is massively better than that of Block, which has disastrously bad earnings quality from what I see when I look at its earnings statements.

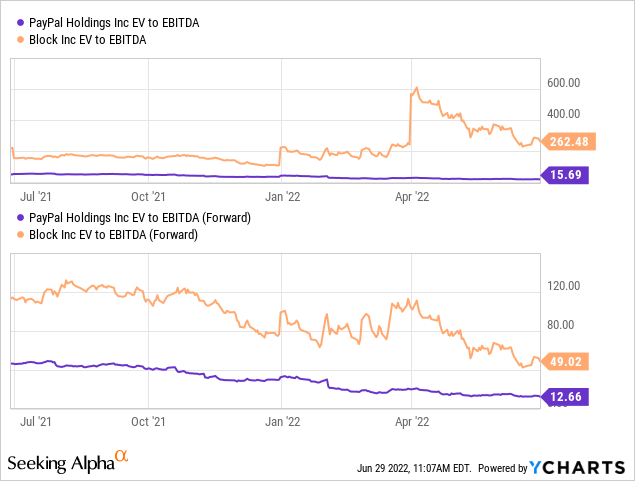

Reason 3 For PayPal Outperformance: Valuation

No matter how one looks at the data, PayPal is by far the less expensive company of these two. When we look at GAAP EBITDA over the last twelve months, PayPal trades at roughly 1/16th of Block’s valuation:

When we look at forward EBITDA estimates, using the analyst consensus (non-GAAP numbers), PayPal is trading at roughly one-fourth of Block’s valuation. This does not yet account for the aforementioned weaker earnings quality at Block. Block could thus fall by 75%, or PayPal could rise by 300%, and the two companies would be valued in line with each other. I do believe that a steep drop in Block is more likely than a steep rise in PayPal, especially in the current interest rate environment where ultra-expensive growth stocks have a hard time.

Even when we look at non-GAAP earnings per share estimates for the current year, even though those overstate Block’s actual earnings power massively, Block looks expensive: It trades for 75x forward earnings, versus an 18x forward earnings multiple for PayPal, according to Seeking Alpha’s data.

In short, the company that is growing less and that has way weaker earnings quality is trading at a massive premium versus the faster-growing company with better earnings quality. I do believe that a positive return for PayPal, relative to Square, is thus very likely. This could happen via a 10% drop in PayPal and a 40% drop in Block, or it might happen via a 5% gain in PayPal and a 25% drop in Block. But in any case, PYPL outperforming SQ is likely, I believe.

Risks To Consider

PayPal will not necessarily perform well going forward, even though I do believe that it will most likely outperform Block. It is possible that both companies perform badly. Or, in case we get into a tech bull market (although I don’t see good reasons for that in the current rising-rates environment), both companies might climb. Should Square come up with a new product or business that is highly attractive, its growth outlook and earnings quality might improve. This could lead to SQ outperformance which would work against this thesis. Due to Block’s cryptocurrency focus, which is a headwind in the current “crypto winter” environment, I do not believe that new, revolutionary, highly profitable products or services by Block are very likely, however.

If one wants to short Block outright, costs aren’t very high, as the current short interest of 8% (data from Seeking Alpha) is only moderate. My broker shows that more than 10 million shares can be borrowed right now, with an annual fee of around 0.3%. That fee can change over time, however, and may be different for other brokers.

For those that prefer to short a stock via options (e.g. by buying puts), costs are rather high when it comes to Block, due to a high level of volatility. The January 2023 $50 puts, for example, are trading for $7 today, while January 2023 $60 puts trade for $12 today. Shares would have to fall to $48, or around one-fourth from the current level, for this position to get into the money.

Takeaway

When looking at these two fintech companies, PayPal looks like the way more promising pick by far. It has better recent growth and better near-term growth, it is insulated from the crypto crash fallout, its earnings quality is on a completely different level, and it trades at a massive discount to Block. In short, I don’t see any good reason why PYPL wouldn’t outperform Block over the coming months and quarters. For investors that want to invest in this pair trade by shorting Block outright, the low borrow fee is good news, although shorting stocks comes with risks that should always be considered.

Be the first to comment